Clinical Alarm Management Market Share, Size, Trends, Industry Analysis Report

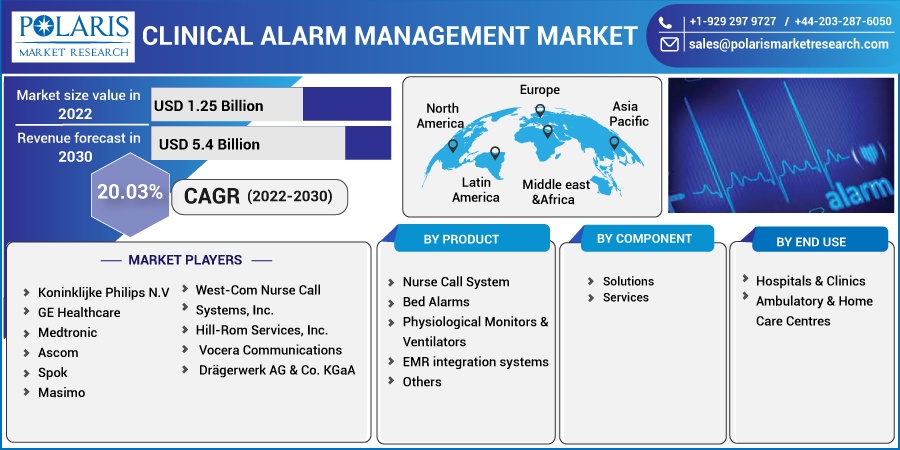

By Product (Nurse Call System, Bed Alarms, Physiological Monitors & Ventilators, EMR integration systems); By Component; By End Use; By Region; Segment Forecast, 2022-2030

- Published Date:Nov-2022

- Pages: 115

- Format: PDF

- Report ID: PM2813

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

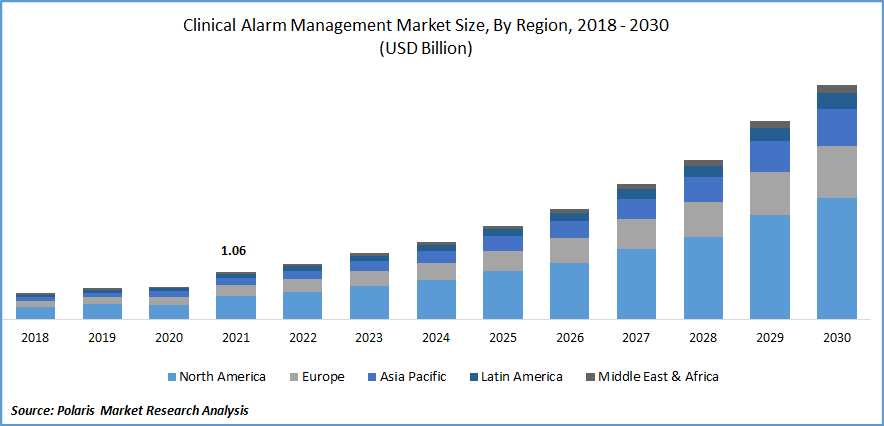

The global clinical alarm management market was valued at USD 1.06 billion in 2021 and is expected to grow at a CAGR of 20.03% during the forecast period.

The emergence of alarm fatigue as a phenomenon and the rising need for cost containment in various healthcare settings, is expected to increase the adoption of novel clinical alarm management systems, thereby growing its market. Clinical alarm management (CAM) refers to reducing unnecessary alarms in a healthcare setting.

Know more about this report: Request for sample pages

The demand for intuitive clinical alarm systems has been on the rise due to the difficulty of hospital staff determining the urgency of medical attention required by a patient and increasing potential for false alarms causing mishaps in hospital management. This, coupled with the rising prevalence of clinician burnout and fatigue among hospital staff, is anticipated to drive the market's growth. Additionally, traditional alarm systems are less accurate in tracking patient vitals, leading to prolonged hospital stays, and augmenting the need for modern integrated CAM systems.

For instance, according to an article published by HIMSS, in September 2022, the prevalence of burnout in U.S. based physicians was 62.8% in 2021 compared to 38.2% in the year 2020. Moreover, in June 2022, the American Medical Association (AMA) announced a recovery plan for physicians in the U.S. due to the increasing prevalence of physician burnout and ordered a telehealth expansion to enable adoption of clinical alarm management systems among others, as a curbing measure.

The market players involved in designing and developing these systems are focused on strategic initiatives to maintain and grow their market presence across key regions and commercialize key products in partnership with healthcare providers. The competitive landscape in this market is also driven by integrative technologies such as merging historical data with artificial intelligence systems to predict and deliver critical services to patients, assistive alerts to clinicians, and healthcare interoperability.

The COVID-19 pandemic has positively impacted the market with increased demand for healthcare management and approvals of emergency protocols for patient care. For instance, according to the Centers for Disease Control and Prevention (CDC), COVID-19 has infected approximately 91% of the population. The pandemic has led to widespread economic disruption and significant changes in healthcare delivery. Many hospitals have adopted various alarm management solutions to manage these disruptions, including clinical alert management and COVID-19 alert systems.

Moreover, increased challenges in the healthcare system, such as staff shortages and increased workload leading to errors in patient care, along with improved patient responses by the aid of intelligent alarm management systems, have supported the market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising trend in developing innovative patient monitoring devices and increasing awareness of predictive analysis algorithms used in patient care systems are key factors driving the market growth. For instance, in June 2022, GE Healthcare announced the launch of Portrait Mobile, a wireless patient monitoring system that helps detect patients' deterioration. The product launch aimed at early detection of patient stays and reduced hospital admissions. The development also caters to the rising need for patient care since 65% of hospital patients are monitored manually on a global scale and are not adequately monitored.

Moreover, the bolstering growth in the Internet of Medical Things (IoMT) industry and the rising need for assistive patient safety among healthcare institutions is anticipated to drive the segment's growth. For instance, according to a study published by BMC Health Services Research, in Marc 2022, one of the ten leading causes of disability and loss of life was patient safety among high-income countries. An estimated 50% of these events could be prevented with interventions such as IoMT systems on clinical alarm management. The study also revealed a reduction in use of beds from 21% to 15%.

Report Segmentation

The market is primarily segmented based on product, component, end-use, and region.

|

By Product |

By Component |

By End Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

EMR integration systems segment is expected to witness fastest growth

The clinical alarm management sector is experiencing the fastest growth in the industry, with a surge in adoption of EHR/EMR solutions by hospitals and health care facilities. Some of the key reasons for increasing development of these technologies are a reduction in cost of healthcare expenditure, improvement of patient care quality and increased revenue.

Additionally, these systems also help to streamline workflow processes and provide a better experience for patients. For instance, in March 2022, Meditech announced its partnership with Google Health to develop an integrated Expanse EHR platform. Moreover, Koninklijke Philips N.V. announced 510(K) market approval for the Philips Capsule Surveillance solution, a patient data aggregation tool. The product enables interoperability with device alarm-aided electronic Intensive Care Units (eICU) among other key features.

services component segment is expeted to dominate the marekt over forecast period

The increasing success rates of utilizing clinical alarm management services in modern hospital environments have proven time and again to reduce the workload and ease of data sharing. For instance, in September 2022, 100Plus, in collaboration with Sweetwater Medical Associates, announced the success of their artificially intelligent (AI) assisted RPM platform among patients with significant improvement in health metrics.

The service platform provides ease of use, is cost-effective, and has strong customer support as key advantages. The increasing advantages of these services aiding the current needs of medical facilities to cater to patient need effectively, along with proven historical records ensuring the services are investment worthy for the provider, are some key factors driving the growth of this segment.

Moreover, rising focus of medical software developers on gaining regulatory approvals to commercialize their proprietary clinical alarm management services is also estimated to augment the growth of the segment. For instance, in January 2022, Ascom announced its Medical Device Regulation (MDR) certification by the European Union under class IIb for its Digistat Care software. The software is an integrated critical care patient service equipped with a CAM system, assisting patient care through a modular suite.

Hospitals & Clinics sector is expected to hold the significant revenue share

The hospital and clinic are anticipated to grow through the forecast period owing to the rising need to reduce inconsequential clinical alarms and alerts to decrease alarm fatigue. Hospitals and clinics face alarm fatigue due to an increasing number of patient footfalls and rising demand of monitoring critical patients. For instance, a study published by the Boston Medical Center reported a drop in audible alarms by 89% by using cardiac monitors enabled with crisis thresholds over standard warning cardiac monitors. The increasing demand for smart alarms catering the rising need of alarm fatigue reduction is estimated to drive the growth of the segment.

Moreover, the increasing acceptance of triaging systems among hospitals, helping in the cross-communication of critical alarms to clinicians and nurses, is a rising trend in the clinical alarm market. This coupled ability of customization among hospital triaging systems to meet specific demands is anticipated to support the growth of the segment.

The demand in North America is expected to witness significant growth

North America is estimated to grow through the study period due to the presence of the largest patient population globally. For instance, the U.S. harbors over 325 million people, with the healthcare industry accounting for 18% of its GDP and employing nearly one in 10 Americans. This is increasing the need for healthcare professionals in North America to adopt advanced clinical alerting solutions to meet their surging needs of patient care.

The region is also projected to increase adoption of novel clinical alarm management solutions owing to the rising need for healthcare institutions to centralize their alarm management systems and speed up the processes. This is promoting key healthcare companies to integrate cloud-based alarm management solutions with key advantages such as control over access management, alarms and clinical surveillance.

For instance, in February 2022, Brivo, Inc. collaborated with Sitasys AG to integrate evalink talos, a clinical alarm management system, with its cloud-based access control system. The product will enable cloud access of clinical alarms to large-scale healthcare institutions to centralize patient monitoring and provide seamless access to clinical alarms on availing these solutions.

Europe is expected to grow through the forecast period owing to a high prevalence of chronic disease among patient population, thereby increasing the demand patient admissions. This coupled with rise in the ageing population prone to developing diseases requiring constant patient monitoring in key countries, is estimated to drive the growth of the regional market.

Competitive Insight

Some of the major players operating in the global market include Koninklijke Philips, GE Healthcare, Medtronic, Ascom, Spok, Masimo, West-Com Nurse Call Systems, Hill-Rom Services, Vocera Communications, Dragerwerk and others.

Recent Developments

In July 2022, Spok announced an agreement with inTechnology, to distribute and implement Spok’s healthcare communication products in the region of Asia Pacific. The development helps the company establish its market presence in the emerging healthcare infrastructure of the region along with improving hospitals’ integrated key communication solutions with their existing data systems upgrade systems such as clinical alarms, patient monitors, and Electronic Medical Records (EMR).

In March 2022, Sheffield Children’s Hospital announced its collaboration with Tutum Medical, to develop a novel concept of a Bedside Equipment Alarm Monitoring System (BEAMS). The system integrates critical bedside monitoring systems to improve ability of nursing staff responses and track staff walking wards to monitor for alarms. The system is estimated to reduce the alarm frequency by 95%, thereby reducing alarm fatigue significantly along with improving the availability of staff to help critical patients effectively.

Clinical Alarm Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1.25 billion |

|

Revenue forecast in 2030 |

USD 5.4 billion |

|

CAGR |

20.03% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Component, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Koninklijke Philips N.V, GE Healthcare, Medtronic, Ascom, Spok, Masimo, West-Com Nurse Call Systems, Inc., Hill-Rom Services, Inc., Vocera Communications, Drägerwerk AG & Co. KGaA among others. |