Customer Data Platform Market Share, Size, Trends, Industry Analysis Report

By Vertical (BFSI, Retail & E-commerce, Media & Entertainment, Travel & Hospitality, IT & Telecom, Healthcare, Others); By Component; By Deployment Mode; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 134

- Format: PDF

- Report ID: PM2229

- Base Year: 2024

- Historical Data: 2020 - 2023

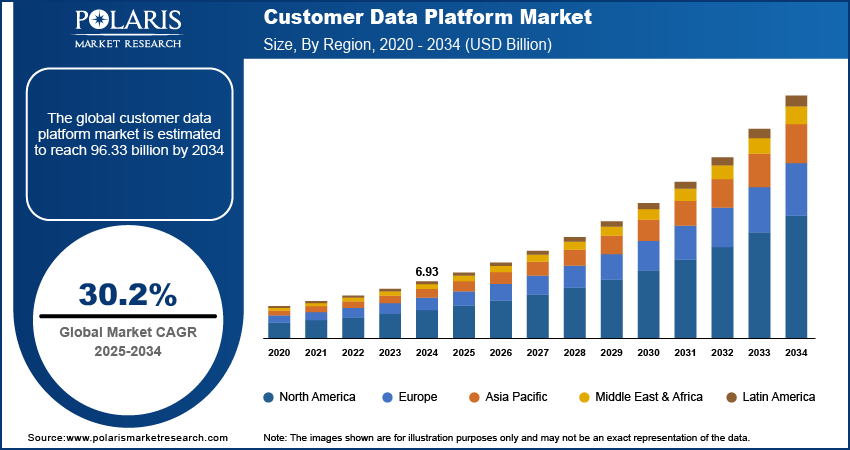

The global customer data platform market was valued at USD 6.93 billion in 2024 and is expected to grow at a CAGR of 30.2% during the forecast period. The prime factors for the market development are an increase in awareness of customer satisfaction and the greater need for a better shopping experience, which eventually increases the platform’s popularity.

Key Insights

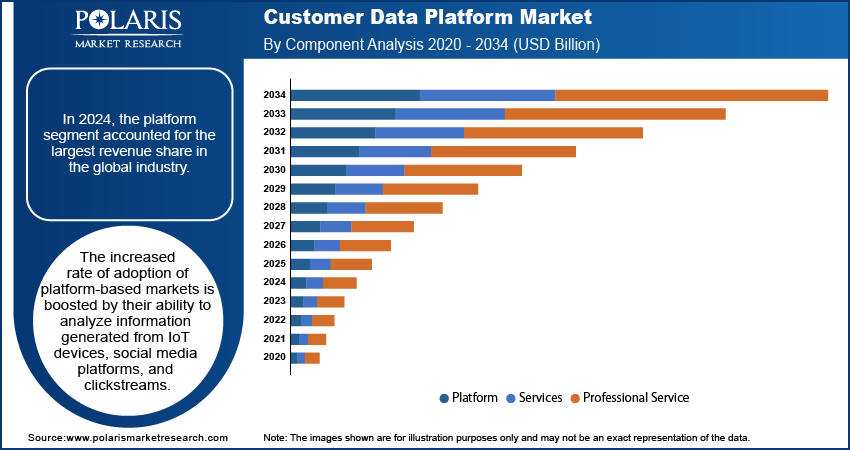

- In 2024, the platform segment dominated the market. This is due to their increased rate of adoption and ability to analyze information generated from IoT devices, social media platforms, and clickstreams.

- The healthcare segment is projected to witness significant growth as it is the most approachable platform for storing personalized information.

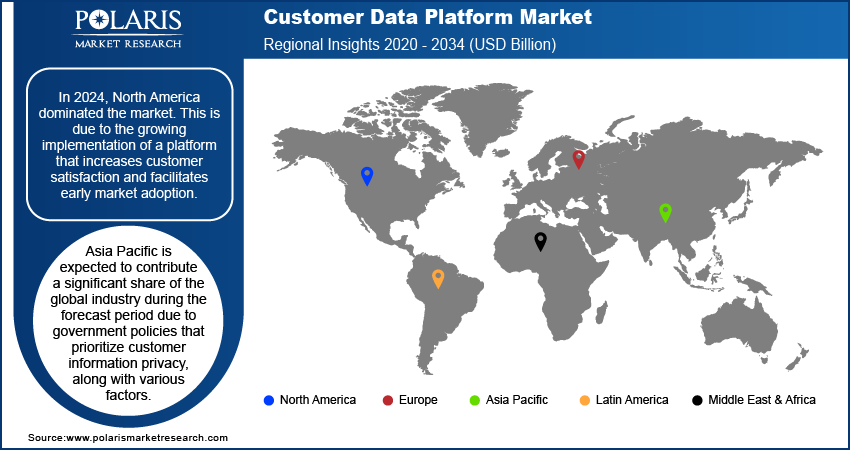

- In 2024, North America dominated the market. This is due to the growing implementation of a platform that increases customer satisfaction and facilitates early market adoption.

- Asia Pacific is expected to contribute a significant share of the global industry during the forecast period due to government policies that prioritize customer information privacy, along with various factors.

Industry Dynamics

- The increase in yearly budgets and expenditures on advertising and promotion can be attributed to the rapidly evolving nature of customer intelligenc.

- Improved technology, specifically AI and ML, is driving companies toward intelligent and automated devices to enhance their customers' experience and better service them.

- Forming consolidated profiles for personalized interactions creates opportunities for a marketing campaign that extends beyond segmentation to real, one-to-one customer experiences.

- The changing privacy regulations are making data collection and consolidation across platforms more difficult.

Market Statistics

- 2024 Market Size: USD 6.93 billion

- 2034 Projected Market Size: USD 96.33 billion

- CAGR (2025-2034): 30.2%

- Largest market in 2024: North America

To Understand More About this Research: Request a Free Sample Report

AI Impact on Industry

- AI algorithms improve matching and merging of customer data in accurate and single view.

- It enable CDPs to forecast future customer behaviors such as proactive engangement and churn probability.

- AI provide real time content automation and allow personalized customer journey without manual intervention.

- ML identify segments based on real-time behavior to provide more precise and effective targeting.

A customer data platform collects and consolidates information about customers from various sources to create a single, actionable customer profile. The focus of marketers and advertisers on providing real-time and personalized consumer services is further attributed to the global demand for the industry. Moreover, as investments in digital transformation increase, the use of a customer data platform has gained increasing acceptance, as it helps companies better interact with their customers both offline and online via blogs, websites, and other sources, supporting market growth. This capability is essential as it allows companies to shift from generic campaigns and deliver relevant messages and offers to customers at the right time. The adoption of these platforms also enables brands to personalize experiences across email, websites, and real-time advertising through the collected data, providing a unified view of individual interactions and preferences.

Industry Dynamics

Growth Drivers

Rise in annual budgets and expenses on advertisement and promotion by top key players in different industrial verticals, with changing customer intelligence landscape worldwide has boosted the adoption of customer data platforms. This is due to the rapid change in customer intelligence landscape, where a unified and deep understanding of customer is now an essential advantage for investments. Demand for these solutions which can activate and integrate information that is accelerating has boosted as businesses globally recognized the necessity of these platforms.

Along with rapid technological advancements, the number of digital end-users has increased, leading to the use of such platforms to an unprecedented extent. The advent of new technologies, particularly artificial intelligence and machine learning, will compel organizations to utilize smart and automated machinery to enhance the buyer experience and provide them with improved service. This automated system requires vast amounts of information to operate effectively. It also offers a feed personalization algorithm capability to deliver highly personalized experiences to consumers. As a result, the customer data platform market is gaining more prominence, as it provides a secure and safe way to advertise and enhance the buyer experience. Additionally, modern technology has revolutionized the way brands and customers interact with each other. According to SAS Institute, by 2030, over 67% of engagement between a consumer and brand using digital devices, such as online, mobile, etc., rather than humans. This, in turn, acts as a catalyzing factor for global industry development in the forthcoming scenario.

Report Segmentation

The market is primarily segmented on the basis of component, deployment mode, application, vertical, and region.

|

By Component |

By Deployment Mode |

By Application |

By Vertical |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Segmental Analysis

Component Analysis

In 2024, the platform segment accounted for the largest revenue share in the global industry. The increased rate of adoption of platform-based markets is boosted by their ability to analyze information generated from IoT devices, social media platforms, and clickstreams. They often deliver effective results through interactive dashboards. Moreover, the platform enables consumers to gain better insights from real-time data, identify high-value segments, enhance machine learning with high-quality data, and anticipate a customer's future actions. Thus, customer data platforms are primarily implemented among various business verticals, which are expected to contribute towards high segmental growth.

The services segment is expected to account for a significant share during the forecast period. This is attributed to factors such as the rising demand for consumer satisfaction and active investment in promotions and advertisements to offer personalized solutions, which is expected to drive segment growth over the forecast period.

Vertical Analysis

The retail & e-commerce segment accounted for the largest share in 2024 due to a surge in e-commerce and retail activities, which enabled reaching a wide consumer base, as well as increased customer attention for digital services, acting as a catalyzing factor for the segment's demand around the world. Moreover, the increasing trend of online shopping has compelled retailers to redefine their delivery models and enhance shopping experiences through various touchpoints and channels. Thus, the proliferation of the industry in the retail and e-commerce sector eventually boosted the segment demand and paved the way for industry growth.

The healthcare segment is projected to witness significant growth across the industry. It is the most approachable platform for storing personalized information, resulting in a higher degree of consumer satisfaction. Additionally, the digitalization trend has also strengthened in the healthcare sector, leading to the adoption of digital solutions that provide patients with a real-time experience. As a result, it is expected to offer most of its customers assistance with providing their proper personal information and lower the risk to patient's health. Therefore, these factors may stimulate industry demand in the near future.

Regional Analysis

North America Customer Data Platform Market Assessment

North America accounted for the largest share of the global market in 2024. This is due to the growing implementation of a platform that increases customer satisfaction and facilitates early market adoption across various businesses and industry verticals, enabling effective task management. Furthermore, the region has a large number of industry players with wide-ranging operations and customer bases, therefore, creating better accessibility to such solutions in the region. For instance, in March 2021, Oracle introduced a new service that offers a single point of contact for all technical delivery and eliminates critical expertise barriers for services. Such initiatives are further responsible for the high market adoption in the region.

Which Country Dominated the North America Customer Data Platform Market?

The U.S. held the largest share of the North America customer data platform industry in 2024. The increasing shift toward cloud-based solutions and rising integration of AI & ML boost the industry expansion. Growing requirements to comply with data privacy regulations are expected to provide market growth opportunities. Surging penetration of e-commerce and data democratization are emerging trends. The presence of key market players drives the industry growth. The following table provides insights into vendors in the U.S. market along with their key strength.

|

Vendor |

Industry |

Key Strengths |

|

Optimove |

|

|

|

Zeta Global |

|

|

|

Qualtrics (Post-Press Ganey Acquisition) |

|

|

|

Infogix |

|

|

|

DataArt |

|

|

Asia Pacific Customer Data Platform Market Insights

Asia Pacific is expected to contribute a significant share of the global industry during the forecast period. Government policies that prioritize customer information privacy, along with factors such as rising digitalization, big data, and data analytics, are driving the adoption of the platform by marketers and advertisers. Moreover, the long-term contracts and agreements related to the digital solution providers' long-term business prospects are paving the way for gaining a competitive edge over industry rivals. Therefore, Asia Pacific region is expected to increase the demand for customer data platforms, creating lucrative opportunities for the market across regions in the near future.

Competitive Insight

Some of the major players operating in the global market include Acquia, Adobe, Amperity, Blueconic, Dun & Bradstreet, Leadspace, Microsoft, Nice, Oracle, Salesforce, SAP, SAS Institute, Tealium, Teradata, Upland Software, and Zeta Global.

Customer Data Platform Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.93 billion |

| Market size value in 2025 | USD 8.96 billion |

|

Revenue forecast in 2034 |

USD 96.33 billion |

|

CAGR |

30.2% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Deployment Mode, By Application, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Acquia, Adobe, Amperity, Blueconic, Dun & Bradstreet, Leadspace, Microsoft, Nice, Oracle, Salesforce, SAP, SAS Institute, Tealium, Teradata, Upland Software, and Zeta Global. |

FAQ's

• The global market size was valued at USD 6.93 billion in 2024 and is projected to grow to USD 96.33 billion by 2034.

• The global market is projected to register a CAGR of 30.2% during the forecast period.

• North America dominated the global market share in 2024.

• A few key players are Acquia, Adobe, Amperity, Blueconic, Dun & Bradstreet, Leadspace, Microsoft, Nice, Oracle, Salesforce, SAP, SAS Institute, Tealium, Teradata, Upland Software, and Zeta Global.

• In 2024, the platform segment dominated the market.

• The healthcare segment is projected to witness significant growth.