Comparator Drug Sourcing Market Size, Share, Trends, & Industry Analysis Report

By Type (Local Sourcing, Central Sourcing, and Market Sourcing), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM5971

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

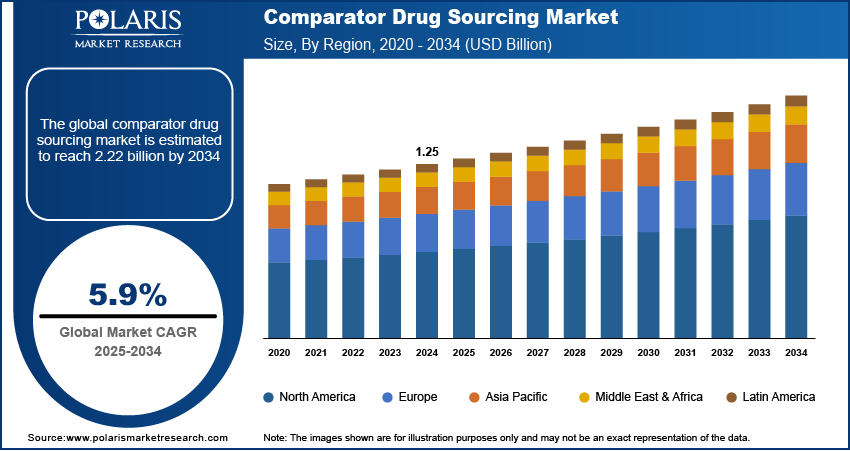

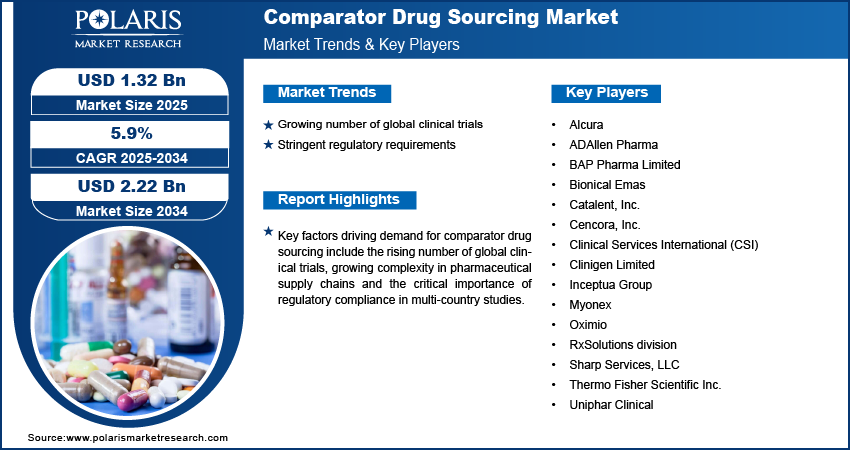

The global comparator drug sourcing market size was valued at USD 1.25 billion in 2024, growing at a CAGR of 5.9% from 2025–2034. Expansion of global clinical trials and strict regulatory compliance requirements are contributing to the growth of the comparator drug sourcing market, due to reliable and verified supply chains to ensure trial integrity across different regions.

Key Insights

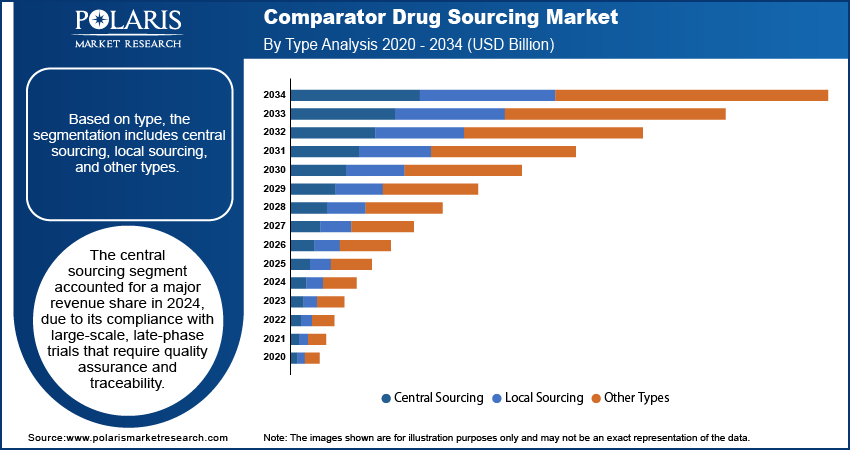

- The central sourcing segment accounted for largest market share in 2024.

- The local sourcing segment is projected to grow at the fastest rate over the forecast period, driven by the rising adoption of decentralized trials and demand for country-specific sourcing flexibility.

- The North America comparator drug sourcing market accounted for largest revenue share of the global market in 2024.

- The U.S. comparator drug sourcing market held largest regional share of the North America market in 2024, driven by pharmaceutical sponsors prioritizing validated and compliant sourcing networks to support large-scale, late-phase trials across diverse therapeutic areas.

- The market in Asia Pacific is projected to grow with fastest CAGR from 2025-2034, owing to the expanding clinical trial activity and localized sourcing infrastructure.

- The India market is expanding steadily, driven by cost-effective trial execution and growing sponsor demand for regional comparator supply capabilities.

Industry Dynamics

- Rising number of global clinical trials is driving demand for validated comparator drug sourcing to ensure protocol adherence and regulatory compliance across multinational studies.

- Stringent import regulations and documentation standards in regulated markets are driving the need for sourcing partners with robust supply networks, GMP-compliant infrastructure, and jurisdiction-specific expertise.

- Rising adoption of decentralized and hybrid trial models is creating new opportunities for flexible, region-specific sourcing strategies to improve supply lead times and site-level logistics.

- High operational costs associated with temperature-controlled logistics, regional import clearances, and quality assurance processes are limiting scalability in cost-sensitive and early-phase trial settings.

Market Statistics

2024 Market Size: 1.25 Billion

2034 Projected Market Size: USD 2.22 Billion

CAGR (2025-2034): 5.9%

North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Comparator drug sourcing involves the procurement of reference drugs used in clinical trials, bioequivalence studies, and regulatory submissions to evaluate the safety and efficacy of new pharmaceutical products. These drugs are sourced through verified supply chains to ensure authenticity, consistent quality, and compliance with regulatory guidelines across different geographies. Sponsors (an entity or organization that initiates, funds and oversees a clinical trial), contract research organizations (CROs) services, and pharmaceutical manufacturers depend on reliable sourcing partners to maintain trial timelines and data integrity.

Rising complexity in clinical trial designs is increasing demand for strategic sourcing solutions. Trials rapidly span multiple countries, requiring timely access to country-specific brands and batch-controlled comparator drugs to meet local regulatory requirements. This is essential for oncology and rare disease trials, where comparator availability and supply continuity directly impact protocol adherence and patient outcomes. As per the World Health Organization (WHO), global cancer cases are expected to rise to over 35 million by 2050, up 77% from 20 million in 2022.

Growing complexity in pharmaceutical supply chains is driving the need for reliable comparator drug sourcing solutions. The rising number of drug development programs globally is further increasing demand for efficient and compliant procurement models to support multi-phase and multi-country clinical trials. According to Deloitte, the top 20 global pharmaceutical companies spent USD 145 billion on R&D in 2022–23, up from USD 139 billion in 2021–22. Sourcing partners are valued for their ability to provide end-to-end logistical support, including temperature-controlled shipping, batch tracking, and multi-market documentation to maintain product integrity across borders. This is essential in trials involving cold chain biologics and niche therapeutic categories where procurement timelines and storage conditions directly impact study continuity. Additionally, the rising preference for centralized procurement models among pharmaceutical companies is driving the adoption of integrated sourcing strategies. These models help reduce fragmentation, simplify coordination with multiple vendors and improve cost efficiency. Global pharmaceutical firms are building strategic sourcing networks to ensure uninterrupted drug supply and maintain operational performance across large-scale research and manufacturing activities.

Growing number of global clinical trials: The expansion of multinational clinical trials is increasing demand for reliable comparator drug sourcing solutions, owing to the sponsors conducting studies across diverse geographies to accelerate product approvals and capture wider patient demographics. According to the World Health Organization (WHO), a total of 39,952 clinical trials were conducted globally in 2024, compared to 30,669 trials in 2010, a growth of 30.3% over the period. This requires access to country-specific comparator drugs with consistent labeling, packaging, and documentation. Additionally, the rising cross-border studies increasing the need for consistent regulatory compliance and multi-market sourcing capabilities. Thus, sponsors are partnering with global distribution networks and expertise in navigating region-specific import, customs and storage regulations.

Stringent regulatory requirements: Compliance with evolving regulatory standards across global markets is driving demand for validated comparator drug sourcing. Regulatory agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), Medicines and Healthcare products Regulatory Agency (MHRA), and National Medical Products Administration (NMPA) mandate full traceability, GMP-compliant storage, and documentation to ensure the authenticity and quality of comparator products. For instance, in March 2024, the FDA’s CDER initiatives aim to streamline drug development and regulatory processes. This supports faster, more reliable comparator drug sourcing for clinical trials. Variability in regional guidelines related to product labeling, import licenses, and site-specific approvals adds operational complexity for sponsors and contract research organizations (CROs). Inaccurate or non-compliant sourcing compromises trial data, delays approvals result in protocol deviations. As a result, pharmaceutical companies are prioritizing sourcing partners with proven regulatory expertise, audited supply chains, and quality-assured infrastructure. The ability to meet jurisdiction-specific compliance requirements is emerging as a differentiator in comparator procurement strategies.

Segmental Insights

Type Analysis

Based on type, the segmentation includes central sourcing, local sourcing, and other types. The central sourcing segment accounted for largest revenue share in 2024, due to its standardized procurement processes and ability to support global clinical trial operations. This model offers improved batch control, uniform documentation, and streamlined logistics across multiple geographies. Sponsors prefer centralized sourcing to maintain consistency, mitigate regulatory risks, and reduce duplication in supply chains. Centralized models are mainly suitable for large-scale Phase III trials where drug traceability, quality assurance, and regulatory compliance requirements are essential for study execution and approval processes. Established sourcing providers continue to expand centralized infrastructure to meet demand from multinational pharmaceutical companies and CROs operating across North America, Europe, and Asia Pacific.

The local sourcing segment is projected to grow at the fastest pace during the forecast period, owing to increasing decentralization of clinical trials and the need to meet country-specific regulatory and logistical requirements. This approach allows sponsors to reduce customs delays, lower transportation costs, and improve supply timelines by leveraging in-market distributors. The model is growing in regions with complex import regulations or limited cold chain infrastructure, where local procurement enables faster access to comparator drugs. Trials involving rare diseases or niche therapeutic areas benefit from region-specific sourcing to maintain protocol adherence. Rising clinical activity in emerging markets is further accelerating the adoption of local sourcing strategies.

Application Analysis

By application, the market includes drug producers/manufacturers, contract manufacturing organizations (CMOs), academic and research institutes, and other applications. The drug producers segment held the largest revenue share in 2024, driven by high-volume demand for comparator drugs across multiple development programs, including bioequivalence, bridging, and therapeutic efficacy trials. These companies invest in large-scale clinical operations that require timely access to branded reference drugs with verified regulatory documentation. Comparator sourcing enables pharmaceutical manufacturers to benchmark new therapies, secure regulatory approvals, and ensure consistency across global trials. Leading sponsors partner with established sourcing firms to manage global supply logistics, regulatory filings, and product integrity in trials involving complex biologics or high-value therapeutics across multiple regulatory jurisdictions.

The contract manufacturing organizations (CMO) segment is anticipated to grow at the fastest rate due to the expanding outsourcing of drug development and clinical trial management. CMOs require efficient comparator sourcing to fulfill study protocols on behalf of pharmaceutical sponsors while adhering to strict regulatory timelines. The growing reliance on CMOs in early-phase and specialty drug trials is fueling demand for end-to-end procurement services, including sourcing, storage, and quality assurance. CMOs are rapidly collaborating with specialized vendors to manage country-specific sourcing for projects involving rare diseases or oncology pipelines, where timely access to comparators is crucial for protocol execution.

Regional Analysis

North America comparator drug sourcing market accounted for largest revenue share of global market in 2024. This dominance is driven by high clinical trial activity and strong regulatory oversight. The region hosts a large number of multinational trials across therapeutic areas such as oncology, cardiology, and immunology. Sponsors operating in this environment require verified sourcing channels that ensure batch traceability and compliance with FDA regulations. Additionally, strategic partnerships between CROs and specialized sourcing providers are strengthening the region’s capacity to support time-sensitive comparator procurement across multi-center trials.

US Comparator Drug Sourcing Market Insight

The U.S. held largest regional market share in the North America comparator drug sourcing landscape in 2024, attributed to the country’s leadership in pharmaceutical R&D and its extensive clinical trial infrastructure. As per the Pharmaceutical Research and Manufacturers of America (PhRMA), the biopharmaceutical industry sponsored around 5,300 clinical trials in the U.S. in 2023, involving over 900,000 participants and spending over USD 30 billion at trial sites nationwide. Sponsors and CROs are opting for centralized sourcing models to maintain protocol consistency across large-scale studies. In addition, the complexity of FDA import requirements is driving demand for sourcing partners with verified supply networks and audit-ready documentation. The trend toward precision medicine and decentralized trials is fueling flexible sourcing strategies tailored to region-specific needs.

Asia Pacific Comparator Drug Sourcing Market

The market in Asia Pacific is projected to grow with fastest CAGR from 2025-2034, driven by rising clinical trial activity and advancing regulatory compliance across key countries. This includes China, India, and South Korea, which attracts sponsor participation due to lower trial execution costs, skilled research personnel, and access to treatment-naïve populations. These factors are making the region highly favorable for early- and late-phase drug delivery. As a result, sourcing providers are expanding regional operations to manage import regulations, product labeling, and cold chain requirements more efficiently. Additionally, investments in digital procurement platforms, regional warehousing, and real-time inventory management systems are improving visibility and responsiveness. This shift is growing the region’s position as a preferred hub for global comparator drug procurement.

India Comparator Drug Sourcing Market Overview

The market in India is expanding due to the rapid growth in clinical trial activity across domestic and multinational studies. The country’s evolving regulatory framework and cost-effective trial environment are driving demand for region-specific comparator sourcing solutions. According to Novartis India, phase 2 and 3 clinical trials in India grew by 15 to18% between 2017 and 2023, driven by key amendments to the Drugs and Cosmetics Act. Moreover, sourcing partners offering in-market storage, labeling, and distribution services that are essential for protocol adherence and reducing trial delays. Moreover, India’s large-scale participation in therapeutic trials in oncology and infectious diseases is further boosting the development of streamlined, compliant sourcing networks.

Europe Comparator Drug Sourcing Market

The comparator drug sourcing landscape in Europe is projected to hold a substantial share in 2034, driven by its structured regulatory framework governed by the European Medicines Agency (EMA), Medicines and Healthcare products Regulatory Agency (MHRA), and European Federation of Pharmaceutical Industries and Associations (EFPIA). For instance, in March 2025, EFPIA raised concerns over the EU's proposed Critical Medicines Act, which aims to improve medicine availability through stronger, evidence-based policies and joint procurement. The focus on resilient and diversified supply chain management directly supports comparator drug sourcing by ensuring reliable access for clinical trials across regions. The region’s centralized regulatory oversight facilitates efficient approval processes and supports comparator procurement across cross-border trials. Sponsors are conducting multinational studies across the region due to the predictability of compliance requirements and established infrastructure for large-scale clinical research. Moreover, centralized sourcing is rapidly adopting to address the complexity of import regulations and documentation standards across member states. This regulatory consistency combined with high sponsor activity in biosimilar and therapeutic trials, continues to drive stable demand for compliant and traceable comparator drug supply across the region.

Key Players & Competitive Analysis Report

The comparator drug sourcing market is moderately fragmented, with active participation from global sourcing specialists, regional distributors, and clinical logistics providers. Companies differentiate themselves based on regulatory expertise, therapeutic focus, and supply chain reliability. Leading players are investing in cold chain infrastructure, sourcing efficiency and jurisdiction-specific compliance to support cross-border trials. Strategic priorities include expanding direct sourcing capabilities, enhancing digital procurement platforms and developing regional hubs to improve responsiveness in multi-country studies. Global sponsors are rapidly engaging sourcing partners that offer centralized and local procurement models with traceable and verified supply chains. Additionally, regional providers continue to attract early-phase trial sponsors by offering cost-effective solutions, shorter lead times and localized regulatory support.

Major companies operating in the comparator drug sourcing industry include Thermo Fisher Scientific Inc., Clinigen Limited, Inceptua Group, Uniphar Clinical, Catalent, Inc, Clinical Services International (CSI), BAP Pharma Limited, Oximio, Bionical Emas, Alcura, Myonex, Cencora, Inc., Sharp Services, LLC, ADAllen Pharma, and RxSolutions division.

Key Players

- Alcura

- ADAllen Pharma

- BAP Pharma Limited

- Bionical Emas

- Catalent, Inc.

- Cencora, Inc.

- Clinical Services International (CSI)

- Clinigen Limited

- Inceptua Group

- Myonex

- Oximio

- RxSolutions division

- Sharp Services, LLC

- Thermo Fisher Scientific Inc.

- Uniphar Clinical

Industry Developments

- November 2024: Cencora announced its inaugural product showcase highlighting its growing portfolio of comparator drugs and biosimilars to support clinical trials. The company highlighted its sourcing capabilities across oncology, immunology, and rare diseases, aiming to streamline access to high-quality comparators for global studies.

- April 2024: BAP Pharma launched a new U.S. headquarters in Somerset, New Jersey, to strengthen its capabilities in comparator drug sourcing for clinical trials. The expanded facility enhances its supply chain infrastructure to support global pharmaceutical and biotech clients conducting studies across North America.

- February 2023: Catalent expanded its clinical supply facility in Singapore to enhance capabilities to support comparator sourcing for Asia-Pacific trials. The upgraded site now includes increased storage capacity and enhanced cold-chain handling, aiming to streamline the procurement, packaging and distribution of comparator drugs for multinational and regional studies.

Comparator Drug Sourcing Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Central Sourcing

- Local Sourcing

- Other Types

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Drug Producers/Manufacturers

- Contract Manufacturing Organizations (CMO)

- Academic and Research Institute

- Other Applications

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Comparator Drug Sourcing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.25 Billion |

|

Market Size in 2025 |

USD 1.32 Billion |

|

Revenue Forecast by 2034 |

USD 2.22 Billion |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.25 billion in 2024 and is projected to grow to USD 2.22 billion by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Thermo Fisher Scientific Inc., Clinigen Limited, Inceptua Group, Uniphar Clinical, Catalent, Inc., Clinical Services International (CSI), BAP Pharma Limited, Oximio, Bionical Emas, Alcura, Myonex, Cencora, Inc., Sharp Services, LLC, ADAllen Pharma, and RxSolutions division.

The central sourcing segment dominated the market in 2024. This is due to its ability to support multinational trials with standardized procurement, streamlined regulatory compliance, and end-to-end traceability.

The CMOs segment is expected to witness the fastest growth during the forecast period, owing to increasing trial outsourcing and rising demand for integrated sourcing and logistics solutions.