Clean Label Functional Beverage Ingredients Market Size, Share, Trends, & Industry Analysis Report

By Ingredient Type (Colors, Flavors, Sweeteners, Preservatives, Starch & Emulsifiers, and Others), By Source, By Functionality, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 128

- Format: PDF

- Report ID: PM5846

- Base Year: 2024

- Historical Data: 2020-2023

Overview

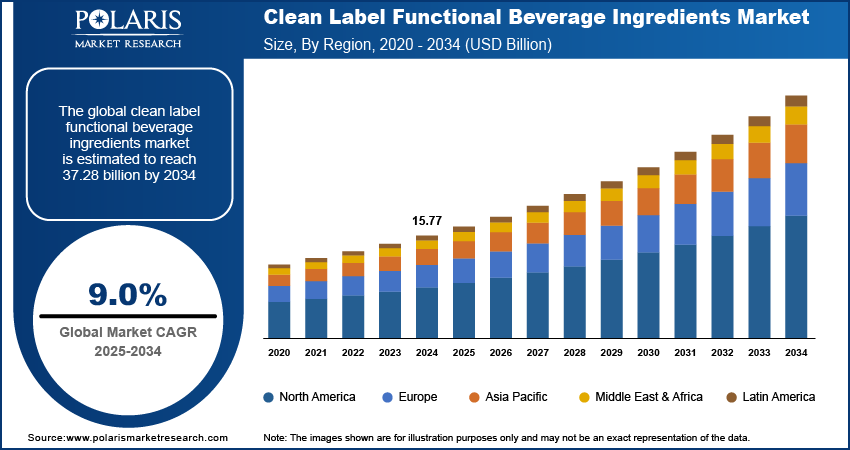

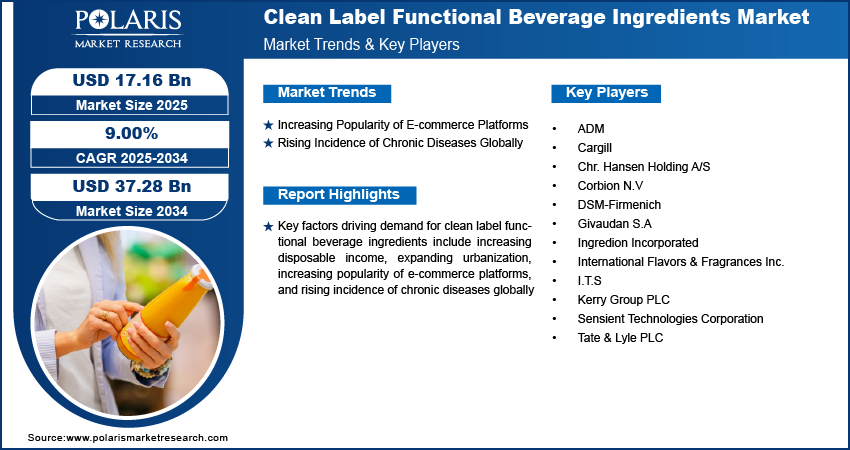

The global clean label functional beverage ingredients market size was valued at USD 15.77 billion in 2024, growing at a CAGR of 9.00 % during 2025–2034. Key factors driving demand for clean label functional beverage ingredients include increasing disposable income, expanding urbanization, increasing popularity of e-commerce platforms, and rising incidence of chronic diseases globally.

Clean label functional beverage ingredients refer to natural and minimally processed components added to beverages to enhance their nutritional or functional benefits while maintaining transparency and simplicity in labeling. These ingredients align with consumer demand for healthier, additive-free products that support wellness without artificial preservatives, colors, or synthetic additives. Common examples include plant-based extracts such as turmeric, ginger, and superfoods, including chia seeds and moringa products. The primary usage of clean label ingredients for functional beverages revolves around boosting hydration, immunity, energy, gut health, or mental clarity while ensuring the product remains free from artificial or chemically modified substances.

To Understand More About this Research: Request a Free Sample Report

The increasing disposable income globally is driving the market growth. Bureau of Economic Analysis, in its report, stated that disposable personal income in the US increased by 0.7% in April 2025 from March 2025. This rise is allowing people to spend more on premium products that align with their values, such as transparency, sustainability, and nutritional benefits, boosting demand for clean label functional beverage ingredients. Additionally, rising disposable income is expanding access to education and information, making consumers more aware of the link between diet and well-being, further fueling demand for functional beverages derived from clean label ingredients.

The clean label functional beverage ingredients demand is driven by the expanding urbanization globally. World Bank, in its report, stated that the urban population is expected to more than double by 2050. Urban consumers usually face busier schedules, higher stress levels, and greater exposure to pollution, making them more inclined to seek beverages derived from clean label ingredients that offer functional benefits like immunity support, energy enhancement, or stress relief. Urban areas also provide easier access to supermarkets, health food stores, and e-commerce platforms, increasing exposure to clean label functional beverages. The influence of urban trends, such as fitness culture and wellness, is further encouraging consumers to prioritize clean label functional beverages over traditional sugary or artificially flavored drinks. Therefore, the expanding urbanization globally is fueling the market adoption clean label functional beverages.

Industry Dynamics

Increasing Popularity of E-commerce Platforms

E-commerce platforms usually feature detailed product descriptions, customer reviews, and personalized recommendations. This increases the adoption of clean label functional beverage ingredients by highlighting their advantages. Additionally, e-commerce platform enables smaller brands to reach a global audience without relying on traditional retail distribution, leading to market expansion. Therefore, as e-commerce grows, consumers are projected to increasingly purchase clean label functional beverage ingredients from their homes.

Rising Incidence of Chronic Diseases Globally

Conditions such as diabetes, obesity, and heart disease are driving people to avoid processed sugars, artificial additives, and synthetic ingredients, making clean label beverages a preferred choice. Growing awareness of the link between diet and chronic disease is also pushing individuals toward clean labeled products that align with their wellness goals. Healthcare professionals and nutritionists are also recommending functional beverages with clean ingredients as part of healthier lifestyles, to reduce the incidence of chronic diseases, thereby driving adoption.

Segmental Insights

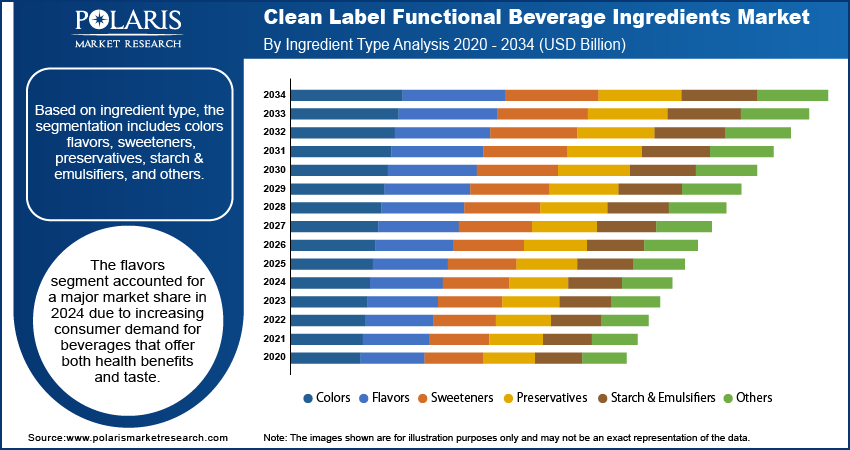

By Ingredient Type Analysis

Based on ingredient type, the segmentation includes colors, flavors, sweeteners, preservatives, starch & emulsifiers, and others. The flavors segment accounted for a major market share in 2024 due to increasing consumer demand for beverages that offer both health benefits and taste. Beverage manufacturers prioritized natural and organic flavor sources such as fruit extracts, botanical infusions, and herbal blends to meet clean label standards. This shift gained momentum as consumers became more conscious of ingredient transparency and the origin of additives in their drinks. The rising popularity of functional beverages like kombucha, infused waters, and protein shakes also fueled the need for innovative flavor solutions that enhance taste without compromising on natural sourcing. Regulatory approvals for plant-based flavors and technological advancements in flavor extraction methods further supported the segment’s dominance.

The sweetener segment is projected to grow at a robust pace in the coming years, owing to the growing health concerns related to obesity and diabetes. Natural alternatives such as stevia, monk fruit, and erythritol are gaining attention by allowing manufacturers to retain sweetness while maintaining clean label claims. The rising demand for low-glycemic, zero-calorie, and keto-friendly beverages, especially among health-conscious and diabetic consumers, is further fueling the adoption of natural sweeteners. Moreover, the evolving regulatory norms that favor the use of non-artificial ingredients are supporting the widespread use of plant-based sweeteners.

By Source Analysis

In terms of source, the segmentation includes plant-based, animal-based, microbial-based, and mineral-based. The plant-based segment held the largest market share in 2024 due to surging global preference for natural and sustainable ingredients derived from fruits, vegetables, herbs, grains, and legumes. Consumers increasingly associate plant-based sources with health, wellness, and environmental responsibility, driving demand across a broad range of functional beverages, including detox drinks, herbal teas, and protein smoothies. The rising adoption of vegan lifestyles further contributed to the widespread demand for plant-based functional beverages. Innovations in botanical extraction and improved shelf stability also enabled the broader application of plant-based ingredients across various product formats.

By Functionality Analysis

In terms of functionality, the segmentation includes flavor enhancement, texture improvement, nutritional enrichment, preservation, and coloring. The flavor enhancement segment dominated the market share in 2024 due to increasing consumer demand for natural and appealing tastes in functional beverages. Consumers increasingly seek products that deliver health benefits without compromising on taste, pushing manufacturers to incorporate clean-label ingredients like fruit extracts, herbal infusions, and natural sweeteners such as stevia and monk fruit. Additionally, the rising popularity of functional beverages such as probiotic drinks, plant-based shakes, and adaptogenic tonics contributed to the dominance of the segment.

By Application Analysis

In terms of application, the segmentation includes energy drinks, sports drinks, fortified juices, dairy-based beverages, plant-based beverages, and others. The energy drinks segment accounted for a major market share in 2024 due to rising consumer demand for beverages that deliver immediate physical and mental stimulation through clean, natural sources. Health-conscious individuals increasingly preferred energy drinks formulated with plant-derived ingredients such as green tea extract, guarana, ginseng, and natural caffeine. Additionally, the growing number of fitness enthusiasts, busy professionals, and students seeking sustained energy throughout the day contributed to the dominance of the segment.

The plant-based beverages segment is projected to grow at a robust pace in the coming years, owing to the increasing adoption of dairy alternatives and the growing popularity of vegan diets. The clean label movement is propelling the demand for these drinks as they often use minimal, non-GMO, and allergen-free ingredients. Rising concerns over lactose intolerance, animal welfare, and environmental impact are also projected to fuel the adoption of plant-based beverages in the coming years. Innovation in taste and texture, along with expanded retail availability, is positioning the plant-based beverage for sustained growth during the forecast period.

Regional Analysis

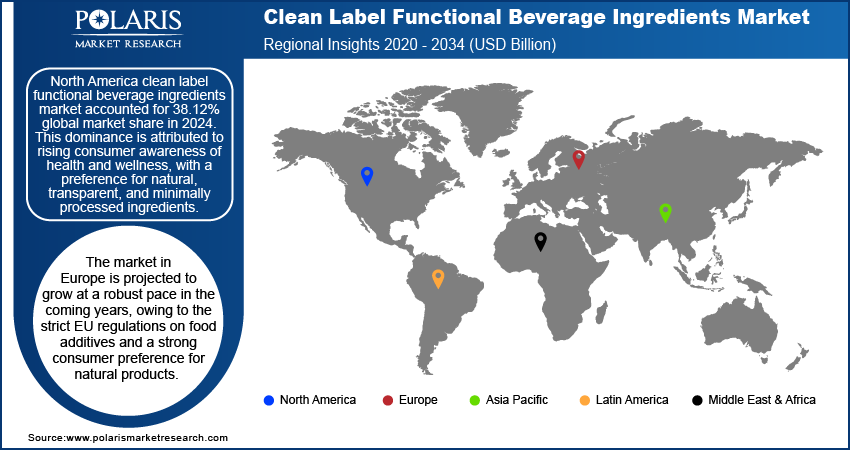

North America clean label functional beverage ingredients market accounted for 38.12% global market share in 2024. This dominance is attributed to rising consumer awareness of health and wellness, with a preference for natural, transparent, and minimally processed ingredients. Consumers in the region increasingly adopted beverages that offer functional benefits such as immunity support, energy enhancement, and gut health, without artificial additives. The region’s stringent food safety regulations and labeling requirements further pushed functional beverages manufacturers to adopt clean-label ingredients. Additionally, the growing popularity of plant-based and organic beverages supported market dominance in 2024, particularly in the US and Canada.

US Clean Label Functional Beverage Ingredients Market Insight

US led the North America clean label functional beverage ingredients industry in 2024 due to a wide population seeking transparency in food and beverage products. The rise of chronic diseases and an aging population has also increased interest in functional ingredients like adaptogens, probiotics, and superfoods in the country. Millennials and Gen Z consumers, in particular, prioritized sustainability and ethical sourcing, driving demand for organic, non-GMO, and eco-friendly ingredients in the US.

Europe Clean Label Functional Beverage Ingredients

The market in Europe is projected to grow at a robust pace in the coming years, owing to the strict EU regulations on food additives and a strong consumer preference for natural products. The region’s focus on digestive health, mental wellness, and energy drinks is increasing demand for probiotics, botanical extracts, and plant-based proteins. The increasing focus on sustainability and ethical sourcing is driving consumers in the region to adopt beverages made from organic and clean label ingredients. Countries like Germany, France, and the UK are leading the adoption of clean label functional beverage ingredients with growing fitness enthusiasts and a vegan population.

UK Clean Label Functional Beverage Ingredients Market Overview

The demand for clean label functional beverage ingredients in Germany is being driven by its health-conscious consumer base and strict food regulations. German consumers are prioritizing natural, organic, and functional beverages, particularly those supporting gut health, hydration, and mental clarity. The country’s strong organic food movement and sustainability focus are further driving the adoption of clean label ingredients. Kombucha, herbal infusions, and plant-based milk alternatives are particularly popular in the country, strengthening the demand for transparent and clean label ingredients.

Asia Pacific Clean Label Functional Beverage Ingredients Market

The Asia Pacific market is projected to hold a substantial market share in 2034, due to expanding urbanization, rising disposable incomes, and increasing health awareness. United Nations Human Settlements Programme stated that the urban population in Asia is expected to grow by 50% by 2050. Countries like Japan, China, and Australia are leading the demand for clean-labeled beverages with digestive health benefits, energy enhancement, and beauty-enhancing properties. Additionally, stricter food safety regulations and a shift toward natural sweeteners are fueling the clean label trend in the region.

Key Players & Competitive Analysis Report

The clean label functional beverage ingredients market is highly competitive, with key players such as ADM, Cargill, Chr. Hansen, Corbion, DSM-Firmenich, Givaudan, Ingredion, International Flavors & Fragrances (IFF), Kerry Group, Sensient Technologies, and Tate & Lyle are leading innovation. These companies compete on factors such as natural ingredient sourcing, scientific research, sustainability, and consumer-driven formulations. ADM and Cargill dominate the industry with their extensive portfolios of plant-based proteins, fibers, and natural sweeteners, catering to the demand for clean-label, functional beverages. Both companies leverage their global supply chains to ensure cost efficiency and scalability. Chr. Hansen and Corbion specialize in fermentation-derived ingredients, including probiotics and natural preservatives, addressing the growing need for gut-health-focused beverages. Competition is intensifying in the industry as consumer’s demand transparency, sustainability, and efficacy. Companies are investing in partnerships, acquisitions, and sustainable sourcing to differentiate themselves.

Major companies operating in the clean label functional beverage ingredients industry include ADM; Cargill; Chr. Hansen Holding A/S; Corbion N.V; DSM-Firmenich; Givaudan S.A; Ingredion Incorporated; International Flavors & Fragrances Inc.; I.T.S; Kerry Group PLC; Sensient Technologies Corporation; and Tate & Lyle PLC.

Key Players

- ADM

- Cargill

- Chr. Hansen Holding A/S

- Corbion N.V

- DSM-Firmenich

- Givaudan S.A

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- I.T.S

- Kerry Group PLC

- Sensient Technologies Corporation

- Tate & Lyle PLC

Industry Developments

June 2025: I.T.S introduced a range of natural, clean label flavours especially formulated to perform in all types of hydration drinks, from electrolyte RTDs to hydration powers and tablets.

February 2024: Ingredion Incorporated announced the launch of NOVATION Indulge 2940, a clean label starch to provides a unique texture for gelling and co-texturizing for popular dairy and alternative dairy products.

Clean Label Functional Beverage Ingredients Market Segmentation

By Ingredient Type Outlook (Revenue, USD Billion, 2020–2034)

- Colors

- Flavors

- Sweeteners

- Preservatives

- Starch & Emulsifiers

- Others

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Plant-based

- Animal-based

- Mineral-based

By Functionality Outlook (Revenue, USD Billion, 2020–2034)

- Flavor Enhancement

- Texture Improvement

- Nutritional Enrichment

- Preservation

- Coloring

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Energy Drinks

- Sports Drinks

- Fortified Juices

- Dairy-based Beverages

- Plant-based Beverages

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Clean Label Functional Beverage Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 15.77 Billion |

|

Market Size in 2025 |

USD 17.16 Billion |

|

Revenue Forecast by 2034 |

USD 37.28 Billion |

|

CAGR |

9.00% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 15.77 billion in 2024 and is projected to grow to USD 37.28 billion by 2034.

The global market is projected to register a CAGR of 9.00% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are ADM; Cargill; Chr. Hansen Holding A/S; Corbion N.V; DSM-Firmenich; Givaudan S.A; Ingredion Incorporated; International Flavors & Fragrances Inc.; I.T.S; Kerry Group PLC; Sensient Technologies Corporation; and Tate & Lyle PLC.

The flavor segment dominated the market share in 2024.

The plant-based beverages segment is expected to witness the fastest growth during the forecast period.