Cybersecurity as a Service Market Size, Share, Trends, & Industry Analysis Report

By Service Type, By Security Type, By Platform, By Enterprise Size, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 128

- Format: PDF

- Report ID: PM5798

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

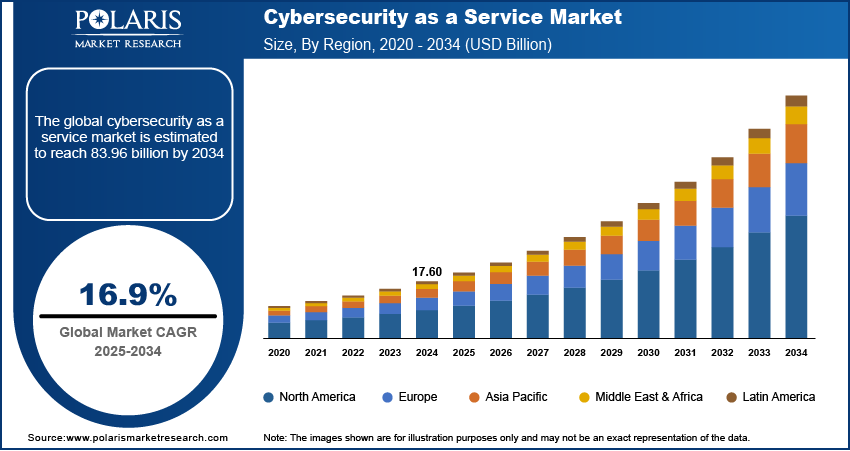

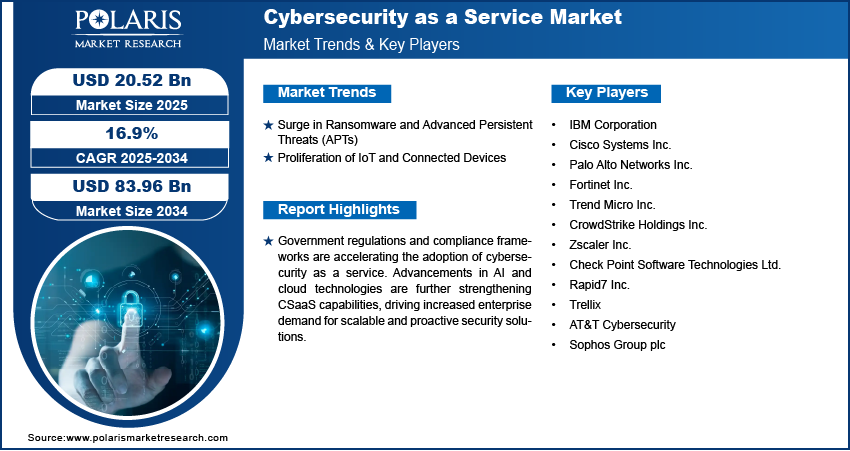

The global cybersecurity as a service market size was valued at USD 17.60 billion in 2024, growing at a CAGR of 16.9% during 2025–2034. Rising cybersecurity threats and digital transformation efforts across sectors are fostering the adoption of cybersecurity as a service (CSaaS).

The increasing reliance on cloud computing, remote work models, and interconnected digital systems fueling the need for scalable, real-time, and cost-efficient security solutions. CSaaS offers outsourced, subscription-based protection that includes services such as threat detection, endpoint security, identity and access management, and incident response. Businesses are utilizing CSaaS to address the shortage of skilled cybersecurity professionals, reduce capital expenditure, and meet evolving compliance mandates. The service model enables efficient monitoring, faster response to breaches, and meeting global standards such as General Data Protection Regulation (GDPR) and Health Insurance Portability and Accountability Act (HIPAA).

Cybersecurity as a service is witnessing strong adoption in highly regulated and data-sensitive industries such as banking, healthcare, government, and retail. These sectors prioritize advanced security due to the volume of confidential data, regulatory scrutiny, and business continuity risks. CSaaS supports enterprise-grade protection through proactive threat intelligence, AI-powered analytics, and centralized policy enforcement. It plays a crucial role in enhancing operational resilience for small and medium-sized enterprises that lack in-house cybersecurity infrastructure. With the rapidly growing cyber risks enterprises are incorporating CSaaS to enhance automation, zero trust frameworks, and managed extended detection and response (MXDR).

The accelerating digitalization of business operations and rising cyber threats due to rising urbanization drives the cybersecurity as a service (CSaaS) industry. As smart cities evolve and integrate complex digital infrastructure, the volume of sensitive data and interconnected systems grows significantly, increasing vulnerability to cyberattacks. According to the SmartAmerica Challenge, US government is projected to invest approximately USD 41 trillion by 2036 to upgrade infrastructure for IoT integration, supporting the development of smart cities to enhance urban efficiency, sustainability, and quality of life. CSaaS offer a safer environment while providing scalable, cloud-based security solutions for urban enterprises and public infrastructure. It also provide real-time monitoring, rapid incident response, and compliance support for digitized urban ecosystems.

In urban economies where competition and digital transformation are progressing rapidly, businesses seek cost-effective and advanced security models that ensure uninterrupted operations. CSaaS helps meet these expectations by offering on-demand, expert-managed security frameworks that reduce the need for in-house teams while enhancing protection against sophisticated threats. The model’s flexibility and performance appeal to urban enterprises aiming for faster deployment, improved risk mitigation, and long-term business resilience.

Industry Dynamics

Surge in Ransomware and Advanced Persistent Threats (APTs)

The rapidly rising ransomware attacks and advanced persistent threats (APTs) is significantly driving demand for CSaaS solutions. These attacks exploit vulnerabilities in digital systems, encrypt critical data, and demand high-value ransoms, causing severe financial and operational disruptions. APTs are prolonged and stealthy, infiltrating networks over time to extract sensitive data or sabotage business operations. According to Cybersecurity Ventures, by 2031, a ransomware attack is expected to hit a consumer or business every 2 seconds, adding up to around 43,200 attacks each day. Thus, businesses are increasingly adopting CSaaS models to gain access to continuous threat monitoring, behavioral analytics, and expert-driven response mechanisms that swiftly detect and neutralize such attacks before they escalate.

Traditional on-premise security infrastructure is often inadequate to combat the evolving tactics of ransomware actors and APT groups. CSaaS providers offer a proactive, intelligence-driven defense architecture that leverages real-time threat intelligence, automated alerting, and managed response services. Enterprises improve their protection without the high costs of maintaining in-house security teams or complex software systems by outsourcing these cybersecurity services. The growing frequency and impact of such high-level attacks are pushing both public and private sector organizations to prioritize CSaaS as a core component of their cyber defense strategy.

Adoption of IoT and Connected Devices

The rapid growth of industrial internet of things (IoT) and connected devices are creating more security risks and making IT systems more vulnerable. As a result, enterprises are turning to advanced and scalable cybersecurity solutions, which is boosting the demand for CSaaS to safeguard their networks and data. From industrial sensors and smart grids to connected healthcare equipment and consumer wearables, these devices often operate with limited built-in security features, making them prime targets for cyber exploitation. In May 2024, Advanced Research Projects Agency for Health (ARPA-H) launched the UPGRADE program, a USD 50 million initiative to develop AI-driven tools that can automatically detect vulnerabilities in hospital IT systems, create digital twins of medical devices, and deploy patches with minimal disruption. As the number of connected endpoints increases exponentially, so does the attack surface, creating unprecedented vulnerabilities across both enterprise and critical infrastructure networks.

Cybersecurity as a service providers address these challenges by offering centralized monitoring, device authentication, secure firmware updates, and network segmentation strategies to safeguard IoT ecosystems. Through a cloud-based, subscription-driven model, CSaaS enables real-time threat detection and coordinated defense across thousands of connected assets without compromising scalability or performance. This is particularly vital in sectors such as manufacturing, healthcare, logistics, and energy, where IoT is integral to operations. The need to protect interconnected environments from device hijacking, data leakage, and distributed denial-of-service (DDoS) attacks is reinforcing the adoption of CSaaS across global markets.

Segmental Insights

By Service Type Analysis

The global segmentation, based on service type includes, threat intelligence & behavior analysis, auditing & logging, and monitoring & alerting. The monitoring & alerting segment is projected to reach at a significant market value in 2024. This growth is attributed to its crucial role in offering continuous visibility into security threats across enterprise networks. As cyberattacks become more sophisticated and persistent, the need for real-time monitoring of anomalies, unusual behaviors, and breach attempts intensified. As an example, in April 2025, Rockwell Automation launched its Security Monitoring and Response service, offering 24/7 real-time threat detection and response for operational technology environments, supported by a dedicated OT Security Operations Center and cybersecurity experts. Enterprises rely on these services to detect and respond to threats before they escalate into major incidents. The ability to receive instant alerts and automated notifications enhances operational efficiency and reduces downtime, which is critical for sectors with sensitive data and around-the-clock operations such as banking and healthcare.

The threat intelligence & behavior segment is projected to grow at a robust pace in the coming years, driven by the growing demand for proactive threat detection and prevention. As enterprises shift from reactive to predictive cybersecurity models, they are increasingly investing in behavior analytics and intelligence platforms that identify patterns, monitor user behavior, and anticipate emerging risks. These services enable organizations to stay ahead of cybercriminals by analyzing global threat landscapes and tailoring defenses accordingly. The integration of artificial intelligence in cybersecurity further enhances this segment’s capability, making it a strategic focus for future-ready cybersecurity infrastructures.

By Security Type Analysis

The global segmentation, based on security type includes, enterprise security, endpoint security, cloud security, network security, and application security. The enterprise security segment accounted for substantial market share in 2024, due to the comprehensive nature of threats targeting internal systems, databases, and employee access points. Large-scale enterprises face increasing pressure to safeguard their digital assets from both internal vulnerabilities and external attacks. Enterprise security solutions offered under CSaaS models provide a holistic defense architecture covering access control, intrusion detection, firewall management, and policy enforcement. The high adoption in this segment is also supported by regulatory frameworks mandating stringent data protection and risk governance measures across sectors such as finance, manufacturing, and telecommunications.

The cloud security segment is projected to grow at a significant pace during the assessment phase, fueled by the rapid acceleration of cloud adoption across business functions. As organizations migrate their infrastructure, applications, and data to cloud environments, the risks of misconfigurations, unauthorized access, and data leakage increased substantially. Cloud security under the CSaaS model delivers specialized protection tailored to public, private, and hybrid cloud ecosystems. With the rise of multi-cloud strategies and the demand for secure remote access, this segment is poised to experience sustained growth throughout the forecast period.

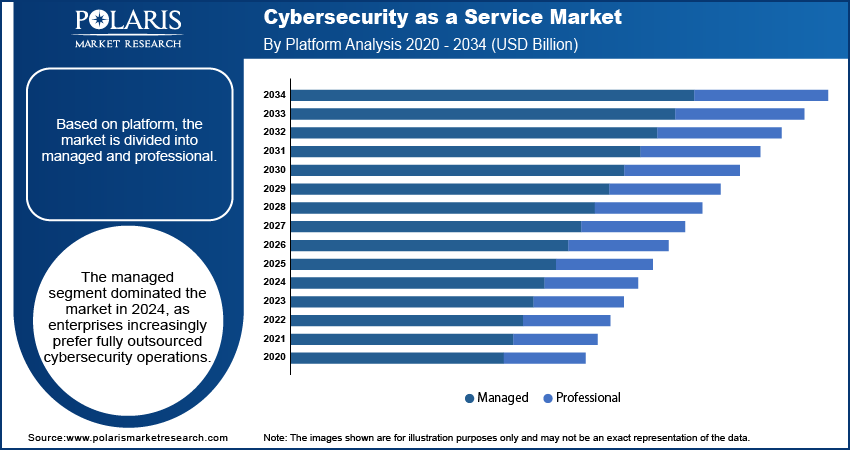

By Platform Analysis

The global segmentation, based on platform includes, managed and professional. The managed segment dominated the market in 2024, as enterprises increasingly prefer fully outsourced cybersecurity operations. These services offer end-to-end solutions including 24/7 monitoring, threat detection, remediation, and compliance reporting. The appeal lies in their ability to provide consistent security coverage without the need for internal staffing or infrastructure. Organizations with limited in-house expertise benefit from managed service providers’ advanced capabilities, tools, and threat intelligence, enabling them to respond to incidents more effectively while maintaining business continuity.

The professional segment is estimated to hold a substantial market share in 2034, as companies seek tailored cybersecurity assessments, strategy consulting, and incident response planning. These services support organizations in addressing industry-specific risks, conducting audits, and building long-term security roadmaps. The segment’s growth is also driven by rising demand for customized solutions to meet regulatory requirements, integrate new technologies, and improve security postures in complex digital environments. With cyber threats becoming more targeted and business models more diverse, the demand for expert advisory and implementation services continues to grow.

By Enterprise Size Analysis

The global segmentation, based on enterprise size includes, small & medium enterprises and large enterprises. The large enterprises segment is projected to grow during the forecast period. This rapid growth is attributed to their complex IT infrastructures, high-value data assets, and exposure to sophisticated cyber threats. These organizations operate in regulated environment thus require to follow compliance standards, which makes advanced cybersecurity solutions a necessity. With larger budgets and a strategic focus on digital risk management, large enterprises adopt comprehensive CSaaS offerings that span endpoint protection, data loss prevention, and real-time analytics. Their global operations and high dependency on data-driven processes further reinforce the importance of robust security frameworks.

The small and medium enterprises segment is estimated to hold a significant market share in 2034. These firms are recognizing the financial and reputational risks posed by cyberattacks, leading to greater adoption of CSaaS solutions. For instance, in March 2025, Cyan AG launched cyan Guard 360, an AI-driven cybersecurity solution designed specifically for SMEs to protect against phishing and other digital threats at minimal cost and effort. However, lacks in adoption of CSaaS solutions due to budget limitations and minimal IT infrastructure, SMEs are now leveraging these services as a cost-effective, subscription-based model that delivers enterprise-grade protection. The surge in ransomware attacks targeting smaller businesses, coupled with strict regulatory requirements made cybersecurity a key priority. CSaaS provides the scalability and affordability needed by SMEs to safeguard digital assets without overburdening their operational resources.

By End User Analysis

The global segmentation, based on end user includes, IT & telecom, retail, BFSI, healthcare, defense, automotive, other end users. The BFSI segment captured significant market share in 2024, driven by its heightened exposure to fraud, regulatory compliance demands, and reliance on secure digital platforms. Financial institutions handle vast volumes of sensitive customer data and real-time transactions, making them a top target for cybercriminals. In March 2025, Resecurity partnered with the Union of Arab Banks (UAB) to enhance cybersecurity, fraud prevention, and threat intelligence sharing across the MENA banking sector. The agreement grants UAB members access to Resecurity’s Fraud Prevention Platform, digital risk monitoring, and advanced cyber threat detection. CSaaS enables these institutions to secure online banking portals, transaction processing systems, and customer information through advanced threat detection, encryption, and compliance tools. The need for uninterrupted service availability and trust in financial operations further supports continued investment in cybersecurity.

The healthcare segment is estimated to grow at a significant CAGR from 2025-2034, owing to the surge in electronic health records (EHRs), telehealth platforms, and connected medical devices. With healthcare industry undergoes rapid digital transformation, it faces risks of data breaches and ransomware attacks. CSaaS provides healthcare providers with a secure framework to protect patient information, meet HIPAA and other compliance requirements, and maintain the integrity of critical systems. The life-critical nature of healthcare operations and growing attack surfaces made cybersecurity a strategic imperative, driving robust demand in this segment.

Regional Analysis

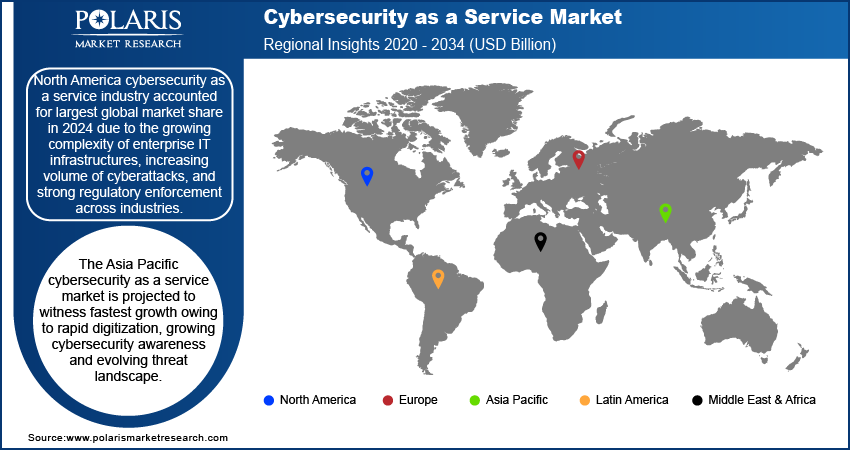

North America cybersecurity as a service industry accounted for largest global market share in 2024 due to the growing complexity of enterprise IT infrastructures, increasing volume of cyberattacks, and strong regulatory enforcement across industries. The region is at the forefront of digital transformation, with widespread adoption of cloud computing, IoT, and remote work models. This shift significantly increasing the attack surface for organizations, making scalable and real-time security solutions critical. The rising financial and reputational losses due to advanced persistent threats (APTs), ransomware, and phishing attacks prompted businesses to adopt CSaaS for threat monitoring, behavior analytics, and incident response. Furthermore, mandates such as the U.S. cybersecurity maturity model certification (CMMC) and CCPA compliance are fueling demand for outsourced cybersecurity models.

US Cybersecurity as a Service Market Insight

The US dominated the regional market attributed to the country’s high cybersecurity expenditure, comprehensive data protection regulations, and a mature network of CSaaS providers offering advanced, scalable security services. Federal directives such as the Executive Order on Improving the Nation’s Cybersecurity (2021), alongside sector-specific compliance frameworks including HIPAA for healthcare and GLBA for the financial sector compelled organizations to adopt continuous cloud-based security solutions. The rapid deployment of digital infrastructure, including smart city projects, 5G connectivity, and financial technology platforms further increasing the demand for dynamic and real-time cybersecurity services. According to 5G Americas, global 5G connections reached nearly 2 billion in Q1 2024, with 185 million new additions, and are projected to grow to 7.7 billion by 2028. North America accounted for 32% of all wireless cellular connections, driven by 11% growth and 22 million new 5G connections in the quarter. Enterprises in banking, defense, healthcare, and critical infrastructure sectors are increasingly engaging third-party cybersecurity vendors to ensure regulatory adherence, operational continuity, and comprehensive threat management.

Asia Pacific Cybersecurity as a Service Market

The Asia Pacific cybersecurity as a service market is projected to witness fastest growth owing to rapid digitization, growing cybersecurity awareness and evolving threat landscape. The region is undergoing a significant technological shift with the expansion of e-commerce, fintech, cloud computing, and smart infrastructure. According to HSBC, China's cross-border B2C e-commerce industry is projected to reach USD 500 billion in 2025, up from USD 350 billion in 2023 and USD 155 billion in 2019, indicating rapid growth. This transformation is exposing critical vulnerabilities in IT systems across both private enterprises and public sectors. Countries including China, India, Japan, and Singapore are witnessing an uptick in cybercrime incidents, leading to heightened investment in threat detection, endpoint protection, and compliance services. Government-led initiatives such as India’s CERT-In directives and China’s Cybersecurity Law are pushing organizations to adopt CSaaS for real-time monitoring and regulatory alignment. Moreover, SMEs across Asia Pacific are embracing CSaaS to gain access to enterprise-grade security without the burden of capital investment in internal teams or infrastructure.

Europe Cybersecurity as a Service Market Overview

The market in Europe is driven by the rigorous data privacy frameworks, increasing enterprise digitization, and strong governmental backing for cybersecurity resilience. As per the Eurostat, about 59% of EU businesses achieved basic digital intensity, with 58% of SMEs and 91% of large firms reaching this level in 2023. While most large companies had high or very high digital intensity, the majority of SMEs remained at low or very low levels. The enforcement of the General Data Protection Regulation (GDPR) is a key driver for businesses to improve their cybersecurity posture through managed and cloud-based services. Regional economies such as Germany, the UK, and France are leading the adoption curve, fueled by industrial digitalization, smart manufacturing, and high penetration of SaaS applications. The European Union Agency for Cybersecurity (ENISA) and initiatives such as the EU Cybersecurity Act are setting technical standards and trust frameworks, encouraging businesses to engage with CSaaS providers. As more European enterprises shift towards hybrid IT environments, demand for continuous threat intelligence, vulnerability assessment, and security-as-a-service models is poised to grow steadily.

Key Players & Competitive Analysis Report

The cybersecurity as a service industry is highly competitive, driven by the rapid evolution of cyber threats and the increasing demand for agile, scalable, and cost-efficient security solutions. Key players are actively expanding their service portfolios, strengthening cloud-based offerings, and investing in next-generation technologies such as AI-driven threat detection, zero-trust architecture, and behavior analytics. Strategic collaborations, mergers and acquisitions, and geographic expansion remain central to competitive positioning. Market participants are also focused on enhancing real-time monitoring, threat intelligence, and compliance management capabilities to address the security needs of highly regulated sectors.

Prominent companies in the cybersecurity as a service market are IBM Corporation, Cisco Systems Inc., Palo Alto Networks Inc., Fortinet Inc., Trend Micro Inc., CrowdStrike Holdings Inc., Zscaler Inc., Check Point Software Technologies Ltd., Rapid7 Inc., Trellix, AT&T Cybersecurity, and Sophos Group plc.

Key Players

- IBM Corporation

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- Fortinet Inc.

- Trend Micro Inc.

- CrowdStrike Holdings Inc.

- Zscaler Inc.

- Check Point Software Technologies Ltd.

- Rapid7 Inc.

- Trellix

- AT&T Cybersecurity

- Sophos Group plc

Industry Developments

April 2025: AT&T partnered with Palo Alto Networks to launch AT&T Dynamic Defense, a network-integrated cybersecurity solution offering real-time threat prevention and AI-powered SASE security. The service provides end-to-end protection for wired and wireless networks, featuring zero-trust access, data loss prevention, and a secure web gateway.

April 2025: IBM launched the autonomous threat operations machine (ATOM), an agentic AI system that provides autonomous triage, investigation, and remediation of cyber threats with minimal human intervention. The company also introducing the X-Force Predictive Threat Intelligence agent, which uses AI and data from 100+ sources to anticipate threats and reduce manual threat hunting.

April 2025: Full Spectrum introduced a comprehensive suite of cybersecurity services tailored for the medical device, digital health, and life science sectors, addressing critical vulnerabilities and regulatory requirements.

Cybersecurity as a Service Market Segmentation

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- Threat Intelligence & Behavior Analysis

- Auditing & Logging

- Monitoring & Altering

By Security Type Outlook (Revenue, USD Billion, 2020–2034)

- Enterprise Security

- Endpoint Security

- Cloud Security

- Network Security

- Application Security

By Platform Outlook (Revenue, USD Billion, 2020–2034)

- Managed

- Professional

By Enterprise Size Outlook (Revenue, USD Billion, 2020–2034)

- Small and Medium Enterprises

- Large Enterprises

By End User Type Outlook (Revenue, USD Billion, 2020–2034)

- IT & Telecom

- Retail

- BFSI

- Healthcare

- Defense

- Automotive

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cybersecurity as a Service Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 17.60 Billion |

|

Market Size in 2025 |

USD 20.52 Billion |

|

Revenue Forecast by 2034 |

USD 83.96 Billion |

|

CAGR |

16.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 17.60 billion in 2024 and is projected to grow to USD 83.96 billion by 2034.

The global market is projected to register a CAGR of 16.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are IBM Corporation, Cisco Systems Inc., Palo Alto Networks Inc., Fortinet Inc., Trend Micro Inc., CrowdStrike Holdings Inc., Zscaler Inc., Check Point Software Technologies Ltd., Rapid7 Inc., Trellix, AT&T Cybersecurity, and Sophos Group plc.

The managed segment dominated the market share in 2024.

The healthcare segment is expected to witness the fastest growth during the forecast period.