Data Pipeline Tools Market Share, Size, Trends, Industry Analysis Report

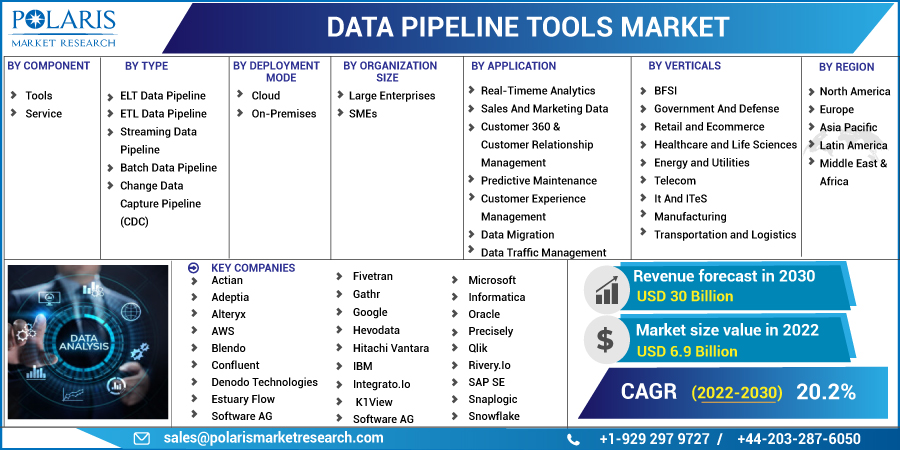

By Component (Tools, Services); By Type; By Deployment Mode (Cloud, On-Premise); By Organization Size; By Application; By Verticals; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 119

- Format: PDF

- Report ID: PM2824

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

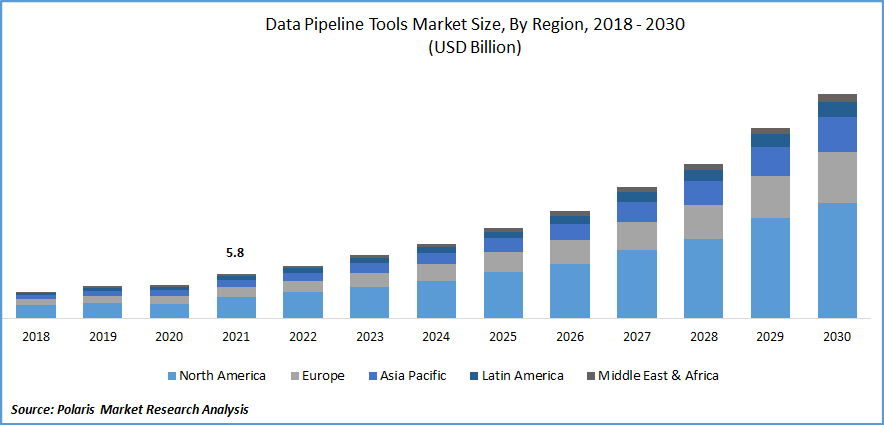

The global data pipeline tools market was valued at USD 5.8 billion in 2021 and is expected to grow at a CAGR of 20.2% during the forecast period. The growing demand for data pipeline tools is expected to be driven due to their ability to reuse and repurpose data flows and the increasing need to combine numerous data sources into a single database.

Know more about this report: Request for sample pages

Data pipeline tools provide a structured framework and respond to flexibility with the changing sources or rising and declining data users. Additionally, it offers security from the initial repeatable pattern of the data, making it reusable and expected to drive market growth. Moreover, the data flow in the pipeline is monitored. It improves the quality of data and is meaningful to the end-user, which avoids the pipeline's breakage, propelling the market growth.

The COVID-19 pandemic had a positive impact on the growth of the data pipeline tools market. Many tools were adopted during the pandemic hit to understand, track and plan accordingly to neutralize the effect of cybersecurity. There was a rapid increase in advanced AI video systems for workplace safety monitoring and virtual networking. Furthermore, many companies released data lakes for better analysis. For instance, AWS provided covid-19 data lake, which gathered data from Johns Hopkins and the New York Times about hospital bed availability and positive patients. Moreover, this data lake helped perform analysis in real-time without consuming much time, which influenced the market growth.

The rising demand to integrate substantial data volumes from numerous internal and external sources require modern data pipeline technology. But the lack of skilled laborers to implement such tools with business intelligence is restraining market growth. However, if organizations made a sound investment in training and certifying the employees with the emerging technologies could effectively influence market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global data pipeline tools are likely driven by the rising demand to access data from anywhere and the rise in cloud computing. The growing demand for organizations to process more data with various network resources and insights increases the need for data pipeline tools. These tools scale billions of data points and build data sets with vertical and horizontal scalability, which will likely complement the market growth.

The demand for data centralization across businesses to manage their data is increasing the need for data pipeline tools. These tools enable data transparency and management, allowing access to data to marketing, data analytics, and BI teams through a single management system to better understand the methods and location of the collected data, which is expected to fuel market growth.

Report Segmentation

The market is primarily segmented based on component, type, deployment mode, organization size, application, verticals, and region.

|

By Component |

By Type |

By Deployment Mode |

By Organization Size |

By Application |

By Verticals |

By Region |

|

|

|

|

|

|

|

Know more about this report: Request for sample pages

Tools segment accounted for the largest share in 2021

The tools segment accounted for the highest revenue share in 2021, owing to flexibility and agility to transfer data. The data tools provide fundamental insights into the data and automate the process effectively and securely, which is expected to drive the market over the forecast period. In addition, tools are required for gathering information from numerous data sources to reach its target.

Furthermore, operators tend to adopt easy tools and software to set, build and deploy, provide resiliency, adapt to a new platform, and perform accordingly, which is expected to propel market growth.

Many key players are investing and increasing their focus on developing data pipeline tools with emerging trends. For instance, Y42 launched “ Modern DataOps Cloud,” which provides businesses with numerous tools to access their data stack to more users with better services for data governance.

ETL data pipeline is expected to spearhead the market growth

The demand for the ETL data pipeline type is driven by its ease of deployment and maintenance and the ability to process data continuously. The ease with which data extraction, transformation, and loading such processes are carried out to reach its target repository has increased its demand among data scientists fueling segment growth.

In addition, the ETL data pipeline loads data and monitors research to develop practical business insights to produce relevant observations and source data which ultimately meet the feature and functionalities of the target database. Furthermore, businesses using the conventional batch process method can upgrade to ETL pipelines without hampering the workflows and keep up with the competitive edge, which is projected to propel market growth.

Cloud deployment is expected to grow at the highest CAGR

Cloud deployment is expected to grow over the forecast period owing to its flexibility and scalability. This deployment sets parameters and ownership to access the data and specifies the amount of data storage to specific infrastructure, raising its demand across various applications. In addition, it offers better scalability and reliability and makes user utilize minimal resources, which lowers operational costs and prevent expensive downtimes, which also complements the market growth.

Furthermore, cloud deployment provides customization and tailored solution according to business needs. Cloud-based data pipelines quickly adapt and offer accessibility of data via numerous filters, apps, and APIs to reach their target. Moreover, it automatically scales computing power and storage capacity depending on the business requirement, which is projected to boost market growth.

SMEs to lead the market over the forecast period

The SMEs segment is expected to lead the market over the forecast period owing to the rising adoption of data pipeline tools across various small and mid-size companies. This elevates customer data to obtain accurate reports and metrics. In addition, organizations are looking for tools that offer high operational efficiency, precise forecasting of sales patterns, and reduced overall cost. Streamlining is expected to increase product demand among SMEs.

Moreover, data pipeline tools enable accessible and accurate information that can transform data into a valuable resource. They are flexible for SMEs, increasing their demand across businesses and driving the segment growth.

Real-time analytics is expected to witness faster growth

The demand for data pipeline tools for real-time analytics is expected to surge significantly over the forecast period as it provides the user with rapid data insights that can drive conclusions immediately. This application allows businesses to prepare and measure data instantly, prevent problems or grab opportunities in real time, and improve the business's decision-making, which is projected to fuel market growth.

Furthermore, streamlining data pipelines let businesses stay ahead of the competition and analyze huge amounts of data in real-time. The business-critical applications that require reporting and analytics use real-time analytics within legacy mainframe systems which is expected to propel market growth.

Healthcare and life science segment is expected to account for the largest share in 2030

Healthcare & life science vertical is expected to dominate the market over the forecast period owing to the rising digitization and growing adoption of tools for building a secure and reliable data pipeline. In addition, the growing demand from healthcare providers to transfer data securely without any complexity with the help of on-premise technologies is expected to bolster market growth.

Furthermore, the healthcare and life science industry has a vast data network and sources, creating massive amounts of data across clinics. Pharmaceutical companies are increasing the demand for products to provide accurate diagnoses to patients, which is expected to boost market growth.

North America dominates the market and is expected to grow significantly over the forecast period

North America is the largest region for data pipeline tools and is expected to witness faster growth over the forecast period owing to rising innovation and emerging new technologies. The rising demand for combining various data volumes from different sources over a single cloud has increased the need for data pipelining and integration across the U.S. and Canada, which is expected to fuel the market over the forecast period.

The presence of major key players and their focus on creating new data pipeline tools and services to deal with integration complexities and data is unaddressed. These regions having the well-established infrastructure to develop new technologies to catalog, manage and analyze critical information is eventually influencing regional growth.

Competitive Insight

Some of the major players operating in the global market include Actian, Adeptia, Alteryx, AWS, Blendo, Confluent, Denodo Technologies, Estuary Flow, Fivetran, Gathr, Google, Hevodata, Hitachi Vantara, IBM, Integrato.Io, K1View, Microsoft, Informatica, Oracle, Precisely, Qlik, Rivery.Io, SAP SE, Snaplogic, Snowflake, Software AG, Talend, Tapclicks, And Tibco.

Recent Developments

In July 2022, SAP SE acquired Askdata to increase its capacity to support businesses in making informative decisions using AI-driven natural language searches. Additionally, these acquisition enables the user to browse, communicate and contribute to real-time data to maximize business insights.

In May 2022, Softserve partnered with google cloud for two new google cloud manufacturing solutions named manufacturing data engine and manufacturing connect solutions and provided solutions from initial implementation to launch.

Data Pipeline Tools Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 6.9 billion |

|

Revenue forecast in 2030 |

USD 30 billion |

|

CAGR |

20.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By Type, By Deployment Mode, By Organization Size, By Application, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Actian, Adeptia, Alteryx, AWS, Blendo, Confluent, Denodo Technologies, Estuary Flow, Fivetran, Gathr, Google, Hevodata, Hitachi Vantara, IBM, Integrato.Io, K1View, Microsoft, Informatica, Oracle, Precisely, Qlik, Rivery.Io, SAP SE, Snaplogic, Snowflake, Software AG, Talend, Tapclicks, And Tibco. |