Containerized Battery Energy Storage System Market Size, Share, Trend, Industry Analysis Report

By Battery Type (Lithium Ion Battery, Lead Acid Battery, Others), By Capacity, By Container Size, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6331

- Base Year: 2024

- Historical Data: 2020-2023

Overview

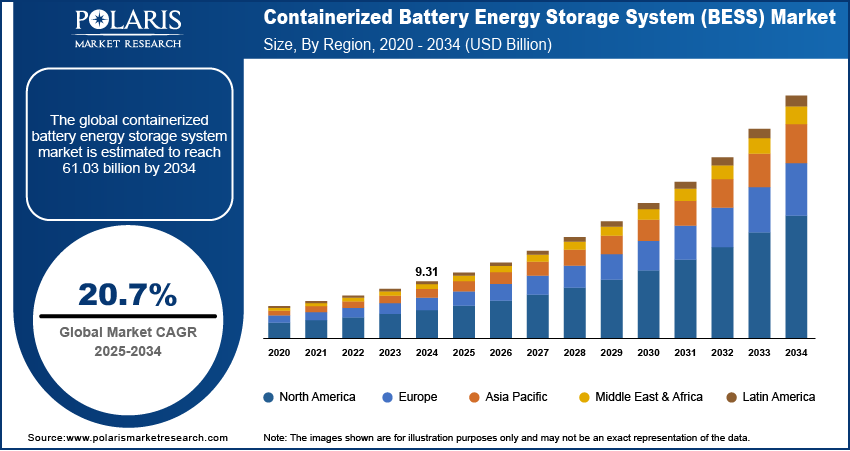

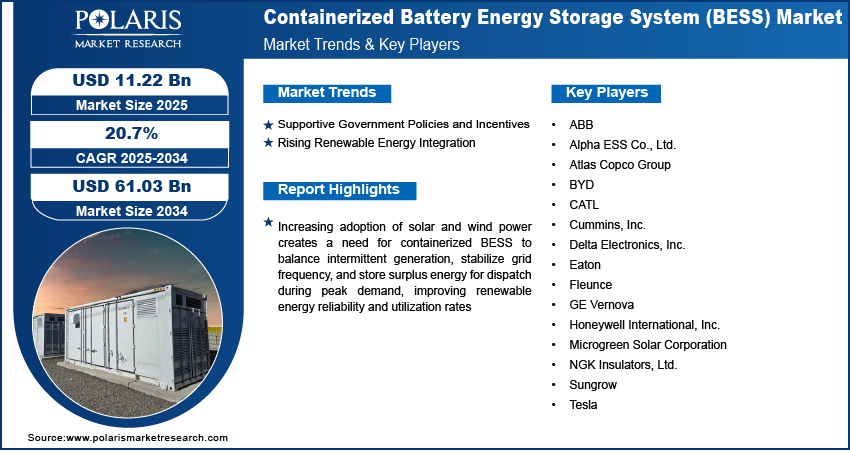

The global containerized battery energy storage system (BESS) market size was valued at USD 9.31 billion in 2024, growing at a CAGR of 20.7% from 2025 to 2034. The increasing adoption of solar and wind power creates a need for containerized BESS to balance intermittent generation, stabilize grid frequency, and store surplus energy for dispatch during peak demand, improving renewable energy reliability and utilization rates.

Key Insights

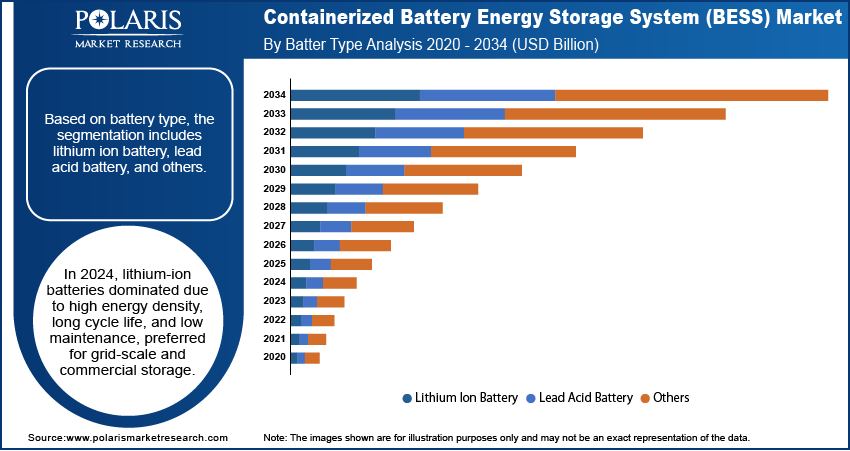

- The lithium-ion battery segment led in 2024 due to high energy density, long cycle life, and widespread suitability for grid and commercial storage.

- The commercial segment dominated in 2024, driven by demand for peak shaving, backup power, and energy cost management in data centers and retail.

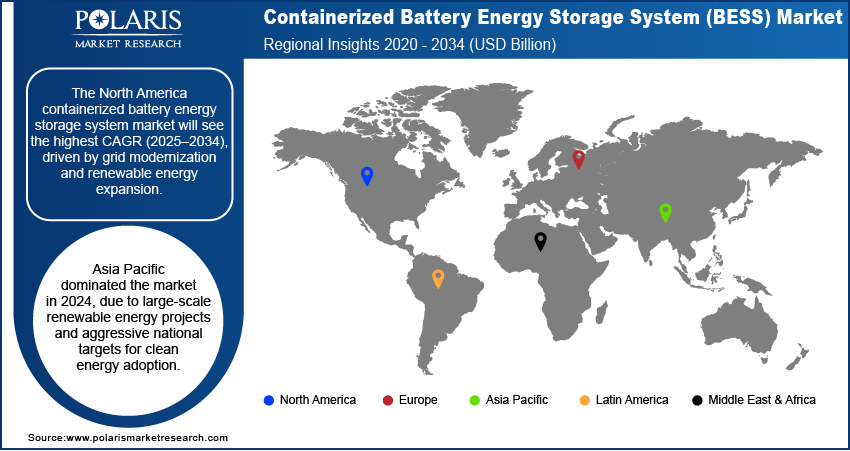

- The industry in North America is projected to register the highest CAGR from 2025 to 2034, fueled by grid modernization and renewable energy expansion.

- The U.S. market is expanding rapidly due to large-scale BESS deployments supporting grids with high solar and wind penetration.

- Asia Pacific dominated the market in 2024, driven by large renewable projects and strong government support for clean energy.

- China led the region in 2024 due to massive renewable capacity growth and significant investments in battery storage infrastructure.

Industry Dynamics

- The rising deployment of renewable energy is driving demand for scalable and mobile storage solutions to ensure grid stability and power reliability.

- Growing focus on rapid project deployment is boosting adoption of pre-engineered, containerized BESS for utility and industrial applications.

- Expansion into hybrid microgrids and remote electrification creates new demand for modular, transportable energy storage systems in off-grid regions.

- High upfront costs and supply chain constraints for lithium-ion batteries limit widespread deployment, especially in price-sensitive markets.

Market Statistics

- 2024 Market Size: USD 9.31 billion

- 2034 Projected Market Size: USD 61.03 billion

- CAGR (2025–2034): 20.7%

- Asia Pacific: Largest market share in 2024

AI Impact on Containerized Battery Energy Storage System Market

- AI enables real-time monitoring and fault detection, reducing downtime and extending battery life through predictive analytics and automated maintenance alerts.

- AI algorithms optimize charge-discharge cycles, improving energy efficiency and reducing operational costs across grid, commercial, and residential applications.

- AI enhances system responsiveness, enabling smoother integration with renewable sources and balancing supply-demand fluctuations in real-time.

- AI-driven modeling predicts system behavior under various conditions, supporting better planning, load forecasting, and investment decision-making.

The containerized battery energy storage system (BESS) market refers to the industry focused on manufacturing, deploying, and operating modular, container-based energy storage units that integrate batteries, inverters, thermal management, and control systems to store and deliver electricity for grid support, renewable integration, and backup power. Utilities are investing in containerized BESS as part of grid upgrade programs to enhance flexibility, manage distributed energy resources, and provide peak shaving, load leveling, and frequency regulation without major infrastructure overhauls, accelerating deployment.

Containerized systems offer plug-and-play design, enabling fast installation and easy relocation, which appeals to utilities, industrial users, and microgrid developers seeking flexible, modular, and scalable energy storage solutions with reduced project lead times. Moreover, ongoing improvements in lithium-ion and alternative chemistries enhance the efficiency, energy density, and lifespan of containerized BESS. It lowers the total cost of ownership and expands the application potential in both stationary and mobile energy storage markets.

Drivers & Opportunities

Supportive Government Policies and Incentives: Government initiatives are playing a crucial role in driving the adoption of containerized battery energy storage systems. In June 2025, the California Energy Commission granted approval for the world’s largest solar energy and battery storage project, located in Fresno County. This initiative has been fast-tracked under the state's Accelerated Permitting Program, which aims to streamline the regulatory process for renewable energy developments. Funding programs, subsidies, and tax credits are helping reduce the upfront costs of these systems, making them more financially viable for a wide range of users. Supportive regulations, such as mandates for energy storage deployment and favorable grid interconnection policies, are also encouraging investment. These measures improve project returns and reduce financial risks for developers, utilities, and industrial operators. As governments prioritize clean energy and grid modernization, policy-driven incentives are accelerating the market’s growth and encouraging large-scale deployment of containerized BESS solutions.

Rising Renewable Energy Integration: The global shift toward renewable energy is creating strong demand for containerized battery energy storage systems. Solar and wind power generation can be unpredictable, leading to fluctuations in electricity supply. In May 2025, the U.S. Department of the Interior approved over 15 gigawatts of clean energy capacity from offshore wind projects, which represents approximately 50% of the 30-gigawatt target set for 2030. Containerized BESS provides an effective way to store excess renewable energy during periods of high generation and release it when demand is high or supply is low. This capability helps maintain grid stability, ensures a consistent power supply, and increases the overall efficiency of renewable energy use. As renewable energy capacity expands worldwide, containerized storage solutions are becoming essential for balancing supply and demand while improving system reliability.

Segmental Insights

Battery Type Analysis

Based on battery type, the containerized BESS market segmentation includes lithium-ion battery, lead-acid battery, and others. The lithium-ion battery segment dominated the market in 2024, driven by its high energy density, long cycle life, and low maintenance requirements, making it a preferred choice for both grid-scale and commercial energy storage applications. Continuous advancements in lithium-ion technology have reduced costs and enhanced performance, while its modular design suits containerized solutions for rapid deployment. Strong demand from renewable energy projects and peak-shaving applications further fueled its growth. Additionally, the compatibility of lithium-ion systems with advanced energy management software enables better optimization of stored power, giving them a competitive edge over alternative battery chemistries in containerized BESS deployments.

The lead acid battery segment is expected to register a significant CAGR from 2025 to 2034, supported by its cost-effectiveness, proven technology, and robust performance in stationary energy storage applications. These batteries are well-suited for shorter-duration backup needs and projects where budget constraints are critical. Their ability to operate in varied temperature ranges and offer stable performance in low-cycle applications makes them appealing for off-grid and rural energy storage systems. Ongoing innovations, such as advanced lead-carbon technology, are improving cycle life and energy efficiency, expanding their applicability in hybrid renewable systems. This balance of affordability and reliability is anticipated to maintain their demand in specific niche applications.

Capacity Analysis

In terms of capacity, the segmentation includes below 1 MWH, between 1 to 5 MWH, and above 5 MWH. Between 1 to 5 MWH capacity segment held the largest revenue share in 2024 due to its suitability for medium-scale commercial, industrial, and utility projects that require reliable backup and grid-balancing capabilities. These systems provide a balanced trade-off between storage duration and project cost, making them ideal for integrating with renewable energy plants, peak shaving, and microgrid applications. Their scalability and modular design allow for flexible deployment in both urban and remote settings. The growing demand from community energy projects and distributed energy networks has further contributed to the dominance of this capacity range in containerized BESS adoption.

The above 5 MWH capacity segment is expected to register a significant CAGR during 2025–2034, fueled by rising investments in large-scale renewable integration and utility grid stabilization projects. This capacity range is critical for handling substantial energy shifts during peak and off-peak periods, especially in regions with high renewable penetration. Increasing demand from energy-intensive industries and regional grid operators for long-duration storage is accelerating adoption. The ability to support frequency regulation, capacity reserve, and emergency backup in large energy networks positions this segment for strong future growth. Advances in high-capacity battery modules and container optimization are making these systems more cost-efficient and operationally reliable.

Container Size Analysis

In terms of container size, the containerized BESS market includes 10 Feet, 20 Feet, and 40 Feet. The 20 Feet segment held the largest revenue share in 2024, driven by its balance between storage capacity and ease of transportation, making it ideal for medium-scale commercial and industrial projects. This size offers enough space to house advanced battery systems while remaining compact enough for rapid deployment and relocation. It is particularly popular in projects that require flexibility in installation sites, such as remote renewable energy farms or temporary power stations. The standardized size allows for seamless integration with existing logistics infrastructure, reducing installation timelines and project costs while maintaining high operational efficiency.

The 40 Feet segment is expected to grow significantly from 2025 to 2034, supported by the demand for large-scale storage solutions in utility and grid applications. These containers can accommodate higher capacity battery modules, making them suitable for multi-MWh projects that require extended backup power and energy shifting. Their ability to house complex control systems and cooling infrastructure within a single unit increases operational efficiency. As large renewable energy projects expand, containers of 40 Feet are becoming preferred for their economies of scale, reducing the per-kWh cost of storage while meeting higher energy demand with fewer units.

Application Analysis

In terms of application, the segmentation includes residential, commercial, industrial, utilities, and others. The commercial segment held the largest revenue share in 2024, driven by the growing need for peak shaving, demand charge management, and backup power in retail complexes, data centers, and office buildings. Businesses are increasingly adopting containerized BESS to reduce operational costs, enhance energy reliability, and meet sustainability targets. The compact and modular nature of containerized systems enables easy installation in commercial premises with space limitations. The growing trend of integrating solar PV with on-site storage in commercial facilities has further boosted adoption, as it allows energy cost optimization and improves resilience against grid disruptions.

The industrial segment is expected to register the highest CAGR from 2025 to 2034, supported by rising energy-intensive operations in sectors such as manufacturing, mining, and oil & gas. These facilities are adopting containerized BESS to stabilize power supply, manage peak demand, and integrate on-site renewable energy sources. The systems help mitigate production losses from outages and optimize energy costs by shifting consumption to off-peak hours. Industrial users are also leveraging BESS for grid services, such as frequency regulation, creating an additional revenue stream. Increasing automation and electrification in industrial processes are further driving the demand for high-capacity, containerized storage solutions.

Regional Analysis

The North America containerized battery energy storage system market is expected to register the highest CAGR from 2025 to 2034, due to strong investments in grid modernization projects and the rapid expansion of renewable energy infrastructure. Utilities and private developers are increasingly deploying containerized BESS to enhance grid flexibility and improve resilience against outages caused by extreme weather events. Supportive regulatory frameworks, coupled with incentives for energy storage projects, are encouraging the faster adoption. The region’s growing focus on decarbonization and the electrification of transportation is further increasing the demand for scalable and modular energy storage solutions that can be deployed across diverse environments.

U.S. Containerized Battery Energy Storage System Market Insights

The U.S. market is growing due to the increasing deployment of large-scale energy storage projects aimed at stabilizing grids with high levels of renewable energy penetration. Federal and state-level programs are offering attractive tax incentives and funding opportunities for storage projects, making containerized BESS more financially viable. Rising electricity demand from data centers, manufacturing, and EV charging infrastructure is creating opportunities for localized storage solutions to prevent grid congestion. The U.S. energy sector is also witnessing a shift toward modular and transportable systems, enabling flexible installation in both urban and remote locations, which is accelerating market expansion across different applications and industries.

Asia Pacific Containerized Battery Energy Storage System Market Trends

Asia Pacific dominated the market in 2024, due to large-scale renewable energy projects and aggressive national targets for clean energy adoption. Governments in the region are prioritizing investments in storage systems to mitigate grid instability caused by fluctuations in solar and wind power generation. Rapid industrialization and urbanization are increasing electricity consumption, pushing utilities to adopt containerized BESS for peak load management and backup power. The presence of major battery manufacturers and cost advantages in production are also driving adoption. The combination of technological innovation and supportive policies has positioned Asia Pacific as a leader in global energy storage deployment.

China Containerized Battery Energy Storage System Market Overview

China led the Asia Pacific market in 2024, due to extensive renewable energy capacity installations and significant investment in energy storage technologies. China's installed renewable energy capacity reached 2.02 billion kilowatts by the end of April 2025, a 58% increase year on year. The combined capacity of wind and solar power hit 1.53 billion kilowatts. The government’s long-term energy transition plan includes ambitious storage deployment targets to support its massive solar and wind farms. Large state-owned enterprises are developing utility-scale containerized BESS projects to improve energy dispatch efficiency and reduce curtailment rates. Cost competitiveness in battery manufacturing gives China a pricing advantage in both domestic and export markets. Advancements in lithium-ion battery technology and strong local supply chains are enabling faster and more cost-effective rollouts of containerized energy storage systems nationwide.

Europe Containerized Battery Energy Storage System Market Outlook

Europe is increasing its adoption of containerized battery energy storage systems due to the rapid expansion of renewable energy capacity and the need for advanced grid balancing solutions. Rising electricity demand from electrified transportation and industrial decarbonization initiatives is creating opportunities for high-capacity, modular storage deployments. EU-wide carbon neutrality goals and funding programs are driving public and private investments in storage infrastructure. The ability of containerized BESS to provide frequency regulation, peak shaving, and energy arbitrage is attracting utilities and independent power producers. Additionally, advancements in energy management software are enhancing operational efficiency, further boosting adoption across European countries.

Key Players & Competitive Analysis

The competitive landscape of the containerized battery energy storage system market is shaped by continuous industry analysis and evolving market expansion strategies aimed at capturing emerging opportunities in renewable integration and grid modernization. Companies are focusing on technology advancements to enhance system efficiency, safety, and scalability, enabling broader adoption across commercial, industrial, and utility sectors. Strategic alliances and joint ventures play a key role in expanding global reach and optimizing supply chains, while mergers and acquisitions strengthen market positioning and product portfolios.

Effective post-merger integration ensures seamless operational alignment and accelerates innovation cycles, providing players with a competitive edge in meeting the growing demand for flexible, high-capacity energy storage solutions. The competitive environment is increasingly defined by the ability to combine advanced engineering capabilities with agile business models, ensuring adaptability in a rapidly transforming energy landscape driven by decarbonization goals and the rising importance of distributed energy resources.

Key Players

- ABB

- Alpha ESS Co., Ltd.

- Atlas Copco Group

- BYD

- CATL

- Cummins, Inc.

- Delta Electronics, Inc.

- Eaton

- Fleunce

- GE Vernova

- Honeywell International, Inc.

- Microgreen Solar Corporation

- NGK Insulators, Ltd.

- Sungrow

- Tesla

Containerized Battery Energy Storage System Industry Developments

May 2025: CATL introduced the TENER Stack, the world’s first 9 MWh ultra-large energy storage system, at EES Europe 2025. This system offers high-density, transportable storage for utilities and industries, with optimized space utilization and efficiency for AI data centers and electrification.

April 2025: Honeywell launched a 1.4 MWh battery energy storage system (BESS) microgrid for SECI’s project in Lakshadweep.

June 2024: NGK Insulators secured a contract to supply containerized NAS batteries for a grid-scale storage project at MVM Balance’s power station in Hungary, aimed at enhancing grid stability by storing excess energy and providing balancing capacity.

Containerized Battery Energy Storage System Market Segmentation

By Battery Type Outlook (Revenue, USD Billion, 2020–2034)

- Lithium-Ion Battery

- Lead-Acid Battery

- Others

By Capacity Outlook (Revenue, USD Billion, 2020–2034)

- Below 1 MWH

- Between 1 to 5 MWH

- Above 5 MWH

By Container Size Outlook (Revenue, USD Billion, 2020–2034)

- 10 Feet

- 20 Feet

- 40 Feet

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

- Utilities

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Containerized Battery Energy Storage System Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.31 billion |

|

Market Size in 2025 |

USD 11.22 billion |

|

Revenue Forecast by 2034 |

USD 61.03 billion |

|

CAGR |

20.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.31 billion in 2024 and is projected to grow to USD 61.03 billion by 2034.

The global market is projected to register a CAGR of 20.7% during the forecast period.

Asia Pacific dominated the market in 2024 due to large-scale renewable energy projects and aggressive national targets for clean energy adoption.

A few of the key players in the market are ABB; Alpha ESS Co., Ltd.; Atlas Copco Group; BYD; CATL; Cummins, Inc.; Delta Electronics, Inc.; Eaton; Fleunce; GE Vernova; Honeywell International, Inc.; Microgreen Solar Corporation; NGK Insulators, Ltd.; Sungrow; and Tesla.

The lithium ion battery segment dominated the market in 2024, driven by its high energy density, long cycle life, and low maintenance requirements, making it a preferred choice for both grid-scale and commercial energy storage applications.

The between 1 to 5 MWH segment held the largest revenue share in 2024 due to its suitability for medium-scale commercial, industrial, and utility projects that require reliable backup and grid-balancing capabilities.

The global market size was valued at USD 9.31 billion in 2024 and is projected to grow to USD 61.03 billion by 2034.

The global market is projected to register a CAGR of 20.7% during the forecast period.

Asia Pacific dominated the market in 2024 due to large-scale renewable energy projects and aggressive national targets for clean energy adoption.

A few of the key players in the market are ABB; Alpha ESS Co., Ltd.; Atlas Copco Group; BYD; CATL; Cummins, Inc.; Delta Electronics, Inc.; Eaton; Fleunce; GE Vernova; Honeywell International, Inc.; Microgreen Solar Corporation; NGK Insulators, Ltd.; Sungrow; and Tesla.

The lithium ion battery segment dominated the market in 2024, driven by its high energy density, long cycle life, and low maintenance requirements, making it a preferred choice for both grid-scale and commercial energy storage applications.

The between 1 to 5 MWH segment held the largest revenue share in 2024 due to its suitability for medium-scale commercial, industrial, and utility projects that require reliable backup and grid-balancing capabilities.