Demulsifier Market Share, Size, Trends, Industry Analysis Report

By Type (Oil Soluble, Water Soluble); By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3927

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

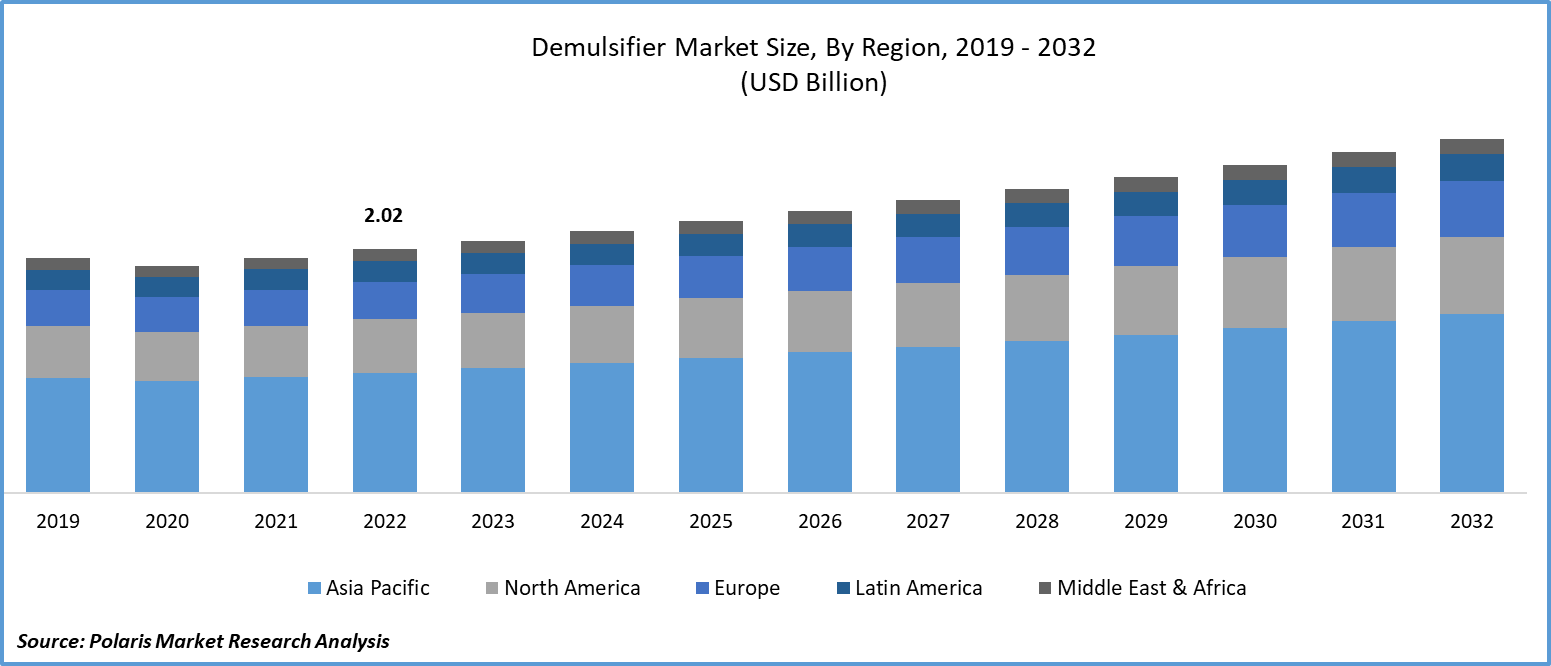

The global demulsifier market size and share was valued at USD 2.09 billion in 2023 and is expected to grow at a CAGR of 3.83% during the forecast period.

The presence of water frequently causes several operational issues during the processing of crude oil. These issues include an increase in production costs as well as equipment and pipeline corrosion. Therefore, it is essential to ensure that the water is separated from the crude oil before it is transported or refined in order to lessen these operational and economic difficulties. One of the most efficient methods for separating crude oil from water is demulsification using a surfactant. Rising company expansion activities among the key market players in the oil and gas industry are fueling the growth of the market. Oilfield chemicals are used to boost oil and gas recovery, improve asset integrity (corrosion inhibitors, biocides, etc.), assure flow assurance (wax inhibitors, demulsifiers, etc.), and help with environmental compliance (water clarifiers).

A demulsifier is a matter of segregating an emulsion into its constituents. It comprises two liquids that neither blend with each other nor segregate into phases. That is, compact droplets of one liquid are uniformly dispensed in the capacity of another liquid. Such a liquid is known as a dispersion avenue, and the droplets are known as the dispersed phase. The demulsifier market demand is on the rise as when a demulsifier is instigated into the emulsion, it gathers on the surface of these droplets and categorizes them. Therefore, it is graded into distinct liquids.

Demulsifiers are utilized at treatment plants to segregate contaminants from water, such as oils, grease, and petroleum commodities. Subsequent to that, it is probable to proceed to its additional purification. It is also utilized by food industry ventures such as meat and fish processing, dairy industry, and confectionary industry. It assists in decreasing the fat matter of the commodity to the wanted value.

The demulsifier market report is a comprehensive assessment of all the opportunities and challenges in the industry. It covers all the recent innovations and major events in the industry while shedding lights on the key market features such as CAGR, supply/demand, cost, production rate and consumption. Along with that, the study offers a thorough analysis of the key market dynamics and latest trends to help businesses develop strategies that will drive demulsifier industry growth.

To Understand More About this Research: Request a Free Sample Report

- For instance, in December 2022, Champion X, the primary provider of chemicals that assist in the operations of the world's oil and gas fields, introduced its local office in Hilton Trinidad.

Moreover, demulsifiers work effectively in the separation of oil and water as the natural stabilizers in the interfacial coating around the water droplets are replaced with demulsifiers. This displacement results from the demulsifier's adsorption at the interface and affects the coalescence of water droplets through improved film drainage.

However, the growing strict government regulations to save the environment are impeding the growth of the demulsifier market. Small droplets of oil and water are combined to create emulsions through the process of emulsification. Emulsions are created by the action of waves and significantly slow down the processes of weathering and cleanup.

Growth Drivers

- Rising oil and gas demand is driving the demand for demulsifiers due to their support in promoting production.

The problem of the development of crude oil emulsions affects the oil sector. It is a typical issue for most oil-producing nations worldwide. In order to extract and transport oil, water-in-oil-type emulsions (also known as reverse emulsions) are generated. The cost of processing and transporting crude oil increases due to the presence of water, which also raises the price of the goods produced by oil refineries. When oil is extracted and delivered, it also causes equipment to corrode. The growing research activities to solve this problem are enhancing the new product innovations on the demulsifier market . A study published in 2022 focused on reviewing the demulsification techniques based on chemical, membrane, electric, magnetic, and microwave separation that have been utilized to separate water-in-oil emulsions in recent years.

The demulsification process is used to separate water from crude oil. It tends to combine with either natural formation water or water that has been blended with injection water as it is produced from a reservoir, driving the need for demulsifiers as they enable the separation of oil and clean water. Research activities are growing to create an effective demulsifier to meet ongoing industrial needs. There is currently a great demand for effective demulsifiers for quick demulsification of crude oil emulsions stabilized by asphaltene. A 2023 study published in Scientific Reports focused on measuring the capability of ethyl cellulose (EC) demulsifiers with various viscosities. The study revealed the effectiveness of EC-4 and EC-22 with their high demulsification efficiency, viscosity, shear stress, and speedy demulsification.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The Oil-soluble segment is expected to witness the highest growth during the forecast period.

The oil soluble segment is projected to grow at a CAGR during the projected period, primarily driven by its effectiveness in separating water from oil. Oil-in-water emulsions are often broken using oil-soluble demulsifiers. The product's wide usage in the oil and gas industry is propelling demand for it in the future. Other than crude oil applications, oil-soluble demulsifiers are also used in pharmaceutical products and lubricants. The rising demand for lubricant oil is further boosting the demand for oil-soluble demulsifiers in the marketplace.

The water-soluble segment registered a substantial revenue share in 2022 due to its rising application in wastewater treatment. Water-in-oil emulsions are typically destabilized with water-soluble demulsifiers. Usually, they assist in oil refining and petrochemicals in separating oil from water. It is known to be environmentally sustainable, as it has a low environmental impact compared to oil-soluble demulsifiers.

By Application Analysis

- The crude oil segment accounted for the largest market share in 2022

The crude oil segment witnessed the largest market share. As a result of the refining, storage, and transportation of crude oil, waste is produced. Because of their high water content and potential health and environmental risks, these wastes cannot be used directly or thrown into the atmosphere. Demulsification, therefore, is crucial to remove water from crude oil before shipment and refining. To break up emulsions, boost oil recovery, and improve water quality, demulsification is a good strategy, driving its application in crude oil extraction.

The petroleum refineries segment is expected to grow at the fastest rate over the next few years due to the requirement of crude oil without any impurities to transform it into jet fuel, petrochemical feedstocks, diesel, and more. The ongoing demand for petrochemical products is fueling the expansion of the demulsifier market in the next few years.

Regional Insights

- Asia Pacific region registered the largest share of the global market in 2022

The Asia Pacific region dominated the global market with the largest market share. This growth is due to the rising demand for oil and gas in the region and the growing economic activities in developing countries. According to the International Energy Outlook report, the number of oil refineries in Asia will rise by 60% by 2050. By 2040, the IEA projects that Asia's daily oil consumption will increase by 9 million barrels. The amount used today per day is 6.5 million barrels. In addition, the increase in LNG will accelerate. This is especially applicable in China and other developing nations in Asia since they see it as a "transitional" fuel. This growth in the demand for gasoline will further create new growth opportunities for the demulsifier market in the coming years.

The Europe region is projected to be the fastest growing region with a healthy CAGR during the study period, owing to the increase in demand for quality oil and gas in the region, which drives the demand for demulsifiers as they assist in filtering the impurities from the crude oil. They are used in the petrochemical industry to produce quality byproducts from crude oil. They are also capable of helping the government meet environmental regulations. Rising effective government regulations are further propelling the demand and growth of the demulsifier market in this region in the future.

Key Market Players & Competitive Insights

The demulsifier market is expected to witness higher competition in the coming years owing to the rising product innovations by companies to increase their product portfolio and gain market share through collaborations, partnerships, mergers, and acquisitions. The growing technological evolution is driving new product innovations by companies.

Some of the major players operating in the global market include:

- Arkema

- Baker Hughes Incorporated

- BASF

- Chemiphase

- Clariant

- Croda International

- Dow Chemical Company

- Ecolab

- Innospec

- Momentive Performance

- Nouryon

- Nova Star LP

- Oil Technics

- Rimpro India

- Schlumberger

- SI Group

Recent Developments

- In July 2022, a study published in European Chemical Societies Publishing focused on discovering highly effective polyether demulsifiers. In this work, bisphenol A, diethylenetriamine, and formaldehyde were used to create bisphenol A phenol amine resin (BPA). The demulsification technology is more efficient at lower temperatures compared to the prevailing technologies.

Demulsifier Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.17 billion |

|

Revenue Forecast in 2032 |

USD 2.94 billion |

|

CAGR |

3.83% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Navigate through the intricacies of the 2024 demulsifier market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.