Copper Clad Laminates Market Share, Size, Trends, Industry Analysis Report

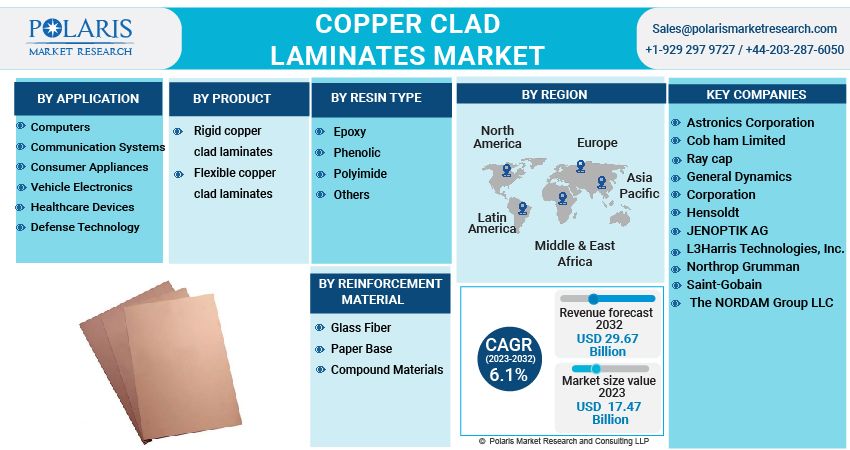

By Application (Computers, Communication Systems, Consumer Appliances, Vehicle Electronics, Healthcare Devices, Defense Technology); By Product; By Resin Type; By Reinforcement Material; By Region; Segment Forecast, 2023 - 2032

- Published Date:Apr-2023

- Pages: 115

- Format: PDF

- Report ID: PM3189

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

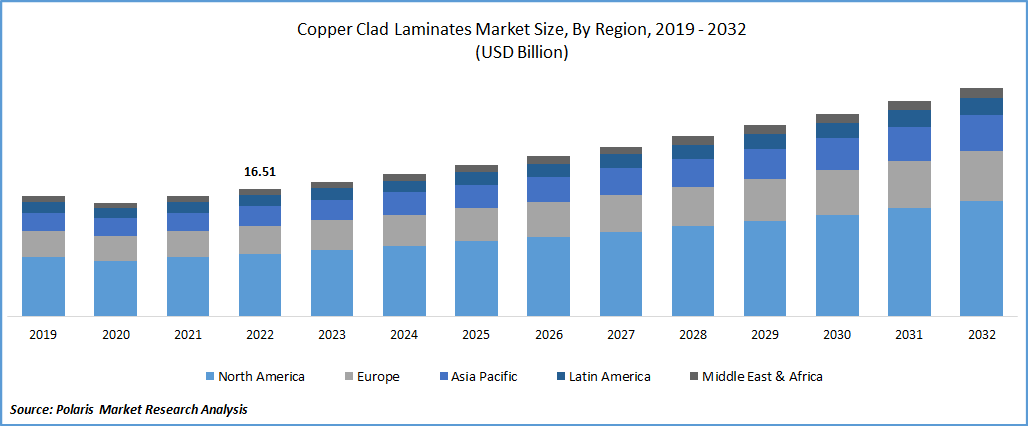

The global copper clad laminates market was valued at USD 16.51 billion in 2022 and is expected to grow at a CAGR of 6.1% during the forecast period. The growth in infrastructure development projects such as smart cities and smart homes drives the demand for CCL as they are used in building automation systems. Additionally, government initiatives to promote the use of renewable energy sources, such as solar and wind energy, are driving the demand for CCL as they are used in manufacturing solar panels and wind turbines.

Know more about this report: Request for sample pages

The market for copper-clad laminates needs to be more cohesive. Many companies are investing in the market due to its growth potential. For instance, in January 2022, DuPont announced the completion of its 250 million USD expansion project for the production of Kapton polyimide film and Pyralux flexible circuit materials. CCL has a cost advantage over other substrate materials, making it more popular. Additionally, the growing adoption of electronic systems in the automotive industry, such as advanced driver assistance systems (ADAS) and electric vehicles (EVs), is driving the demand for CCL as they are used in the manufacturing of electronic control units (ECUs) and battery management systems (BMS).

Excellent insulation, conductivity, signal transmission, and support transfer are all features of copper-clad lamination, which makes it a crucial raw material for PCB construction. Therefore, the market for goods will benefit from PCB boards' ongoing development and the rising need for them in terminal electronic devices throughout the anticipated period. The demand for the product will be positively influenced by the large growth of several end-use sectors and the quick expansion of downstream electronics information industries such as optical information storage systems and vacuum fluorescent displays.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The key drivers that will propel the worldwide copper-clad laminates market in the next years are the advancement of printed circuit boards (PCB) fabrication, electronic assembly, semiconductor fabrication, and electronic machine goods. The market for automotive PCBs has grown quickly thanks to the trend of vehicle electronics. This, in turn, is positively affecting the copper clad laminates market. By enhancing signal transmission, preventing delamination, managing heat, reducing weight, controlling moisture, and improving overall cost-effectiveness, copper-clad laminates are employed in the infrastructure of 5G, which is predicted to boost demand for the product. But it's anticipated that the infrastructure would need to undergo considerable adjustments as the conventional telecom paradigm evolves.

Report Segmentation

The market is segmented based on application, product, resin type, reinforcement material, and region.

|

By Application |

By Product |

By Resin Type |

By Reinforcement Material |

By Region |

|

|

|

|

|

Know more about this report:Speak to Analyst

Vehicle Electronics Segment is Expected to Grow at the Fastest CAGR During the Forecast Period

The vehicle electronics segment is expected to grow fastest during the forecast period. Many electrical parts of cars, including touchscreens, airbag controllers, anti-theft systems, audio systems, ignition timing systems, and more, employ copper-clad laminates. The demand for sophisticated automotive and transportation safety and driver assistance systems, such as emergency braking and collision avoidance, blind spot identification, lane departure warning, and others, is expected to increase throughout the forecast period.

For instance, in December 2022, according to the Taiwan Printed Circuit Association, the third quarter of 2022 saw the highest-ever output for Taiwan-based PCB manufacturers, which totaled 8.2 billion USD. The main source of this demand came from high-end smartphones, servers, and automotive components.

In 2022, the communication systems segment held the highest market share globally. Printing circuit boards (PCBs) for electronic devices frequently employ copper-clad laminates in their making. They are utilized in communication systems like radios and cellular networks due to their superior electrical conductivity and robustness. A rise in demand for communication system applications is mostly due to the expansion of the computer, laptop, and drone industries.

Epoxy Resin Dominated the Global Market in 2022

The epoxy resin segment registered the largest market share in 2022. This is due to its strong electrical, mechanical, and bonding qualities. It also offers chemical resistance, which raises the need for its use in producing copper-clad laminates. Reduced cost of manufacturing process will promote market growth during the forecast period.

The Phenolic resin segment is expected to grow at a substantial CAGR during the forecast period owing to its high demand across developing nations. For instance, in May 2022, UBE Corporation shared its 1st stage management plan for its UBE Vision 2030 transformation. In that, the company intends to focus on a new business in semiconductor encapsulating material, for which it brought in-house a phenolic resin business that was a separate subsidiary. Phenolic resin is popular for PCB production since it is reasonably priced and simple.

Fiber Glass Segment Dominated the Market share in 2022

The fiberglass segment held the highest market share in 2022 and is expected to maintain its dominant position during the forecast period. The advantages of using fiberglass sheets include their great electrical qualities, strong moisture resistance, good heat resistance, high strength, and other advantages. Due to these advantages, they are frequently employed to create a variety of electrical goods that offer excellent energy-saving advantages.

The paper segment also held a substantial market share in 2022. This CCL is excellent for Printed Wiring Boards (PWB) in consumer electronics like TVs and AV equipment since it is lead-free. Additionally, phenol-formaldehyde-soaked paper CCLs are frequently employed. They are used in insulating electrical equipment and transformers because of their mechanical heat resistance and dielectric characteristics.

Flexible Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Flexible CCL is anticipated to grow at the fastest CAGR during the forecast period. These thin, flexible, and low-weight flexible copper-clad laminates are suitable for many electronic applications, including mobile phones, digital cameras, vehicle GPS, and laptops. For instance, in December 2022, Doosan Corporation started the construction of a flexible copper-clad laminates production plant in Gimje. This expansion is a measure to meet the ever-changing demand in the market.

The rigid CCL segment accounted for the largest market share in 2022 in the global market. Rigid CCLs come in various forms, such as metal substrates, build-up multilayer substrates, thermoplastic substrates, ceramic substrates, substrates with embedded capacitors, etc., making them suitable for a wide range of applications, including those in computers, communication systems, and household appliances. Electronic devices, automobiles, and consumables all employ rigid copper-clad items. Reinforcement materials like robust copper-clad products add stiffness and significant fracture prevention.

Asia Pacific region is expected to grow at a high CAGR in 2022

Asia Pacific region accounted for the highest CAGR in the global market in 2022. The region is also expected to grow at the fastest CAGR during the forecast period. This is because it is a firmly established center for several applications, including communication systems, automotive electronics, healthcare technology, and the defense and aerospace industries. Due to the region's strong economic growth rate, cheap labor and transportation costs, ample supply of raw materials at low prices, competitive production costs, and PCB industry, which in turn drives the market for copper-clad laminates. Additionally, the region's expanding demand for 5G communications and e-vehicles will continue to propel the product market for various applications throughout the projection period.

North America is also expected to grow at a substantial CAGR over the forecast period. The increasing demand for electronic devices such as smartphones, laptops, and tablets is driving the growth of the CCL market in North America. Additionally, the growing adoption of 5G and IoT technology drives the demand for CCLs, which are used in producing PCBs for these technologies.

Competitive Insight

Some of the major players operating in the global copper clad laminates market include Shandong Jinbao Electronics, Taiwan Union, Kingboard Laminates, Guangdong Chaohua Technology, Doosan Corp., Grace Electron, NAN YA Plastics, Shengyi Technology, Isola Group, ITEQ Corporation, and Cipel Italia

Recent Developments

- In January 2023, the purchase of Nexflex, a Korean business that manufactures flexible copper-clad laminate (FCCL) for cellphones, is being promoted by MBK Partners. MBK Partners have signed a MoU and are conducting due diligence on Nexplex, after which the stock transfer agreement will be signed.

- In August 2022, Taiflex Scientific, a manufacturer of flexible CCL (copper-clad laminate), announced that it had bought a manufacturing site in eastern Thailand and would invest USD 35 million to build a flexible CCL facility there in the first phase, with production expected to start in the first half of 2024.

Copper clad Laminates Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 17.47 billion |

|

Revenue forecast in 2032 |

USD 29.67 billion |

|

CAGR |

6.1% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Technology Type, By Frequency Range, By Radome type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Shandong Jinbao Electronics, Taiwan Union, Kingboard Laminates, Guangdong Chaohua Technology, Doosan Corp., Grace Electron, NAN YA Plastics, Shengyi Technology, Isola Group, ITEQ Corporation, and Cipel Italia |

FAQ's

The copper clad laminates market report covering key segments are application, product, resin type, reinforcement material and region.

Copper clad Laminates Market Size Worth $29.67 billion By 2032.

The global copper clad laminates market expected to grow at a CAGR of 6.1% during the forecast period.

Asia Pacific is leading the global market.

Key driving factors in copper clad laminates market are government initiatives to promote the use of renewable energy sources.