Cold Chain Monitoring Market Size, Share, Trends, Industry Analysis Report

: By Component, End User, Technology, Temperature Type, Offering (Hardware and Software), Logistics, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM2363

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

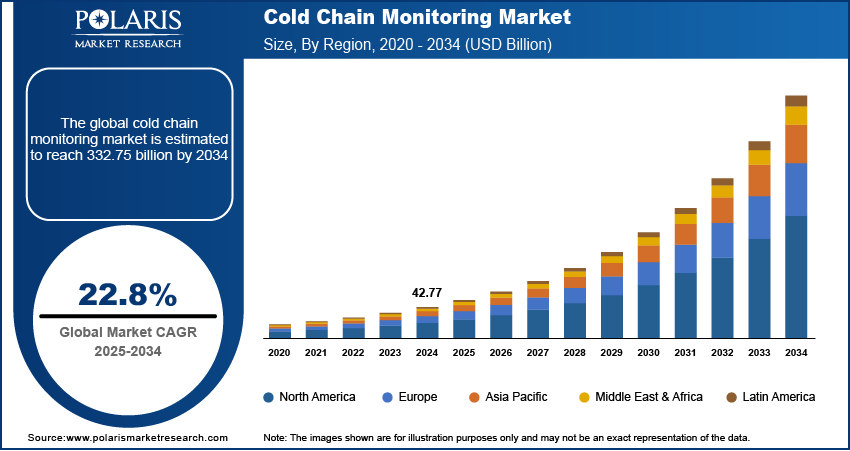

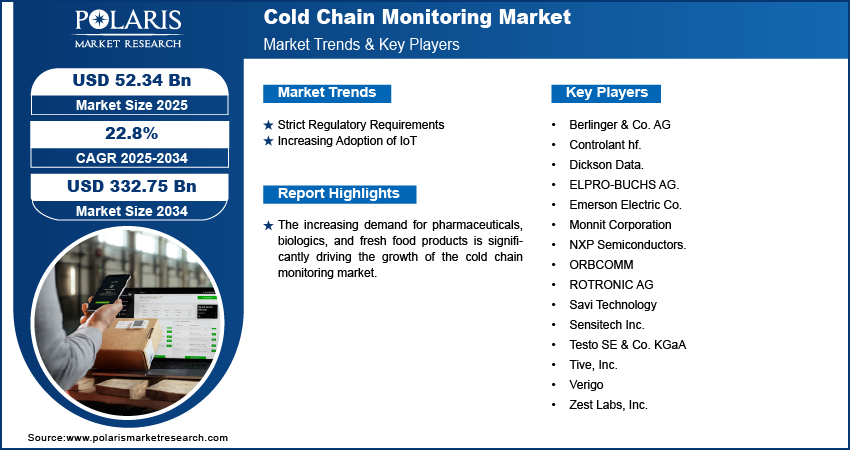

Cold chain monitoring market size was valued at USD 42.77 billion in 2024, growing at a CAGR of 22.8% from 2025 to 2034. The market is driven by rising demand for temperature-sensitive goods, stricter regulatory standards, and widespread adoption of IoT-enabled, energy-efficient technologies ensuring product safety, transparency, and reduced wastage.

Key Insights

- The pharmaceuticals & healthcare segment dominated the market revenue in 2024 due to rising demand for temperature-sensitive products such as biologics, vaccines, and specialty drugs.

- The software & cloud solutions sector is expected to witness the highest growth due to predictive insights, real-time data analysis, and supply chain integration.

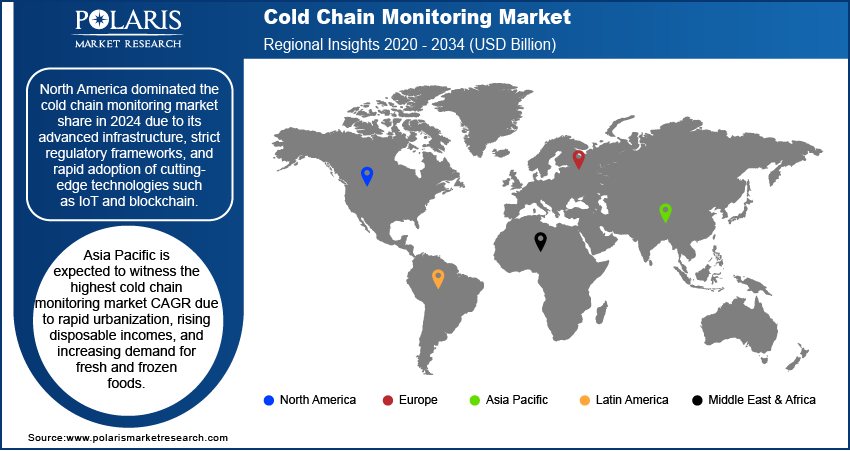

- North America dominated the market in 2024 due to advanced infrastructure, strict regulatory frameworks, and rapid adoption of technologies like IoT and blockchain.

- Asia Pacific is expected to witness the highest CAGR due to urbanization, rising disposable income, and demand for fresh and frozen foods.

Industry Dynamics

- The growing demand for temperature-sensitive pharmaceuticals and vaccines is increasing the adoption of advanced cold chain monitoring systems worldwide.

- Governments are enforcing stricter regulations requiring real-time monitoring and control to ensure the safety of perishable and medical products.

- Investment in food security infrastructure and the need to reduce global food wastage are encouraging the adoption of efficient cold chain monitoring technologies.

- Limited infrastructure and unreliable electricity in remote or developing regions challenge the effective deployment of cold chain monitoring systems and device performance.

Market Statistics

2024 Market Size: USD 42.77 billion

2034 Projected Market Size: USD 332.75 billion

CAGR (2025–2034): 22.8%

North America: Largest market in 2024

AI Impact on Cold Chain Monitoring Market

- AI enhances cold chain monitoring by providing predictive analytics that forecast potential temperature deviations, thereby reducing spoilage risks.

- Machine learning algorithms help analyze real-time data from IoT devices, improving decision-making and optimizing supply chain efficiency.

- AI-driven automation improves the accuracy of temperature control and monitoring, minimizing human error and ensuring product safety.

- By optimizing route planning and logistics, AI contributes to energy savings, reducing operational costs, and promoting sustainability in the cold chain.

To Understand More About this Research: Request a Free Sample Report

Cold chain monitoring involves the use of advanced technologies, such as IoT technology, AI, and blockchain technology, to maintain optimal conditions for temperature-sensitive goods during transportation and storage.

The cold chain monitoring market ensures the integrity and safety of temperature-sensitive products, such as pharmaceuticals, vaccines, and perishable foods, by providing advanced monitoring and tracking solutions. This market plays a key role in reducing product spoilage, ensuring compliance with regulatory standards, and maintaining end-to-end visibility in the supply chain. The growing demand for temperature-sensitive pharmaceuticals and vaccines is driving the cold chain monitoring market expansion. For example, in February 2024, Sensitech launched the TempTale GEO X, a GxP-compliant IoT solution designed to monitor temperature-sensitive pharmaceuticals during global transportation. Governments and organizations are also enforcing stricter regulations to ensure the reliability of cold chains, particularly in the healthcare and food industries. Additionally, advanced technologies, such as IoT-enabled monitoring devices and block chain for enhanced data transparency, are becoming essential components of modern cold chain solutions.

The cold chain monitoring market growth is driven by the growing focus on reducing food wastage globally. The UN environment programme report published in September 2022 noted that people waste almost 1 billion tons of food produced globally, mainly due to poor cold chain infrastructure. Governments and industry stakeholders are investing in robust cold chain monitoring systems market to address this issue and improve food security. Additionally, environmental sustainability concerns have led to the adoption of energy-efficient cold chain solutions resulting in market expansion.

Market Dynamics

Strict Regulatory Requirements

Regulatory bodies mandate precise temperature and humidity controls during storage and transportation to prevent product degradation, particularly for temperature-sensitive goods such as vaccines, biologics, and perishable food items. For instance, in September 2024, WHO released guidelines for manufacturers of temperature monitoring devices under the PQS system, ensuring performance, quality, and safety for cold chain equipment. The process includes rigorous testing and evaluation to maintain vaccine efficacy, especially in off-grid or unreliable electricity areas. Complying with regulations, industries such as pharmaceuticals, food and beverages, and biotechnology must use advanced cold chain monitoring solutions that provide real-time tracking and automated alerts to ensure product safety and efficacy. Additionally, increasing global trade and cross-border shipments of temperature-sensitive products have further boosted the need for regulatory compliance. Therefore, as governments and industry authorities continue to enforce stricter quality and safety standards, the reliable cold chain monitoring market demand is expected to grow.

Increasing Adoption of IoT

A notable cold chain monitoring market trend is the adoption of IoT and blockchain technologies. IoT sensors provide real-time data on temperature, humidity, and location, enhancing supply chain transparency and reducing risks associated with human errors. These devices enable seamless tracking of shipments and alert stakeholders in case of temperature deviations. For example, in February 2024, JimiIoT introduced the LL303 tracker, an IoT-enabled cold chain management solution offering solar-powered operation, GNSS-based location tracking, and real-time temperature monitoring. Designed to ensure the safety of perishable goods, it transmits data via cellular or satellite networks for enhanced cold chain visibility.

Cold Chain Monitoring Market Segment Analysis

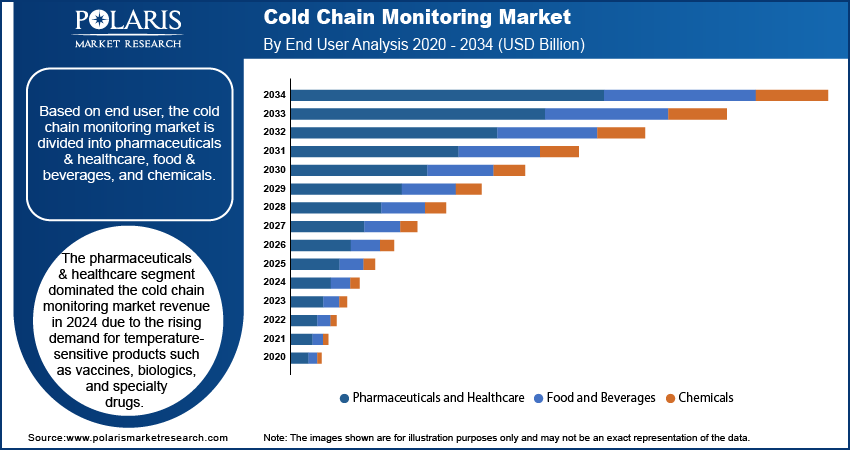

Assessment by End User

The global cold chain monitoring market segmentation, based on end user, includes pharmaceuticals & healthcare, food & beverages, and chemicals. The pharmaceuticals & healthcare segment dominated the market revenue in 2024 due to the rising demand for temperature-sensitive products such as vaccines, biologics, and specialty drugs. The global focus on vaccine distribution during and after the pandemic highlighted the critical need for precise temperature control in the pharmaceutical supply chain. Additionally, the increasing cases of chronic diseases and advancements in biologics and gene therapies have amplified the need for robust cold chain infrastructure. For instance, a report released by the World Health Organization (WHO) in December 2024 highlighted that non-communicable diseases (NCDs) were responsible for at least 43 million deaths in 2021. This figure represents approximately 75% of all deaths globally that were not related to pandemics. Regulatory requirements for maintaining strict storage and transportation conditions further strengthened the adoption of advanced monitoring technologies in this segment.

Evaluation by Component

The global cold chain monitoring market segmentation, based on component, includes sensors & data loggers, software & cloud solutions, and telemetry & telematics devices. The software & cloud solutions segment is expected to witness the fastest cold chain monitoring market growth during the forecast period due to the increasing need for real-time data analysis, predictive insights, and seamless integration across the supply chain expansion. Cloud-based solutions offer improved scalability, allowing businesses to monitor the temperature, humidity, and location of perishable goods in real time, ensuring product safety and compliance. These platforms also facilitate centralized data storage and advanced analytics, assisting in decision making and risk management. Furthermore, the growing adoption of IoT-enabled systems and blockchain technology in cold chain logistics is boosting the demand for robust software solutions, further expanding the cold chain monitoring market expansion.

Regional Insights

By region, the report provides the cold chain monitoring market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024 due to its advanced infrastructure, strict regulatory frameworks, and rapid adoption of advanced technologies such as IoT and blockchain. The US, in particular, plays a key role, driven by its strong pharmaceutical sector, large-scale vaccine production, and sophisticated healthcare logistics. The region's focus on maintaining compliance with strict safety standards for temperature-sensitive goods further enhances the demand for cold chain monitoring solutions. For instance, the September 2022 IATA report highlighted the need for proper cold storage in shipping pharmaceuticals at temperatures as low as -20°C to ensure product integrity and compliance with regulations. Additionally, government support for vaccine distribution programs and increasing investments in cold storage facilities contribute particularly to cold chain monitoring market growth. This combination of technological, industrial, and regulatory factors ensures North America's leadership in the market.

Asia Pacific is expected to witness the highest cold chain monitoring market CAGR due to rapid urbanization, rising disposable incomes, and increasing demand for fresh and frozen foods. Countries such as India and China are investing in cold chain infrastructure to support their expanding pharmaceutical and food industries. China stands out as the leading country in the region, driven by government initiatives to modernize cold chain logistics and improve food security. For example, a report by IGDP highlighted that the Chinese government’s "14th Five-Year Plan" highlights the development of cold chain logistics to reduce post-harvest losses and ensure food safety, positioning the country as a growth hub for cold chain monitoring technologies.

List Of Key Companies

- Monnit Corporation

- ELPRO-BUCHS AG.

- Berlinger & Co. AG

- Sensitech Inc.

- ORBCOMM

- Emerson Electric Co.

- Testo SE & Co. KGaA

- ROTRONIC AG

- Dickson Data.

- Tive, Inc.

- Controlant hf.

- Zest Labs, Inc.

- Verigo

- NXP Semiconductors.

- Savi Technology

Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the cold chain monitoring market growth even more. Market leaders such as Sensitech and Emerson Electric focus on providing end-to-end solutions, including IoT-enabled sensors and cloud-based platforms, ensuring real-time tracking and compliance These companies dominated the market by leveraging advanced technologies and extensive distribution networks. Companies such as Orbcomm and Controlant differentiate themselves with blockchain-enabled transparency and AI-driven analytics, helping clients optimize supply chain operations. The competitive landscape is characterized by innovation, strategic partnerships, and global expansion efforts, enabling these players to maintain market dominance.

Sensitech Inc. has specialized in cold chain monitoring specializing in supply chain visibility solutions since 1990 by Sandy Santin. The company focuses on tracking and safeguarding temperature-sensitive products across various sectors, including food, pharmaceuticals, and consumer goods, based in Beverly, Massachusetts. Sensitech's innovative technology combines real-time monitoring with advanced analytics to ensure product quality and compliance throughout complex supply chains. The company's flagship products, such as the TempTale monitors and SensiWatch platform, enable businesses to gain comprehensive insights into their logistics performance and proactively manage risks associated with temperature fluctuations during transit. Over the years, Sensitech has evolved from its early mechanical monitoring roots to embrace cutting-edge IoT solutions that facilitate global visibility for its clients. Sensitech continues to address the growing demands of the cold chain industry, ensuring that products maintain their integrity from origin to destination with a commitment to quality and innovation.

Emerson Electric Co. is an American multinational corporation headquartered in St. Louis, Missouri, recognized for its vast range of engineering services and manufacturing capabilities. Established in 1890, the company has evolved into a global technology and software powerhouse, focusing on automation, climate control systems, and precision measurement instruments across various industries such as oil and gas, power generation, and aerospace. Emerson's commitment to innovation is clear in its strategic investments in digital transformation technologies, which improve operational efficiency and sustainability for its clients. In the domain of cold chain monitoring, Emerson provides advanced solutions that ensure the integrity of temperature-sensitive products throughout the supply chain. Their technologies enable real-time monitoring and data analytics, facilitating compliance with safety standards while reducing waste and improving product quality. The company's digital platforms, such as Plantweb and DeltaV, are integral to these solutions, allowing for predictive maintenance and enhanced decision-making processes that are crucial for maintaining the cold chain. Emerson's focus on sustainability and operational excellence positions it as a leader in delivering innovative solutions that address the complexities of modern supply chains.

Cold Chain Monitoring Industry Developments

- September 2024: ELPRO, a global player in environmental monitoring solutions, announced the launch of elproPREDICT, an advanced real-time predictive analytics solution designed to revolutionize cold chain logistics.

- April 2024: Tower Cold Chain announced a live tracking feature to support its advanced passive temperature-controlled containers. The system created by ELPRO will give clients almost real-time visibility into their shipments during the trip.

- November 2023: Sensitech launched a new cloud-based solution for last-mile cold-chain monitoring, using IoT sensors for real-time tracking to ensure the quality of perishables.

- August 2023: Emergent Cold Latin America (Emergent Cold LatAm) announced that it had acquired Montevideo, a Uruguay-based cold storage company, from Frigorifico Modelo (Frimosa). At the same time, Emergent Cold LatAm announced that it would begin the development of a 17,000-pallet expansion for the newly purchased facility in Polo Oeste.

- May 2023: Tridentify, a provider of cold-chain monitoring solutions, announced the launch of its latest innovation, a real-time cold chain monitoring system that includes a ground-breaking feature for continuously monitoring the stability and remaining shelf-life of shipped products in the cold-chain.

Cold Chain Monitoring Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020 - 2034)

- Sensors & Data Loggers

- Software & Cloud Solutions

- Telemetry & Telematics Devices

By End User Outlook (Revenue, USD Billion, 2020 - 2034)

- Pharmaceuticals & Healthcare

- Food & Beverages

- Chemicals

By Technology Outlook (Revenue, USD Billion, 2020 - 2034)

- IoT-based Monitoring

- RFID-based Monitoring

- Wireless Sensor Networks

By Temperature Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Frozen

- Chilled

By Offering Outlook (Revenue, USD Billion, 2020 - 2034)

- Hardware

- Software

By Logistics Outlook (Revenue, USD Billion, 2020 - 2034)

- Storage

- Transportation

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cold Chain Monitoring Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 42.77 billion |

|

Market Size Value in 2025 |

USD 52.34 billion |

|

Revenue Forecast in 2034 |

USD 332.75 billion |

|

CAGR |

22.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global cold chain monitoring market size was valued at USD 42.77 billion in 2024 and is projected to grow to USD 332.75 billion by 2034.

The global market is projected to grow at a CAGR of 22.8% during the forecast period.

North America dominated the cold chain monitoring market share in 2024.

Some of the key players in the market are Monnit Corporation; ELPRO-BUCHS AG.; Berlinger & Co. AG; Sensitech Inc.; ORBCOMM; Emerson Electric Co.; Testo SE & Co. KGaA; ROTRONIC AG; Dickson Data; and Tive, Inc.

The pharmaceuticals & healthcare segment dominated the cold chain monitoring market revenue in 2024.