Cylinder Deactivation Systems Market Share, Size, Trends, Industry Analysis Report

By Component (Valve Solenoid, Engine Control Units, Electronic Throttle Control); By Actuation Method; By End Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3758

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

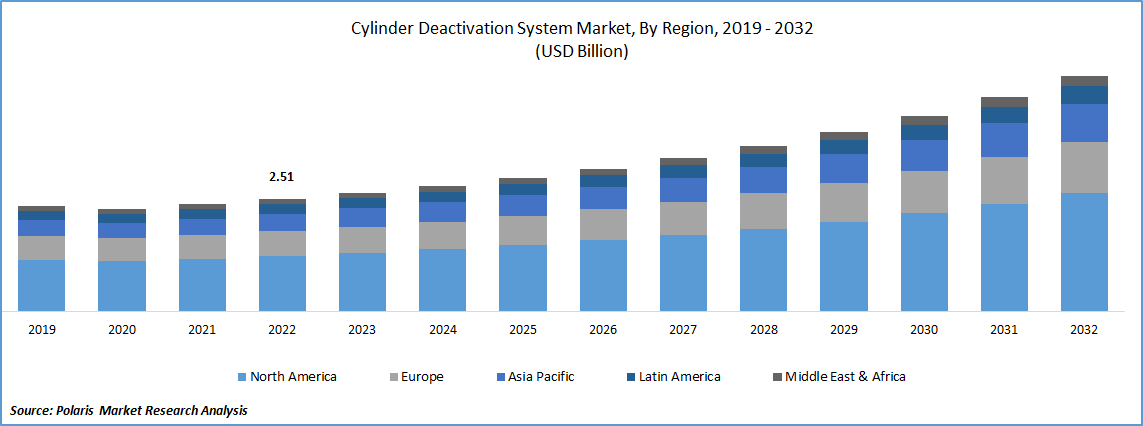

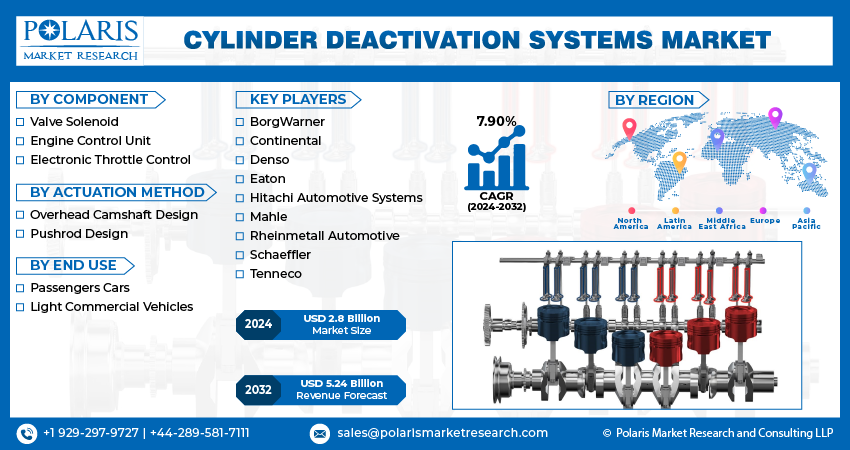

The global cylinder deactivation systems market was valued at USD 2.65 billion in 2023 and is expected to grow at a CAGR of 7.90% during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Cylinder deactivation, known as CDA, is a crucial technology in modern engines aimed at improving efficiency and fuel economy. Within an engine, cylinders play a significant role in powering the car. However, once their work is done, it becomes necessary to deactivate them. CDA provides a systematic approach to temporarily deactivate specific cylinders in engines with multiple cylinders. During cylinder deactivation, the intake and exhaust valves are closed, and the fuel injector stops delivering fuel to the deactivated cylinder. Despite being deactivated, the piston continues to move due to its connection to the crankshaft. This process effectively reduces the engine's displacement, leading to increased overall efficiency and improved fuel economy. This will further fuel the growth of the cylinder deactivation systems market soon.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces cylinder deactivation system market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Growing environmental consciousness among consumers is driving the demand for more fuel-efficient and eco-friendly vehicles, leading automakers to integrate cylinder deactivation systems to reduce emissions. It has the potential to decrease fuel consumption by 4 to 10%, leading to cost savings and a reduced environmental impact. Implementing cylinder deactivation systems can improve engine performance by optimizing power delivery and reducing mechanical losses, enhancing the overall driving experience. The primary motivation behind cylinder deactivation is to prevent the wastage of excess power that the vehicle doesn't require during certain operating conditions. By selectively deactivating cylinders, the engine operates more efficiently, conserving fuel and minimizing unnecessary energy consumption. This technology plays a significant role in advancing automotive efficiency and sustainability.

Industry Dynamics

Growth Drivers

Increasing demand for improved fuel efficiency and reduced emissions

The increasing demand for improved fuel efficiency and reduced emissions in vehicles is a significant driving force behind the growth of the CDA market. Automakers are continuously seeking innovative technologies to gain a competitive edge. Cylinder deactivation systems provide a way to differentiate vehicles in the market, especially in terms of fuel efficiency and emissions performance. For instance, Jacobs Vehicle Systems, renowned for creating Jake Brakes, has developed innovative valvetrain technologies designed to aid engine and truck manufacturers in meeting more stringent federal exhaust emission regulations anticipated in 2027. Additionally, these technologies have the potential to significantly reduce engine shutdown vibrations, preventing disturbances to sleeping drivers in their bunks. The rising research activities on fuel efficiency is creating new growth potential for the market in coming years.

Report Segmentation

The market is primarily segmented based on component, actuation method, end use and region.

|

By Component |

By Actuation Method |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

Electronic Control Unit segment is expected to witness fastest growth during forecast period

Electronic Control Unit segment is expected to have faster growth for the market. Cylinder deactivation systems are primarily implemented to improve fuel efficiency and reduce emissions. The ECU plays a vital role in achieving these objectives by effectively managing cylinder activation and deactivation based on real-time data. The ECU ensures that the right cylinders are deactivated at the right times, minimizing pumping losses and optimizing overall engine efficiency.

The ECU is responsible for maintaining engine performance while operating in reduced-cylinder mode. It continuously monitors factors like engine load, throttle position, and vehicle speed to ensure that the remaining active cylinders deliver sufficient power and torque to meet driver demands. The ECU adjusts fuel injection, ignition timing, and other parameters to maintain smooth operation and prevent any noticeable performance degradation.

By Actuation Method Analysis

Overhead Camshaft Design segment accounted for the largest market share in 2022

Overhead Camshaft (OHC) Design segment holds the largest market share for the market in the study period. The overhead camshaft design allows for more precise control of the engine's valves, making it easier to implement cylinder deactivation technology effectively. As a result, automakers can improve fuel efficiency and reduce emissions, leading to a higher demand for these systems in the market. The automotive market demands both performance and efficiency from vehicles. OHC designs, combined with cylinder deactivation technology, offer the potential to achieve a balance between these two requirements. By selectively deactivating cylinders, engine power is optimized for driving conditions, improving fuel efficiency without compromising performance. This market demand for performance-oriented yet efficient vehicles drives the growth of OHC-based cylinder deactivation systems.

By End-Use Analysis

Passenger cars segment is expected to hold the larger revenue share in 2022

Passenger cars segment is projected to witness a larger revenue share in the coming years. Fuel efficiency is a significant consideration for car buyers, and many consumers prioritize vehicles that offer better mileage and lower fuel consumption. Cylinder deactivation systems enable passenger cars to achieve improved fuel efficiency without sacrificing performance. As consumers become increasingly conscious of fuel costs and environmental impact, the demand for fuel-efficient vehicles rises, contributing to the growth of cylinder deactivation systems in the passenger car segment.

These cars often incorporate advanced engine technologies to enhance performance and efficiency. Cylinder deactivation systems work in synergy with these advanced technologies, such as direct injection, turbocharging, and variable valve timing, to optimize engine operation under different load conditions. The integration of cylinder deactivation with these advanced engine technologies allows passenger cars to achieve higher levels of efficiency and power, driving the adoption of cylinder deactivation systems.

Regional Insights

APAC expected to have highest growth rate in the study period

APAC is expected to experience a higher growth rate for the market. This region is one of the largest automotive manufacturing regions globally, with several countries producing a significant number of vehicles. The growing vehicle production in countries like China, India, and others creates a substantial market for cylinder deactivation systems as automakers seek to improve fuel efficiency and meet stringent emission regulations. In 2021, China retained its position as the world's largest vehicle producer, manufacturing a staggering total of over 26 million vehicles. This impressive figure comprised more than 21.4 million cars and 4.6 million commercial vehicles, solidifying China's leading role in the global automotive manufacturing industry.

The release of strengthened HDV (Heavy-Duty Vehicles) fuel economy standards in China creates a positive outlook for the demand for cylinder deactivation systems. These tighter fuel consumption limits for new tractors, trucks, and buses, which came into force in 2019 under the Stage III National Standard, emphasize the need for improved fuel efficiency in heavy-duty vehicles. Given that cylinder deactivation systems offer a practical and effective method to achieve improved fuel economy in internal combustion engines, the demand for these systems is likely to grow in response to the more stringent fuel economy standards.

North America is projected to witness a larger revenue share for the market. Manufacturers in this are using fuel safety technologies in their vehicles like cylinder deactivation systems. In recent decades, automotive manufacturers have dedicated significant time and resources to the development of fuel-saving technologies. These innovations encompass a range of advancements, including direct injection, cylinder de-activation, & auto start-stop features.

- For instance, General Motors uses 54% of cylinder deactivation technologies in the manufacturing process according to the EPAs Automotive Trends Report 2022.

GM refers to this feature as Active Fuel Management (AFM), which shuts down half of the engine's cylinders during the light driving to optimize fuel efficiency. As companies in the region adopt fuel-efficient vehicle technologies, it will further fuel the demand for cylinder deactivation systems.

Key Market Players & Competitive Insights

The Cylinder Deactivation System market is fragmented and is anticipated to witness competition due to several players' presence. Major players in the market are constantly upgrading their products to stay ahead of the competition. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- BorgWarner

- Continental

- Denso

- Eaton

- Hitachi Automotive Systems

- Mahle

- Rheinmetall Automotive

- Schaeffler

- Tenneco

Recent Developments

- In May 2023, A research study found that both cylinder deactivation systems strategies (Open-loop, Closed-loop) can contribute to improved catalyst performance and emissions reduction in internal combustion engines.

- In October 2022, Research study published in Frontiers demonstrates that cylinder deactivation can be a valuable thermal management approach in heavy-duty diesel engines to meet stringent NOx emissions regulations without sacrificing fuel efficiency.

Cylinder Deactivation Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.8 billion |

|

Revenue forecast in 2032 |

USD 5.24 billion |

|

CAGR |

7.90% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Actuation Method, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

BorgWarner, Eaton, Schaeffler, Continental, Denso, Hitachi Automotive Systems, Tenneco, Mahle & Rheinmetall Automotive. |

The analysis of cylinder deactivation system market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis. report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor.

FAQ's

The cylinder deactivation systems market report covering key segments are component, actuation method, end use and region.