Dental X-ray Market Share, Size, Trends, Industry Analysis Report

By Type (Extraoral, Intraoral); By Technology; By Application; By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4697

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

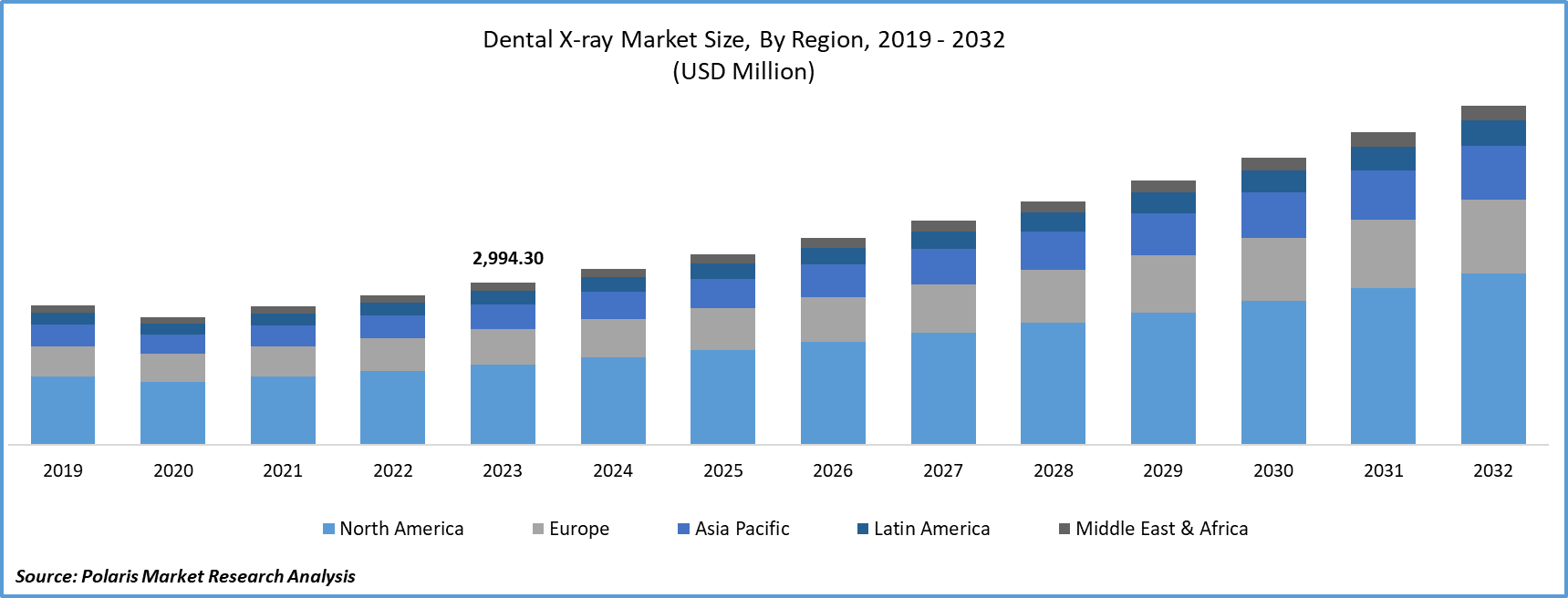

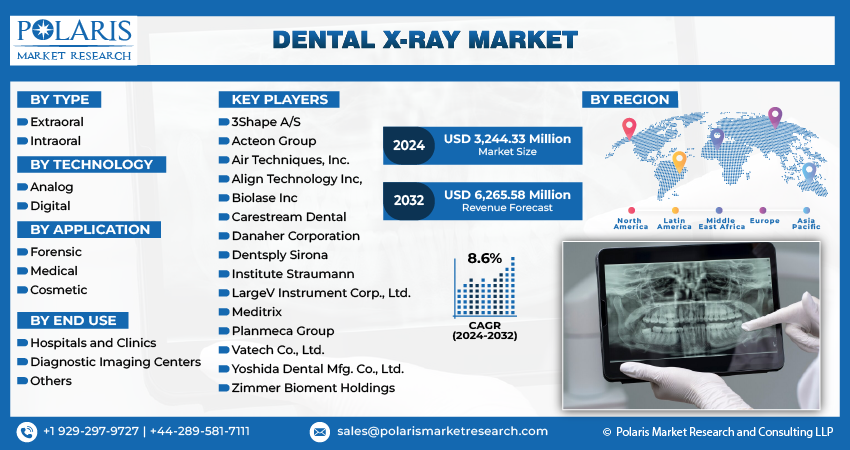

Global dental x-ray market size was valued at USD 2,994.30 million in 2023.

The market is anticipated to grow from USD 3,244.33 million in 2024 to USD 6,265.58 million by 2032, exhibiting the CAGR of 8.6% during the forecast period.

Market Introduction

The dental X-ray market size is experiencing a surge driven by the increasing emphasis on preventive dentistry. With rising awareness about oral health, individuals seek regular check-ups to detect dental issues early. Dental X-rays play a crucial role by providing detailed images and aiding in identifying problems like cavities and gum disease. Advancements in X-ray technology offer superior imaging quality and reduced radiation exposure, promoting their adoption in preventive dentistry. Dental professionals prioritize proactive measures such as regular cleanings and fluoride treatments to prevent dental problems.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

To Understand More About this Research: Request a Free Sample Report

For instance, in October 2023, LunaLite Dental introduced the LunaLite automated laser-assisted dental x-ray positioner. This tool offers a streamlined and comfortable experience for both dental practitioners and patients.

Technological advancements are propelling the market and enhancing imaging and patient care. Digital radiography offers benefits such as reduced radiation exposure and faster image acquisition. Cone-beam computed tomography (CBCT) enables precise three-dimensional visualization of dental structures. Advanced software solutions enhance image analysis and interpretation, improving diagnostic accuracy. Integration of digital technologies with practice management systems facilitates efficient image storage and sharing. Artificial intelligence (AI) algorithms automate tasks, streamlining workflow and enhancing diagnostic capabilities. Ongoing research and development ensure continuous innovation, driving market growth by improving diagnostic precision, patient safety, and workflow efficiency.

Industry Growth Drivers

Increasing Prevalence of Dental Disorders is Projected to Spur Product Demand

The dental X-ray market share is growing due to the increasing prevalence of dental disorders globally. Poor oral hygiene, unhealthy diets, and genetic factors contribute to rising incidences of cavities, periodontal disease, and oral infections. Dental X-rays are crucial for diagnosing issues like decay, bone loss, and infections, enabling timely treatment. Technological advancements like digital radiography and cone-beam computed tomography (CBCT) improve imaging accuracy and safety, driving demand for dental X-ray systems. As the global population ages and oral health awareness increases, the prevalence of dental disorders is expected to rise further, sustaining the market growth.

Growing Dental Care Expenditure is Expected to Drive Dental X-Ray Market Growth

The dental X-ray market share is witnessing growth due to increasing expenditure on dental care. Rising awareness about oral health leads to more dental check-ups and treatments, driving demand for diagnostic procedures like X-rays. Technological advancements in X-ray systems offer superior imaging quality, reduced radiation exposure, and enhanced patient comfort, encouraging their adoption by dental clinics and hospitals globally. Additionally, the aging population contributes to a higher demand for dental X-ray services, as older individuals require more dental treatments. Moreover, government initiatives promoting oral health awareness and improving access to dental care further fuel market growth by encouraging regular dental check-ups and screenings and increasing the utilization of dental X-ray services.

Industry Challenges

High Cost of Equipment is Likely to Impede the Market Growth

The market faces a significant challenge due to the high cost of equipment, deterring adoption among dental practices. Substantial upfront investment, ongoing maintenance expenses, and regulatory compliance costs pose financial burdens, particularly for smaller clinics. Additionally, upgrading to advanced digital X-ray systems further strains budgets. Reimbursement difficulties from insurance providers and government healthcare programs sometimes lead to financial challenges, limiting return on investment. Consequently, many practices delay or forgo investment in innovative X-ray technology, impeding market growth.

Report Segmentation

The dental X-ray market analysis is primarily segmented based on type, technology, application, and end use, and region.

|

By Type |

By Technology |

By Application |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Intraoral Segment Held Significant Market Revenue Share in 2023

The intraoral segment held significant revenue share in 2023 due to its indispensable role as a routine diagnostic tool in dental practice. Its versatility allows precise imaging of specific areas within the mouth, aiding comprehensive assessment and diagnosis. Moreover, intraoral X-rays ensure patient comfort and safety with lower radiation exposure. Their compact design and portability make them suitable for various dental settings, enhancing accessibility. Ongoing technological advancements, including digital imaging, continually improve diagnostic accuracy and efficiency, driving adoption.

By Technology Analysis

Digital Segment is Expected to Experience Significant Growth During the Forecast Period

The digital segment is expected to experience significant growth during the forecast period. Digital X-ray systems offer superior image quality, faster imaging, and enhanced diagnostic capabilities, facilitating accurate diagnoses and treatment planning. Additionally, these systems require lower radiation doses, ensuring patient safety while minimizing health risks. Environmental benefits, such as the elimination of chemical processing and film storage, further drive adoption. Seamless integration with electronic health records streamlines communication between dental professionals, enhancing workflow efficiency. Ongoing technological advancements, including cone-beam computed tomography (CBCT), expand the capabilities of digital imaging, contributing to its anticipated growth in the market.

By Application Analysis

Medical Segment Held Significant Market Revenue Share in 2023

The medical segment held a significant revenue share in 2023. Dental X-rays are indispensable for diagnosing conditions like cavities, periodontal disease, and dental anomalies, facilitating precise treatment planning. They guide surgical procedures, ensuring optimal outcomes in tooth extractions, implants, and orthodontic treatments. X-rays monitor disease progression, evaluate treatment efficacy and aid in orthodontics and prosthodontics. In emergencies, they provide rapid diagnostic insights for prompt intervention. Additionally, X-rays educate patients about oral health conditions and treatment options, enhancing understanding and compliance.

By End Use Analysis

Hospitals and Clinics Segment Held Significant Revenue Share in 2023

The hospitals and clinics segment held a significant revenue share in 2023 due to their comprehensive oral healthcare services, including routine check-ups, specialized treatments, and emergency care. These facilities invest in advanced dental X-ray systems, ensuring accurate diagnoses and effective treatment planning. With a diverse patient base of all ages, they consistently utilize dental X-ray services. Many hospitals have specialized dental departments or clinics equipped with dedicated X-ray facilities, further enhancing revenue. Affiliations with insurance providers facilitate reimbursement, while compliance with stringent regulations ensures patient safety and upholds reputation.

Regional Insights

Asia-Pacific is Expected to Experience Significant Growth During the Forecast Period

Asia-Pacific is expected to experience growth during the forecast period due to its large and rapidly growing population, driving increased demand for dental X-rays. Rising awareness about oral health and economic development leads to higher disposable incomes, enabling more individuals to afford dental treatments and diagnostics. Investments in healthcare infrastructure expand access to dental care and diagnostics, while government initiatives promoting preventive dentistry further drive demand. Additionally, the rise of dental tourism in the region contributes to increased demand for dental services, including diagnostic procedures such as dental X-rays.

In 2023, the North American region accounted for a significant market share due to its advanced healthcare infrastructure and technological innovation, particularly in digital X-rays and CBCT systems. High dental care spending among North Americans, stringent regulatory standards ensuring quality and safety, and extensive dental insurance coverage also contribute to its market dominance. Increasing awareness about oral health encourages preventive dental practices and diagnostics. Moreover, North America's focus on dental research and development leads to continuous improvements in dental imaging technologies.

Key Market Players & Competitive Insights

The dental X-ray market players encompasses various participants, and the anticipated influx of new entrants is set to heighten competition. Market leaders consistently innovate their technologies to sustain a competitive edge, focusing on efficiency, dependability, and safety. These companies prioritize strategic initiatives such as forging partnerships, enhancing product offerings, and engaging in joint ventures. Their objective is to surpass rivals in the sector, ultimately securing a notable dental X-ray market share.

Some of the major players operating in the global dental X-ray market include:

- 3Shape A/S

- Acteon Group

- Air Techniques, Inc.

- Align Technology Inc,

- Biolase Inc

- Carestream Dental

- Danaher Corporation

- Dentsply Sirona

- Institute Straumann

- LargeV Instrument Corp., Ltd.

- Meditrix

- Planmeca Group

- Vatech Co., Ltd.

- Yoshida Dental Mfg. Co., Ltd.

- Zimmer Bioment Holdings

Recent Developments

- In April 2023, DEXIS unveiled FDA 510(k) Clearance for dental findings AI on 2D intraoral X-ray images. Representing the latest iteration of DEXIS software, DTX Studio Clinic introduced an imaging solution, presenting six distinct categories of dental anomalies on periapical and bitewing intraoral radiographs. This technology seamlessly integrates into existing on-premise imaging software, offering practitioners an advanced diagnostic tool to enhance dental treatment planning and patient care.

- In November 2023, RTI unveiled its latest X-ray meter, Mako. This versatile X-ray meter features state-of-the-art detector technology, ensuring precision with an accuracy of ±1.5% kVp uncertainty.

- In November 2022, Henry Schein One revealed a collaboration with VideaHealth, introducing Dentrix Detect AI, developed and powered by VideaHealth. This AI-driven X-ray analysis tool seamlessly integrates into Dentrix Practice Management Systems. Dentrix Detect AI offers real-time clinical decision support to dental professionals, empowering them with advanced diagnostic capabilities.

Report Coverage

The dental X-ray market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, technologies, applications, and end uses, and their futuristic growth opportunities.

Dental X-ray Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3,244.33 million |

|

Revenue forecast in 2032 |

USD 6,265.58 million |

|

CAGR |

8.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in Dental X-ray Market are Air Techniques, Inc., Align Technology Inc, Biolase Inc, Danaher Corporation, Dentsply Sirona

Dental X-ray Market exhibiting the CAGR of 8.6% during the forecast period.

The Dental X-ray Market report covering key segments are type, technology, application, and end use, and region.

key driving factors in Dental X-ray Market are Increasing prevalence of dental disorders

Dental X-ray Market Size Worth $6,265.58 Million By 2032