Cooling Fabrics Market Share, Size, Trends, Industry Analysis Report

By Type (Natural, Synthetic); By Textile Type; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4084

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

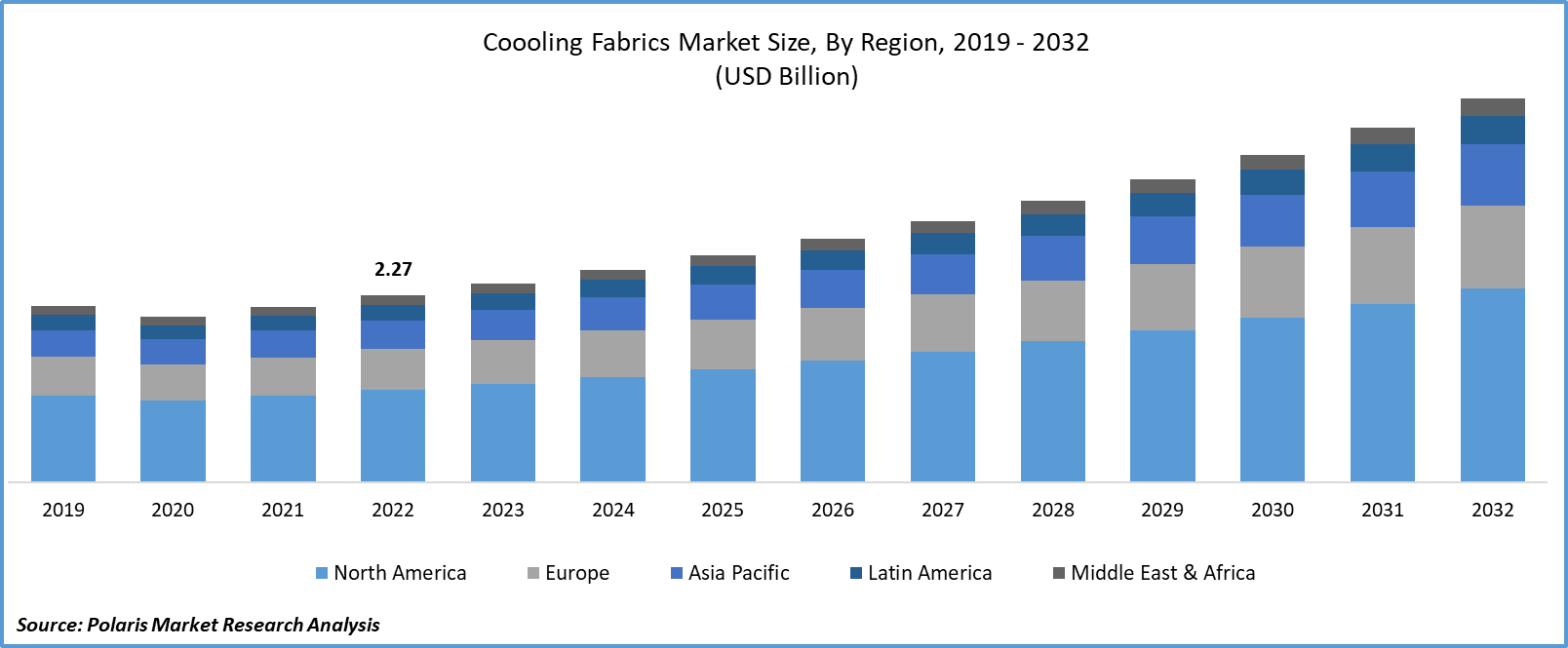

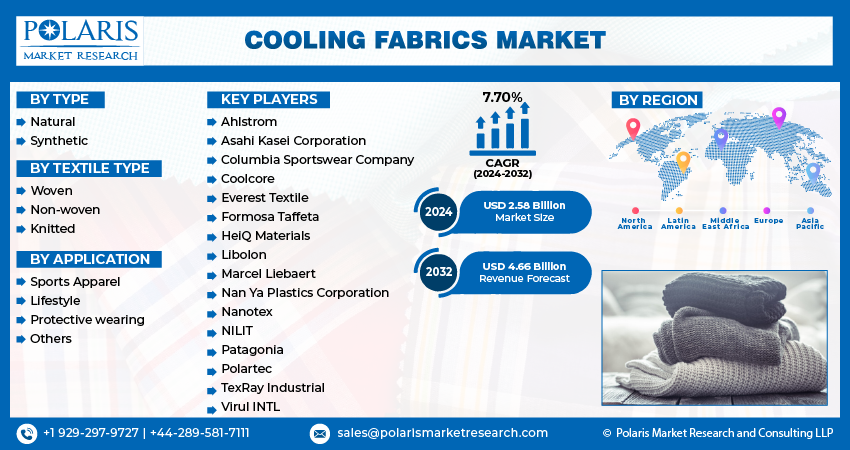

The global cooling fabrics market was valued at USD 2.42 billion in 2023 and is expected to grow at a CAGR of 7.70% during the forecast period.

The purpose of cooling fabrics is to keep you, well, cool. They do this by absorbing heat from the body. They are frequently used by both athletes and medical professionals, as well as people with heatstroke and other illnesses that put them in danger of hyperthermia. Additionally, they enhance blood flow to the skin's surface, allowing people to maintain their body temperature under stress. Cooling textiles function by removing moisture from their body as they perspire, which lowers the user's body core temperature and helps them stay hydrated. The rising product innovations in the marketplace are expanding product availability to consumers.

There is an escalating aggregate of commodities on the market that utilize fabrics with a cooling purpose. From cooing clothes to cooling covers, carpets, cushions, and even children's commodities, the demand for cooling commodities is escalating. In an environment that is not excessively sultry, these fabrics can void the sweat from the skin and permit clothes and skin to dehydrate swiftly. This potential to remain fresh also translates into a cooling effect.

The material that provides the best cooling traits is polyester. The moisture material within the polyester fiber is not excessive. The cooling fabrics market size is expanding due to its hydrophobic identity; polyester fibers can dehydrate swiftly, offering a refreshing influence. As the fabric does not soak up water, the clothes do not effortlessly adhere to the skin, thus generating a cooling impact. The moisture retrieval of polyester fiber is 0.4%, which indicates that sweat swiftly vaporizes without staying in a yarn or cloth, permitting the thermal energy to be debarred swiftly.

To Understand More About this Research: Request a Free Sample Report

- For instance, in September 2023, Taram Textiles launched a substantial home textiles collection that promotes the idea of "sleep as a sport" with a licensing agreement with Reebok covering Canadian and American markets. It includes the offering of sleep pillows with cooling down-alternative fill, cooling and supportive shredded foam fill, or cooling and supportive graphite memory foam.

Moreover, the rapid changes in climate brought about by the increase in greenhouse gas emissions are creating a need for cooling fabrics. Furthermore, cooling fabrics are used in the oil and gas industry due to the higher chance of exposure to heat, driving demand for workwear made up of cooling fabrics.

However, the huge cost associated with the manufacturing of cooling fabrics is hampering small-scale companies from entering this field, leading to fewer players specializing in cooling fabrics and driving higher prices due to the lower supply in the marketplace. This is restraining the growth of the cooling fabric market, as people may prefer its substitutes, like air conditioning.

Growth Drivers

- The companies that specialize in offering cooling apparel are witnessing rapid growth.

Cooling fabrics are highly used in the summer season. According to research, heat waves will probably happen more frequently in the future. This is driving the success of businesses like Techniche. Currently, the brand offers hats, neckbands, vests, and other clothing items with built-in cooling technology to businesses and private clients in close to 30 countries. Compared to £150,000 in 2014, when Techniche introduced cooling baseball caps as its first commercial product, it reported revenue of nearly EUR 7 million (USD 8.8 million) in 2020. This further boosts the company's ability to expand its product portfolio and product offering towards cooling fabrics, driven by the existence of a rapid surge in demand for fashionable wear in the summer.

Report Segmentation

The market is primarily segmented based on type, textile type, application and region.

|

By Type |

By Textile Type |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- Natural segment is expected to witness the highest growth during the forecast period

The natural segment is projected to grow at a CAGR during the projected period, mainly driven by rising demand for environmentally friendly products. Natural materials provide optimum breathability and airflow. The ideal materials for a cooler night's sleep are cotton, linen, bamboo, and eucalyptus. In natural cooling fabrics, bamboo linen is highly preferred due to its structure and thread count; it naturally cools the body by 3°C more than cotton. The rising consumer interest in greener products will further boost the growth of the cooling fabric market in the coming years.

The synthetic segment led the industry market with a substantial revenue share in 2022, largely attributable to the presence of its applications in the textile industry, primarily polyester, as it does not contain a significant amount of moisture. These fibers can dry fast, producing a refreshing feeling due to their hydrophobic nature. A cooling sensation is produced by the clothing's inability to easily attach to the skin because the fabric doesn't absorb water. Polyester fiber has a moisture regain of only 0.4%, meaning that perspiration quickly evaporates and doesn't get caught in the yarn or fabric, releasing thermal energy more quickly. The wide usage of polyester is propelling the growth of the cooling fabrics market.

By Textile Type Analysis

- Knitted segment accounted for the largest market share in 2022

The knitted segment accounted for the largest market share. The flexibility and stretchability of knitted fabrics are driving their use in sportswear. Growing studies on finding applications for knitted fabrics are creating awareness among a wider audience. A 2013 study focused on the effect of knitted materials' composition on how well they cool under simulated sweating. It has been discovered that knitted fabrics with polyester filaments have the maximum amount of cooling because they transport liquid moisture down the fabric's plane through its grooved surface. The ability of knitted fabrics to ensure coolness will fuel their adoption as cooling fabrics.

By Application Analysis

- Sports Apparel segment held the significant market revenue share in 2022

The sports apparel segment held a significant market share in revenue in 2022, which is highly accelerated due to the rising demand for flexible sportswear by athletes. Due to the rise in leisure time, interest in health-related activities, rise in female participation in sports, accessibility and availability of sports like skiing, golf, and sailing, as well as the expansion of sports facilities, there is a steadily growing demand for sports. This may facilitate the need for cooling fabrics due to their effectiveness in enforcing coolness in the human body.

Regional Insights

- Asia Pacific region dominated the global market in 2022

The Asia Pacific region registered the largest share of the global market in 2022 and is expected to maintain its dominance over the anticipated period. The growing population in countries in this region, primarily India, Japan, & China, is driving the demand for cooling fabrics, driven by the prevalence of humid temperatures in the region. Japanese businesses are taking advantage of a rising market for products to help people survive the summer heat.

As in other nations, summers in Japan are getting hotter and hotter. This July was the warmest in a century, with roughly 50,000 people requiring emergency care and at least 53 individuals passing away from heatstroke. To capture this market, companies are launching new products into the marketplace. For instance, the high-street version of Workman's fan-fitted jackets was introduced in 2020 as demand for clothing for construction workers increased. As the demand for cooling fabrics is increasing in the region, there will be potential for market expansion in the coming years.

The Europe region is expected to have the fastest pace, owing to the growing trend of fashionable wear. This region is witnessing the hottest summer due to the existence of climate change driven by growing climate pollution and greenhouse gas emissions. In September 2023, Austria, France, Poland, and Switzerland registered higher temperatures than ever. This was the warmest in human history as climate change accelerates, fueling demand for cooling fabrics in the coming years as they enable individuals to stay cool in the hottest weather conditions.

Key Market Players & Competitive Insights

The cooling fabrics market is projected to witness rapid expansion driven by growing product innovations, partnerships, collaborations, mergers, and acquisitions by key market players to gain a competitive advantage and capture a wider consumer base. Companies’ initiatives are fueling product availability to end consumers and increasing awareness about the product in the marketplace.

Some of the major players operating in the global market include:

- Ahlstrom

- Asahi Kasei Corporation

- Columbia Sportswear Company

- Coolcore

- Everest Textile

- Formosa Taffeta

- HeiQ Materials

- Libolon

- Marcel Liebaert

- Nan Ya Plastics Corporation

- Nanotex

- NILIT

- Patagonia

- Polartec

- TexRay Industrial

- Virul INTL

Recent Developments

- In August 2022, Brrr, a pioneer in cooling yarn technology, teamed up with Strafe Outerwear to launch a new line of technical clothing for men and women that is made up of brrr cooling performance fabric.

Cooling Fabrics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.58 billion |

|

Revenue forecast in 2032 |

USD 4.66 billion |

|

CAGR |

7.70% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Textile Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |