Copper Flat Rolled Products Market Size, Share, Trends, & Industry Analysis Report

By Product (Strips, Sheets, Plates, Foils, and Others), By Application, By Thickness, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5761

- Base Year: 2024

- Historical Data: 2020-2023

Overview

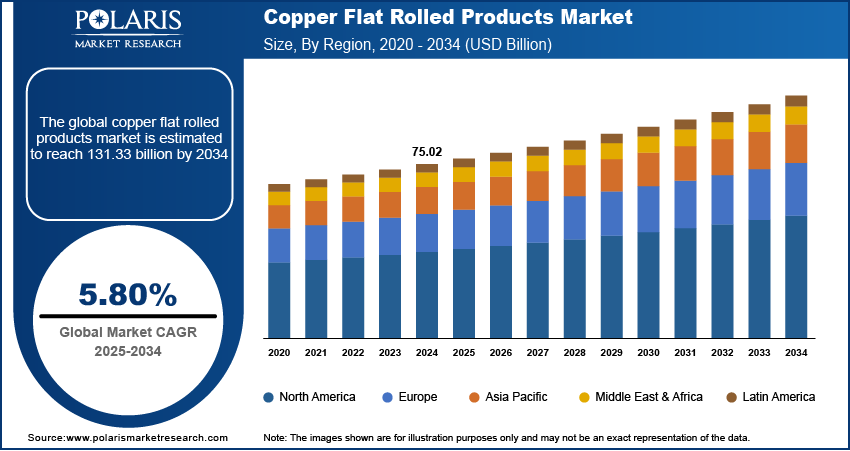

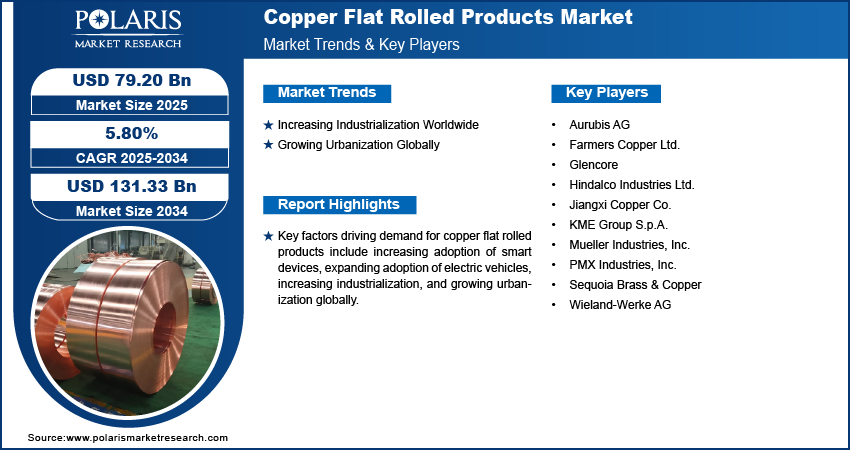

The global copper flat rolled products market size was valued at USD 75.02 billion in 2024, growing at a CAGR of 5.80 % during 2025–2034. Key factors driving demand for copper flat rolled products include increasing adoption of smart devices, expanding adoption of electric vehicles, increasing industrialization, and growing urbanization globally.

Copper flat rolled products refer to copper materials that manufacturers process into flat shapes such as plates, sheets, and strips by rolling copper ingots or billets through a series of rollers to achieve the desired thickness and surface finish. These products are available in several primary forms such as plates, sheets, and strips, or coils. They are known for their electrical and thermal conductivity, which makes them crucial in the electrical and electronics industries for applications such as printed circuit boards, connectors, busbars, and transformer windings.

The increasing adoption of smart devices such as smartphones is driving the market growth. Smartphones and other smart devices rely heavily on copper for their internal circuitry, wiring, and connectors due to its excellent electrical conductivity, thermal efficiency, and corrosion resistance. Copper flat rolled products, including thin sheets, strips, and foils, are particularly vital in producing printed circuit boards (PCBs), battery components, and electromagnetic shielding used in smartphones and other smart devices. According to the Groupe Spéciale Mobile Association (GSMA’s) annual State of Mobile Internet Connectivity Report 2023, over half, or 54% of the global population, owns a smartphone, including 5G smartphone. Therefore, as the adoption of smart devices such as smartphones increases, the demand for copper flat rolled products also rises.

To Understand More About this Research: Request a Free Sample Report

The demand for copper flat rolled products is driven by the expanding adoption of electric vehicles globally. EVs rely heavily on copper for electrical components, including batteries, motors, wiring, and charging systems. Copper flat rolled products, such as sheets, strips, and foils, are essential in producing high-performance battery electrodes, busbars, and power distribution systems, which ensure efficient energy transfer and thermal management in EVs. As per data published by the International Energy Agency, almost 14 million new electric cars were registered globally in 2023. Such expansion of EV adoption leads to the construction of EV charging infrastructure, which increases the demand for copper products, as charging stations require substantial copper wiring and connectors to handle high-power transmission. Hence, the expanding adoption of electric vehicles globally is fueling the market growth.

Industry Dynamics

Increasing Industrialization Worldwide

Industrialization leads to the construction of factories, power plants, and transportation networks. These developments require extensive use of electrical wiring, heat exchangers, and tubing systems, applications where copper flat rolled products, such as copper sheets, strips, and plates, are required due to their high conductivity, corrosion resistance, and thermal efficiency. Moreover, industrialization drives infrastructure upgrades, especially in developing economies where the demand for modern power distribution systems and telecommunication is rising. Copper flat rolled products are integral to these sectors due to their reliability and efficiency in energy transfer and data transmission. Thus, as industrialization expands globally, the demand for copper rolled products increases.

Growing Urbanization Globally

Urbanization increases the need for urban housing, utilities, and public amenities. These needs require massive quantities of electrical wiring, plumbing systems, and HVAC components, all of which rely heavily on copper flat rolled products due to copper’s excellent conductivity, durability, and resistance to corrosion. Urbanization also leads to the development of smart buildings and smart cities, which are equipped with advanced electrical and communication networks. These electrical and communication networks depend on reliable and efficient copper-based materials for power distribution, signal transmission, and energy management. The World Bank, in its report, stated that the urban population is expected to more than double by 2050. Therefore, the growing urbanization globally is fueling the market expansion.

Segmental Insights

By Product Analysis

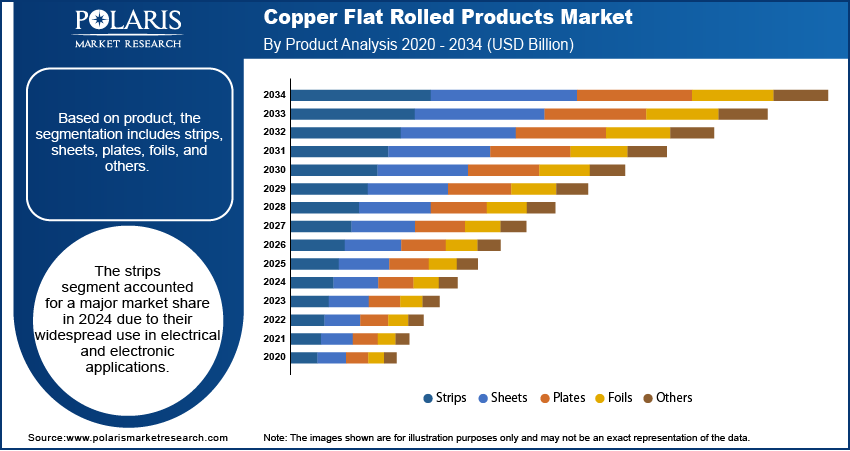

Based on product, the segmentation includes strips, sheets, plates, foils, and others. The strips segment accounted for a major market share in 2024 due to their widespread use in electrical and electronic applications. Many industries, such as automotive, telecommunications, and consumer electronics, heavily rely on copper strips for their excellent conductivity, flexibility, and corrosion resistance. The rapid expansion of renewable energy infrastructure, particularly in solar panels and wind turbines, further drove demand, as strips played a critical role in electrical connections and components. Additionally, the push for energy-efficient technologies and miniaturization in electronics contributed to the segment's dominance, with manufacturers prioritizing high-precision strips for advanced circuitry and battery applications.

The foils segment is projected to grow at a robust pace in the coming years, owing to the rising demand from the electric vehicle (EV) and energy storage sectors. Copper foils serve as essential components in lithium-ion batteries, which power EVs and grid-scale storage systems. Innovations in ultra-thin foils for flexible printed circuit boards (PCBs) and 5G technology is projected to contribute to segment growth, as these applications require lightweight, high-performance materials. Furthermore, government incentives for green energy projects and increasing investments in EV production is estimated to fuel the demand for foils.

By Application Analysis

In terms of application, the segmentation includes electrical & electronics, automotive, construction & architecture, industrial machinery, consumer goods, and others. The electrical & electronics segment dominated the market share in 2024, due to the essential role of copper materials in power transmission, circuitry, and electronic devices. The rapid growth of renewable energy systems, particularly solar and wind power, has increased demand for efficient conductive components such as copper strips in transformers, busbars, and wiring. Additionally, the expansion of 5G infrastructure and the adoption of smart devices necessitated precise, high-performance copper materials for printed circuit boards (PCBs) and connectors. The automotive sector’s shift toward electrification further supported the growth of the segment, as electric vehicles (EVs) required extensive copper usage in batteries, motors, and charging systems.

By Thickness Analysis

Based on thickness, the segmentation includes below 0.1 mm, 0.1 mm–1 mm, 1 mm–6 mm, and above 6 mm. The 0.1 mm–1mm segment held the largest share in 2024 due to its versatility across multiple industries such as electronics, automotive, and others. Copper flat rolled products with the thickness of 0.1 mm–1mm are ideal for electrical applications, including transformers, busbars, and wiring, where the products balance conductivity with structural durability. The electronics industry heavily relied on this thickness for printed circuit boards (PCBs) and connectors. Additionally, the automotive sector uses 0.1 mm–1mm copper material in battery components and power electronics for electric vehicles (EVs), driving demand.

Regional Analysis

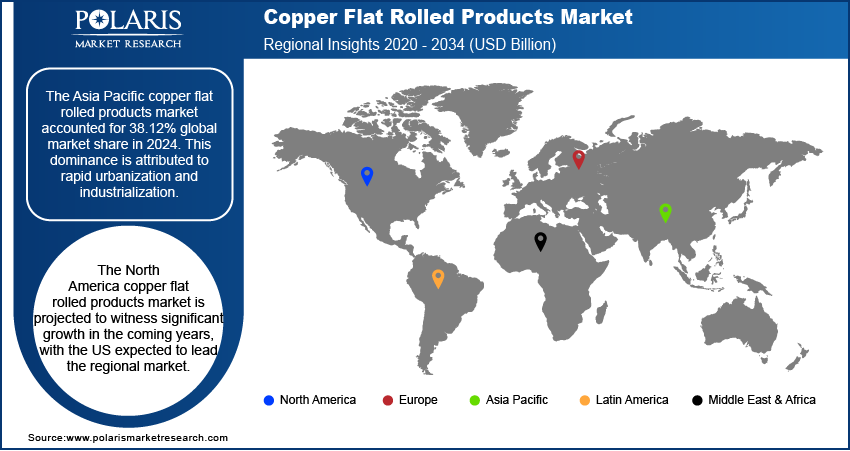

The Asia Pacific copper flat rolled products market accounted for 38.12% global market share in 2024. This dominance is attributed to rapid urbanization and industrialization. The growing adoption of EVs and rising investments in renewable energy in the region contributed to the increased copper usage. India’s power grid expansions and Make in India initiative further boosted demand for copper flat rolled products such as strips, sheets, foils, and others. Japan and South Korea’s expanding electronics and automotive industries also supported the regional dominance, as these industries rely on precision copper. According to AMRO, an international organization that provides macroeconomic surveillance of the ASEAN+3 region, automobiles and automotive parts accounted for approximately 15% of South Korea’s total exports as of August 2024.

China Copper Flat Rolled Products Market Insight

China dominated the Asia Pacific market in 2024 due to its extensive manufacturing ecosystem, strong government support, and aggressive push toward electrification and industrial automation. The country accounted for the majority of the region’s copper production, supplying copper sheets and foils to both domestic and international markets. Massive investments in renewable energy, electric vehicles, 5G infrastructure, and consumer electronics also drove demand for high-conductivity and thermally stable copper materials. Local producers expanded capacity to meet growing application needs in solar panels, lithium-ion batteries, and high-speed rail networks, further contributed to the country's dominance.

Europe Copper Flat Rolled Products Market

In Europe, demand for copper flat rolled products is fueled by strict environmental regulations promoting energy efficiency and electrification initiatives. The European Green Deal and REPowerEU plan is fueling investments in wind and solar energy, which require copper products such as strips, foils, and others for power distribution systems. The automotive sector transition to EVs is also increasing copper usage in batteries and motors. Additionally, the growing construction industry, particularly in the UK and France, to meet rising housing demand, is fueling copper flat rolled products adoption for sustainable building materials.

Germany Copper Flat Rolled Products Market Overview

The demand for copper flat rolled products in Germany is driven by its strong automotive and industrial machinery sectors. The rising transition toward electric vehicles (EVs) and expanding renewable energy infrastructure in the country is propelling the adoption of copper sheets, strips, foils, and others. Germany’s Industry 4.0 advancements are also boosting demand for copper in automation and smart manufacturing. Moreover, the expanding construction sector in the country is fueling the demand for copper flat rolled products as the construction sector utilizes copper products for roofing and electrical systems in energy-efficient buildings.

North America Copper Flat Rolled Products Market

North America is projected to witness significant growth in the coming years, with the US expected to lead the regional market during the forecast period. The US government’s investments in renewable energy projects, electric vehicle charging networks, and grid modernization programs is boosting copper flat rolled products consumption. Domestic electronics manufacturers and automotive OEMs are also expanding their operations to reduce reliance on imports, which is projected to boost the US copper flat rolled products market growth in the coming years. The US Inflation Reduction Act (IRA) and other green energy policies are also fueling demand for copper flat rolled products in the US by supporting EV battery production.

Key Players and Competitive Analysis Report

The global copper flat rolled products (FRP) market features high competition among key players such as Aurubis AG, Glencore, Hindalco Industries Ltd., Jiangxi Copper Co., KME Group, and Wieland-Werke AG, who are leveraging product portfolio expansion, strategic partnerships, and mergers & acquisitions (M&A) to strengthen their market positions. These companies are continuously investing in high-precision copper strips, ultra-thin foils, and specialized alloy sheets to cater to growing demand from industries like electrical & electronics, automotive, and renewable energy. Strategic partnerships are another critical growth strategy, enabling firms to enhance technological capabilities and expand geographic reach. These partnerships also allow companies to align production with evolving industry demands while securing long-term customer contracts.

Aurubis AG; Farmers Copper Ltd.; Glencore; Hindalco Industries Ltd.; Jiangxi Copper Co.; KME Group S.p.A.; Mueller Industries, Inc.; PMX Industries, Inc.; Sequoia Brass & Copper; and Wieland-Werke AG are among the major companies operating in the copper flat rolled products market.

Key Players

- Aurubis AG

- Farmers Copper Ltd.

- Glencore

- Hindalco Industries Ltd.

- Jiangxi Copper Co.

- KME Group S.p.A.

- Mueller Industries, Inc.

- PMX Industries, Inc.

- Sequoia Brass & Copper

- Wieland-Werke AG

Industry Developments

January 2025: JSW Group announced an investment of Rs 2,600 crore or USD 300 million to develop and operate two copper mines, along with establishing a copper concentrator plant in Jharkhand.

March 2024: Adani Group announced the start of the first phase of the single-location copper manufacturing plant at Mundra in Gujarat, with an investment of $1.2 billion.

April 2024: Wieland acquired the flat-rolled products production facility in Buffalo, New York, from Aurubis AG. The aim of this acquisition was to supply copper strip and sheet across the US.

Copper Flat Rolled Products Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Strips

- Sheets

- Plates

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Electrical & Electronics

- Automotive

- Construction & Architecture

- Industrial Machinery

- Consumer Goods

- Others

By Thickness Outlook (Revenue, USD Billion, 2020–2034)

- Below 0.1 mm

- 0.1 mm–1 mm

- 1 mm–6 mm

- Above 6 mm

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Copper Flat Rolled Products Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 75.02 Billion |

|

Market Size in 2025 |

USD 79.20 Billion |

|

Revenue Forecast by 2034 |

USD 131.33 Billion |

|

CAGR |

5.80% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 75.02 billion in 2024 and is projected to grow to USD 131.33 billion by 2034.

The global market is projected to register a CAGR of 5.80% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Aurubis AG; Farmers Copper Ltd.; Glencore; Hindalco Industries Ltd.; Jiangxi Copper Co.; KME Group S.p.A.; Mueller Industries, Inc.; PMX Industries, Inc.; Sequoia Brass & Copper; and Wieland-Werke AG.

The strips segment dominated the market share in 2024. • Which segment, by thickness, dominated the copper flat rolled products market revenue share in 2024? • The 0.1 mm–1mm segment dominated the market share in 2024.