Commercial Seaweed Market Share, Size, Trends, Industry Analysis Report

By Form (Powdered, Flakes, Leaf), By Product (Red Seaweed, Brown Seaweed, Green seaweed), By Region; Segment Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 115

- Format: PDF

- Report ID: PM2100

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

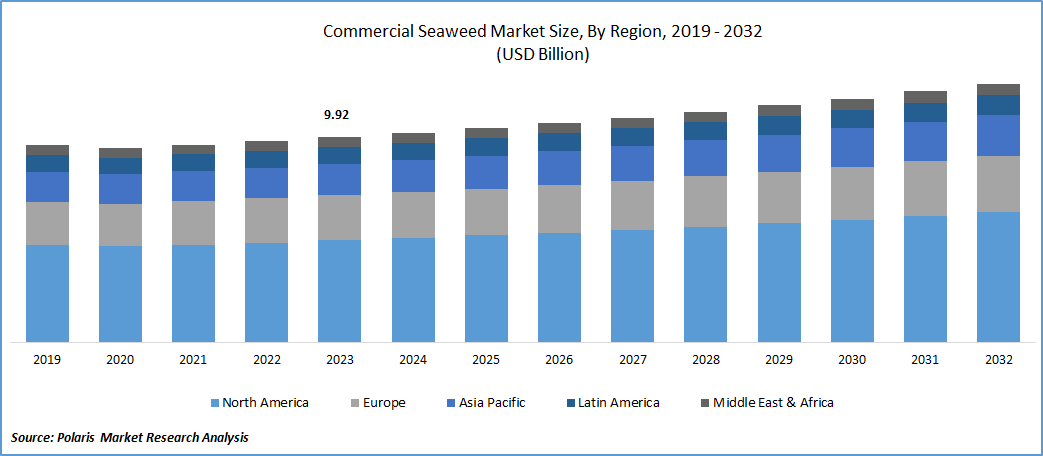

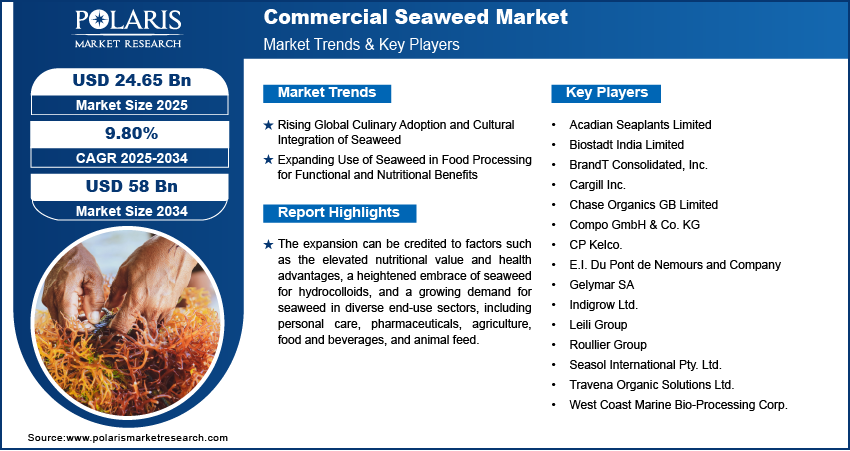

The global commercial seaweed Market was valued at USD 21.88 billion in 2024 and is forecasted to grow at a CAGR of 9.8% from 2025 to 2034. The market benefits from the rising seaweed applications in food, personal care, agriculture, and bioplastics due to its functional, nutritional, and environmental properties.

Key Insights

- The Leaf segment held the largest revenue share in 2024. Seaweed leaves have gained popularity in diverse global culinary traditions, serving as a salad ingredient, vegetable additive, and even in pickles.

- The green seaweed segment accounted for the largest share in 2024. The rising demand for green algae incorporated into capsules and tablets is anticipated to boost the segment expansion during the forecast period.

- Asia Pacific dominated the largest market in 2024. The rising consumer preference for plant-based cosmetics and personal care products will fuel market growth in the coming years.

- The North America market is expected to witness rapid growth during the forecast period. It is driven by the increasing demand for plant-based products in the region.

Industry Dynamics

- Increasing utilization of seaweeds in food processing is contributing to the market growth.

- Growing use of seaweed extracts in the personal care sector propels the demand for commercial seaweed.

- Adverse ecological consequences of seaweed cultivation are among the major restraints of the industry expansion.

- Rising awareness regarding the health benefits of seaweed is expected to offer lucrative opportunities in the coming years.

Market Statistics

2024 Market Size: 21.88 billion

2034 Projected Market Size: USD 58.00 billion

CAGR (2025–2034): 9.80%

Asia Pacific: Largest market in 2024

AI Impact on Commercial Seaweed Market

- Artificial intelligence (AI) models are used to analyze satellite data and oceanographic conditions. It helps predict optimal harvest times to maximize yield and quality.

- AI tools sort and grade seaweed based on color, texture, and thickness. It ensures consistent product standards, mostly in high-volume processing such as nori sheets.

- The technology helps manage various environmental variables such as temperature, salinity, and nutrient levels in land-based and open-ocean farms, enhancing biomass output.

To Understand More About this Research: Request a Free Sample Report

The expansion can be credited to factors such as the elevated nutritional value and health advantages, a heightened embrace of seaweed for hydrocolloids, and a growing demand for seaweed in diverse end-use sectors, including personal care, pharmaceuticals, agriculture, food and beverages, and animal feed.

Farmers incorporate seaweed extract in agriculture as it proves to be an excellent fertilizer for crop production, demonstrating novel mechanisms that enhance crop productivity. The awareness of seaweed's utility in crop production has led to farmers observing additional benefits, such as improved root structures of plants. Additionally, seaweeds contribute to enhancing soil microbiology, soil structure, and water retention capacity, anticipating increased product demand in the forecast period.

Seaweed, being a rich source of iodine, a nutrient scarce in other foods, plays a crucial role in regulating estradiol and estrogen levels in the human body. The utilization of seaweed and its isolates is known to boost satiety, reducing postprandial glucose and lipid absorption rates, thereby contributing to the development of anti-obesity foods. Furthermore, the anti-microbial properties of seaweeds position them as ingredients or consumed foods, offering preservative benefits to various food products.

Increasing environmental awareness has brought about notable shifts in consumer preferences, driving the desire for sustainable products. Cultivation of macroalgae is regarded as a sustainable practice, given the fast growth and nutrient-rich properties of algae, which contribute to oxygen emission and carbon dioxide absorption. The growing popularity of plant-based products and the adoption of veganism further fuel the demand for seaweed production. As per the State of the Industry Report 2021 by the Good Food Institute, sales of plant-based meat witnessed an almost 50% growth from 2019 to 2021. Consequently, the escalating demand for plant-based products is anticipated to propel Commercial Seaweed market growth.

Industry Dynamics

- Growth Drivers

- Increasing Utilization of Seaweeds in Food Processing, contributing to market growth.

Seaweeds find widespread use in diverse global cuisines. While traditionally consumed in China, Japan, and South Korea, the demand for seaweed as a food source has expanded with the migration of consumers from these regions to other parts of the world. This is evident in the increasing demand in certain areas of the United States and South America, where the Asian population is growing. Notably, efforts by French government and commercial entities have successfully promoted seaweeds for culinary purposes in restaurants and households. Additionally, in some developing nations with a tradition of using fresh seaweeds in salads and as vegetables, an informal market has emerged among coastal residents.

Numerous studies have assessed the gelling, thickening, and therapeutic properties of seaweed when utilized independently. This research also underscores the nutritional, textural, sensory, and health-related attributes of food products enhanced with seaweed and its extracts. The impact of incorporating seaweed into various food items such as meat, fish, and bakery products has experienced significant growth within the food and beverage industry. Recent data from the United Nations Commodity Trade reveals a consistent increase in the export/import value of seaweed (2012-2020) and other forms of algae intended for human consumption in Europe. This trend signals a notable uptick in the utilization of seaweed ingredients within the food processing industry, both in Europe and the global market.

Report Segmentation

The market is primarily segmented based on form, product, application, and region.

|

By Form |

By Product |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

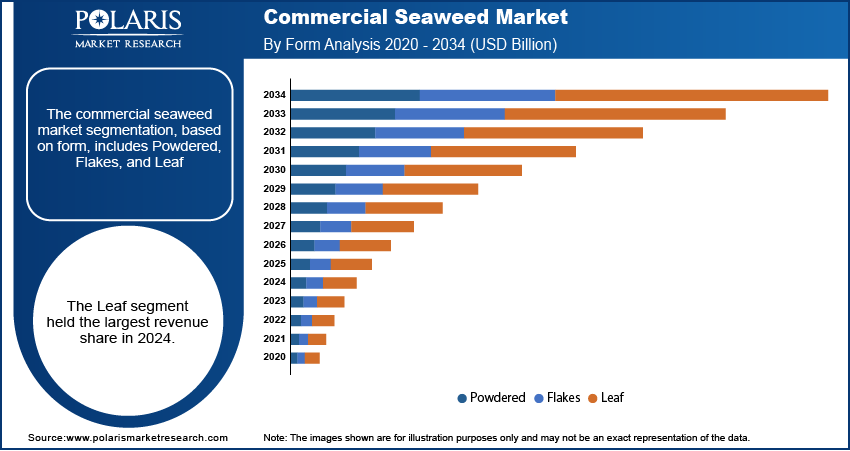

By Form Analysis

- The Leaf segment held the largest revenue share in 2024

Seaweed leaves have been integral to local cuisines spanning from Japan to Indonesia, featuring in dishes like Nori, Onigiri, Sushi, Pandan, and more. Additionally, seaweed has been a part of Icelandic, Norwegian, and Irish cuisines for over a millennium. Recently, seaweed has gained popularity in diverse global culinary traditions, serving as a salad ingredient, vegetable additive, and even in pickles.

The powdered form is projected to be the second-fastest-growing market segment, with a rising CAGR during the forecast period. Powdered seaweeds find extensive use in both the cosmetics and food industries. The conversion of macroalgae extracts into powder removes water, enhancing the product's shelf life. Powders offer ease of storage and transportation, reducing operational costs and minimizing spoilage risks. Additionally, the increasing demand for vegan products and plant-based proteins is anticipated to contribute to the growing demand for powdered seaweed in the future.

By Product Analysis

- The Green seaweed segment accounted for the highest market share during the forecast period

Green seaweed, characterized by its elevated beta-carotene content, known for its efficacy in cancer prevention, is poised to experience growth in the dietary supplement segment. The rising demand for green algae incorporated into capsules and tablets is anticipated to contribute to the segment's expansion throughout the forecasted period.

Red seaweeds, primarily employed in food and as a hydrocolloid source like carrageenan and agar, boast high levels of vitamins and proteins, making them a notable alternative protein source. With key health benefits such as lowering bad cholesterol, controlling blood sugar levels, and serving as a source of antioxidants that enhance immunity and nourish the skin, the demand for red seaweed is anticipated to fuel market growth.

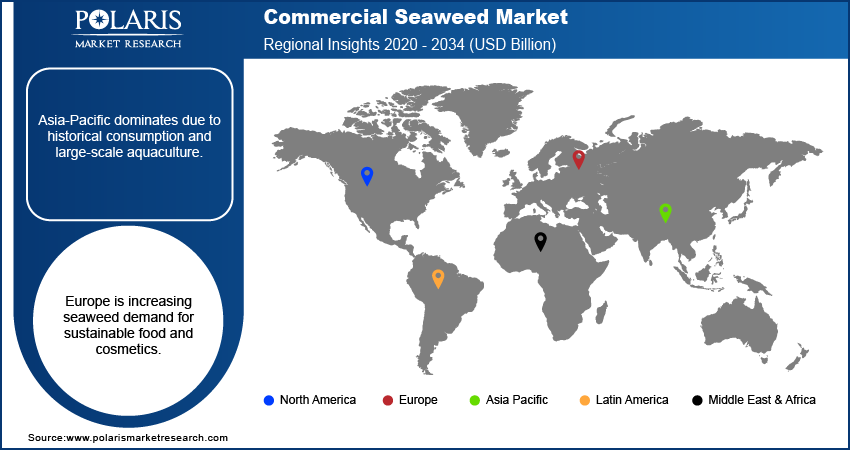

Regional Insights

- Asia Pacific dominated the largest market in 2024

The global demand for commercial types of algae has surged in recent years, propelled by their increasing adoption in traditional cuisines of countries like China, Japan, and Vietnam. Market growth is also driven by the growing demand for macroalgae from the foodservice sector. Additionally, the rising consumer preference for plant-based cosmetics and personal care products is anticipated to further fuel market growth in the coming years.

Considerable growth is anticipated in North America, driven by the increasing demand for plant-based products in the region. The U.S. seaweed market has emerged as a dominant force in North America. The rising popularity of vegan and vegetarian diets has spurred demand for plant proteins in a variety of food products. Moreover, the increasing trend toward functional food and beverages has heightened the use of algae in various products. Ongoing developments and technological advancements in algae cultivation and harvesting are expected to contribute to the market's growth in the region.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market includes

- Acadian Seaplants Limited

- Biostadt India Limited

- BrandT Consolidated, Inc.

- Cargill Inc.

- Chase Organics GB Limited

- Compo GmbH & Co. KG

- CP Kelco.

- E.I. Du Pont de Nemours and Company

- Gelymar SA

- Indigrow Ltd.

- Leili Group

- Roullier Group

- Seasol International Pty. Ltd.

- Travena Organic Solutions Ltd.

- West Coast Marine Bio-Processing Corp.

Recent Developments

- In August 2024, North Sea Farm 1 launched within the Hollandse Kust Zuid wind farm, marking the world’s first seaweed farm in a wind park. It aims to boost carbon capture and sustainable farming.

- In November 2022, Cargill and CARE International have entered into a Memorandum of Understanding (MoU) for the 'She Thrives' program, a two-year initiative launched in Hanoi. 'She Thrives' seeks to enhance sustainable livelihoods for rural smallholders, with a particular focus on women and ethnic minorities from Dak Lak province in Vietnam. The program aims to connect farmers and producers with the necessary tools and resources to improve their livelihoods sustainably.

- In October 2022, Cargill, in collaboration with its partner Naturisa S.A., is joining forces with Skyvest EC Holding S.A. to establish a new joint venture. This venture aims to address the growing demand for premium shrimp feed within the Ecuadorian shrimp farming sector.

- In September 2022, CadalminTM LivCure extract, an innovative nutraceutical developed by the ICAR-Central Marine Fisheries Research Institute (CMFRI) from seaweeds to address non-alcoholic fatty liver disease, is set to be introduced to the market. This patent-protected product is derived from carefully selected seaweeds and consists of 100% natural bioactive ingredients. Employing eco-friendly green technology, it aims to enhance liver health and represents the 9th nutraceutical achievement from CMFRI.

Commercial Seaweed Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 24.65 billion |

|

Revenue forecast in 2034 |

USD 58 billion |

|

CAGR |

9.80% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Form, By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global Commercial Seaweed market size is expected to reach USD 58 billion by 2034.

The global key market players include Acadian Seaplants Limited, Biostadt India Limited, BrandT Consolidated, Inc., Cargill Inc

Asia Pacific is the region contribute notably towards the Commercial Seaweed Market.

The global Commercial Seaweed market is expected to grow at a CAGR of 9.80% during the forecast period.

Commercial Seaweed Market report covering key segments are form, product, application, and region.