Climate Adaptation Market Size, Share, Trends, Industry Analysis Report

: By Type (Nature-Based, Technology-Based, Enhanced Natural Process, and Early Climate Warning & Environment Monitoring), By End User, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 120

- Format: PDF

- Report ID: PM5077

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

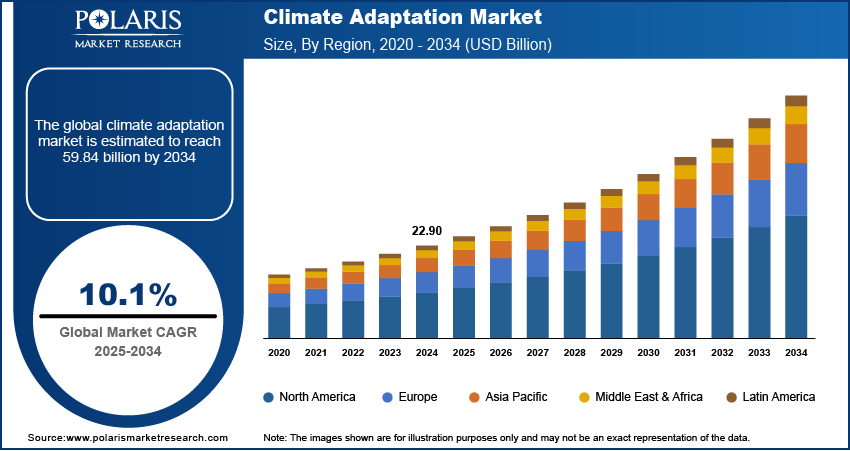

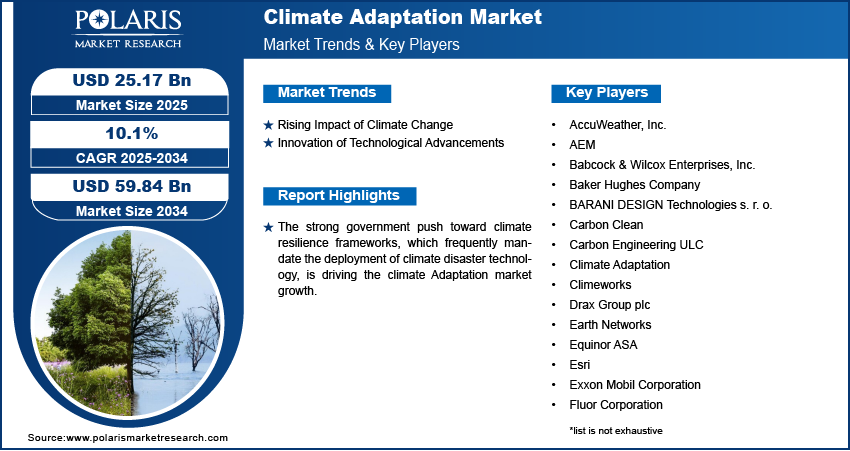

The global climate Adaptation market size was valued at USD 22.90 billion in 2024. It is projected to grow from USD 25.17 billion in 2025 to USD 59.84 billion by 2034, exhibiting a CAGR of 10.1% during the forecast period (2025–2034).

Climate adaptation refers to the process of adjusting practices, policies, and infrastructure to mitigate the adverse effects of climate change and enhance resilience to its impacts. Unlike climate moderation, which focuses on reducing or preventing the causes of climate change, adaptation seeks to manage and cope with its consequences.

The public awareness of climate change impacts is growing, leading to increased demand for solutions that mitigate these impacts and adapt to changing conditions. Furthermore, organizations are recognizing the financial risks associated with climate change and are investing in adaptation strategies to protect their operations, supply chains, and investments. In February 2022, the Global Environment Facility (GEF) member approved USD 203 million in targeted climate adaptation investments. These funds are aimed at boosting food systems, water resources, and early warning systems in least-developed countries, small island developing states, and other vulnerable nations facing escalating climate risks.

To Understand More About this Research: Request a Free Sample Report

Government policies, regulations, and international agreements aimed at reducing greenhouse gas emissions and promoting resilience to climate change are driving demand for solutions in the climate Adaptation market. The surging demand for climate disaster technology is one of the primary growth drivers in the market. Innovations such as AI-powered risk modeling, satellite-based monitoring, and advanced disaster response platforms are enabling faster, more accurate responses to climate threats. As catastrophic events such as floods, wildfires, and hurricanes become more frequent, organizations are increasingly investing in these technologies to mitigate losses and ensure operational continuity.

The strong government push toward climate resilience frameworks, which frequently mandate the deployment of climate disaster technology is driving the climate Adaptation market growth. Public and private sectors alike are prioritizing investments in smart infrastructure, adaptive urban planning, and community-based resilience initiatives. Coupled with rising ESG (Environmental, Social, and Governance) commitments, these developments are expected to accelerate the integration of climate adaptation solutions across the globe.

Market Dynamics

Rising Impact of Climate Change

The increasing climate change impacts are driving the climate adaptation industry expansion. The increased occurrence of extreme weather events such as hurricanes, floods, and heatwaves necessitates robust climate adaptation strategies. Governments, businesses, and communities are investing in solutions to mitigate the damage and enhance resilience against these events. This growing need for adaptive measures contributes to the demand for climate adaptation solution.

Policies and regulations increasingly mandate adaptation measures to address climate risks. This regulatory environment creates a driving force for investment in the market. Organizations and governments seek to comply with new standards by adopting a comprehensive program to increase awareness and enhance the understanding of climate change impacts, thereby driving demand for solutions in the market. For instance, in December 2023, Serbia launched its inaugural Programme for adaptation to Changed Climatic Conditions, spanning from 2023 to 2030, along with an accompanying Action Plan. The program underscores that Serbia is experiencing warming at a rate faster than the global average of 1.8 degrees Celsius compared to the global increase of 1.1 degrees Celsius, with summer temperatures rising by 2.6 degrees Celsius. These initiative aims to enhance awareness, improve understanding, and address the impacts of climate change more effectively on a global scale.

Innovation of Technological Advancements

The market is experiencing significant growth, driven by the innovation of technological advancements in climate adaptation. Innovations in climate adaptation technology, such as better weather forecasting system, digital technologies track climate solutions, advanced materials for infrastructure resilience, and renewable energy solutions, are driving growth in the market. These technologies help mitigate and adapt to the effects of climate change more effectively.

Multilateral organizations, development banks, and international donors are providing support for climate adaptation projects in vulnerable regions. For instance, in November 2023, the World Bank Group highlighted how digital technologies are revolutionizing global efforts to combat climate change. These technologies are pivotal in reducing emissions across industries, fostering greener transportation networks, and enhancing early warning systems to mitigate climate impacts. Governments are increasingly seeking urgent and scalable solutions to address the climate crisis, with digital tools playing a crucial role. Such developments underscore the growing demand for climate adaptation solutions.

Segment Insights

Market Evaluation by Type

The global climate adaptation market segmentation, based on type, includes nature-based, technology-based, enhanced natural process, and early climate warning & environment monitoring. The early climate warning and environmental monitoring segment is expected to experience the highest CAGR during the forecast period. As climate change intensifies, leading to more frequent and severe extreme weather events, the demand for early warning systems (EWS) is steadily increasing. This growing awareness of the need for timely and accurate information to mitigate the impacts of such events is driving investment and innovation in this crucial area of climate adaptation.

EWS are cost-effective measures for disaster risk reduction and climate adaptation, proven to protect lives, livelihoods, and ecosystems. These systems help communities and governments prepare and respond effectively, reducing damage and saving lives by increasingly investing in these systems to enhance resilience and preparedness.

According to the UN Environment Programme, climate change is expected to increase the frequency and intensity of climate-related hazards. Multi-Hazard Early Warning Systems (MHEWS) significantly reduce disaster risk and minimize damage by enabling informed decision-making.

In November 2022, at COP27, the UN Secretary-General launched the Early Warnings for All (EW4All) initiative. This initiative aims to implement global early warning systems by the end of 2027. Such launch is driving the high growth rate projected for the early climate warning and environmental monitoring segment.

Market Assessment by End User Outlook

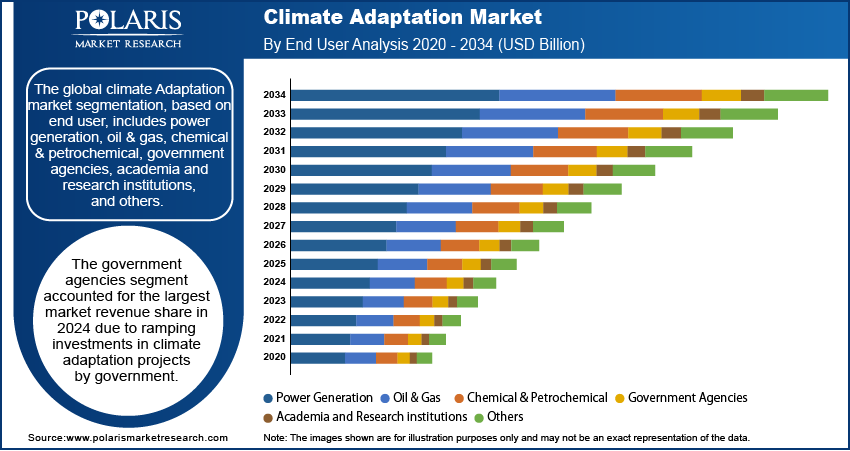

The global market segmentation, based on end user, includes power generation, oil & gas, chemical & petrochemical, government agencies, academia and research institutions, and others. The government agencies segment accounted for the largest share of the climate adaptation market in 2024 due to ramping investments in climate adaptation projects by governments. This includes funding for infrastructure improvements and other measures designed to mitigate the impacts of climate change. This surge in investment drives climate adaptation industry growth. This involves improving systems, processes, and infrastructure to better withstand and recover from climate impacts.

In June 2024, NASA joined 20 federal agencies to release its updated Climate Adaptation Plan. This initiative supports the Biden-Harris Administration's goal of enhancing federal operations' resilience to climate change impacts. The updated plan advances the National Climate Resilience Framework, which aligns climate resilience investments across both public and private sectors through shared principles and opportunities. Additionally, the administration is boosting climate resilience by allocating over USD 50 billion toward related efforts. These factors are driving the rapid growth of the industry.

Regional Outlook

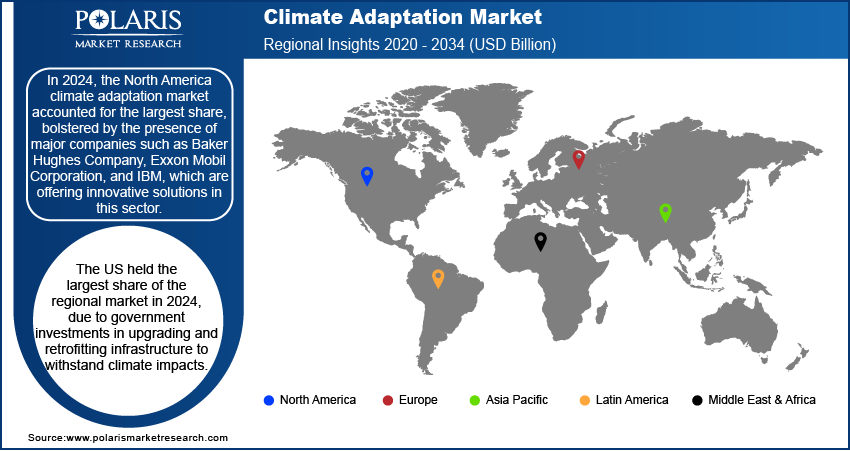

By region, the study provides climate adaptation market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share, boosted by the presence of major companies such as Baker Hughes Company, Exxon Mobil Corporation, and IBM, which are offering innovative solutions in this sector. Key market players are actively merging, acquiring, and collaborating to enhance their market presence and improve their offerings. This strategic activity is expected to further drive the market growth during the forecast period, positioning North America as a leader in climate adaptation initiatives. The US held the largest share due to government investments in upgrading and retrofitting infrastructure to withstand climate impacts. According to the United Nations Environment Programme, COP28 began with significant developments in climate adaptation. The global community agreed to activate the Loss and Damage Fund, which will offer financial support to countries most affected by climate change. First introduced in 2022, this fund received nearly USD 300 million in pledges during COP28.

The US committed USD 3 billion to the Green Climate Fund, raising its total replenishment to nearly USD 13 billion, with half of this amount allocated for adaptation efforts. The US also announced USD 1 billion for climate and health initiatives, approximately USD 200 million for the Global Environment Facility, and around USD 170 million for the adaptation Fund. These developments significantly boost the climate adaptation market expansion in the country.

Canada held a significant share of the North America climate adaptation market with extensive and aging infrastructure, including transportation networks, buildings, and coastal defenses, which are increasingly vulnerable to climate change. There is significant demand for upgrading and retrofitting infrastructure to enhance resilience, which drives the market for climate adaptation solutions. For instance, in June 2023, the International Institute for Sustainable Development (IISD) reported the release of Canada’s first National adaptation Strategy (NAS). The NAS adopts a comprehensive approach to climate adaptation, focusing on enhancing resilience across society and boosting Canadian economies against the growing risks of climate-related disasters.

The market in Asia Pacific is expected to register the highest CAGR from 2025 to 2034. This is due to severe threats from climate change-induced disasters. Crucial collaborative action is needed to manage disaster risks and enhance climate resilience. For instance, according to the Economic and Social Commission for Asia and the Pacific (ESCAP), ESCAP and UNDP are running a two-year collaborative SDG-funded project (2022-2023) to integrate Disaster Risk Reduction and Climate Change adaptation into national and sub-national development plans. This initiative aims to improve the achievement of SDGs and Agenda 2030. As part of the project, ESCAP has developed an updated risk profile using high-resolution climate projections and geospatial techniques to help stakeholders make informed decisions.

The climate adaptation industry in India held a significant market share in 2024 due to increased awareness of climate change. On the other hand, Japan's market is expected to continue its steady growth during the forecast period due to advancements in climate adaptation technologies, including early warning systems, resilient infrastructure, and data analytics.

Key Players and Competitive Insights

The competitive landscape of the climate adaptation market is undergoing significant transformation, driven by intensified industry analysis, evolving market expansion strategies, and an increasing number of strategic alliances. Companies are focusing on joint ventures and mergers and acquisitions to strengthen their positioning and expand their geographic reach, particularly in regions highly vulnerable to climate change. Post-merger integration has become critical as organizations seek to harmonize operations and accelerate innovation to meet the growing demand for resilient infrastructure, early warning systems, and adaptive technologies. There is a notable surge in new product launches tailored to flood control, drought resilience, and coastal protection, reflecting a heightened emphasis on customized climate solutions.

Technology advancements, such as AI-powered environmental monitoring and predictive analytics for disaster management, are reshaping market dynamics and fostering competitive differentiation. Moreover, collaborative initiatives with governmental and non-governmental bodies are becoming central to scaling up adaptation solutions and securing long-term sustainability. As climate risks become more complex, key players are prioritizing investments in green infrastructure, nature-based solutions, and sustainable urban development. This dynamic environment is also marked by rising funding for research and innovation, highlighting the critical role of agile strategies and cross-sector partnerships in driving the next phase of climate adaptation market evolution.

A few major market players include AccuWeather, Inc.; AEM; Babcock & Wilcox Enterprises, Inc.; Baker Hughes Company; BARANI DESIGN Technologies. r. o.; Carbon Clean; Carbon Engineering ULC; Climate Adaptation ; Climeworks; Drax Group plc.; Earth Networks; Equinor ASA; Esri; Exxon Mobil Corporation; Fluor Corporation; Global Thermostat; Heirloom Carbon Technologies; IBM; Metasensing; OnSolve; Previsico Limited; SLB; Soletair Power; The Nielsen Company; and Vaisala; etc.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. The company provides healthcare and healthcare payer solutions through the IBM Watson Health business. IBM Watson started in 2010, is a supercomputer that uses Digital Workplace (AI) and advanced analytical tools to operate optimally as a "question-answering" machine. For businesses and organizations, IBM Watson uses Digital Workplace to optimize employees' time, automate complex processes, and predict future outcomes. In March 2024, IBM pledged up to USD 45 million for climate adaptation, beginning with a new request for proposals (RFP) focused on developing resilient cities.

BARANI DESIGN Technologies s.r.o., founded in 2003 in Seattle, USA, specializes in developing innovative meteorological devices and weather stations that enhance climate adaptation by providing precise, real-time data for early warning and disaster preparedness. Their technologies, such as advanced radiation shields and IoT-enabled rain gauges, support cities and communities in building resilience to extreme weather events and climate change impacts. The company actively partners with climate resilience initiatives and donates instrumentation to support global environmental research and the fight against accelerated global warming.

List of Key Companies in Climate Adaptation Market

- AccuWeather, Inc.

- AEM

- Babcock & Wilcox Enterprises, Inc.

- Baker Hughes Company

- BARANI DESIGN Technologies s. r. o.

- Carbon Clean

- Carbon Engineering ULC

- Climate Adaptation

- Climeworks

- Drax Group plc

- Earth Networks

- Equinor ASA

- Esri

- Exxon Mobil Corporation

- Fluor Corporation

- Global Thermostat

- Heirloom Carbon Technologies

- IBM

- Metasensing

- OnSolve

- Previsico Limited

- SLB

- Soletair Power

- The Nielsen Company

- Vaisala

Climate Adaptation Industry Developments

March 2024: AccuWeather and Ambient Weather launched a new line of weather stations, leveraging their combined expertise to deliver advanced meteorological monitoring solutions. This exclusive product line integrates advanced technology for precise data collection and analysis, offering features tailored for both professional and enthusiast users.

October 2023: AEM introduced the AEM Elements Resiliency Platform, a comprehensive multi-hazard solution designed to equip communities and organizations with the critical insights and tools needed for effective natural disaster risk management and climate mitigation.

March 2023: Baker Hughes and HIF Global announced a collaboration to develop technology for capturing carbon dioxide directly from the atmosphere, aiming to support and accelerate the energy transition to address climate change.

May 2021: Babcock & Wilcox unveiled its ClimateBright suite, a set of decarbonization technologies intended to help utilities and industries significantly reduce greenhouse gas emissions and combat climate change.

Climate Adaptation Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Nature-Based

- Technology-Based

- Enhanced Natural Process

- Early Climate Warning & Environment Monitoring

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Power Generation

- Oil & Gas

- Chemical & Petrochemical

- Government Agencies

- Academia and Research Institutions

- Others

By Regional Outlook (Revenue – USD billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Climate Adaptation Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 22.90 billion |

|

Market Size Value in 2025 |

USD 25.17 billion |

|

Revenue Forecast by 2034 |

USD 59.84 billion |

|

CAGR |

10.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 22.90 billion in 2024 and is expected to reach USD 59.84 billion by 2034.

The global market is expected to exhibit a CAGR of 10.1% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are AccuWeather, Inc.; AEM; Babcock & Wilcox Enterprises, Inc.; Baker Hughes Company; BARANI DESIGN Technologies s. r. o.; Carbon Clean; Carbon Engineering ULC; Climeworks; Drax Group plc.; Earth Networks; Equinor ASA; Esri; Exxon Mobil Corporation; Fluor Corporation; Global Thermostat; Heirloom Carbon Technologies; IBM; Metasensing; OnSolve; Previsico Limited; SLB; Soletair Power; The Nielsen Company; and Vaisala; etc.

The early climate warning & environment monitoring segment is projected to witness the highest CAGR during the forecast period.

• The government agencies segment is expected to witness the highest CAGR during the forecast period.