Closed System Transfer Devices Market Size, Share, Trends, Industry Analysis Report

: By Type (Needleless Systems, Membrane-to-Membrane Systems), By Component, By Technology, By Closing Mechanism, By End User, By Distribution Channels, By Region – Market Forecast, 2025-2034

- Published Date:Oct-2025

- Pages: 120

- Format: PDF

- Report ID: PM1829

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

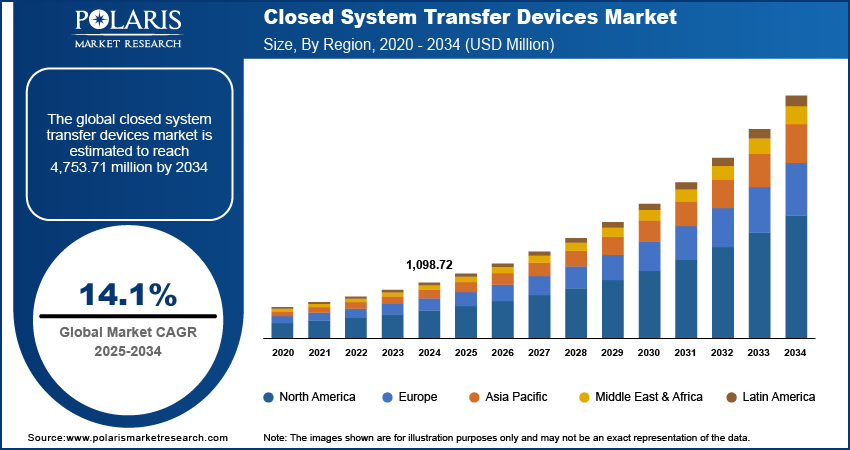

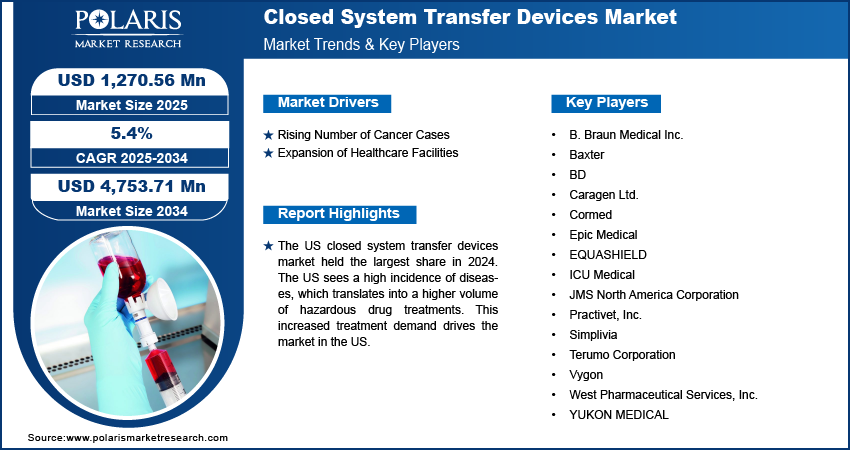

The global closed system transfer devices market size was valued at USD 1,098.72 million in 2024, exhibiting a CAGR of 14.1% during the forecast period. The market is driven by technological advancements, rising cancer cases, expanding healthcare facilities, regulatory compliance, and heightened safety awareness.

Key Insights

- In 2024, the needleless systems segment accounted for a significant market share due to their ability to minimize needle-stick injuries, enhance safety, and increase efficiency in drug handling.

- Oncology centers & clinics are expected to experience the largest growth over the forecast period, driven by the increasing number of cancer patients.

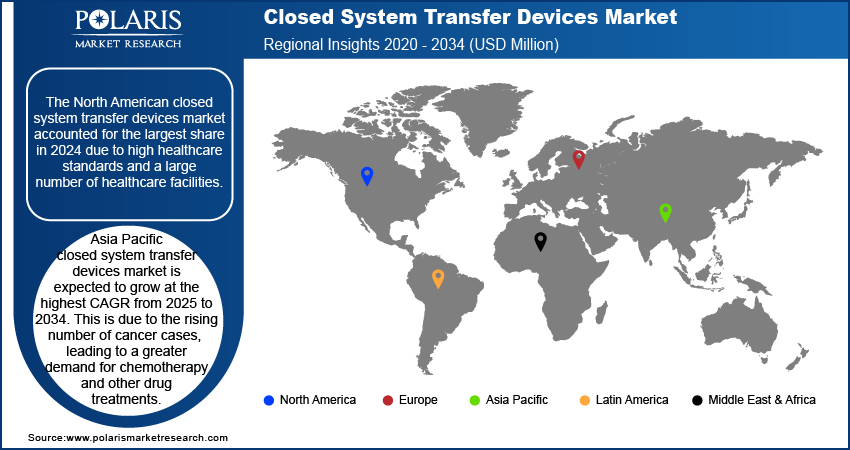

- In 2024, North America accounted for the largest proportion of the closed system transfer devices market, primarily due to its high healthcare standards and a large concentration of healthcare facilities.

- Asia Pacific is expected to develop at the fastest rate between 2025 and 2034, driven by a rise in cancer cases and increased demand for treatments.

Industry Dynamics

- Technological innovations are driving the growth of the closed system transfer devices market by enhancing CSTDs to become more effective, user-friendly, and current for healthcare workers.

- The growing incidence of cancer is fueling the need for CSTDs, driving higher adoption and market growth in healthcare institutions.

- Market growth is driven by the increasing number of healthcare facilities implementing CSTDs to ensure the safe handling of hazardous drugs.

- One of the significant market restraints is the elevated cost of these systems, which may constrain adoption in lower-resource healthcare environments.

Market Statistics

2024 Market Size: USD 1,098.72 million

2034 Projected Market Size: USD 4,753.71 million

CAGR (2025-2034): 14.1%

North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Closed system transfer devices (CSTDs) are specialized systems developed to safely transfer hazardous drugs between containers without exposing the drug to the environment or the healthcare workers to potential contaminants. These devices are crucial in healthcare settings, particularly for handling chemotherapy agents and other toxic medications, as they prevent leakage, spillage, and aerosolization of these drugs, thereby ensuring safety and minimizing the risk of exposure.

Advances in technology are driving the growth of the closed system transfer devices market. These advancements have led to the development of more effective and user-friendly CSTDs, keeping healthcare professionals informed and up-to-date. Additionally, stringent regulations and guidelines set by health authorities further bolster the closed system transfer devices market share.

Increased awareness of occupational safety and the push for improved healthcare standards also play a significant role and increasingly adopt CSTDs to ensure safety and compliance with regulatory requirements. Also, forming strategic partnerships with healthcare providers, pharmaceutical companies, and other stakeholders creates new avenues for growth. Collaborations involve joint ventures, product development, acquisition, or co-marketing efforts that broaden closed system transfer devices' market reach.

Market Drivers Analysis

Rising Number of Cancer Cases

The closed system transfer devices market CAGR is being driven by the rising number of cancer cases globally. As cancer incidence continues to increase, there is a heightened demand for chemotherapy and other drugs used in treatment for blood cancer and others. CSTDs play a crucial role in this context by ensuring the safe handling and transfer of these potent medications. They protect healthcare workers from potential exposure to toxic drugs and prevent contamination of the environment.

The growing prevalence of cancer amplifies the need for effective safety measures in drug handling, leading to greater adoption of CSTDs across hospitals, clinics, and outpatient centers. As more cancer patients require treatment, the demand for CSTDs rises accordingly, driving market expansion and innovation in these safety devices.

For instance, the World Health Organization (WHO) reported that in 2022, there were an estimated 20 million new cancer cases and 9.7 million cancer-related deaths. Additionally, 53.5 million people were alive five years after diagnosis, highlighting both the prevalence of cancer and the ongoing need for effective treatment solutions, with predictions indicating over 35 million new cancer cases by 2050, representing a 77% increase from 2022. This required the proper drugs, which resulted in a growing need for safety in drug handling is reflected in the expanding use of CSTDs across medical facilities. Thus, it increases the closed system transfer devices market revenue.

Expansion of Healthcare Facilities

The closed system transfer devices market is experiencing significant growth, driven by the expansion of healthcare facilities. As the number of hospitals, outpatient clinics, and specialty treatment centers continues to rise, so does the volume of harmful drugs handled in these settings. New and expanding healthcare facilities are increasingly adopting CSTDs to ensure the safe and efficient handling of chemotherapy and other potent medications, which is critical for protecting healthcare workers, patients, and the environment. For instance, in April 2024, the World Bank Group unveiled an ambitious plan to help countries provide quality and affordable health services to 1.5 billion people by 2030.

Segment Analysis

Market Breakdown by Type Insights

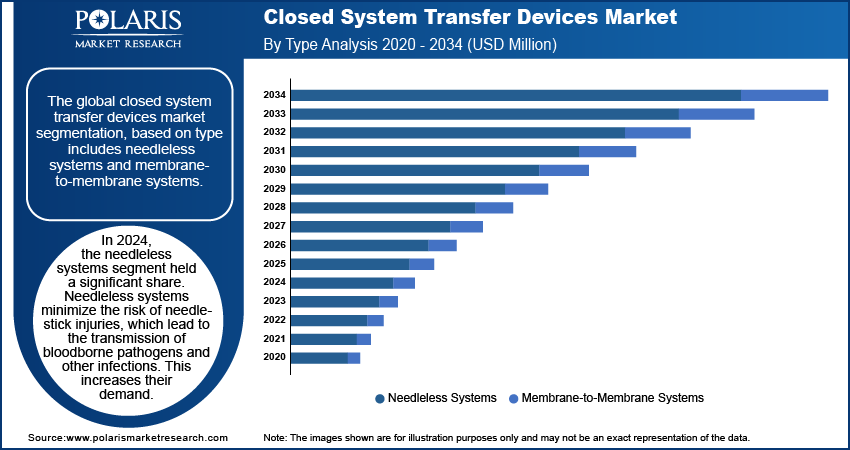

The global closed system transfer devices market segmentation, based on type, includes needleless systems and membrane-to-membrane systems. In 2024, the needleless systems segment held a significant share. Needleless systems minimize the risk of needle-stick injuries, which lead to the transmission of bloodborne pathogens and other infections. This feature makes them particularly appealing for healthcare facilities focused on improving safety protocols and protecting staff. Needleless systems are often easier to use compared to traditional needle-based devices, reducing the likelihood of errors and improving efficiency in drug handling.

Increasing awareness of the benefits of needleless systems and their role in enhancing safety has led to greater adoption across healthcare settings. This growing preference contributes to the significant share of needleless systems in the CSTD market.

Key players leverage this trend by focusing on developing and refining needleless systems to meet evolving needs and preferences. By investing in research and development to enhance the functionality, usability, and safety features of needleless systems, companies position themselves as a major player in the market.

For instance, ICU Medical, Inc. offers the ChemoLock and ChemoClave needle-free closed system transfer devices designed to minimize exposure to hazardous drugs and ensure compliance with USP <800> regulations. By providing these advanced solutions, ICU Medical is well-positioned to enhance its market share in the closed system transfer devices sector.

Market Breakdown by End User Insights

The closed system transfer devices market segmentation, based on end users, includes hospitals, ambulatory surgical centers, oncology centers & clinics, academic and research institutes, and others. The oncology centers & clinics are expected to witness the highest growth during the forecast period due to the rising number of cancer patients. This increase in patient volume directly drives up the demand for CSTDs to safely manage the administration of chemotherapy and other drugs.

Oncology centers are specialized facilities that handle a major volume of chemotherapy drugs used in cancer treatment. As the incidence of cancer continues to rise globally, these centers are seeing a growing number of patients requiring such treatments, driving up the demand for CSTDs to ensure safe drug handling.

For example, the American Cancer Society estimates that in 2022, there will be approximately 1.9 million new cancer cases and 609,360 cancer-related deaths in the US. Additionally, the World Health Organization reports that cancer is the second leading cause of death worldwide. Such a rising number of cancer patients heightens the need for effective safety measures in drug administration. CSTDs help prevent leaks and contamination, protecting both patients and healthcare workers from the adverse effects of hazardous drugs.

Regional Insights

By region, the study provides closed system transfer devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North American closed system transfer devices market accounted for the largest share in 2024 due to high healthcare standards and a large number of healthcare facilities. The increasing awareness of drug safety, regulatory compliance, and the rising incidence of cancer and other conditions requiring hazardous drug handling contribute to the rise of the closed system transfer devices market demand.

The US closed system transfer devices market held the largest share in 2024. The US sees a high incidence of diseases, which translates into a higher volume of hazardous drug treatments. This increased treatment demand drives the need for effective and safe drug-handling solutions, boosting the demand for CSTDs.

For instance, in April 2023, Baxter, a global provider of sterile medication production and distribution, announced the US launch of ZOSYN (piperacillin and tazobactam) Injection for treating various infections caused by susceptible bacteria. Given the need for stringent drug safety protocols associated with this injection, the use of CSTDs is required to ensure safe handling and administration.

Asia Pacific closed system transfer devices market is expected to grow at the highest CAGR from 2025 to 2034. This is due to the rising number of cancer cases, leading to a greater demand for chemotherapy and other drug treatments. This increase drives the need for CSTDs to ensure the safe handling and administration of these medications. For instance, the projected number of cancer patients in India for the year 2020 was 1,392,179.

Closed system transfer devices market in India had the largest share in 2024, driven by factors such as urgency and scale of the vaccine rollout, highlighting the importance of safe handling and transfer of pharmaceuticals. For instance, in February 2022, Zydus Cadila delivered the first consignment of its COVID-19 vaccine, ZyCoV-D, to the Indian government. Such a necessity for a safe transfer process for vaccines significantly increases the demand for closed-system transfer devices.

Key Market Players & Competitive Analysis Report

Major closed system transfer devices market players are focusing on continuous innovation to enhance the safety, usability, and efficiency of CSTDs. This includes developing needle-free systems, automated transfer solutions, and advanced safety features. Companies with important market developments and technological advancements capture a significant market share to strengthen their market position.

In the closed system transfer devices market, companies are also prioritizing regulatory adherence to meet stringent guidelines, thus ensuring their products are widely accepted and trusted in various healthcare settings. Additionally, strategic partnerships, geographic expansion, and product diversification play key roles in these company growth strategies.

Major players in the closed system transfer devices market includes B. Braun Medical Inc.; Baxter,; BD; Caragen Ltd.; Cormed; Epic Medical; EQUASHIELD; ICU Medical; JMS North America Corporation; Practivet, Inc.; Simplivia; Terumo Corporation; Vygon; West Pharmaceutical Services, Inc.; YUKON MEDICAL; etc.

B. Braun Medical Inc., a prominent player in infusion therapy and pain management, specializes in developing, manufacturing, and marketing innovative medical products and services. The company focuses on eliminating preventable treatment errors and enhancing safety for patients, clinicians, and the environment. Headquartered in Bethlehem, Pennsylvania, B. Braun Medical is part of the B. Braun Group of Companies in the U.S., with over 64,000 employees across 64 countries. In December 2021, B. Braun Medical Inc. introduced the OnGuard 2 Closed System Transfer Device (CSTD) in the United States for ease of operation and integration into healthcare practices, aiding facilities in meeting USP <800> standards for handling hazardous drugs.

Simplivia is a manufacturer dedicated to providing high-quality medical solutions for drug delivery, ensuring the safety of healthcare professionals. The company’s products are produced to the highest ISO standards and hold approvals from major regulatory bodies, with a global sales network. With over 20 years in the market, Simplivia operates in more than 33 countries and continues to expand into new regions. The company boasts a diverse and innovative product pipeline featuring FDA and CE-approved drug delivery solutions. In March 2024, Simplivia launched the SmartCompounders chemo automation solution, enhanced by the advanced Chemfort Closed System Drug-Transfer Device (CSTD).

List Of Key Companies

- B. Braun Medical Inc.

- Baxter

- BD

- Caragen Ltd.

- Cormed

- Epic Medical

- EQUASHIELD

- ICU Medical

- JMS North America Corporation

- Practivet, Inc.

- Simplivia

- Terumo Corporation

- Vygon

- West Pharmaceutical Services, Inc.

- YUKON MEDICAL

Closed System Transfer Devices Industry Developments

October 2023: EQUASHIELD’s Syringe Unit received expanded FDA clearance for full-volume use. This milestone establishes it as the most widely used CSTD in the USA.

March 2022: Vygon, the manufacturer of Qimono CSTD, announced its acquisition of Macatt Medica, a Peruvian distribution company, to enhance its presence in South America.

April 2021: Fresenius Kabi joined a premier US distribution contract with Corvida Medical for the HALO Closed System Drug-Transfer Device.

Closed System Transfer Devices Market Segmentation

By Type Outlook (Revenue - USD Million, 2020-2034)

- Needleless Systems

- Membrane-to-Membrane Systems

By Component Outlook (Revenue - USD Million, 2020-2034)

- Vial Access Components

- Male Luers

- Bag Spikes

- Female Components

- Other Components

By Technology Outlook (Revenue - USD Million, 2020-2034)

- Air Cleaning/Filtration Devices

- Diaphragm-Based Devices

- Compartmentalized Devices

By Closing Mechanism Outlook (Revenue - USD Million, 2020-2034)

- Click-to-Lock System

- Luer Lock System

- Push-to-Turn System

- Color-to-Color Alignment System

By End User Outlook (Revenue - USD Million, 2020-2034)

- Hospitals

- Ambulatory Surgical Centers

- Oncology Centers & Clinics

- Academic and Research Institutes

- Others

By Distribution Channels Outlook (Revenue - USD Million, 2020-2034)

- Distributors

- Direct Sales

By Regional Outlook (Revenue - USD Million, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Closed System Transfer Devices Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,098.72 million |

|

Market Size Value in 2025 |

USD 1,270.56 million |

|

Revenue Forecast in 2034 |

USD 4,753.71 million |

|

CAGR |

14.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global closed system transfer devices market size was valued at USD 1,098.72 million in 2024 and is expected to grow at 4,753.71 million in 2034.

The global market is estimated to register a CAGR of 14.1% during the forecast period 2025-2034.

North America held the largest share of the global market

The key players in the market are B. Braun Medical Inc.; Baxter; BD; Caragen Ltd.; Cormed; Epic Medical; EQUASHIELD; ICU Medical; JMS North America Corporation; Practivet, Inc.; Simplivia; Terumo Corporation; Vygon; West Pharmaceutical Services, Inc.;YUKON MEDICAL; etc.

In 2024, the needleless systems segment held a significant share.

The oncology centers & clinics are expected to witness the highest growth during the forecast period.