Coffee Roaster Market Size, Share, Trends & Industry Analysis Report

: By Type (Direct Fire, Half Hot Air, Hot Air, and Others), By Batch Size, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM3571

- Base Year: 2024

- Historical Data: 2020-2023

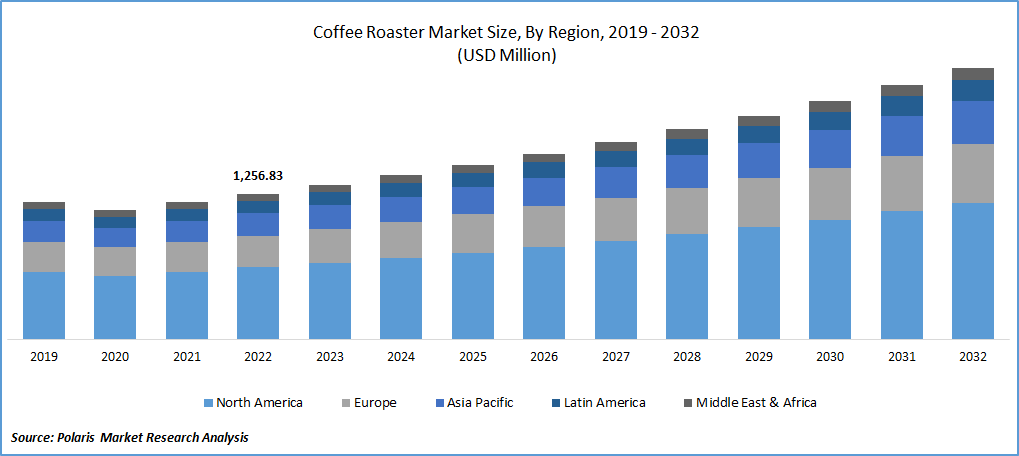

The coffee roaster market size was valued at USD 1,457.85 million in 2024, exhibiting a CAGR of 6.6% during 2025–2034. The coffee roaster market is primarily driven by increasing global coffee consumption, rising demand for specialty and artisanal coffee, advancements in roasting technology, sustainability initiatives, and the expansion of coffee retail chains.

Market Overview:

The coffee roaster market encompasses the manufacturing, distribution, and sale of machinery designed to transform raw, green coffee beans into roasted, aromatic beans suitable for consumption. This specialized equipment is crucial for developing the distinct flavors, aromas, and textures characteristic of brewed coffee. The market caters to a diverse range of end-users, from large industrial producers handling significant volumes to small-batch commercial roasteries and even residential consumers seeking to roast their coffee. This industry plays a pivotal role in the broader coffee ecosystem, ensuring that coffee beans undergo the essential physiochemical changes required before grinding and brewing, thereby meeting the escalating global demand for freshly prepared coffee.

A primary driver stems from the rising global coffee consumption and the increasing preference for specialty and artisanal coffee experiences. Consumers are increasingly discerning about coffee origin, roast profiles, and freshness, which fuels the demand for high-quality roasting equipment that offers precision and customization. Furthermore, the expansion of coffee shop chains and independent cafes worldwide contributes substantially to the commercial segment's growth. The growing trend of home brewing and interest in DIY coffee roasting among enthusiasts also represents a notable trend, driving the potential for smaller, user-friendly residential roasters. Advancements in roasting technology, incorporating digital controls and automation for enhanced consistency and efficiency, further shape the outlook and contribute to its ongoing development.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics:

Rising Global Coffee Consumption and Specialty Coffee Demand

The increasing global consumption of coffee, particularly the growing demand for specialty coffee, serves as a fundamental driver for the coffee roaster sector. Consumers are increasingly seeking premium, high-quality coffee, and coffee cream experiences, focusing on aspects like bean origin, ethical sourcing, and unique flavor profiles, which necessitates advanced roasting capabilities. According to the USDA Foreign Agricultural Service, global coffee consumption was expected to rise by 5.1 million bags to 168.1 million in the 2024/25 period, with significant gains anticipated in key markets such as the European Union, the United States, and China. This sustained increase in consumption directly translates into a greater need for efficient and sophisticated coffee roasting machinery across the supply chain, bolstering the overall potential for coffee roasters.

Proliferation of Coffee Shops and Cafes

The continuous expansion of coffee shops and cafes worldwide is a substantial growth factor for commercial coffee roasters. These establishments, ranging from multinational chains to independent artisanal cafes, require robust and reliable roasting equipment and high quality coffee filter paper to ensure a consistent supply of freshly roasted beans to their customers. As per CoffeeDasher, the expansion of coffee shop chains and independent cafes globally points to a robust out-of-home coffee market. In the United States alone, there were over 42,700 coffee shops in 2024, with the branded coffee shop expected to surpass 51,100 outlets by September 2029. This widespread growth in out-of-home coffee consumption fuels the demand for commercial-grade coffee roasting solutions, impacting the size and share of equipment manufacturers.

Growing Interest in Home Roasting and DIY Coffee Culture

A notable market trend impacting the development is the increasing consumer interest in home coffee roasting and the broader do-it-yourself (DIY) coffee culture. Enthusiasts are investing in smaller-scale, often residential-grade, coffee roasters to personalize their coffee experience, experiment with different bean varieties that uses coffee bean grinding machines and achieve peak freshness. The ability to make high-quality espresso at home is becoming more accessible, partly due to the rise of advanced home coffee machines. Brands like Breville are introducing "smart coffee machines" designed to help users perfect their espresso-making skills. This shift towards home-based coffee preparation represents a growing potential for compact and user-friendly coffee roasting appliances, contributing to the overall penetration of residential coffee roasters.

Segmental Insights:

Market Assessment By Type

The market is segmented by type into direct fire, half hot air, hot air, and others. Among the various types of coffee roasting technologies, hot air roasters are widely recognized for holding a significant share within the industry. This dominance is primarily attributed to their ability to provide highly consistent and controllable roasting environments, which is crucial for achieving uniform roast profiles and repeatable results, especially in large-scale commercial operations. The efficiency with which hot air systems transfer heat to the coffee beans minimizes scorching and uneven roasting, leading to a cleaner and more consistent final product.

The hot air segment within the coffee roaster market is also anticipated to demonstrate the highest growth rate, driven by evolving industry trends and increased demand for technologically advanced solutions. The ongoing emphasis on automation, energy efficiency, and data-driven roasting processes favors hot air technology, which often integrates seamlessly with sophisticated control systems. As specialty coffee consumption continues to expand, roasteries are increasingly seeking equipment that can precisely manipulate roast parameters to highlight nuanced flavors, a capability at which hot air roasters excel.

Market Evaluation By Batch Size

The market is segmented by batch size into small (100 grams to 1 kg), medium (1 kg to 15 kg), and large (above 15 kg). The medium batch size segment is widely understood to hold the most substantial share within the coffee roaster industry. This is primarily due to its pivotal role in serving the commercial coffee industry, encompassing independent coffee shops, regional chains, and specialty roasteries that cater to a significant consumer base. These businesses require roasters that can balance production volume with the flexibility to roast diverse coffee origins and profiles, making medium-sized machines an ideal fit. Their robust capabilities combined with a manageable footprint contribute significantly to penetration in the burgeoning cafe landscape, driving the overall demand for this segment and solidifying its position in the dynamics.

The small batch size segment, typically ranging from 100 grams to 1 kg, is experiencing a remarkable growth rate. This accelerated expansion is largely fueled by the burgeoning home coffee roasting movement and the rise of experimental and sample roasting within the specialty coffee sector. As consumer interest in artisanal coffee experiences deepens, and the desire for ultimate freshness and customization grows, the potential for compact, user-friendly roasters designed for personal or very small-scale commercial use has surged. This segment's rapid development underscores a key trend towards personalized coffee consumption, driving innovation and expanding the overall outlook for small-scale roasting equipment

Market Evaluation By Application

The market is segmented by application into industrial, commercial, and residential. The commercial application subsegment is widely recognized for holding the most substantial share within the coffee roaster industry. This dominance is primarily driven by the extensive network of coffee shops, cafes, and independent roasteries globally, which consistently require robust and reliable roasting equipment to meet consumer demand. These businesses, ranging from small local establishments to large regional chains, represent the primary destination for freshly roasted coffee. Their continuous investment in high-quality roasters to ensure consistent product standards even for alternative coffee-based products, and diverse offerings contributes significantly to the dynamics and the overall size, establishing commercial applications as a leading force in the outlook.

The residential application subsegment is demonstrating the highest growth rate. This rapid expansion is a clear trend stemming from the increasing consumer interest in home brewing and a desire for personalized coffee experiences. As individuals become more discerning about their coffee and seek to control factors like freshness and roast profile, the potential for compact, user-friendly residential roasters has surged. This growing demand from passionate home baristas and enthusiasts contributes significantly to the development and penetration of smaller-scale roasting units, indicating a dynamic shift in consumer behavior.

Regional Analysis

North America coffee roaster market is consistently recognized as the region holding the largest share. This commanding position is largely attributed to the deeply ingrained coffee-drinking culture, high per capita coffee consumption, and a well-developed specialty coffee industry across the United States and Canada. The presence of numerous large-scale commercial roasteries, extensive coffee shop chains, and a significant base of independent cafes creates a continuous and substantial demand for a wide range of coffee roasting equipment. Additionally, a strong interest in home brewing and the availability of diverse coffee products further contribute to the region's overall size and penetration in the coffee roaster sector.

The Asia Pacific coffee roaster market is rapidly emerging as the area with the highest growth rate. This accelerated growth is primarily driven by shifting consumer lifestyles, increasing disposable incomes, and the swift adoption of Western coffee culture in countries like China, India, and various Southeast Asian nations. As urbanization expands and the number of coffee shops and cafes proliferates across the region, there is a burgeoning demand for coffee roasting equipment to support this nascent yet rapidly expanding industry. The growing consumer appreciation for specialty coffee and fresh roasts further fuels this development, indicating significant potential and promising outlook for coffee roaster manufacturers in the Asia Pacific.

Key Players and Competitive Insights

Some major players in the coffee roaster market include Probat (Probat Group), Diedrich Roasters, Loring Smart Roast, Giesen Coffee Roasters, Toper, Brambati S.p.A., Fuji Royal, Coffee-Tech Engineering, US Roaster Corp, and Bühler. These entities offer a range of equipment from small sample roasters to large industrial plants, catering to diverse demands and applications globally, ensuring a robust competitive landscape. Their continuous efforts in research and development, particularly in automation and efficiency, underpin the ongoing evolution of roasting technology.

The competitive landscape is characterized by a mix of long-established companies and innovative newcomers, each vying for share through advancements in technology, energy efficiency, and user-friendly interfaces. Companies differentiate themselves by focusing on precision roasting controls, reduced environmental impact, and comprehensive customer support, including training and maintenance services. The increasing demand for specialty coffee drives players to offer highly customizable and consistent roasting solutions. Furthermore, the outlook suggests a competitive environment where strategic partnerships, global distribution networks, and adaptation to emerging trends, such as home roasting and micro-roasteries, are crucial for sustained development and penetration.

List of Key Companies in Coffee Roaster Industry:

- Brambati S.p.A.

- Bühler

- Coffee-Tech Engineering

- Diedrich Roasters

- Fuji Royal

- Giesen Coffee Roasters

- Loring Smart Roast

- Probat (Probat Group)

- Toper

- US Roaster Corp

Coffee Roaster Industry Developments

- May 2025: The Dutch coffee roasting equipment maker Giesen introduced a comprehensive rebranding, changing its name from Giesen Coffee Roasters to Giesen Roasting Solutions.

- March 2024: Probat has confirmed the acquisition of Netherlands-based Royal Duyvis Wiener, an equipment business specializing in cocoa and chocolate processing. This move is part of Probat's strategy to expand its specialisms beyond coffee into related food processing industries.

Coffee Roaster Market Segmentation

By Type Outlook (Revenue – USD Million, 2020–2034)

- Direct Fire

- Half Hot Air

- Hot Air

- Others

By Batch Size Outlook (Revenue – USD Million, 2020–2034)

- Small (100 grams to 1 kg)

- Medium (2 kg to 5 kg)

- Large (10 kg to 30 kg)

- Industrial

By Application Outlook (Revenue – USD Million, 2020–2034)

- Industrial

- Commercial

- Residential

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Coffee Roaster Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,457.85 Million |

|

Market Size Value in 2025 |

USD 1,550.42 Million |

|

Revenue Forecast by 2034 |

USD 2,755.89 Million |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The coffee roaster market has been segmented into detailed segments of type, batch size, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

Manufacturers primarily employ a multi-faceted growth and marketing strategy to enhance their share and penetration. Key approaches include continuous product innovation, focusing on energy efficiency, automation, and digital integration to meet evolving commercial and industrial demands. Establishing strong global distribution networks and forging strategic partnerships are crucial for expanding geographic reach and presence. Additionally, companies invest in building brand reputation through exceptional customer service, comprehensive training, and engaging content that highlights their expertise and product quality, catering to both professional roasteries and the burgeoning residential market segments.

FAQ's

The global market size was valued at USD 1,457.85 million in 2024 and is projected to grow to USD 2,755.89 million by 2034.

The market is projected to register a CAGR of 6.6% during the forecast period, 2024-2034.

North America had the largest share of the market.

Some major players in the market include Probat (Probat Group), Diedrich Roasters, Loring Smart Roast, Giesen Coffee Roasters, Toper, Brambati S.p.A., Fuji Royal, Coffee-Tech Engineering, US Roaster Corp, and Bühler.

The Hot Air segment accounted for the largest share of the market in 2024.

Following are some of the trends: ? Advanced Automation and Digital Integration: A growing emphasis on smart roasters with IoT connectivity, AI, and machine learning capabilities for precise roast profiling, real-time data analysis, and remote control, enhancing consistency and efficiency. ? Sustainability and Energy Efficiency: Increasing demand for eco-friendly roasting solutions, such as electric roasters, recirculating heat systems, and reduced emissions technology, driven by environmental concerns and consumer preferences for sustainable products.

A coffee roaster refers to either the machine or the professional responsible for transforming green, unroasted coffee beans into the aromatic, flavorful roasted beans that are ready for brewing. The primary function of a coffee roaster, the machine, is to apply controlled heat to green coffee beans. This process, known as roasting, involves a series of complex chemical reactions that develop the beans' characteristic aroma, color, and flavor profiles by caramelizing sugars, breaking down acids, and creating new aromatic compounds. Different types of roasters, such as drum roasters and hot air roasters, exist to achieve specific roast levels and flavor nuances, catering to various demands from industrial production to home brewing.