Crypto Wallet Market Share, Size, Trends, Industry Analysis Report

By Wallet Type (Hot, Cold); By Operating System; By Application; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 117

- Format: PDF

- Report ID: PM2784

- Base Year: 2024

- Historical Data: 2020-2023

What is the crypto wallet market size?

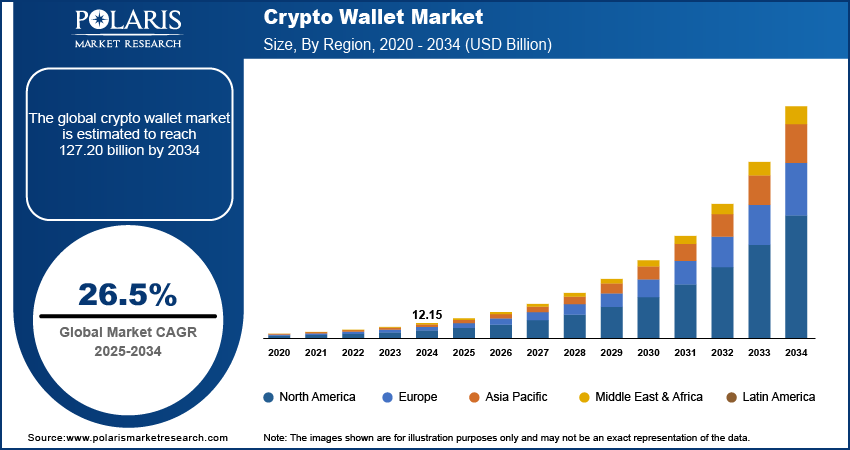

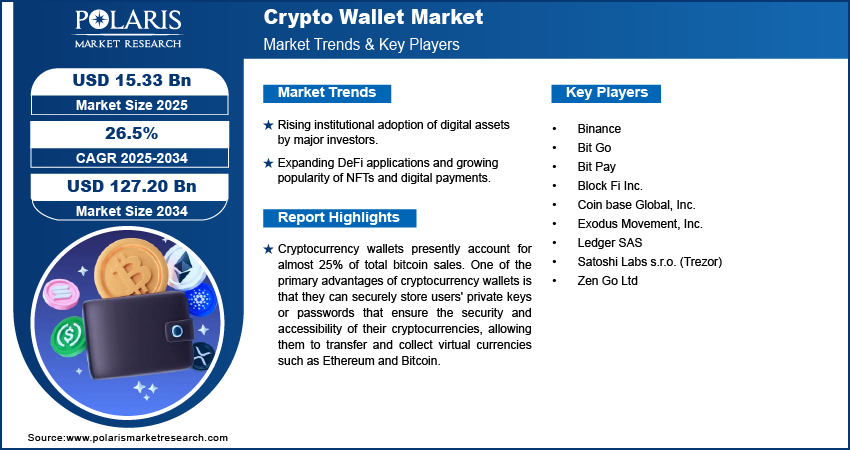

The global crypto wallet market was valued at USD 12.15 billion in 2024 and is expected to grow at a CAGR of 26.5% during the forecast period. The enhanced security provided by crypto vaults is projected to drive demand, consequently driving the future market growth.

Key Insights

- By wallet type, hot wallets held the largest share in 2024, largely due to their ease of access and user-friendly experience, as they can be downloaded and used instantly on smartphones, desktops, or other devices.

- By operating system, the Android operating system held the largest share in 2024, benefiting from the widespread global adoption and huge user base of Android-based smartphones.

- By application, the remittance application segment held the largest share in 2024, as crypto wallets are primarily used by individuals and institutions for the buying and selling of cryptocurrencies on exchanges.

- By end-use, the individual end-use segment held the largest share in 2024, which is directly linked to the growing number of people adopting and utilizing cryptocurrencies globally.

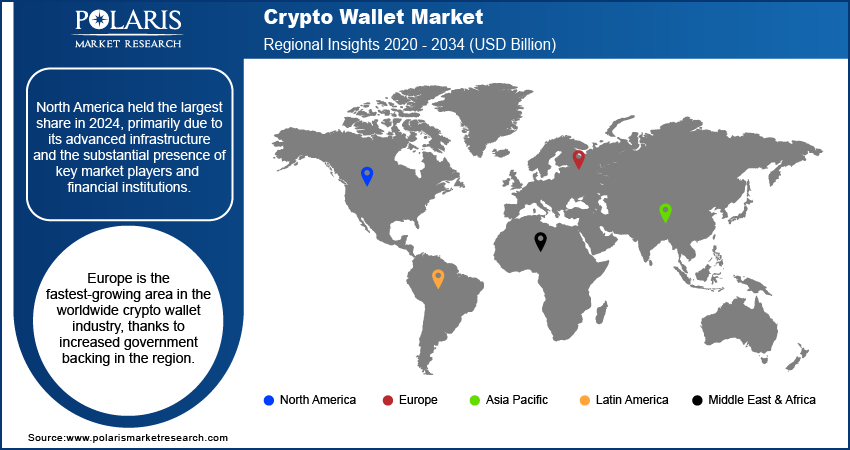

- By region, North America held the largest share in 2024, primarily due to its advanced infrastructure and the substantial presence of key market players and financial institutions.

Industry Dynamics

- The increasing institutional adoption of digital assets is a major driver, as large investment firms and corporations add them to portfolios.

- Decentralized finance (DeFi) and new use cases, such as non-fungible tokens (NFTs) and digital payments, are fueling demand trends.

- Advancements in blockchain technology, especially scalability and efficiency improvements like Layer 2 solutions, are critical drivers for broader adoption.

Market Statistics

- 2024 Market Size: USD 12.15 billion

- 2034 Projected Market Size: USD 127.20 billion

- CAGR (2025-2034): 26.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Market

- AI helps to make markets much more efficient. AI-powered algorithms can process massive amounts of market data, news, and even social media sentiment in real-time.

- AI systems are very good at analyzing complex and large datasets to spot anomalies and potential risks faster than human analysts.

- AI helps businesses to offer highly personalized products and services, which drives consumer demand and business growth.

Cryptocurrency wallets presently account for almost 25% of total bitcoin sales. One of the primary advantages of cryptocurrency wallets is that they can securely store users' private keys or passwords that ensure the security and accessibility of their cryptocurrencies, allowing them to transfer and collect virtual currencies such as Ethereum and Bitcoin.

The increased use of cryptocurrency can be ascribed to the rise in crypto wallet usage. The number of crypto wallet users worldwide reached 84.02 million in 2022, up from 76.32 million in 2021. The number of cryptocurrency purchasers is more than before. Companies increasingly offer digital payment options across all channels as more crypto purchasers emerge. Furthermore, rising banking rivalry, growing distrust in banks and financial institutions, and rising money laundering activities are driving the expanding adoption of cryptocurrencies. The growing popularity of crypto money is boosting the popularity of private crypto wallets.

Despite the economic crisis during the COVID, the value of Bitcoin has increased over the last month. Bitcoin is currently worth more than USD 6,000. This rise is unavoidable since China, the largest country handling bitcoin transactions, has hindered workflow due to a severe epidemic in Wuhan, China. Many problems endangered the crypto sector prior to the coronavirus, yet nothing changed the crypto world's expansion. Among the others are hacking, political issues, frauds, economic slump, and government regulations. Although consumers cannot believe that crypto assets would immediately solve the current global crisis, they may serve as viable tools to alleviate the economic turbulence.

Industry Dynamics

Which are the major factors driving crypto wallet market?

Growth Drivers

Increasing bitcoin use and merchant acceptance of crypto payments might be key distinctions in the increasingly competitive digital payment landscape. As a result of shop adoption, cryptocurrency wallets are progressively gaining customer familiarity. By incorporating crypto wallets, industries' paths will alter since they provide benefits such as current payment methods. By removing monetary restrictions and increasing the value of member data, these wallets enable virtual collaborations with shops. Given consumers' enthusiasm to adopt current technology, merchants may achieve success and get a physical grasp on cryptocurrency.

Crypto wallets with multiple accounts and privacy capabilities would be an exceptionally safe sign-in option. Users must additionally submit an encrypted login ID to guarantee total security. A digital wallet, in addition to the data encryption necessary to digitally validate transactions, maintains a record of the blockchain address where a given item is housed.

Report Segmentation

The market is primarily segmented based on wallet type, operating system application, end-use, and region.

|

By Wallet Type |

By Operating System |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The hot wallet is the fastest and largest segment in 2024

The hot wallets category led the market in 2024, accounting for more than 50% of total sales. Hot wallets are more user-friendly since they are linked to the internet. Hot wallets are a collection of crypto wallets that include desktop, mobile, and web-based wallets. These wallets are simple to use and can be downloaded to desktop workstations, cell phones, and other devices. They are used to transfer and receive crypto cash and to show users how many tokens are available. Hot wallet use is being driven by greater smartphone and internet penetration, as well as increased knowledge of cryptocurrency. Hot wallets' ease of use and efficiency fuel their popularity among cryptocurrency users.

The cold wallets category is predicted to increase significantly throughout the forecast period. Cold wallets are offline wallets that include paper wallets and hardware wallets. Cold wallets are regarded as a safer or more secure choice for keeping cryptocurrency since they are not connected to the internet.

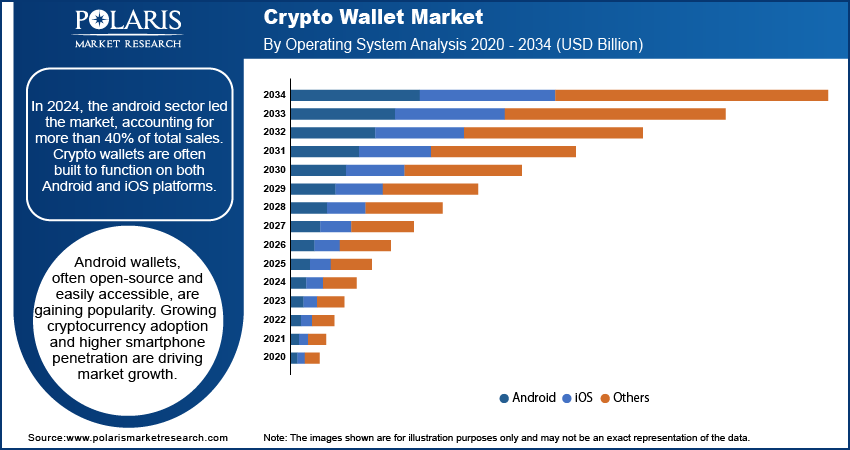

Android system dominated the market in 2024

In 2024, the android sector led the market, accounting for more than 40% of total sales. Crypto wallets are often built to function on both Android and iOS platforms. Android wallets are often open-source accounts that are easy for consumers to download and access. The increased usage of cryptocurrencies, combined with rising smartphone penetration, is likely to propel the market forward. By 2022, Android phones will account for 70% of all smartphones globally. During the projected period, the increased usage of Android devices is likely to boost the growth of the Android operating system sector.

The iOS category is predicted to increase significantly throughout the projection period. iOS is regarded as a more secure solution than Android systems. Data has just become the most precious commodity. As a result, worries about data privacy have grown over time. Concerns about data security have encouraged the development of solutions that keep users' data safe and restrict the personal information supplied to operating system owners. As of 2022, an estimated 1 billion people globally use iPhones. This is a 5.48% gain over the previous year. Since 2017, the number of active iPhone users has climbed by 22.85%, with the number of iPhones in use increasing by 186 million. The private keys kept on the crypto wallet are more secure on iOS.

Furthermore, iOS crypto wallets provide a secure and dependable method of keeping crypto money. The iOS operating systems' security, accessibility, and ease of use will likely boost the segment's development throughout the projection period.

The remittance application is expected to witness the highest growth

The remittance category is predicted to expand the most throughout the projection period. Consumers across the world are using cryptocurrency to transmit money internationally. Users choose cryptocurrency for remittances because they may be able to avoid some of the hefty fees paid by regular banks and money transfer providers.

Most crucially, several markets have lately seen the introduction of remittance-specific crypto products based mostly on Stablecoins. Because they are linked to a fiat currency, Stablecoins are great for remittances. This removes most of the price volatility while also allowing users to benefit from the speed and cheaper expenses of cryptocurrency.

The demand in North America is expected to witness significant growth

Geographically, North America is predicted to account for the greatest share of the global market due to the region's strong presence of key participants and their new advancements. There are around 22 million users, with 30 to 40% residing in the United States. The crypto wallet industry in the United States is expected to account for more than 70% of the market share in North America by 2030. Another important aspect that will drive growth in the United States is the arrival of new enterprises into the sector of cryptocurrencies.

Europe is the fastest-growing area in the worldwide crypto wallet industry, thanks to increased government backing in the region. For example, the European Union planned to develop a digital wallet in 2021 that would allow its people to make payments across all member states with little friction. It also allows for the storage of digital ID information. The wallet would save passwords, allowing the local government websites with a single digital identity.

Competitive Insight

Who are the key players in crypto wallet market?

Some of the major players operating in the global market include Block Fi, Coin base, Bit Go, Binance, Bit Pay, Satoshi Labs, Ledger SAS, Exodus Movement, Zen Go, Crypto.com, and Blockchain.com.

Recent Developments

- April 2025: Binance collaborated with global payment technology leader Worldpay to integrate Google Pay and Apple Pay, two of the world’s most widely used digital wallets into its fiat on-ramp ecosystem.

- January 2025: Trezor introduced the Safe 5 Freedom Edition, a limited-edition hardware wallet with only 2,100 individually numbered units available globally, symbolizing the principles of personal freedom and financial sovereignty.

- In 2022, Bit main, a prominent Chinese business, unveiled the first fully functioning water-cooling data centre in North America. The event was hosted, and prominent data mining businesses were invited to utilize hydro cooling technology in their operations.

- In 2022, Bitstamp, a Luxembourg-based crypto exchange business, presented the first crypto plus report, a genuine global barometer of cryptocurrency trust and acceptance worldwide.

- In 2022, EarlyBird, the platform that makes it easy for parents, relatives, and friends to invest in their children's future, has launched EarlyBird Crypto.

Crypto Wallet Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 12.15 billion |

| Market size value in 2025 | USD 15.33 billion |

|

Revenue forecast in 2034 |

USD 127.20 billion |

|

CAGR |

26.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Wallet Type, Operating System, Application, End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Block Fi Inc., Coin base Global, Inc., Bit Go, Binance, Bit Pay, Satoshi Labs s.r.o.(Trezor), Ledger SAS, Exodus Movement, Inc., Zen Go Ltd |

FAQ's

? The global market size was valued at USD 12.15 billion in 2024 and is projected to grow to USD 127.20 billion by 2034.

? The global market is projected to register a CAGR of 26.5% during the forecast period.

? North America dominated the market share in 2024.

? The hot wallets segment accounted for the largest share of the market in 2024.