Coffee Subscription Market Share, Size, Trends, Industry Analysis Report

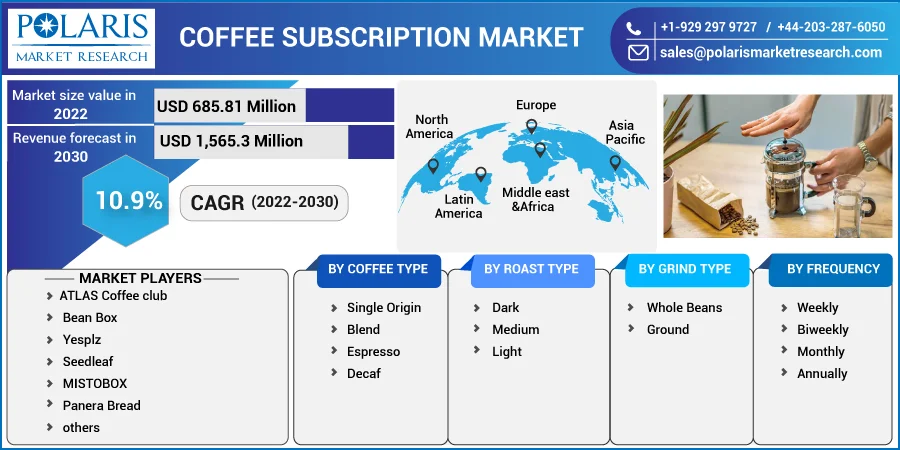

By Coffee Type; By Roast Type; By Grind Type (Whole Beans, Ground); By Frequency (Weekly, Biweekly, Monthly, Annually); By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 117

- Format: PDF

- Report ID: PM2816

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

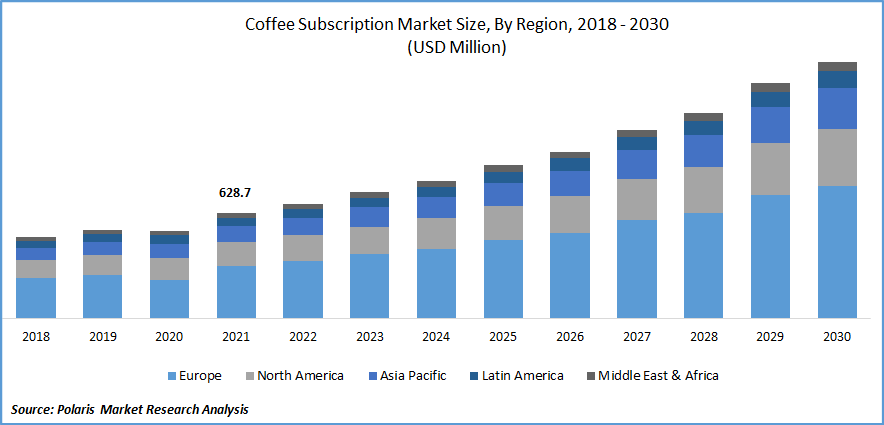

The global coffee subscription market was valued at USD 628.7 million in 2021 and is expected to grow at a CAGR of 10.9% during the forecast period.

Coffee subscription is the service provided by roasters & cafes, allowing consumers to receive their regular deliveries of coffee. These subscription services operate on a rolling basis, such as weekly, monthly, or annually – with the flexibility to cancel anytime. Manufacturers offer sample kits with several coffees, from single or of multiple origins to refundable 1st orders, to gain prominent market share and increase their subscription sales.

Know more about this report: Request for sample pages

Service providers are subsequently offering customized & tailor-made coffee delivered anywhere in the world. They are also invigorating consumer penetration by strengthening their distribution & supply chain networks in emerging markets. Several coffee subscription providers offer add-on services and discounts on subscription plans to gain consumer attention.

Moreover, the rising demand for single-cup brewing equipment in mature markets such as the U.S. is driving the coffee demand. However, many people are limiting the consumption of coffee owing to its side effects, including disrupted sleep, intense anxiety, and digestive problems, which will likely hamper the market growth.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of market. The COVID-19 crisis engulfed the world during 2020 with challenges, including changes in consumer behaviors and changing and revolutionizing the coffee subscription market worldwide. The restricted mobilization and increased consumer dependence on online purchases continued even after the loosening of restrictions, and subscription providers saw a rise in sales of coffee subscriptions. American coffee chain Peet's Coffee saw an almost 70% increase in subscription orders in 2020.

However, add-on services and discounts the roaster provides will help the industry acquire rapid traction over the forthcoming years.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growing popularity of coffee subscriptions has increased due to people practicing their barista skills at home. The increasing variety of at-home coffee products found a profound change in how coffee is consumed worldwide. The growing adoption of single-cup brewing machines due to the rising trend of home-based coffee consumption will drive market growth. The increasing demand for coffee in emerging economies such as India, China, Indonesia, and Japan will further contribute to market growth. The increased coffee consumption in recent years has encouraged new players to enter the market worldwide.

Further, the rise in the competition will push established market players to focus on brand loyalty and introduce coffee subscription services. Offering massive discounts on subscription services and memberships with varying tenures and plan flexibility will significantly drive product demand.

Moreover, with the desire to imitate and create the café-level experience at home post-pandemic, consumers rapidly adopted the coffee subscription plans. The rising number of coffee enthusiasts worldwide and the desire to explore new coffee flavors and blends have played a vital role in the growing popularity of coffee subscriptions.

Report Segmentation

The market is primarily segmented based on coffee type, roast type, grind type, frequency, and region.

|

By Coffee Type |

By Roast Type |

By Grind Type |

By Frequency |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Espresso coffee type dominated the market in 2021

Espresso coffee offers low cost, higher nutritional value, long shelf life, and ease of use. Espresso coffee is usually consumed as a coffee shot with cream, chocolate, or milk. Making espresso is faster due to its mechanical procedures as it contains less caffeine and has a bitter taste. Espresso coffee has a longer shelf life; consumers increasingly prefer it. Manufacturers are engaged in strategic marketing and promotion efforts, expected to aid product demand.

Besides, various companies are launching premium products to attract customers. The ready-to-drink espresso coffee in different flavors and blends, including mocha, vanilla, and caramel, will drive the market growth. The rising popularity of espresso coffee worldwide results from coffee producers mixing espresso shots with other beverages like cappuccino, latte, and mocha. Rising demand for espresso coffee in developing nations will further drive the subscription market.

Medium coffee roast is gaining popularity

Based on roast type, the medium coffee roast is expected to dominate the market and will continue to grow rapidly over the forecast period. The growth is attributable to its full, balanced flavor and aroma. Medium roast coffee beans are darker than their light roast counterparts, having a chocolatey-brown color and a balanced flavor between sweet, toasty, and acidic.

Monthly coffee subscriptions will dominate the market

Monthly coffee subscription services are gaining popularity as one can explore coffee from around the world every month. Roasters deliver coffee from new countries every month. It is selected & prepared to match the flavor profile of the origin country. In addition, sometimes, the shipment comes with a postcard explaining more about the beans and a suggested brewing method.

The demand in Europe is expected to witness significant growth

Europe is anticipated to dominate the global market throughout the forecast period due to many factors, such as major regional companies offering a variety of coffee blends from single and diverse origins. Around one-third of the world's coffee consumption comes from Europe, presenting an opportunity for coffee subscription services. Manufacturers promote samples, tasting kits, and coffee subscription boxes, allowing consumers to explore all varieties before deciding on their subscription plan.

Many service providers also offer a replacement or refund for the first order if a consumer needs help finding the product attractive. Health consciousness among its population will have risen the consumption of coffee & healthy blends of the coffee euro region and encourage consumers to choose online subscriptions instead of offline plans.

Asia Pacific is expected to be the fastest-growing global market over the forecast period due to growing disposable income, changing lifestyles, and eating habits of people in the region. In addition, increasing investment in the food and beverages sector also significantly drives the Asia Pacific market growth. Service providers in the region are also offering variants & blends of coffee products catering to the customized requirements of the millennial population.

Competitive Insight

Some major global players operating in the global market include ATLAS Coffee, Bean Box, MISTOBOX, La Colombe Coffee Roasters, Yesplz, Panera Bread, Seedleaf, Bean & Bean, Driftaway Coffee, and Blue Bottle, among others.

Recent Developments

In August 2022: Steeped Coffee partnered with Ayesha Curry's Subscription Box, assisting the company in making high-quality coffee more affordable and sustainable. The Subscription Box is a quarterly subscription box with seasonally curated lifestyle products selected by the Curry and Sweet July Team. The box members receive four boxes yearly and experience the best beauty, health & wellness, and home decor products.

Coffee Subscription Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 685.81 million |

|

Revenue forecast in 2030 |

USD 1,565.3 million |

|

CAGR |

10.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Coffee Type, By Roast Type, By Grind Type, By Frequency, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ATLAS Coffee club, Bean Box, Yesplz, Seedleaf, MISTOBOX, Panera Bread, and others. |