Companion Animal Osteoarthritis Market Size, Share, Trend, Industry Analysis Report

By Animal (Canine, Equine, Feline), By Product, By Route of Administration, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6060

- Base Year: 2024

- Historical Data: 2020-2023

Overview

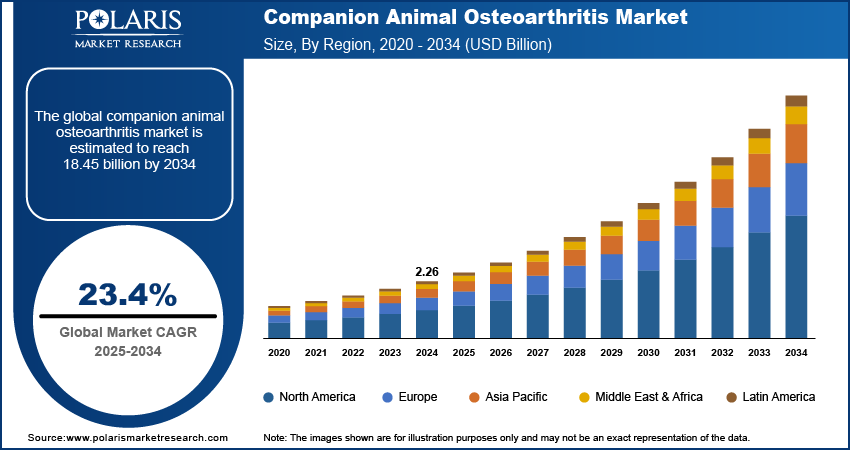

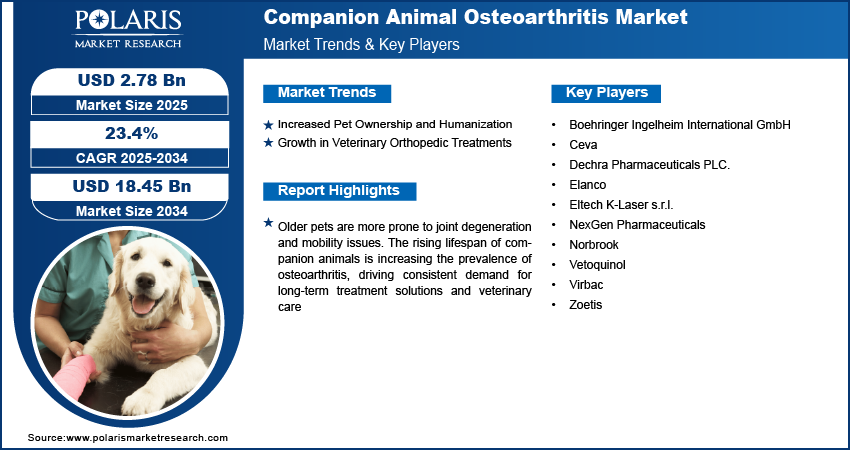

The global companion animal osteoarthritis market size was valued at USD 2.26 billion in 2024, growing at a CAGR of 23.4% from 2025 to 2034. Older pets are more prone to joint degeneration and mobility issues. The increasing lifespan of companion animals is leading to a rise in the prevalence of osteoarthritis, driving a consistent demand for long-term treatment solutions and veterinary care.

Key Insights

- Biologics segment accounted for ~54% of the revenue share in 2024 due to their ability to target the underlying causes of osteoarthritis rather than just alleviating symptoms.

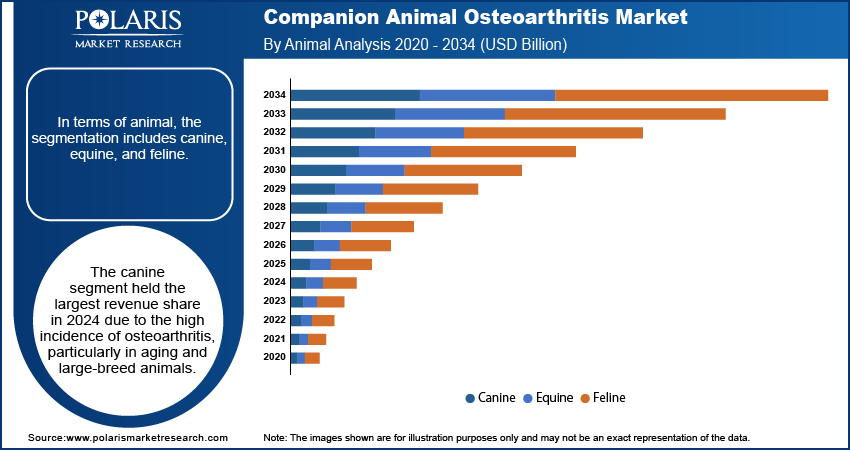

- The canine segment held the largest revenue share in 2024 due to the high incidence of osteoarthritis, particularly in aging and large-breed animals.

- The injectable segment accounted for the largest revenue share in 2024 due to their fast onset of action and ability to provide long-lasting pain relief.

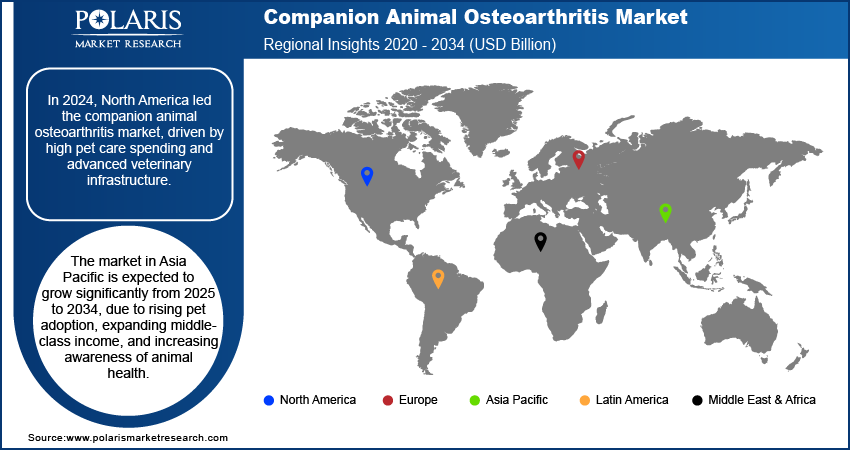

- In 2024, the North America companion animal osteoarthritis market accounted for the largest revenue share, due to high pet healthcare spending, advanced veterinary infrastructure, and strong awareness of chronic joint conditions in companion animals.

- The market in Asia Pacific is expected to grow significantly from 2025 to 2034.

- The Europe market is expanding steadily due to growing emphasis on companion animal wellness and geriatric care.

Industry Dynamics

- Rising pet ownership and humanization across the world positively influence the market growth.

- Veterinary medicine is seeing a sharp rise in specialized orthopedic procedures aimed at treating mobility-related conditions in pets, propelling the market expansion.

- Improved imaging technologies and diagnostic tools enable early detection of joint issues in pets, boosting the industry growth.

- High treatment costs hinder the market growth.

Market Statistics

- 2024 Market Size: USD 2.26 billion

- 2034 Projected Market Size: USD 18.45 billion

- CAGR (2025–2034): 23.4%

- North America: Largest market in 2024

The companion animal osteoarthritis market refers to the industry focused on diagnosing, managing, and treating osteoarthritis in pets such as dogs and cats. It includes pharmaceuticals, supplements, biologics, medical devices, and physical therapy services aimed at reducing joint pain, improving mobility, and enhancing quality of life in aging or injured companion animals. More pet owners are treating animals as family members and are willing to invest in advanced medical care. This shift in attitude boosts demand for chronic disease management products, including osteoarthritis treatments.

Improved imaging technologies and diagnostic tools enable early detection of joint issues in pets. Earlier diagnosis encourages timely intervention, increasing the uptake of therapies and expanding the osteoarthritis treatment industry. Moreover, the development of minimally invasive surgical techniques and regenerative therapies such as stem cell and PRP treatments is enhancing clinical outcomes in pets, supporting industry expansion for more specialized osteoarthritis care.

Drivers and Opportunities

Increased Pet Ownership and Humanization: Pet ownership has evolved beyond companionship into a more emotional, family-like relationship. Owners are more proactive and emotionally invested in their pets’ well-being, often equating pet care to human healthcare. This behavioral shift is reflected in the growing acceptance of routine health checkups, chronic disease management, and specialized care plans. Pet parents are increasingly seeking advanced diagnostic services, prescription drugs, and long-term therapy options when dealing with chronic conditions such as osteoarthritis. The willingness to spend on pet wellness is rising steadily. This factor is driving demand for veterinary products and services designed specifically to manage joint pain, improve mobility, and maintain quality of life for aging pets.

Growth in Veterinary Orthopedic Treatments: Veterinary medicine is seeing a sharp rise in specialized orthopedic procedures aimed at treating mobility-related conditions in pets. Clinics are incorporating advanced options such as arthroscopy, joint replacement, and corrective surgery that improve functional outcomes in osteoarthritic animals. Regenerative therapies, including platelet-rich plasma (PRP) and stem cell injections, are gaining traction for their ability to reduce inflammation and promote tissue repair. These treatments offer noninvasive or minimally invasive alternatives to traditional surgery, making them more acceptable to pet owners. Continued innovation in orthopedic tools and biologics is opening new avenues for treating osteoarthritis more effectively, encouraging veterinarians to offer these options and thereby fueling the demand for advanced osteoarthritis care solutions. In January 2024, Laurent Guiot, DVM, DACVS, DECVS, has developed an advanced robotic device designed to assist with minimally invasive orthopedic surgeries in dogs and cats.

Segmental Insights

Product Analysis

Based on product, the segmentation includes biologics, viscosupplements, pharmaceuticals, and nutritional supplements. Biologics segment accounted for ~54% of the revenue share in 2024 due to their ability to target the underlying causes of osteoarthritis rather than just alleviating symptoms. Stem cell therapy and platelet-rich plasma are increasingly adopted in veterinary medicine for their regenerative potential and minimal side effects. Pet owners are more willing to opt for advanced therapies that improve long-term mobility and reduce the need for chronic drug use. Rising availability of specialized veterinary services and greater clinical evidence supporting biologics are further accelerating their adoption. This segment is also gaining momentum due to an increase in chronic cases that require sustained intervention.

The viscosupplements segment is expected to grow rapidly during the forecast period, due to their ability to enhance joint lubrication and reduce inflammation in osteoarthritic joints. Hyaluronic acid-based injections are becoming more popular in veterinary practices, especially for dogs with moderate to severe joint issues. These products offer longer relief intervals and can delay the progression of joint degeneration. Increased awareness among veterinarians and owners regarding minimally invasive treatment options supports segment growth. The clinical shift toward multimodal pain management is also positioning viscosupplements as a complementary therapy alongside other medical interventions.

Animal Analysis

In terms of animal, the segmentation includes canine, equine, and feline. The canine segment held the largest revenue share in 2024 due to the high incidence of osteoarthritis, particularly in aging and large-breed animals. Regular veterinary visits and routine screenings in dogs make early detection more likely, prompting timely therapeutic intervention. Pet owners tend to prioritize mobility and pain relief in dogs, which drives consistent demand for treatment. Availability of a wide range of canine-specific osteoarthritis medications, supplements, and regenerative options also boosts market presence. The emotional bond between owners and their dogs often translates to higher treatment acceptance and adherence.

The feline segment is growing due to the increasing recognition of mobility issues among older felines. Improved diagnostic services and education around subtle symptoms in cats are enabling more veterinarians to identify and treat feline osteoarthritis effectively. Specialized formulations, such as flavor-enhanced oral drugs and low-stress injectable therapies, are making it easier for pet owners to manage chronic joint conditions at home. The development of feline-friendly delivery methods and analgesics is encouraging treatment uptake. Greater awareness among cat owners and more proactive care are contributing to the steady growth of the segment.

Route of Administration Analysis

In terms of treatment, the segmentation includes oral, injectable, and others. The injectable segment accounted for the largest revenue share in 2024 due to their fast onset of action and ability to provide long-lasting pain relief. These formulations are widely used in both emergency and routine management of osteoarthritis, especially in moderate to severe cases. Veterinarians prefer injectable solutions when rapid improvement is needed or when oral compliance is uncertain. Regenerative injectables such as stem cell therapies and PRP further strengthen the segment’s clinical appeal. Frequent usage in veterinary settings and greater perceived value among pet owners contribute to the strong industry share.

The oral therapies segment is gaining traction due to ease of administration and increasing availability of palatable formulations. This route is often preferred for long-term, low-grade osteoarthritis management in pets. Advances in drug delivery, including flavored chews and extended-release tablets, have improved compliance and owner satisfaction. The affordability and convenience of oral products make them a preferred option for ongoing therapy, particularly when combined with supplements. While they may not match injectables in speed of action, their role in daily care continues to expand across multiple treatment plans.

End Use Analysis

In terms of end use, the segmentation includes veterinary hospitals & clinics, e-commerce, and others. The veterinary hospitals & clinics segment accounted for the largest revenue share in 2024, due to their central role in diagnosis, prescription, and administration of osteoarthritis treatments. These facilities offer a range of interventions, from clinical assessments and radiographic imaging to advanced biologic injections and physiotherapy. Owners rely on veterinarian guidance for tailored care plans, making hospitals the primary point of access. The trust built between pet owners and veterinary professionals supports higher acceptance of premium or long-term therapies. In-house pharmacies and rehabilitation services further enhance their contribution to market revenue.

The e-commerce segment is expected to register the highest CAGR from 2025 to 2034 due to growing demand for convenience, subscription services, and home delivery of pet medications and supplements. Pet owners are increasingly turning to online platforms to access a wider variety of osteoarthritis products, compare prices, and read reviews before purchasing. Many online retailers now collaborate with veterinary clinics to ensure prescription compliance, boosting trust and accessibility. Digital marketing, tele-veterinary consultations, and mobile app integration are also enhancing the visibility of osteoarthritis treatments across consumer segments. Rising tech adoption among pet owners supports the growth of the e-commerce segment.

Regional Analysis

In 2024, the North America companion animal osteoarthritis market accounted for the largest revenue share, due to high pet healthcare spending, advanced veterinary infrastructure, and strong awareness of chronic joint conditions in companion animals. In August 2024, according to Mosquito Joe, households in New York State spent an average of around USD 29,000 annually on essential pet-related expenses, including nutrition, veterinary care, and hygiene products. Routine wellness checks, early diagnosis, and long-term disease management are standard practices across veterinary hospitals and clinics. Pet owners in the region actively seek out evidence-based therapies, including prescription medications, joint supplements, and regenerative treatments. Insurance coverage for chronic illnesses is also more common, making osteoarthritis care more accessible. Ongoing innovations in animal health and rehabilitation tools further support the widespread adoption of multi-modal osteoarthritis treatment strategies.

U.S. Companion Animal Osteoarthritis Market Insights

In 2024, the U.S. market experienced significant growth due to its large pet population and high prevalence of osteoarthritis in aging dogs and cats. Veterinary professionals are increasingly integrating digital radiography, mobility assessments, and tailored care protocols to ensure early intervention. Growing emphasis on preventive care and wellness programs encourages proactive treatment adoption, particularly for chronic conditions. Pet owners benefit from access to a wide range of pharmaceutical and nutritional options through both clinics and online platforms. Awareness campaigns and collaborations between veterinary groups and product manufacturers continue to strengthen industry penetration and treatment adherence.

Asia Pacific Companion Animal Osteoarthritis Market Trends

The industry in Asia Pacific is expected to grow significantly from 2025 to 2034 due to rising pet adoption, increasing disposable income of middle-class, and increasing awareness of animal health. Urbanization and changing lifestyles are prompting pet owners to invest more in veterinary care, including long-term treatment for mobility issues. Veterinarians across emerging markets are witnessing more frequent osteoarthritis diagnoses, especially in senior dogs and large breeds. Product availability is improving through both local manufacturing and international imports. Government initiatives to promote animal welfare and the growing number of specialized pet clinics also play a key role in driving the regional industry demand.

China Companion Animal Osteoarthritis Market Overview

The market in China is showing strong growth as urban households continue to embrace pet ownership. Spending on pet healthcare is increasing steadily, leading to higher diagnosis rates for chronic conditions such as osteoarthritis. Veterinary services are evolving, and more clinics are offering diagnostic imaging and mobility support. Demand for supplements and medications tailored for joint care is rising among middle- and high-income consumers. Growth in domestic veterinary pharmaceutical production is improving affordability and access. Digital platforms are helping pet owners learn more about managing degenerative conditions, which is leading to greater engagement in ongoing care.

Europe Companion Animal Osteoarthritis Market Outlook

The Europe market is expanding steadily due to growing emphasis on companion animal wellness and geriatric care. Veterinary networks across the region provide structured chronic disease management programs that prioritize mobility preservation and pain reduction. Countries with mature veterinary systems are offering advanced treatment modalities, including laser therapy, hydrotherapy, and stem cell injections. Pet owners are showing increased interest in preventative care strategies, driving uptake of nutraceuticals and routine mobility screenings. Educational campaigns by animal welfare organizations and professional associations are also contributing to greater awareness. Strong regulatory oversight ensures product quality, supporting trust and repeat purchases.

Key Players and Competitive Analysis

The competitive landscape of the companion animal osteoarthritis market is evolving rapidly, driven by the integration of advanced treatment modalities and growing veterinary awareness. Industry analysis indicates a shift toward comprehensive care models that combine pharmaceuticals, supplements, and regenerative therapies to address chronic joint degeneration in pets. Industry participants are deploying strategic alliances and joint ventures to expand product portfolios and improve geographic presence. Mergers and acquisitions are increasingly common, enabling companies to accelerate innovation, streamline supply chains, and leverage post-merger integration to enter new verticals such as biologics and companion diagnostics. Technological advancements in imaging, mobility assessment tools, and tele-veterinary platforms are also shaping the market by facilitating early diagnosis and customized care. Firms are actively pursuing market expansion strategies by targeting emerging economies where pet ownership and veterinary access are on the rise. The push for long-acting injectable, breed-specific formulations, and natural supplements is intensifying product differentiation. Regulatory compliance and R&D in osteoarthritis biomarkers are further supporting competitive positioning.

Key Players

- Boehringer Ingelheim International GmbH

- Ceva

- Dechra Pharmaceuticals PLC.

- Elanco

- Eltech K-Laser s.r.l.

- NexGen Pharmaceuticals

- Norbrook

- Vetoquinol

- Virbac

- Zoetis

Companion Animal Osteoarthritis Industry Developments

April 2025: Epiq Animal Health, in collaboration with Interpath Global, introduced the supplement 4CYTE Epiitalis Forte for dogs in the U.S. This formulation is derived from plant seed oil that boasts a high concentration of specialized fatty acids, known for their beneficial properties in enhancing joint health and overall well-being in canine patients.

September 2024: Zoetis partnered with the Arthritis Foundation to enhance awareness regarding the impact of osteoarthritis pain in pets. This collaboration aims to address the significant challenges of managing osteoarthritis, a common degenerative joint condition, by promoting education and resources for pet owners and veterinary professionals alike.

Companion Animal Osteoarthritis Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Biologics

- Stem Cells

- Platelet-Rich Plasma (PRP)

- Monoclonal Antibodies (mAb)

- Other Biologics

- Viscosupplements

- Pharmaceuticals

- Steroids

- NSAIDS

- Others

- Nutritional Supplements

By Animal Outlook (Revenue, USD Billion, 2020–2034)

- Canine

- Equine

- Feline

By Route of Administration Outlook (Revenue, USD Billion, 2020–2034)

- Oral

- Injectable

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Veterinary Hospitals/Clinics

- E-commerce

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Companion Animal Osteoarthritis Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.26 billion |

|

Market Size in 2025 |

USD 2.78 billion |

|

Revenue Forecast by 2034 |

USD 18.45 billion |

|

CAGR |

23.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.26 billion in 2024 and is projected to grow to USD 18.45 billion by 2034.

The global market is projected to register a CAGR of 23.4% during the forecast period.

In 2024, North America accounted for the largest share of the companion animal osteoarthritis market revenue due to high pet healthcare spending, advanced veterinary infrastructure, and strong awareness of chronic joint conditions in companion animals.

A few of the key players in the market are Boehringer Ingelheim International GmbH, Ceva, Dechra Pharmaceuticals PLC., Elanco, Eltech K-Laser s.r.l., NexGen Pharmaceuticals, Norbrook, Vetoquinol, Virbac, and Zoetis.

The biologics segment accounted for ~54% of the revenue share in 2024 due to their ability to target the underlying causes of osteoarthritis rather than just alleviating symptoms

The canine segment held the largest revenue share in 2024 due to the high incidence of osteoarthritis, particularly in aging and large-breed animals.