Construction Adhesive Tapes Market Size, Share, Trends, Industry Analysis Report

: By Type, Application (Residential, Commercial, Infrastructure, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 133

- Format: PDF

- Report ID: PM2658

- Base Year: 2024

- Historical Data: 2020-2023

Construction Adhesive Tapes Market Overview

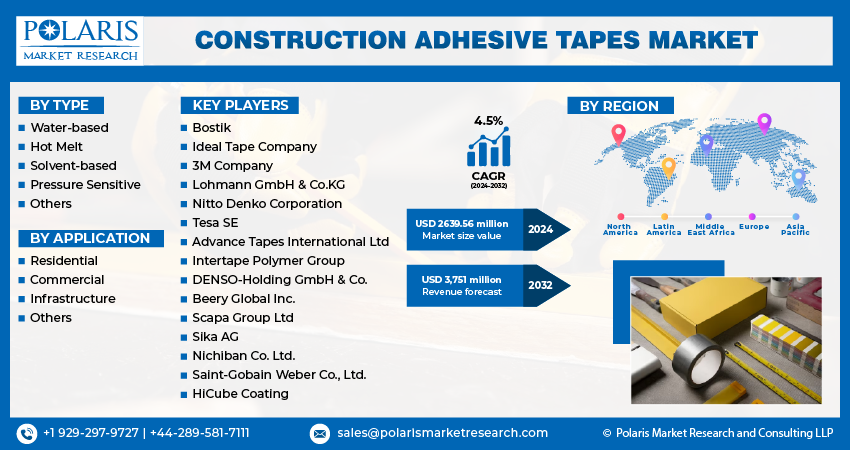

The global construction adhesive tapes market size was valued at USD 2,029.19 million in 2024. The market is projected to grow from USD 2,119.39 million in 2025 to USD 3,149.35 million by 2034, exhibiting a CAGR of 4.5% during 2025–2034.

The construction adhesive tapes market demand is growing due to the rapid expansion of the building and construction industry, particularly in emerging economies. These tapes are integral in applications such as flooring, roofing, windows, doors, walls, and HVAC systems, offering efficient bonding solutions that enhance structural integrity and streamline installation processes.

Government initiatives to enhance public infrastructure are fueling the construction adhesive tapes market growth. In emerging countries such as India, significant investments are made in infrastructural development, which is increasing the demand for construction adhesive tapes. For instance, according to the Ministry of Information & Broadcasting, the Indian government has allocated a budget of USD 120.48 billion for infrastructural development in the financial year 2023-24. Thus, such investments boost infrastructure development and construction activities, thereby increasing the demand for construction materials, including adhesive tapes.

To Understand More About this Research:Request a Free Sample Report

The residential sector has emerged as a substantial consumer of adhesive tapes, driven by their ease of application and strong bonding properties that facilitate efficient construction and renovation activities. The market is also experiencing a shift toward eco-friendly and sustainable adhesive solutions. Manufacturers are focusing on developing recyclable tapes with a lower environmental impact, aligning with global sustainability goals. Moreover, the growing focus on addressing environmental concerns has led to the opening of new construction adhesive tapes market opportunities as the construction of green buildings is increasing.

Construction Adhesive Tapes Market Dynamics

Increasing Modular Construction

The surge in modular construction is positively influencing the construction adhesive tapes market trends due to an ease of assembling at onsite location. Since 80% of building components are prefabricated off-site and then assembled at the construction location, high-performance adhesive tapes have become critical for ensuring fast, airtight, and vibration-resistant bonds in modular construction. This approach offers significant benefits, including reduced onsite construction time, cost efficiency, flexibility, enhanced quality control, minimized waste, and improved sustainability. Moreover, self-adhered construction adhesives play an important role by eliminating the need for traditional fasteners, thereby reducing module weight and simplifying assembly processes. The integration of self-adhered construction adhesives tapes in modular building practices offers substantial advantages such as reduced module weight, simple assembly, and minimized labor requirements.

Increasing Demand from Residential Sector

The demand for construction adhesive tapes in the residential sector is growing due to rapid urbanization and population growth, particularly in developing economies. The rising population necessitates the development of single-family homes and multifamily housing units to accommodate the expanding urban populace. Governments are responding with initiatives aimed at addressing housing shortages and promoting affordable housing. For instance, the UK government has set an ambitious target of constructing 300,000 new homes annually by the mid-2020s to alleviate the housing crisis. Additionally, economic factors such as low interest rates and rising disposable incomes have bolstered individuals' capacity to invest in residential properties. These elements contribute to a robust expansion in the global residential building construction industry, presenting significant opportunities for players operating in the construction adhesive tapes market.

Construction Adhesive Tapes Market Segment Analysis

Construction Adhesive Tapes Market Assessment by Type

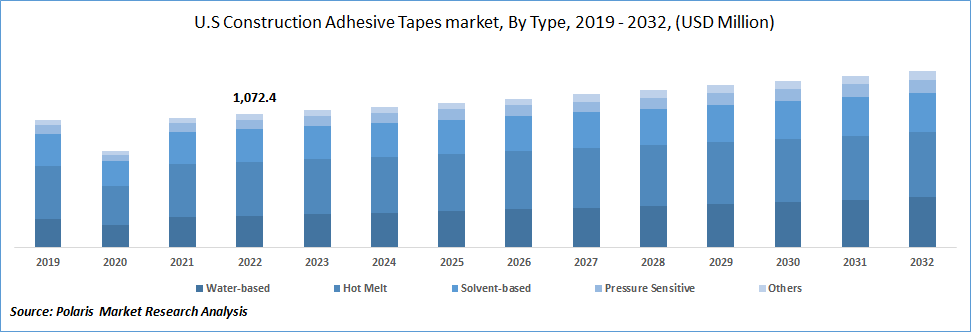

The construction adhesive tapes market segmentation, based on type, includes water-based, hot melt, solvent-based, pressure sensitive, and others. The hot melt segment dominated the construction adhesive tapes market revenue in 2024 with a 39.55% share, due to its versatile applications such as cost-effectiveness and rapid bonding capabilities across diverse substrates. Hot-melt adhesives, often referred to as glue sticks, are solid high-performance thermoplastics adhesives processed above their softening point, suitable for simplified processing through extrusion, rolling, or spraying. The demand for hot-melt adhesive tapes is rising due to their quick setting times and strong adhesion properties, which are essential for modern construction demands. These adhesives are composed primarily of polymers, tackifiers, wax, and antioxidants that are widely used due to their quick curing time, low production costs, and negligible VOC emissions. In construction, they are favored for their resistance to vibrations and their ability to maintain structural rigidity. Moreover, the growth in urbanization and population in regions including North America and Asia Pacific is resulting in rising demand for more buildings. Thus, hot-melt adhesives support streamlined manufacturing and effectively address modern infrastructure needs while the recovering construction sectors in Latin America and Europe further boost overall construction adhesive tapes market demand.

Construction Adhesive Tapes Market Evaluation by Application

In terms of application, the construction adhesive tapes market is divided into residential, commercial, infrastructure, and others. The commercial segment is expected to experience the highest growth rate during the forecast period due to the increasing demand for durable and versatile adhesive solutions in high-traffic commercial spaces. The application of floor adhesives in commercial buildings is particularly crucial, as these environments are exposed to constant wear and tear. The type of flooring, such as tile, stone, carpet, laminate, and timber, directly influences the selection of adhesive in commercial construction. In the commercial sector, construction adhesive tapes are increasingly preferred for their strong bonding capabilities, ease of application, and ability to enhance overall durability and efficiency. Thus, these high-performance features enable adhesive tapes to meet strict safety, reliability, and efficiency demands in commercial construction.

Construction Adhesive Tapes Market Regional Analysis

By region, the study provides construction adhesive tapes market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global construction adhesive tapes market share in 2024, driven by the steady recovery of the construction sector post-economic slowdown and rising demand for non-residential construction activities. The surge in consumer spending on home furnishing and renovations has significantly boosted the use of polyurethane adhesives across various building applications. In addition, increased construction spending, especially in the US and Canada, is expected to fuel market growth during the forecast period. The residential sector also continues to play a pivotal role in driving market demand, supported by rising disposable incomes and a growing emphasis on home improvement and energy-efficient buildings solutions.

The US construction adhesive tapes market is witnessing continuous growth, driven by rising residential renovations, increasing spending on infrastructure, and growing demand for energy-efficient buildings. The trend toward smart and sustainable housing, along with the recovery of commercial real estate projects post-pandemic, is boosting adhesive tape applications. Additionally, advancements in high-performance adhesive technologies and a growing preference for fast, clean, and durable bonding solutions are further fueling market expansion.

In Canada, the construction adhesive tapes market is gaining traction due to growing residential construction activity, government-backed infrastructure investments, and an increasing shift toward modular and prefabricated buildings. The market benefits from rising demand for eco-friendly and moisture-resistant adhesives in regions with harsh climates. A focus on affordable housing and energy efficiency, combined with innovations in tape formulations, continues to drive market growth across both urban development and renovation projects.

According to the construction adhesive tapes market statistics, Asia Pacific represents the second-largest and fastest-growing market and is projected to register the highest CAGR of 6.9% during the forecast period. The growth is attributed to rapid urbanization, expanding residential construction, and significant infrastructure development across countries such as China, India, Japan, Malaysia, and Australia. Moreover, ongoing mega infrastructure projects and housing initiatives in China and India are creating substantial demand for high-performance adhesive solutions. Manufacturers in the region are benefiting from easy access to raw materials and cost advantages to scale up production efficiently. Factors such as rising income levels, growing government investments in urban infrastructure, and increasing adoption of modern construction materials continue to boost market demand. Therefore, regional growth is driven by strong economic development and rapid construction activity.

Construction Adhesive Tapes Market – Key Players & Competitive Analysis Report

Major companies operating in the construction adhesive tapes market are actively investing in research and development to diversify their product portfolios and meet evolving industry needs, which is expected to accelerate market growth during the forecast period. These players are also pursuing strategic initiatives such as international partnerships, mergers and acquisitions, and technology-driven innovations to strengthen their global footprint. The market remains partially consolidated, with dominant global and regional players shaping its competitive landscape.

A few leading companies in the construction adhesive tapes market such as 3M Company; Saint-Gobain Weber Co., Ltd.; ATP Adhesive Systems AG; Sika AG; Nitto Denko Corporation; Denso Corp.; Berry Global Group Inc.; Arkema SA (Bostik); HiCube Coating; Lohmann GmbH & Co; Scapa Group Ltd.; and Tesa SE continue to drive growth through innovation, strategic collaborations, and the development of high-performance adhesive solutions tailored for modern construction applications.

3M Company (3M) is a global manufacturing and distributing company having a wide range of industrial and consumer products. Its diversified portfolio includes advanced materials, personal safety equipment, home care solutions, display systems, roofing granules, closure and masking systems, and office supplies. Its Industrial Adhesives and Tapes Division focuses on delivering high-performance bonding solutions for building and construction applications. This division provides a comprehensive range of pressure-sensitive tapes and adhesive technologies designed for structural bonding, insulation, sealing, and surface protection.

Compagnie de Saint-Gobain (Saint-Gobain) is a global manufacturing construction and building materials company offering a wide range of solutions tailored for both residential and commercial sectors. Its diversified product portfolio includes glass, ceramic tiles, plastics, pipes, industrial mortars, roofing materials, gypsum, and exterior wall systems. A key business segment contributing to the construction adhesive tapes market is Saint-Gobain Weber, which specializes in high-performance construction adhesives and solutions for tiling, insulation, and external thermal systems. The company markets its offerings under well-recognized brands such as Saint-Gobain, Weber, Gyproc, Isover, Placo, Norton, PAM, and CertainTeed.

List of Key Companies in Construction Adhesive Tapes Market

- 3M Company

- Arkema SA (Bostik)

- ATP Adhesive Systems AG

- Berry Global Group Inc.

- Denso Corp.

- HiCube Coating

- Lohmann GmbH & Co

- Nitto Denko Corporation

- Saint-Gobain Weber Co., Ltd.

- Scapa Group Ltd.

- Sika AG

- Tesa SE

Construction Adhesive Tapes Industry Developments

February 2022: Arsenal Acquired ATP Group from Bregal Unternehmerkapital. This partnership has enabled Arsenal to continue global expansion and become the partner of choice of specialty water-based tapes to an international customer base.

May 2022: Arkema announced the acquisition of Permoseal and strengthened its position in the adhesives industry in South Africa. This new operation enables the company to continue its expansion in the region, benefiting in particular from the strong growth in demand in the building renovation market.

Construction Adhesive Tapes Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Water-Based

- Hot Melt

- Solvent-Based

- Pressure Sensitive

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Residential

- Commercial

- Infrastructure

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Construction Adhesive Tapes Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,029.19 million |

|

Market Size Value in 2025 |

USD 2,119.39 million |

|

Revenue Forecast by 2034 |

USD 3,149.35 million |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2,029.19 million in 2024 and is projected to grow to USD 3,149.35 million by 2034.

The global market is projected to register a CAGR of 4.5% during the forecast period.

North America held the largest share of the global market in 2024.

A few of the key players in the market are 3M Company; Saint-Gobain Weber Co., Ltd.; ATP Adhesive Systems AG; Sika AG; Nitto Denko Corporation; Denso Corp.; Berry Global Group Inc.; Arkema SA (Bostik); HiCube Coating; Lohmann GmbH & Co; Scapa Group Ltd.; and Tesa SE.

The hot melt segment dominated the market share in 2024.