Cloud Managed Services Market Size, Share, Trends & Industry Analysis Report

By Organization Size (Large Enterprises, Small and Medium-Sized Enterprises), By Service, By Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 112

- Format: PDF

- Report ID: PM2306

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

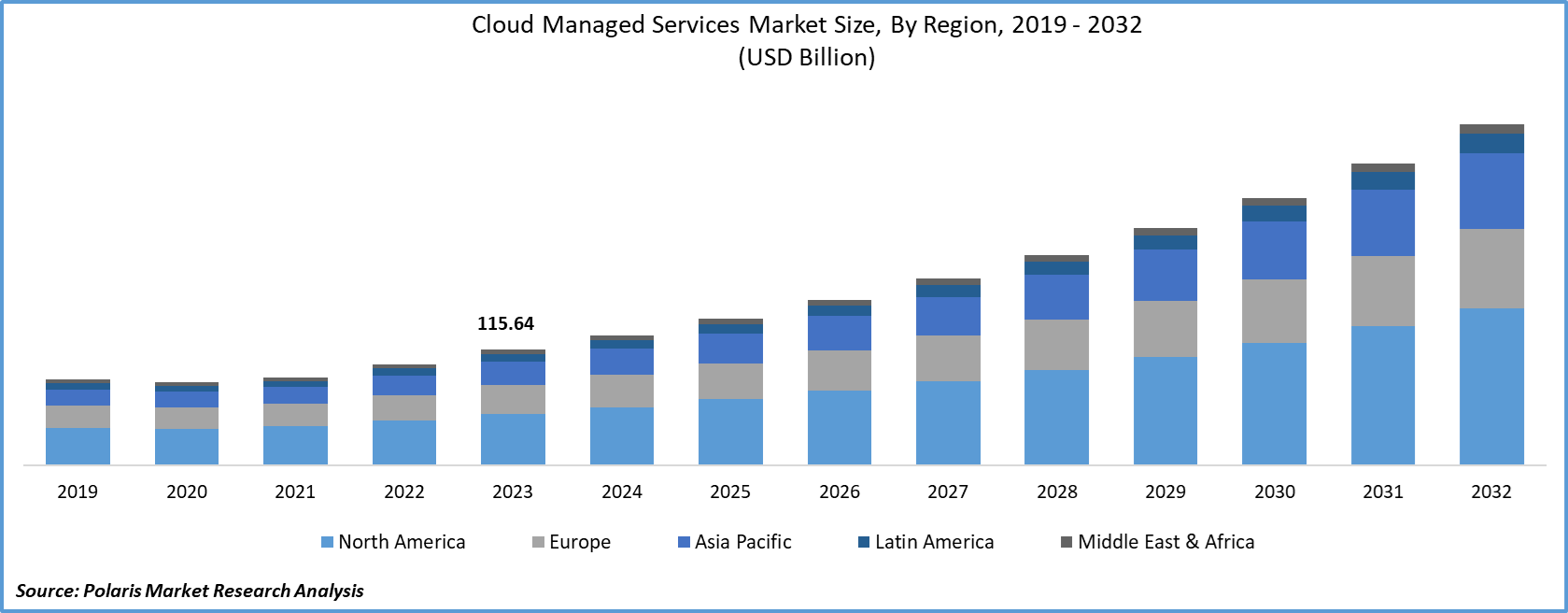

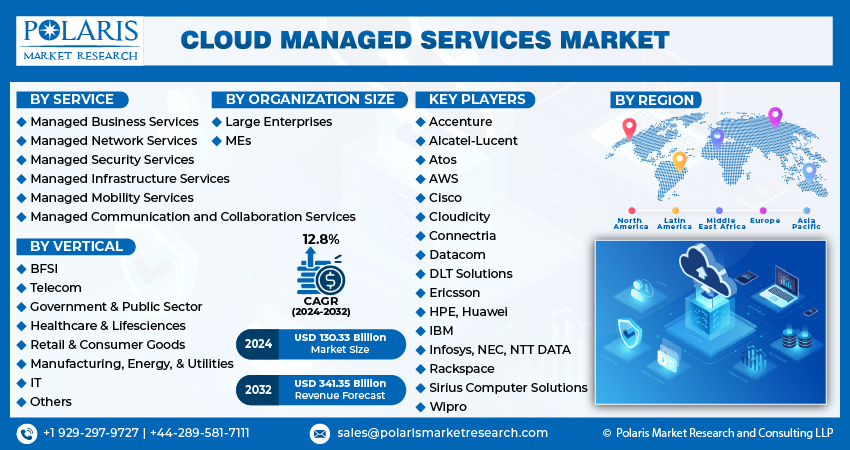

The cloud managed services market size was valued at USD 134.48 billion in 2024 and is projected to register a CAGR of 14.6% from 2025 to 2034. Increasing cloud adoption and rising demand for IT cost optimization boost the market growth. Also, enhanced data security needs and growing reliance on remote work solutions prompt businesses to outsource cloud infrastructure management and support. This factor propels the demand for cloud managed services.

Key Insights

- In 2024, the large enterprises segment dominated the market share. Large enterprises frequently adopt hybrid cloud and multi-cloud networking to integrate various systems and optimize their performance, propelling the segment growth.

- The managed infrastructure services segment held a significant share in 2024, due to their critical role in maintaining core IT operations.

- In 2024, North America emerged as the dominant region in the global market. It is driven by the early adoption of advanced technologies and strong presence of major cloud service providers.

- The Asia Pacific cloud managed services industry is rapidly emerging as the fastest-growing area. Increasing digital transformation across industries and rising cloud adoption among small and medium enterprises boost the industry growth.

Industry Dynamics

- Rising emphasis on digital transformation and operational efficiency boosts the demand for cloud managed services.

- Increasing incidents of cybersecurity threats, including data breaches, ransomware attacks, and phishing attempts, are posing significant challenges for businesses across all sectors. As a result, the growing demand for comprehensive and proactive cybersecurity solutions is a key industry growth driver.

- The growing complexity is a significant driver of demand in the cloud managed services market.

- Dependence on third-party providers hinders the market expansion.

Market Statistics

2024 Market Size: USD 134.48 billion

2034 Projected Market Size: USD 524.28 billion

CAGR (2025–2034): 14.6%

North America: Largest market in 2024

AI Impact on Cloud Managed Services Market

- Artificial intelligence technology is used to automate routine tasks such as monitoring, incident resolution, and patching. It minimizes downtime and enhances service reliability.

- Machine learning models predict system failures before they happen. This facilitates proactive support and reduces operational costs.

- The AI tools flag threats, detect anomalies, and respond to breaches in real time. It strengthens cloud infrastructure against cyber risks.

- The tools optimize cloud resource usage by analyzing demand patterns, which improves cost-efficiency and scalability for clients.

To Understand More About this Research: Request a Free Sample Report

Cloud managed services refer to the delegation of various IT management tasks related to specific cloud applications to a service provider. These services include monitoring, maintenance, enhancement, security, and support for an organization's cloud ecosystem, whether it be public, private, or hybrid. This approach allows businesses to take full advantage of the flexibility and scalability of cloud computing without having to manage the complexities of administration. Such a shift enables organizations to achieve greater operational efficiency and resource optimization, which are critical in today's technological landscape.

The demand for cloud managed services has significantly increased due to the growing complexity of cloud environments, especially as enterprises adopt multi-cloud and hybrid cloud strategies. The demand for specialized skills often leads organizations to prefer external managed service providers, as platforms integrate diverse capabilities and compliance needs. Another key factor driving the market is heightened focus on cybersecurity. As cyber threats and data breaches rise, there is a greater demand for robust security solutions. Managed service providers excel in areas such as encryption, intrusion detection, and compliance management, helping to reduce risks and potential financial losses.

Industry Dynamics:

Increasing Complexity of Cloud Environments

As businesses increasingly adopt multi-cloud and hybrid cloud strategies, managing these complex environments becomes more challenging. Different cloud platforms come with their unique tools, configurations, and compliance requirements, which make it difficult for internal IT teams to manage them effectively. This complexity often leads to performance issues, security vulnerabilities, and higher operational costs.

Cloud managed service providers offer the expertise needed to streamline operations, ensure seamless integration across multiple platforms, and maintain compliance with various regulations. Businesses relieve internal pressures, enhance system performance, and concentrate on achieving strategic goals by outsourcing cloud management. This growing complexity is a significant driver of demand in the cloud managed services market.

Escalating Cybersecurity Threats

Escalating cybersecurity threats, including ransomware attacks, data breaches, and phishing attempts, are posing significant challenges for businesses across all sectors. For instance, according to the "2024 SonicWall Cyber Threat Report," cryptojacking incidents surged by 659% compared to 2022, reaching a total of 1.06 billion attacks in 2023, highlighting its continued widespread presence. Many organizations struggle to maintain adequate in-house security capabilities as these cyber threats become more sophisticated. Consequently, there is an increasing reliance on cloud-managed service providers, which offer advanced security measures such as real-time threat detection, data encryption, vulnerability management, and support for regulatory compliance. These services help businesses protect sensitive data, reduce operational risks, and maintain the confidence of stakeholders. As a result, the growing demand for comprehensive and proactive cybersecurity solutions is a key driver in the cloud-managed services market.

Focus on Digital Transformation and Operational Efficiency

Organizations globally are actively adopting digital transformation strategies to support competitive positioning, boost customer engagement, and optimize operational efficiency. Cloud computing serves as a critical factor for these initiatives, offering the necessary scalability, agility, and infrastructure flexibility to support advanced applications and data-driven decision-making. However, maximizing the value of cloud adoption increases effective resource management and ongoing cost-performance optimization. This transformation is increasing due to the collaborations between major cloud providers to expand service accessibility. For instance, in April 2025, Oracle and Google Cloud launched a joint partner program, allowing their partners to resell Oracle Database and Google Cloud through private marketplace offers. This initiative allows technology partners to seamlessly integrate the solution into their offerings, giving greater deployment flexibility and choice.

Segmental Insights:

Market Assessment By Organization Size

In 2024, large enterprises dominated the cloud managed services market. These organizations usually have extensive and complex IT infrastructures that span multiple regions, necessitating sophisticated and secure cloud environments. With substantial budgets, they place a high priority on uptime, compliance management, and disaster recovery, resulting in significant investments in managed services. Furthermore, large enterprises frequently adopt multi-cloud and hybrid cloud strategies to integrate various systems and optimize their performance.

Small and medium-sized enterprises (SMEs) are expected to witness highest growth during forecast period in the cloud managed services market. This growth is driven by their increasing recognition of cloud technologies and the constraints they face due to limited resources. Many SMEs lack in-house IT departments with the necessary expertise to implement complex cloud architectures and deployments, making outsourced managed services a more cost-effective solution. By leveraging cloud managed services, these businesses gain access to enterprise-level technology without incurring high capital expenses.

Furthermore, as AI continues to evolve in addressing cybersecurity threats alongside increasing regulatory scrutiny, SMEs are turning to managed service providers for support in securing sensitive data, ensuring compliance, and minimizing the risk of business interruptions. This trend is significantly boosting demand in the cloud managed services market.

Market Evaluation By Service

Managed infrastructure services hold a significant share of the cloud managed services market due to their critical role in maintaining core IT operations. As businesses migrate to cloud environments, they require reliable management of servers, storage, networks, and virtual machines to ensure smooth and secure functioning. These services provide continuous monitoring, performance optimization, security management, and technical support, which are essential for minimizing downtime and operational risks. Additionally, managing complex infrastructure internally demands high expertise and resources, prompting organizations to outsource to specialized providers. This enables companies to focus on strategic initiatives while ensuring their IT infrastructure remains efficient and secure.

Managed security services are becoming increasingly significant in the cloud managed services sector due to the growing frequency and sophistication of cyber threats. As organizations transition critical data and applications to the cloud, ensuring their protection is a top priority. Many businesses lack the in-house expertise to address advanced security requirements, making outsourced solutions more appealing. Managed service providers offer continuous threat monitoring, incident response, compliance support, and data protection. These services help businesses reduce risk, meet regulatory requirements, and maintain trust with customers and stakeholders.

Market Evaluation By Vertical

The BFSI (Banking, Financial Services, and Insurance) sector holds a significant share of the cloud managed services market due to its strong demand for data security, regulatory compliance, and continuous system availability. With the rise of digital transactions, online banking, and increasing volumes of customer data, financial institutions need a robust IT infrastructure and advanced cybersecurity measures. Cloud managed services provide secure, scalable, and compliant solutions that facilitate real-time processing and disaster recovery. By outsourcing these services, BFSI firms focus on innovation and enhancing customer experience while ensuring operational stability and effective risk management.

The healthcare and life sciences sector has experienced the fastest adoption growth rate of cloud-managed services due to the increasing need for secure data storage, regulatory compliance, and efficient patient data management. The rise of telemedicine, electronic health records (EHRs), and digital diagnostics has further accelerated the use of cloud solutions. Managed service providers assist healthcare organizations in ensuring data privacy, enabling seamless system integration, and maintaining system uptime—all of which are critical for patient care. Consequently, the sector is rapidly adopting cloud solutions to enhance service delivery and improve operational efficiency.

Regional Analysis

The cloud managed services market exhibits distinct dynamics across various global regions, which are influenced by factors such as technological maturity, legislative compliance, level of digital transformation, and economic development. Every region has its own rationale based on the investments being made and the strategies adopted that shape the demand and growth of these services in unique ways, both qualitatively and quantitatively.

In 2024, the North America cloud managed services market emerged as the dominant region, driven by the early adoption of advanced technologies, a strong presence of major cloud service providers, and significant demand from sectors such as banking, financial services, and insurance (BFSI), healthcare, and information technology (IT). The region's emphasis on digital transformation, cybersecurity, and regulatory compliance further fuels market growth. Additionally, businesses in North America are increasingly investing in outsourcing their IT infrastructure and security management to enhance efficiency, reduce costs, and maintain competitiveness, solidifying its position as the dominant market for cloud managed services.

The Asia Pacific cloud managed services market is rapidly emerging as the fastest-growing area due to increasing digital transformation across industries, rising cloud adoption among small and medium enterprises, and government initiatives supporting cloud infrastructure. Countries like China, India, and Southeast Asian nations are experiencing strong demand for cost-effective, scalable IT solutions. Additionally, the growing need for cybersecurity, data localization, and improved operational efficiency is encouraging businesses to rely on managed service providers, driving the region’s rapid market expansion.

Key Players and Competitive Insights

Several established organizations are key participants in the cloud managed services market, offering a diverse range of solutions to support enterprises in their cloud journeys. These include Amazon Web Services (AWS), Microsoft Azure (Microsoft Corporation), Google Cloud (Alphabet Inc.), IBM Consulting (IBM), Accenture plc, Capgemini, Wipro Limited, Tata Consultancy Services (Tata Group), HCLTech, Kyndryl, Infosys Limited, and Cognizant. These entities provide comprehensive services encompassing infrastructure management, security, application management, and more, catering to the evolving needs of cloud-centric operations.

The cloud managed services market is experiencing ongoing changes and increased competition due to new technological advancements as well as mergers and acquisitions. Service providers gain competitive advantages by demonstrating expertise in various cloud platforms, offering unique services, and delivering industry-specific solutions. There is now a stronger emphasis on advanced automation, AIOps, and cybersecurity.

In the competition for market share, providers also highlight their ability to deliver services globally, comply with stringent policy frameworks, and maintain robust partnerships within their ecosystems. The current demand for improved efficiency and resilience, along with the need for rapid digital transformation, continues to shape the competitive landscape in the cloud industry.

List of Key Companies:

- Accenture plc

- Amazon Web Services (AWS)

- Capgemini

- Cognizant

- Google Cloud (Alphabet Inc.)

- HCLTech

- IBM Consulting (IBM)

- Infosys Limited

- Kyndryl

- Microsoft Azure (Microsoft Corporation)

- Tata Consultancy Services (Tata Group)

- Wipro Limited

Industry Developments

- May 2025: Kyndryl, in collaboration with Microsoft, announced the expansion of its Kyndryl Distributed Cloud capabilities by utilizing the AI-powered Microsoft adaptive cloud approach.

- April 2025: Accenture announced an expansion of its strategic relationship with Google Cloud, launching new capabilities to help organizations scale the latest cloud and artificial intelligence technologies.

Cloud Managed Services Market Segmentation

By Organization Size Outlook (Revenue – USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium-Sized Enterprises

By Service Outlook (Revenue – USD Billion, 2020–2034)

- Managed Business Services

- Managed Network Services

- Managed Security Services

- Managed Infrastructure Services

- Managed Mobility Services

- Managed Communication & Collaboration Services

By Vertical Outlook (Revenue – USD Billion, 2020–2034)

- BFSI

- Telecom

- Government & Public Sector

- Healthcare & Lifesciences

- Retail & Consumer Goods

- Manufacturing

- Energy

- Utilities

- IT

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Cloud Managed Services Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 134.48 billion |

|

Market Size Value in 2025 |

USD 153.78 billion |

|

Revenue Forecast by 2034 |

USD 524.28 billion |

|

CAGR |

14.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 134.48 billion in 2024 and is projected to grow to USD 524.28 billion by 2034.

The market is projected to register a CAGR of 14.6% during the forecast period, 2024-2034.

North America had the largest share of the market.

Some major players include Amazon Web Services (AWS), Microsoft Azure (Microsoft Corporation), Google Cloud (Alphabet Inc.), IBM Consulting (IBM), Accenture plc, Capgemini, Wipro Limited, Tata Consultancy Services (Tata Group), HCLTech, Kyndryl (an IBM spin-off), Infosys Limited, and Cognizant.

The Large enterprises segment accounted for the largest share of the market in 2024.

The following are some of the market trends: ? Shift Toward AIOps and Automation: There is a heightened focus on applying AI and machine learning for IT operations (AIOps), which encompasses automating mundane tasks, anticipating and resolving potential issues, and optimizing resource allocation for the cloud. ? Increased Attention to Cloud Security and Compliance: With the increased cyber threat landscape, along with more stringent regulations, compliance, maintenance, and threat detection have resulted in a significant demand for managed security services.

Cloud managed services mean that the infrastructure and the operation management of the cloud is externalized to a service provider, and the organization itself no longer has to oversee the management of the cloud resources, whether they be private, public, or hybrid. With the advancement of technology, companies no longer have to manage their cloud resources on a daily basis because these services offer them the sustained assistance needed in efficiency, security, and performance.