Cloud Performance Management Market Share, Size, Trends, Industry Analysis Report

By Component (Solutions, Services); By Industry Vertical (BFSI, Government, IT & Telecom, Others); By Deployment Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 116

- Format: PDF

- Report ID: PM2678

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

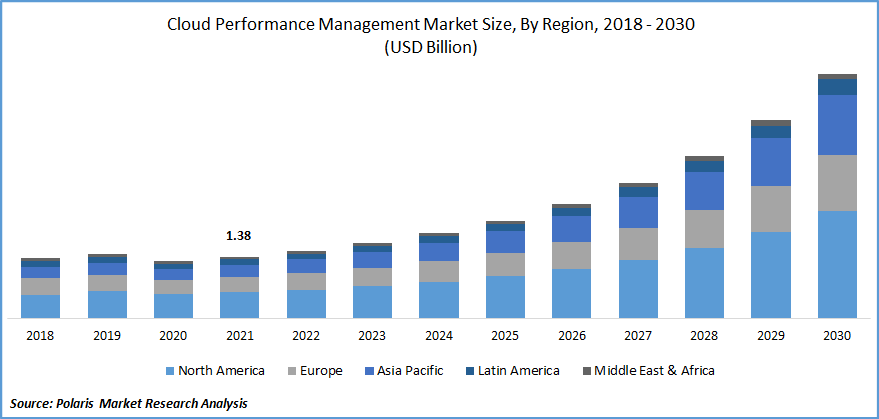

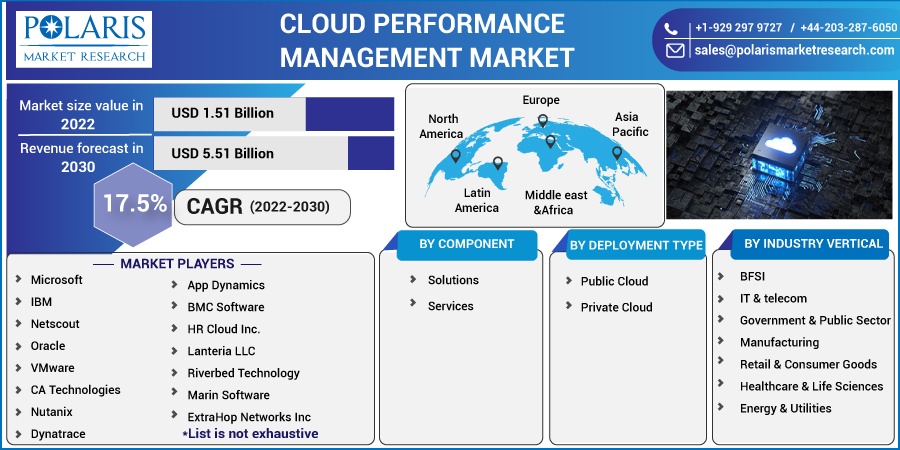

Global cloud performance management was valued at USD 1.38 billion in 2021 and is expected to grow at a CAGR of 17.5% during the forecast period. Key factors responsible for the market growth include the rise in adoption of cloud computing technologies, integration in heterogeneous working environments, increased penetration of machine learning and artificial intelligence in cloud environments, and the emergence of cloud infrastructure for better agility and performance.

Know more about this report: Request for sample pages

Insecure data migration to cloud databases compromises data security at rest, infrastructure security gaps, data security at rest, identity validation and administration errors, access control security has been compromised, cloud security architecture and strategy deficiencies, and unsecure APIs and interfaces. These primarily deal with information that is kept in databases. Before data could be kept in cloud databases, database activities migrated to the cloud often undergo a rigorous series of security examinations. Most accidents happen during and after the shift to the cloud.

Additional security best practices for transferring data to cloud databases include data governance teams, data backups, encryption, and safe data porting using VPN or private tunnels. It is essential to ensure that any replications or Disaster Recovery (DR) database setup adheres to strict security measures like hardening, encryption, and strict access control to prevent data loss, leakages, etc., once data has been moved to cloud databases.

It'll also help to ensure that not even a single row or column of data is lost or spilled into the wrong hands. Employing such practices, people are protected against data breaches and other similar situations. These aspects will fuel the expansion of cloud performance management within the anticipated period.

For instance, specifications for latency, operational wait times, CPU and memory power, and other metrics might be needed. Additionally, uptime and downtime clauses could specify how frequently a service will be available. When looking for ways to enhance or expand operations, it enables IT teams, to control cloud performance and quantify what services are offered. According to Symantec's 2018 Internet Security Threat Report (ISTR), there were twice as many malware variants in 2017 as in 2016. This statistic comes from the ISTR.

The COVID-19 pandemic has affected the ways businesses function. It is taxing back-end support systems and increasing traffic on networks that connect users to these services as more employees use conferencing and collaboration services while working from home. Only providers with great architecture and a consistent level of customer service will be able to handle the increased load.

It can be challenging for cloud providers to implement business continuity plans. They must respond to challenging inquiries, such as whether their public cloud architecture is sufficiently durable and scalable to manage rising demand. In addition, they must decide whether they can continue to provide services even if support staff becomes distressed.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

As a result of these growing security threats and vulnerabilities, cloud platforms need to implement efficient security measures. Compromises in cloud performance may result in loss of business and consumer dissatisfaction. For cloud security and performance management, cloud monitoring is a crucial component. Users can quickly identify patterns to identify potential threats and weaknesses that may jeopardize the protection of the cloud infrastructure.

The cloud infrastructure is continuously studied and measured as part of cloud monitoring to find any security issues. As a result, the risk of data breaches is reduced while the cloud infrastructure and platforms operate at their peak efficiency. Additionally, cloud monitoring aids in evaluating the modular performance of the cloud architecture. Monitoring aids in the evaluation of variables like uptime and reaction time. This makes it easier to assess the performance of the cloud and enhances the client experience.

Report Segmentation

The market is primarily segmented based on component, deployment type, industry vertical, and region.

|

By Component |

By Deployment Type |

By Industry Vertical |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The services segment is expected to witness the fastest growth.

In 2022, the cycle of deploying and running software and hardware depends on services. Cloud performance management services consult, integrate, and support organizations across various industries to successfully deal with threats and maintain visibility and security across business operations. Enterprise demand for cloud performance management services is rapidly growing as cloud computing, and related technologies like IoT, edge computing, and serverless architecture become more widely adopted.

The ubiquitous user-and infrastructure-centric approaches to controlling IT performance and organizations' interest in monitoring IT services for mobile users. The services are crucial to handling and maintaining software and solutions, implementing the software in the organization's infrastructure, and providing training. These services are provided by companies that have dedicated teams, software experts, and consultants.

Public Cloud accounted for the second-largest market share in 2021

The purpose of cloud performance monitoring and testing tools is to assist organizations in gaining visibility into their virtual environments by assessing performance using specific metrics and techniques. To guarantee company continuity and give everyone who needs access to internet-based services access, efficient cloud performance is essential. This is true for sophisticated hybrid and multi-cloud designs and general public cloud usage.

Enterprises produce standardized, highly automated solutions using publicly accessible resources. A service provider owns the networking, storage, and compute resources available on demand with a few SLAs for performance, isolation, and tenancy. By adopting public cloud monitoring, businesses may get visibility into the functionality and stability of their cloud-based infrastructure, services, apps, and connectivity. Cloud monitoring tools use alerts and reports to gather data from hybrid and multi-cloud deployments and give it to network teams.

The retail and Consumer Goods segment is expected to witness the fastest growth

In 2022, the cycle of deploying and running software and hardware depends on services. Cloud performance management services consult, integrate, and support organizations across various industries to successfully deal with threats and maintain visibility and security across business operations. Enterprise demand for cloud performance management services is rapidly growing as cloud computing, and related technologies like IoT, edge computing, and serverless architecture become more widely adopted.

The demand in Asia-pacific is expected to witness significant growth

Asia Pacific is estimated to hold the highest CAGR in cloud advertising during the forecast period. Especially in nations with a developed cloud ecosystem, like Japan, there is an increasing need for managed cloud and professional services. This is a result of the growing movement of sophisticated big data workloads to cloud platforms, including enterprise resource planning (ERP) applications. The development of single-tenant cloud servers with API access and the spread of open-source technologies contribute to the increased acceptability of managed private cloud providers.

In addition, as the Internet of Things (IoT) expands, the cloud plays a more significant role in facilitating the creation and distribution of IoT applications. More Asian Pacific companies are rebuilding their networks and implementing cloud services to deal with the information explosion. The market for cloud performance management has been pushed by rising urbanization, technological advancement, and government backing for the digital economy through appropriate rules and compliance.

Competitive Insight

There are several major players in the global market, such as Microsoft, IBM, Netscout, Oracle, VMware, CA Technologies, Nutanix, Dynatrace, App Dynamics, BMC Software, HR Cloud Inc., Run: AI, Lanteria LLC, NamLabs Technologies Pvt Ltd (Atatus), Riverbed Technology, Marin Software, ExtraHop Networks Inc, Citrix Systems Inc, and Commvault.

Recent Developments

In August 2022, a multi-cloud management platform was unveiled by VMware. The VMware Aria Hub, initially unveiled at VMworld 2021 as Project Ensemble, will serve as the foundation of VMware Aria. It will give administrators access to a centralized view and management of the complete multi-cloud system. The VMware Tanzu platform, the company's application platform that offers a selection of developer tools, will also be complemented and expanded by the platform to manage the development, delivery, DevSecOps, and lifespan of cloud-native apps.

In September 2021, the first hybrid cloud software solution to manage AI workloads was just released. The first platform to handle hybrid cloud and multi-cloud AI infrastructure is the Atlas Platform, the industry pioneer in computing orchestration for AI workloads. Run: ai's centralized monitoring and control panel offers a seamless and uniform user experience to manage resources running in many places, including on-prem and in the cloud. Organizations may easily benefit from implementing a multi-cloud approach with Run: ai, preventing unanticipated downtime, increasing compute availability, and managing expenses.

Cloud Performance Management Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1.51 billion |

|

Revenue forecast in 2030 |

USD 5.51 billion |

|

CAGR |

17.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Product, By End-User By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Microsoft, IBM, Netscout, Oracle, VMware, CA Technologies, Nutanix, Dynatrace, App Dynamics, BMC Software, HR Cloud Inc., Run: AI, Lanteria LLC, NamLabs Technologies Pvt Ltd (Atatus), Riverbed Technology, Marin Software, ExtraHop Networks Inc, Citrix Systems Inc, and Commvault. |