Roll-Your-Own Tobacco Product Market Share, Size, Trends, Industry Analysis Report

By Product (RYO Tobacco, Rolling Paper & Cigarette Tubes, Injector, Filter & Paper Tip); By Distribution Channel (Offline, Online); By Regions; Segment Forecast, 2021 - 2028

- Published Date:May-2021

- Pages: 65

- Format: PDF

- Report ID: PM1878

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

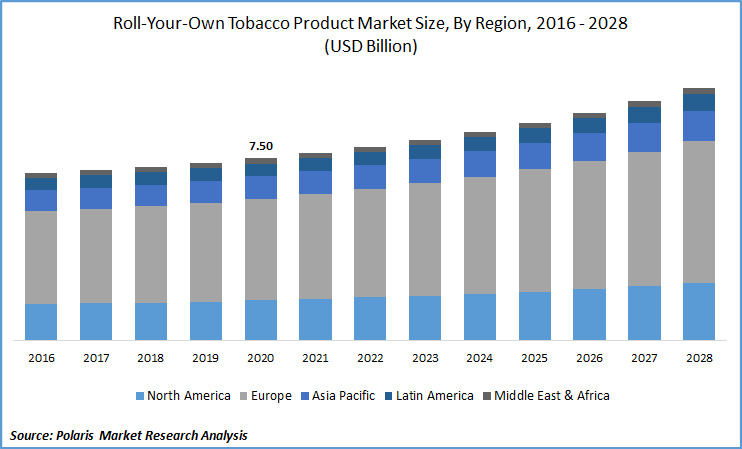

The global roll-your-own tobacco product market was valued at USD 7.50 billion in 2020 and is expected to grow at a CAGR of 4.3% during the forecast period. Growing preference towards hand-made cigarettes, popularity among low-income groups, and fewer regulations, in comparison to factory-made cigarettes, are the key factors responsible for the roll-your-own tobacco product market growth.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Handmade cigarettes are less costly and are subjected to low taxation and preferred choice among millennials and financially stressed income groups. Over the past few years, it is being observed that roll-your-own product’s consumption has been increasing in the developed economies. Moreover, handmade cigarettes are believed to be less harmful in comparison to factory-based cigarettes. The same trend has also boosted the market growth for roll-your-own tobacco product.

Know more about this report: request for sample pages

Roll-Your-Own Tobacco Product Market Report Scope

The market is primarily segmented on the basis of product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

RYO market segment accounted for the largest revenue share in 2020. Such a high share is attributed to the growing popularity of RYO tobacco, as there is a common belief that rolling cigarettes are needed to reduce smoking and to avoid adulteration of toxic chemicals, present in the filtered cigarettes. Most consumers believe that RYO cigarettes are less harmful than they naturally produced. Moreover, rolling tobacco pouches and papers are less expensive than factory-made cigarettes.

The filter & paper tip segment in roll-your-own tobacco product industry is expected to register a lucrative growth rate over the assessment period. Smokers all over the globe are increasingly using filters to decrease the consumption of tar and harmful chemicals.

Manufactures in the market for roll-your-own tobacco product are introducing eco-friendly and innovative filters to increase the flavor of cigarettes to expand their consumer base. For instance, in December 2019, Karma Filter tips company introduced environment-friendly filter tips. These are 100% bio-degradable products and improves the smoking experience.

Insight by Distribution Channel

In 2020, the offline market segment accounted for the largest revenue share. The segment includes liquor stores, supermarkets, pharmacies, convenience stores, grocery stores, and newsstands. Companies are actively using their retail distribution network to reach their customers, through innovative advertisements, and promotions. Moreover, authentic, and natural tobacco manufactures are located in distressed populated areas, where there is a significant number of low-income groups.

The online channel is expected to witness the fastest market growth in roll-your-own tobacco product over the study period. The rising millennials and the emergence of online portals are primarily responsible for such high growth. Moreover, increasing app-based sellers and delivery services also promoting the uptake of products among young and stressed consumers. Thus, an increasing number of online channels, coupled with busy and sedentary lifestyles are bound to increase the demand for roll-your-own tobacco product industry.

Geographic Overview

Europe roll-your-own tobacco product industry accounted for the largest revenue share of the global roll-your-own tobacco product market. The high smoking rate among males and females, luxury lifestyle, and high disposable income among consumers are responsible for the region’s market growth for roll-your-own tobacco product.

According to the market statistics published by the WHO, in 2018, the average smoke rate in the region stood at 28.7%, the highest among all the regions. Moreover, the factory-based cigarette industry in the UK, in past few years, is on the decline and consistent rise in demand for RYO tobacco products.

North America roll-your-own tobacco product industry is projected to witness the fastest market growth rate over the study period. In the U.S., the demand for traditional cigarettes is declining and a positive trend for RYO cigarettes has been gaining popularity among the young generation. Consumption of tobacco products is actively rising among females in the country. Thus, the huge demand for tobacco-based products in the region is bound to boost the roll-your-own tobacco product market.

Competitive Insight

The prominent players operating in the market for roll-your-own tobacco product industry are Imperial Brands, Curved Papers, Inc., Japan Tobacco International, Karma Filter Tips, British American Tobacco, Scandinavian Tobacco, Altria Group, Inc., Philip Morris International, HBI International, and Shine Brands.