Cloud Advertising Market Share, Size, Trends, Industry Analysis Report

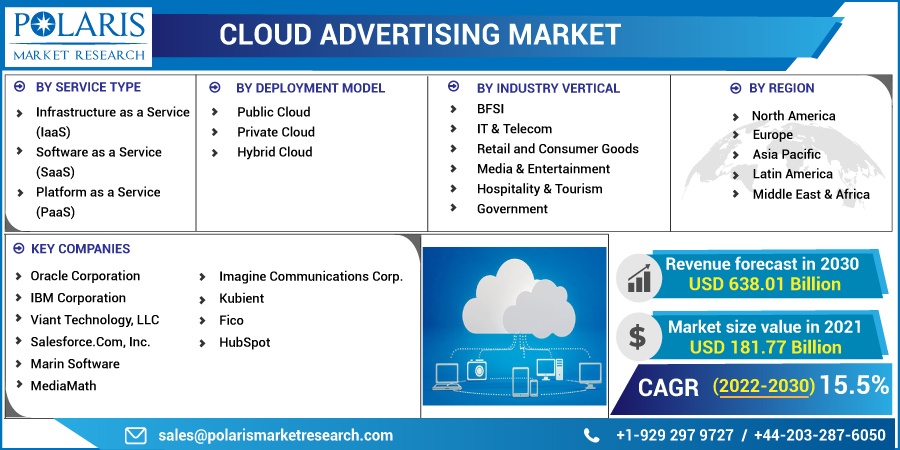

By Service Type (Infrastructure as a Service (IaaS), Software as a Service (SaaS), Platform as a Service (PaaS)); By Deployment Model; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 111

- Format: PDF

- Report ID: PM2562

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

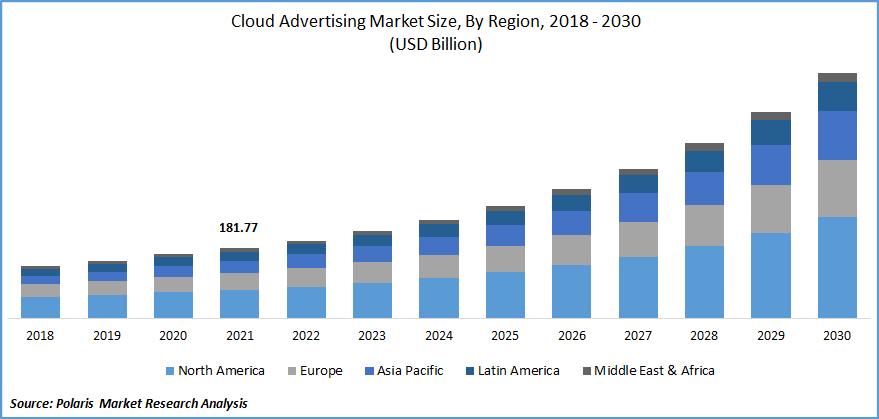

The global cloud advertising market was valued at USD 181.77 billion in 2021 and is expected to grow at a CAGR of 15.5% during the forecast period. The global market for cloud advertising has grown rapidly due to the rapidly increasing number of internet users. The Internet has an extended network of connected computers that allows users to share information, communicate, and access online data sources.

Know more about this report: Request for sample pages

Online advertising campaigns that use the Internet and social media platforms can be viewed as utilizing cloud advertising. As a result, there is more client involvement on platforms due to the increase in internet users. Consequently, the industry is expanding due to the increasing number of internet users in the forecast period.

The key factors that are significantly influencing the market are technological improvements. The major companies in the cloud advertising market are concentrating on creating cutting-edge technology solutions to dominate the industry due to the rising demand. Customers' experiences and engagement with advertisements will be enhanced by these platforms that use cutting-edge technologies like data science, AI, and machine learning.

In addition to integrating with advertising networks, these platforms allow users to integrate with various tools. This implies that advertisers can utilize the platform in any way they see fit. Users can expand the size of their online display advertising campaigns with cloud advertising. Businesses can obtain economies of scale and take a leaner approach to produce online advertising by increasing output via these solutions. Such factors will drive the industry growth in the forecast period.

Covid-19 has impacted the industry to a certain extent. It significantly affected both the lives of individuals and businesses. It began as a catastrophe affecting human health but has now become a significant threat to international trade, the financial system, and the economy. During a pandemic, the industry was positively impacted by COVID-19.

A lockdown was imposed by the governments of multiple nations, which forced the closure of numerous shops, offices, telecom and IT firms, and educational facilities. The ability to choose a product on an e-commerce platform while sitting in the comfort of one's homemade online shopping is much more popular following COVID-19.

Furthermore, the inability to operate from offices and retail establishments caused COVID-19 to affect several enterprises. Consumers have rushed to digital platforms for news, entertainment, education, and to keep in touch with friends and family. Consequently, COVID-19 has led to a significant increase in demand across all end users. This is expected to drive the cloud advertising market during the forecast period.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Cloud-based advertising services allow users to create, update, and manage display advertising campaigns without being tied down to a specific device or office chair. Simply log in and get to work. For remote teams or digital nomads who are dispersed throughout the globe, the flexibility of working from any location is ideal for contemporary advertisers who might need to operate while on the go. It is also practical.

The steadily rising use of smartphones, widespread internet access, and rising digital media consumption are the main factors driving the industry. However, during the forecast period, these factors are expected to increase the number of online users worldwide and create new growth opportunities for the cloud advertising market.

The consumption of digital information has expanded as more and more items become digital, and smartphone users have access to high-speed Internet, which is anticipated to lead to more lucrative chances for key cloud advertising market players. It will show the industry growth in the forecast period. As a result, such factors have driven a higher demand worldwide.

Report Segmentation

The market is primarily segmented based on service type, deployment model, industry vertical, and region.

|

By Service Type |

By Deployment Model |

By Industry Vertical |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Software as a Service (SAAS) Segment is Expected to Witness the Fastest Growth

In 2022, the software as a service (SaaS) segment accounted for the largest revenue share. The industry is heavily dominated by software as a service (SaaS). Businesses can use the most cutting-edge technologies for marketing and advertising without significant up-front fees by employing SaaS tools. Traditional on-premise solutions necessitate significant technological investments and committed IT personnel to keep the system running smoothly.

Marketers who use SaaS also benefit from several factors that can significantly impact their level of success. The real-time data they get from their platform stands out the most. As a result, advertising and marketing teams are no longer required to wait for audience input. They can adjust their plans based on the information obtained from their media sources. Due to their numerous benefits, software as a service (SaaS) will lead the market growth in the forecast period.

Public Cloud Accounted for the Second-Largest Market Share in 2021

A public cloud advertising platform allows numerous organizations to share cloud advertising services while limiting internet access to each organization's data and applications. Outside service providers own public services. BPaaS, PaaS, IaaS, are few of the several services (SaaS). Throughout the forecast period, the public cloud is expected to be used more frequently and drive industry growth.

Retail and Consumer Goods Segment is Expected to Witness the Fastest Growth

The retail and Consumer Goods segment is expected for the largest market share. In the retail and e-commerce sectors, goods have expanded far beyond the displays in shopping windows to the availability of goods through mobile devices. Prior to making a purchase, consumers research costs, read product reviews and visit the websites of rival companies. Salesforce reports that 82% of marketers start the consumer journey online before making any in-store purchases. A variety of marketing methods are being used by retailers to attract customers to physical stores so they can purchase goods through online eCommerce platforms to stay competitive.

This platform allows marketers to create engaging content and enhance customer engagement. This helps manufacturers of consumer goods increase brand loyalty and encourages customers to buy their goods. By coordinating with all omnichannel brand engagements and strengthening customer relationships, the usage of content analytics also significantly contributes to understanding customers' shopping habits.

The Demand in Asia-Pacific is Expected to Witness Significant Growth

Asia-Pacific is estimated to hold the highest CAGR in cloud advertising during the forecast period. The region's expansion is primarily attributable to the rapid economic development of nearby developing nations like China, Malaysia, Indonesia, and India.

In the APAC area, there is a rising need for cloud-driven and cloud-supported advertising, driving up expenditures and technological improvements across numerous industries. The region is anticipated to offer considerable growth prospects during the projection period. During the forecast period, untapped potential markets, growing penetration of cutting-edge technologies, and application development in various verticals are anticipated to propel the region's growth.

Competitive Insight

There are several major players in the global market, such as Adobe Systems Incorporated, Google LLC (Alphabet Inc.), Sprinklr Inc., Oracle Corporation, IBM Corporation, Viant Technology, LLC, Salesforce.Com, Inc., Marin Software, Imagine Communications Corp., Kubient, Fico, HubSpot, and MediaMath.

Recent Developments

- In may 2022, A new, cloud-based version of the WhatsApp Business Platform will be available to organisations worldwide thanks to Meta. In order to let businesses and developers quickly utilise our service, to improve response times for their consumers.

- In September 2021, IBM Watson Assistant introduces new AI capabilities to help businesses create better customer service across different platforms.

Cloud Advertising Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 181.77 billion |

|

Revenue forecast in 2030 |

USD 638.01 billion |

|

CAGR |

15.5% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Product, By End-User By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Adobe Systems Incorporated, Google LLC (Alphabet Inc.), Sprinklr Inc., Oracle Corporation, IBM Corporation, Viant Technology, LLC, Salesforce.Com, Inc., Marin Software, Imagine Communications Corp., Kubient, Fico, HubSpot, and MediaMath. |