Dendritic Cell Cancer Vaccine Market Size, Share, Trends, Industry Analysis Report

: By Product (CreaVax, Sipuleucel-T, and Others), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 117

- Format: PDF

- Report ID: PM2964

- Base Year: 2024

- Historical Data: 2020-2023

Dendritic Cell Cancer Vaccine Market Overview

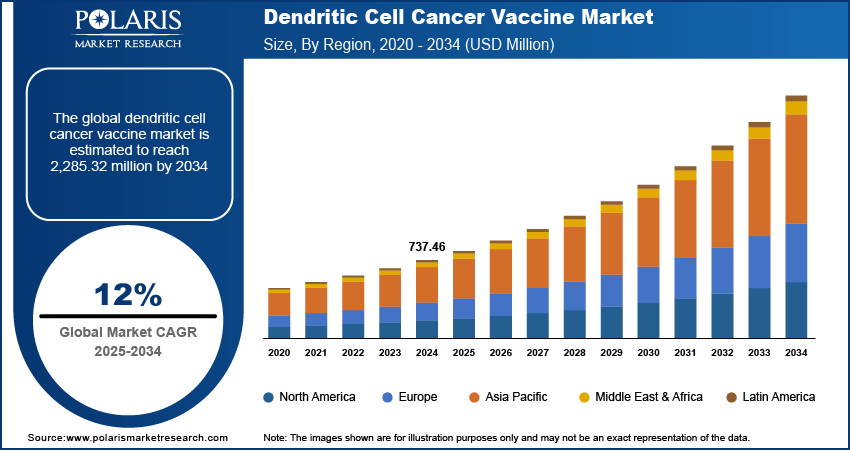

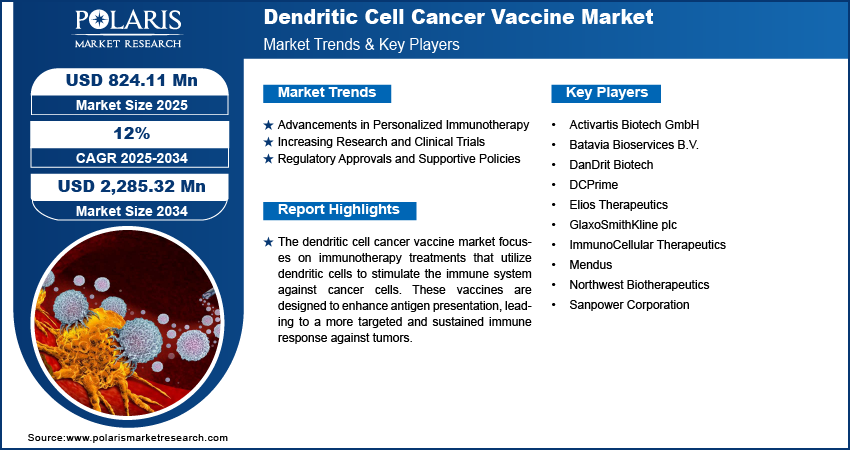

The dendritic cell cancer vaccine market size was valued at USD 737.46 million in 2024. The market is projected to grow from USD 824.11 million in 2025 to USD 2,285.32 million by 2034, exhibiting a CAGR of 12.0% during 2025–2034.

The dendritic cell cancer vaccine market is experiencing growth due to advancements in personalized cancer immunotherapy and increasing research on antigen-specific immune responses. The rising prevalence of cancer, coupled with growing investments in immuno-oncology, is driving demand for dendritic cell-based therapies.

Key dendritic cell cancer vaccine market trends include the development of combination therapies integrating checkpoint inhibitors and personalized neoantigen-based vaccines. Regulatory approvals and ongoing clinical trials further contribute to market expansion. However, challenges such as high manufacturing costs and complex regulatory pathways may limit widespread adoption. The market is expected to grow as technological advancements enhance the efficacy and scalability of dendritic cell cancer vaccines.

To Understand More About this Research: Request a Free Sample Report

Dendritic Cell Cancer Vaccine Market Dynamics

Advancements in Personalized Immunotherapy

The dendritic cell cancer vaccine market demand is propelled by significant progress in personalized immunotherapy approaches. Dendritic cells, as antigen-presenting cells, play a crucial role in initiating and regulating immune responses against tumors. The development of vaccines utilizing autologous dendritic cells loaded with tumor-specific antigens has shown promise in eliciting targeted immune responses. For instance, sipuleucel-T (Provenge) is an FDA-approved dendritic cell-based vaccine for prostate cancer, highlighting the potential of this personalized approach. The success of such therapies underscores the importance of personalized immunotherapy in advancing cancer treatment.

Increasing Research and Clinical Trials

A surge in research activities and clinical trials focusing on dendritic cell-based vaccines is a major driver of dendritic cell cancer vaccine market growth. As of 2024, the clinicaltrials.gov website lists over 1,900 trials associated with the term "cancer vaccine," with 186 being Phase 3 trials. This robust pipeline reflects the scientific community's commitment to exploring the efficacy of dendritic cell vaccines across various cancer types. The outcomes of these studies are anticipated to expand the therapeutic applications of dendritic cell vaccines, thereby fueling dendritic cell cancer vaccine market expansion.

Regulatory Approvals and Supportive Policies

Regulatory approvals and supportive governmental policies significantly contribute to the growth of the dendritic cell cancer vaccine market revenue. The approval of sipuleucel-T by the U.S. Food and Drug Administration (FDA) marked a milestone in cancer immunotherapy, setting a precedent for subsequent vaccine developments. Such endorsements validate the efficacy of dendritic cell vaccines and encourage investment and research in this field. Additionally, government initiatives aimed at promoting cancer research and immunotherapy development provide a conducive environment for dendritic cell cancer vaccine market growth.

Dendritic Cell Cancer Vaccine Market Segment Insights

Dendritic Cell Cancer Vaccine Market Assessment by Product

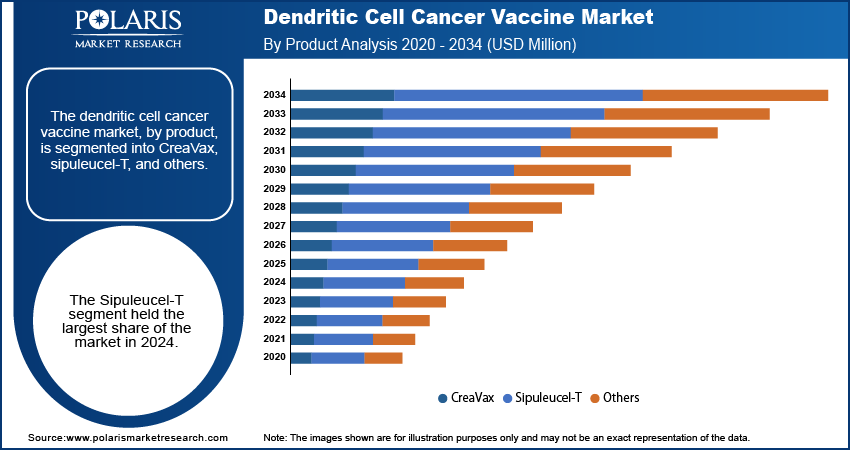

The dendritic cell cancer vaccine market, by product, is segmented into CreaVax, sipuleucel-T, and others. The sipuleucel-T segment dominated the dendritic cell cancer vaccine market share in 2024 due to its ability to enhances the immune response to prostatic acid phosphatase antigen. The rising incidence of prostate cancer across the globe is propelling the demand for sipuleucel-T as it is used to treat certain types of advanced prostate cancer. Moreover, spuleucel-T is the only immunotherapy that has shown results to improve survival in prostate cancer, contributing to its adoption and dominance.

Dendritic Cell Cancer Vaccine Market Evaluation by End Use

The dendritic cell cancer vaccine market, by end use, is segmented into pediatrics and adults. The adult segment dominated the market revenue share in 2024. This dominance is attributed to the higher incidence of cancer among adults, leading to increased demand for effective immunotherapeutic interventions. The prevalence of various cancers, such as lung, breast, and prostate, is notably higher in the adult population, necessitating advanced treatment options such as dendritic cell vaccines. Additionally, the adult segment benefits from a greater number of clinical trials and approved therapies, further contributing to the segment's dominant position.

The pediatric segment, while currently smaller, is experiencing significant growth. This expansion is driven by rising awareness of childhood cancers and the need for specialized treatments tailored to younger patients. Advancements in pediatric oncology and increased research funding are contributing to the development of dendritic cell vaccines specifically designed for children.

Dendritic Cell Cancer Vaccine Market Regional Outlook

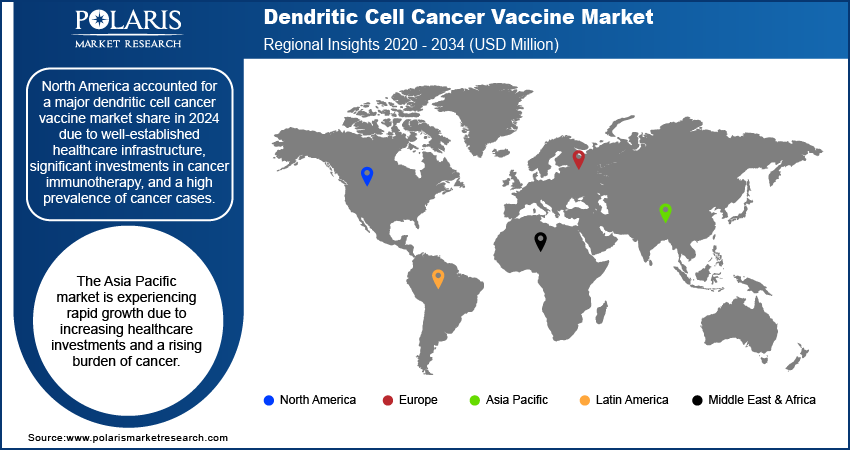

By region, the study provides dendritic cell cancer vaccine market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for a major dendritic cell cancer vaccine market share in 2024 due to well-established healthcare infrastructure, significant investments in cancer immunotherapy, and a high prevalence of cancer cases. The presence of key market players, coupled with strong research and development activities, supports the region’s dominance. The US, in particular, leads in clinical trials and regulatory approvals, facilitating faster adoption of innovative therapies. Additionally, favorable government policies, increasing awareness about personalized cancer treatment, and the availability of advanced medical facilities contribute to the strong market position in North America.

The dendritic cell cancer vaccine market in Europe is driven by increasing research initiatives and a strong focus on immuno-oncology. Several countries, including Germany, France, and the UK, have well-established biopharmaceutical industries that support the development and commercialisation of cancer vaccines. Favorable regulatory frameworks and funding programs for cancer research further contributed to dendritic cell cancer vaccine market expansion. Additionally, the region’s growing geriatric population, which is more susceptible to cancer, increases the demand for advanced immunotherapies. Expanding clinical trials and collaborations between pharmaceutical companies and research institutions further strengthen the market in Europe.

The Asia Pacific dendritic cell cancer vaccine market is experiencing rapid growth due to increasing healthcare investments and a rising burden of cancer. Countries such as China, Japan, and South Korea are actively advancing cancer research, with government initiatives supporting immunotherapy development. Expanding biotechnology sectors and increasing collaborations between academic institutions and industry players are contributing to the progress of dendritic cell-based therapies. Additionally, the growing adoption of personalized medicine and improvements in healthcare infrastructure are expected to enhance market penetration in the region.

Dendritic Cell Cancer Vaccine Market – Key Players and Competitive Analysis Report

In the dendritic cell cancer vaccine market, several companies are actively contributing to advancements in immunotherapy. ImmunoCellular Therapeutics, Ltd. focuses on developing immune-based therapies for cancer treatment. Argos Therapeutics, Inc. is known for its work in personalized immunotherapy using dendritic cell technology. Northwest Biotherapeutics, Inc. specializes in developing personalized immune therapies for various cancer types. DCPrime BV is engaged in creating off-the-shelf dendritic cell vaccines aimed at preventing cancer recurrence. Medigene AG is involved in the development of T cell-based immunotherapies, including dendritic cell vaccines.

Other notable companies include Annias Immunotherapeutics, Inc., which is working on dendritic cell vaccines targeting brain tumors. Immunicum AB focuses on allogeneic dendritic cell vaccines for solid tumors. Kiromic Biopharma, Inc. is developing off-the-shelf, allogeneic cell therapies, including dendritic cell-based approaches. SOTIO a.s. is involved in the development of dendritic cell vaccines for various cancer indications. CELLMEDICA Ltd. is working on cellular immunotherapies, including dendritic cell-based treatments.

Companies such as Vaxil Bio Ltd.; OncoTherapy Science, Inc.; and ImmunoPulse, Inc. are contributing to the development of dendritic cell cancer vaccines. These companies are focusing on various aspects of dendritic cell vaccine development, including personalized approaches, off-the-shelf solutions, and combination therapies. Their efforts are aimed at enhancing the efficacy and accessibility of dendritic cell-based immunotherapies for cancer patients.

ImmunoCellular Therapeutics, Ltd. is a clinical-stage biopharmaceutical company specializing in the development of immune-based therapies for cancer treatment, particularly through dendritic cell vaccines. The company’s primary focus is on leveraging dendritic cells, which are critical components of the immune system, to create innovative cancer immunotherapies. Among its notable programs is ICT-107, a dendritic cell-based vaccine targeting multiple tumor-associated antigens and cancer stem cells. This vaccine has been developed for glioblastoma, an aggressive brain cancer. In addition to ICT-107, ImmunoCellular’s pipeline includes ICT-121 and ICT-140, both of which are dendritic cell-based vaccines targeting CD133-positive cancer stem cells and ovarian cancer antigens, respectively.

Batavia Bioservices B.V. is a major contract development and manufacturing organization (CDMO) specializing in the development of biopharmaceuticals, including vaccines, gene therapies, and monoclonal antibodies. Headquartered in the Netherlands, the company provides comprehensive services covering early-stage development, process optimization, and large-scale production, enabling its partners to accelerate the transition from research to clinical and commercial manufacturing. With a strong focus on innovation, Batavia Bioservices employs bioprocessing technologies to enhance efficiency, reduce costs, and ensure high-quality biopharmaceutical production. The company’s expertise spans viral vector manufacturing, recombinant protein production, and cell and gene therapy development, making it a trusted partner for pharmaceutical and biotechnology firms worldwide. Among its key therapeutic focus areas, Batavia Bioservices is actively engaged in the development and optimization of dendritic cell (DC)-based cancer vaccines.

List of Key Companies in Dendritic Cell Cancer Vaccine Market

- Activartis Biotech GmbH

- Batavia Bioservices B.V.

- DanDrit Biotech

- DCPrime

- Elios Therapeutics

- GlaxoSmithKline plc

- ImmunoCellular Therapeutics

- Mendus

- Northwest Biotherapeutics

- Sanpower Corporation

Dendritic Cell Cancer Vaccine Industry Developments

- July 2024: Diakonos Oncology Corporation announced that the U.S. Food and Drug Administration (FDA) granted Fast Track designation for its dendritic cell vaccine (DCV) targeting pancreatic ductal adenocarcinoma.

Dendritic Cell Cancer Vaccine Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- CreaVax

- Sipuleucel-T

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Paediatrics

- Adults

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Dendritic Cell Cancer Vaccine Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 737.46 million |

|

Market Value in 2025 |

USD 824.11 million |

|

Revenue Forecast by 2034 |

USD 2,285.32 million |

|

CAGR |

12% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The cell cancer vaccine market has been segmented into detailed segments of product and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: Companies in the dendritic cell cancer vaccine market focus on expanding clinical trials, securing regulatory approvals, and enhancing manufacturing capabilities to improve product availability. Strategic collaborations with research institutions and biotechnology firms help accelerate vaccine development. Market players also invest in personalized immunotherapy approaches to improve treatment efficacy and patient outcomes. Geographic expansion, particularly in emerging markets, is a key strategy to increase market penetration. Additionally, companies leverage digital marketing and physician awareness programs to drive the adoption of dendritic cell-based cancer vaccines.

FAQ's

The dendritic cell cancer vaccine market size was valued at USD 737.46 million in 2024 and is projected to grow to USD 2,285.32 million by 2034.

The market is projected to register a CAGR of 12% during the forecast period.

North America had the largest share of the market in 2024.

A few of the key players in the market are Activartis Biotech GmbH, Batavia Bioservices B.V., DanDrit Biotech, DCPrime, Elios Therapeutics, GlaxoSmithKline plc, ImmunoCellular Therapeutics, Mendus, Northwest Biotherapeutics, and Sanpower Corporation.

The sipuleucel-T segment accounted for the largest share of the market in 2024.

The adult segment accounted for a larger share of the market in 2024.

A dendritic cell cancer vaccine is an immunotherapy designed to stimulate the body's immune system to recognize and attack cancer cells. Dendritic cells, which play a crucial role in activating immune responses, are extracted from a patient’s blood, modified to recognize specific cancer antigens, and then reintroduced into the body to enhance the immune response against tumors. These vaccines are developed to target various cancers, including prostate cancer and glioblastoma, by promoting long-lasting immunity. Unlike traditional treatments, dendritic cell cancer vaccines aim to improve the immune recognition of cancer cells while minimizing damage to healthy tissues.

A few key trends in the market are described below: Increasing Research and Development – Ongoing clinical trials and advancements in immunotherapy are driving innovation in dendritic cell cancer vaccines. Growing Adoption of Personalized Medicine – Customization of dendritic cell vaccines based on patient-specific tumor antigens is enhancing treatment effectiveness. Rising Collaborations and Partnerships – Pharmaceutical companies, biotech firms, and research institutions are entering strategic alliances to accelerate vaccine development and commercialization. Regulatory Advancements and Approvals – Increasing regulatory support and approvals for immunotherapies are facilitating market expansion.

A new company entering the dendritic cell cancer vaccine market must focus on personalized immunotherapy, leveraging advanced biomarkers and AI-driven analytics to enhance patient-specific treatment outcomes. Investing in cost-effective and scalable manufacturing techniques would help address production challenges and improve accessibility. Collaborations with research institutions and pharmaceutical companies could accelerate clinical development and regulatory approvals. Expanding into emerging markets with high cancer prevalence and limited immunotherapy options would provide dendritic cell cancer vaccine market opportunities. Additionally, integrating dendritic cell vaccines with combination therapies, such as immune checkpoint inhibitors, could enhance treatment efficacy and market differentiation.

Companies manufacturing, distributing, or purchasing dendritic cell cancer vaccine and related products and other consulting firms must buy the report.