Construction Lubricants Market Share, Size, Trends, Industry Analysis Report

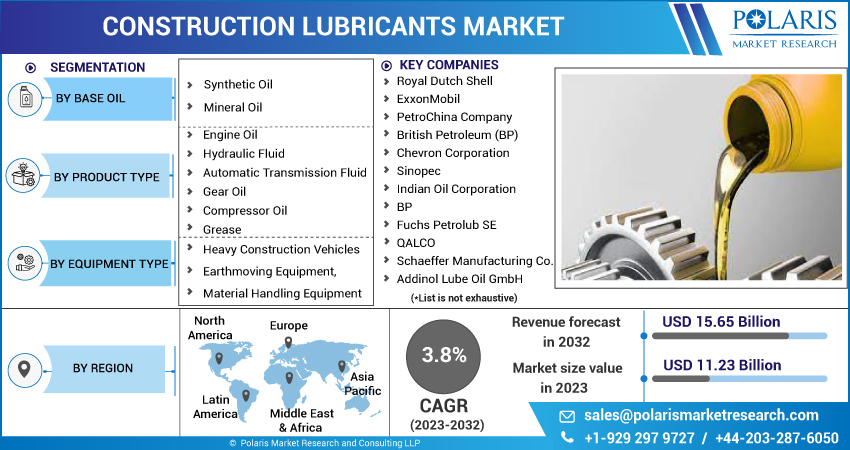

By Base Oil (Synthetic Oil and Mineral Oil); By Product Type; By Equipment Type; By Region; Segment Forecast, 2023 - 2032

- Published Date:Mar-2023

- Pages: 116

- Format: PDF

- Report ID: PM3101

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

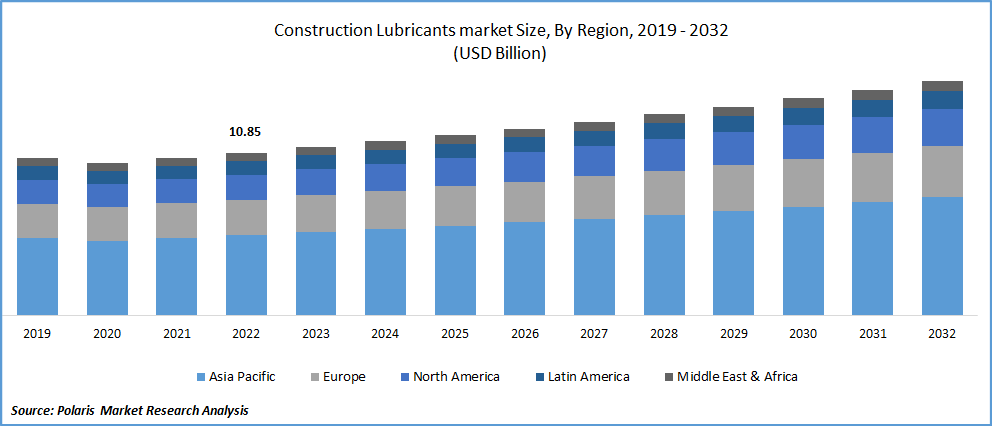

The global construction lubricants market was valued at USD 10.85 billion in 2022 and is expected to grow at a CAGR of 3.8% during the forecast period. The market for construction lubricants is driven by the growth of the construction industry, which is caused by increasing urbanization and infrastructure development activities worldwide. The demand for construction lubricants is also influenced by the need to maintain and repair equipment and machinery used in construction activities.

Know more about this report: Request for sample pages

The construction lubricants market refers to the industry that provides lubricants and other related products to the construction sector. Construction lubricants are used in various equipment and machinery used in construction activities, including heavy machinery, excavators, loaders, bulldozers, cranes, and other vehicles.

Construction lubricants are specialty lubricants used in various construction machinery for several purposes. Construction lubricants are used in building materials, and each has a certain set of characteristics that help build and strengthen the confining structure. The most popular construction lubricants include mineral oil and synthetic oils such as PAO, PAG, Esters, hydraulic fluid, engine oil, gear oil, compressor oil, grease, brake fluid, chain, and cable oil. Different lubricants are available, each with a unique set of properties. For instance, hydraulic fluid is frequently used as a lubricant in construction. Due to its special characteristics, it is also used as a lubricant in vehicle parts.

Many construction projects were delayed or postponed during the pandemic due to social distancing measures, travel restrictions, and labor shortages, reducing demand for construction lubricants. Moreover, the lockdowns and restrictions on movement affected the transportation of raw materials and finished products, causing supply chain disruptions that impacted the availability of construction lubricants.

The pandemic has also led to a shift in consumer behavior, with many individuals and businesses opting for remote working and reduced travel, reducing the need for infrastructure development activities and, consequently, reducing demand for construction lubricants.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The construction industry is witnessing significant growth worldwide, driven by increasing urbanization, population growth, and infrastructure development activities. This growth is expected to drive the demand for construction lubricants, as they are essential for maintaining and smoothly operating equipment and machinery used in construction activities.

Emerging economies, such as India, China, and Brazil, are witnessing significant growth in infrastructure development activities, driven by increasing urbanization and population growth. This growth is expected to drive these countries' demand for construction lubricants.

Moreover, developing high-performance lubricants that offer better efficiency, longer lifespan, and improved environmental performance is expected to drive the demand for construction lubricants. Advanced fats can help reduce maintenance costs, improve equipment performance, and extend equipment lifespan, driving the need for these products.

Report Segmentation

The market is primarily segmented based on base oil, product type, equipment type, and region.

|

By Base Oil |

By Product Type |

By Equipment Type |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Mineral Oil Segment Accounted for the Largest Market Share in 2022

Mineral oils account for the largest market share in the market due to their low cost and wide availability. Mineral oils are commonly used as base oils for engine oils, hydraulic fluids, gear oils, and other lubricants used in construction equipment and machinery.

However, synthetic oils as base oils in construction lubricants are expected to increase in the coming years due to their superior performance characteristics, such as better oxidative stability, improved viscosity index, and higher flash points. Synthetic oils can also provide better protection against wear and tear, reduce energy consumption, and minimize environmental impact, making them an attractive option for construction companies looking to improve their sustainability and reduce their carbon footprint.

Hydraulic Fluids is Expected to Dominate the Market over the Forecasted Period

Hydraulic fluids will dominate the market in the coming years. Hydraulic fluids are used extensively in construction equipment and machinery, such as excavators, loaders, and bulldozers, to transfer power and control the movement of hydraulic cylinders.

The demand for hydraulic fluids is driven by several factors, including the growing construction industry, increasing demand for efficient construction equipment, and advancements in hydraulic technology. Hydraulic fluids are essential for the smooth operation and maintenance of hydraulic systems. The need for high-quality hydraulic fluids is expected to increase with the growing demand for construction equipment and machinery worldwide.

Moreover, the increasing awareness of the environmental impact and the development of environmentally friendly hydraulic fluids are expected to further boost the demand for hydraulic fluids in the construction lubricants market. Eco-friendly hydraulic fluids can improve sustainability and reduce environmental impact, making them an attractive option for construction companies looking to reduce their carbon footprint.

Earthmoving Equipment Accounted for the Largest Market Share in 2022

Earthmoving Equipment is accounted for the largest market share. Earthmoving equipment is widely used in the construction industry for digging, grading, demolition, and excavation activities. The equipment includes excavators, loaders, bulldozers, and graders.

The demand for lubricants in the earthmoving equipment segment is driven by factors such as the growing construction industry, increasing demand for efficient and reliable equipment, and the need for better lubrication to improve equipment performance and reduce maintenance costs.

Moreover, the increasing focus on sustainability and environmental regulations is expected to boost the demand for biodegradable and eco-friendly lubricants used in earthmoving equipment. These lubricants can help reduce environmental impact and improve sustainability, making them an attractive option for construction companies adopting greener practices.

Asia Pacific Dominated the Global Market in 2022

The Asia Pacific region is expected to dominate the market in terms of demand and supply during the forecast period. The region's rapidly growing construction industry is driving the need for construction lubricants. The rising urbanization, population growth, and increasing infrastructure projects in countries such as China, India, and Japan are the major drivers of the construction industry in the region.

In addition, the increasing government investments in infrastructure development projects such as highways, railways, airports, and ports are boosting the demand for construction equipment and lubricants in the region. Moreover, the region has a large number of construction equipment manufacturers, which is further driving the need for lubricants.

Furthermore, the growing awareness about the benefits of using high-quality lubricants for equipment maintenance and the increasing adoption of sustainable and eco-friendly lubricants are expected to boost the demand for construction lubricants in the region. The availability of low-cost labor and raw materials also contributes to the growth of the regional market.

Competitive Insight

Some of the major players operating in the global market include Royal Dutch Shell, ExxonMobil, PetroChina Company, British Petroleum (BP), Chevron Corporation, Sinopec, Indian Oil Corporation, BP, Fuchs Petrolub SE, QALCO, Schaeffer Manufacturing Co., Addinol Lube Oil GmbH.

Recent Developments

- In February 2020, Chevron launched its Delo 600 ADF diesel engine oil, designed to help reduce particulate emissions from diesel engines used in construction equipment.

- In July 2019, ExxonMobil launched its Mobil SHC Elite synthetic gear oil, designed to provide superior protection for construction equipment operating under extreme conditions.

Construction Lubricants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 11.23 billion |

|

Revenue forecast in 2032 |

USD 15.65 billion |

|

CAGR |

3.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Base Oil, By Product Type, By Equipment Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Royal Dutch Shell, ExxonMobil, PetroChina Company, British Petroleum (BP), Chevron Corporation, Sinopec, Indian Oil Corporation, BP, Fuchs Petrolub SE, QALCO, Schaeffer Manufacturing Co., Addinol Lube Oil GmbH |

FAQ's

The construction lubricants market report covering key segments are base oil, product type, equipment type, and region.

Construction Lubricants Market Size Worth $15.65 Billion By 2032.

The global construction lubricants market expected to grow at a CAGR of 3.8% during the forecast period.

Asia Pacific is leading the global market.

Key driving factors in construction lubricants market are rise in automation in the construction industry and developing high-performance lubricants.