Dermatology Drugs Market Size, Share, Trends, Industry Analysis Report

: By Therapy (Acne, Psoriasis, Rosacea, Alopecia, and Others), Type, Route of Administration, Distribution Channel, Drug Class, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM1106

- Base Year: 2024

- Historical Data: 2020-2023

Dermatology Drugs Market Overview

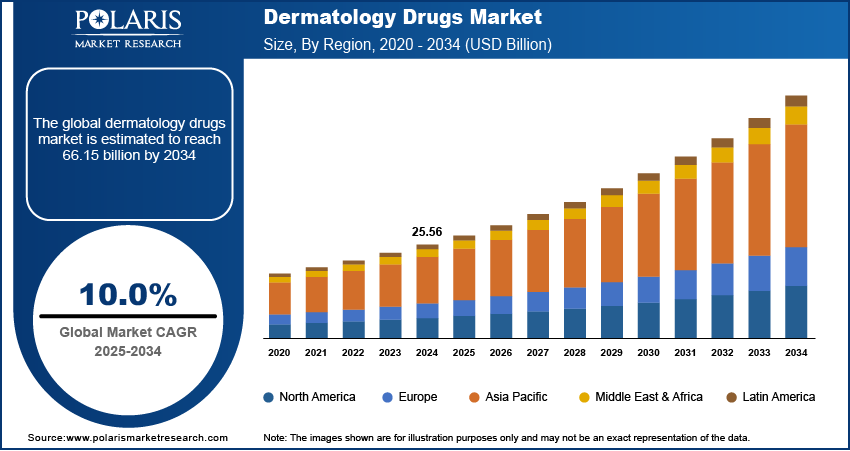

The dermatology drugs market size was valued at USD 25.56 billion in 2024. The market is projected to grow from USD 28.06 billion in 2025 to USD 66.15 billion by 2034, exhibiting a CAGR of 10.0% during 2025–2034.

The dermatology drugs market focuses on the development, production, and distribution of medications used to treat various skin conditions, including acne, eczema, psoriasis, and skin cancer. The market is driven by factors such as the increasing prevalence of skin disorders, rising awareness about skin health, and advancements in dermatological research and treatments. Dermatology drugs market trends include the growing demand for biologics, targeted therapies, and personalized treatments, as well as the rising adoption of over-the-counter dermatological products. Additionally, innovations in drug delivery systems and the increasing focus on aesthetic dermatology are contributing to the market growth.

To Understand More About this Research: Request a Free Sample Report

Dermatology Drugs Market Dynamics

Growing Demand for Biologics in Dermatology

Biologics have become a significant trend in the dermatology drugs market, driven by their targeted action and ability to treat complex conditions such as psoriasis, atopic dermatitis, and hidradenitis suppurativa. Therapies, such as monoclonal antibodies and other biological agents, offer advantages over traditional small-molecule treatments, including fewer side effects and more precise targeting of disease-causing mechanisms. In recent years, biologic drugs have been increasingly approved for a broader range of dermatologic conditions, with the global biologics market for dermatology estimated to grow at a rapid pace. For instance, the approval of drugs such as Dupixent (dupilumab) for eczema has significantly changed treatment paradigms. The adoption of biologics is expected to continue to rise in the coming years due to their effectiveness, which is driving dermatology drugs market growth.

Shift Toward Topical Treatments and Over-the-Counter (OTC) Products

There is an increasing shift toward the use of topical treatments and OTC dermatology products, as they offer convenience and cost-effectiveness for consumers. Topical therapies, such as corticosteroids, retinoids, and moisturizers, remain the first-line treatment for various skin conditions. The growing preference for self-care has led to a surge in OTC dermatology products available in the market, particularly for acne, eczema, and psoriasis management. This trend is also fueled by the rise of e-commerce platforms, which make these products more accessible. Hence, the rising shift toward topical treatments and over-the-counter products propels the dermatology drugs market demand.

Advancements in Personalized Dermatological Treatments

Personalized medicine is gaining momentum in the dermatology drugs market as the industry focuses on tailoring treatments to individual patient needs based on genetic, environmental, and lifestyle factors. Advances in genomics biomarkers and dermatology imaging devices have enabled more precise treatments, particularly in managing chronic skin conditions such as psoriasis and acne. Personalized dermatological therapies offer better outcomes by addressing the root causes of conditions, improving patient compliance, and reducing side effects. In 2023, several companies introduced skin microbiome-based treatments, marking a significant step toward personalized care. With advancements in genetic testing and the development of targeted therapies, the demand for personalized dermatology solutions is expected to increase, further transforming the dermatology drugs market landscape during the forecast period.

Dermatology Drugs Market Segment Insights

Dermatology Drugs Market Assessment – Therapy-Based Insights

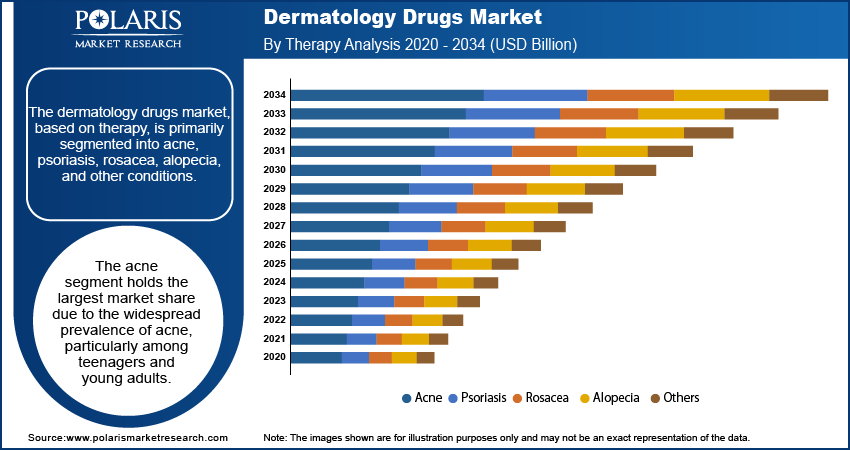

Based on therapy, the dermatology drugs market is primarily segmented into acne, psoriasis, rosacea, alopecia, and others. The acne segment holds the largest market share due to the widespread prevalence of acne, particularly among teenagers and young adults. With advancements in topical treatments, such as retinoids and antibiotics, and oral medications such as oral contraceptives and isotretinoin, the segment remains a dominant player. Psoriasis, another major segment, is also witnessing robust growth, driven by the increasing adoption of biologics and targeted therapies, which have demonstrated improved efficacy over traditional treatments. Psoriasis therapies are expanding with new drug approvals, particularly biologics that offer more durable results for patients having moderate-to-severe forms of the disease.

The alopecia segment is experiencing the highest growth rate, fueled by increasing awareness of hair loss treatments and innovations in topical and systemic solutions, including oral finasteride and newer biologics targeting hair follicles. Rosacea therapies, while essential for managing symptoms such as redness and inflammation, represent a smaller portion of the market, with treatment options focusing on topical agents and oral medications. The others segment includes conditions such as eczema and dermatitis, which, although significant, are growing at a slower pace compared to more prominent areas, including acne and psoriasis. The introduction of new treatments across all these segments continues to boost the dermatology drugs market, particularly in regions with increasing healthcare access and dermatological care awareness.

Dermatology Drugs Market Outlook – Type-Based Insights

Based on type, the dermatology drugs market is bifurcated into prescription and over-the-counter (OTC) products. The prescription segment holds a larger market share due to the specialized nature of treatments required for more severe and complex skin conditions, such as psoriasis, eczema, and alopecia. Prescription medications, including biologics, oral drugs, and potent topical therapies, dominate this segment, with treatments such as Dupixent and biologics for psoriasis leading the way. The segment’s growth is primarily driven by the increasing prevalence of chronic dermatological conditions, advancements in targeted therapies, and the higher cost associated with prescription treatments, which often provide more effective results for patients suffering from moderate to severe conditions.

The OTC segment is registering a higher growth, reflecting the increasing focus on self care and convenience in treating common skin conditions such as acne, mild eczema, and rosacea. The segment benefits from consumer preferences for easily accessible, cost-effective treatments, which are available without a doctor’s prescription. OTC products, including topical creams, moisturizers, and acne treatment products, are being increasingly marketed with a focus on natural ingredients and dermatologically tested formulas, appealing to a broader consumer base. The growth of e-commerce platforms has further accelerated the OTC segment by making these products more readily available to consumers.

Dermatology Drugs Market Evaluation – Route of Administration-Based Insights

By route of administration, the dermatology drugs market is segmented into topical, oral, and parenteral therapies. The topical segment holds the largest market share due to the widespread use of topical treatments for common skin conditions such as acne, eczema, and psoriasis. These products, including creams, gels, and ointments, are typically the first line of treatment for many dermatological issues and are widely available. Topical treatments are preferred for their ease of use, localized effect, and lower risk of systemic side effects. The segment's growth is driven by advancements in formulation technology, improving the effectiveness and tolerability of topical agents.

The oral segment is registering the highest growth rate, particularly due to the increasing demand for oral medications to treat more severe or widespread skin conditions, such as severe acne, psoriasis, and alopecia. Oral therapies such as antibiotics, oral contraceptives for acne, and systemic treatments for psoriasis are gaining popularity as they provide more comprehensive management for chronic conditions. The introduction of novel oral drugs, such as oral biologics and targeted therapies, is fueling the growth of this segment, making it a key area of expansion in the dermatology drugs market. Parenteral treatments, though essential for certain conditions, remain a smaller segment compared to the other routes, primarily used for severe or systemic forms of skin diseases that require injections or infusions.

Dermatology Drugs Market Assessment – Distribution Channel-Based Insights

By distribution channel, the dermatology drugs market is segmented into hospital pharmacies, retail pharmacies, and others. The hospital pharmacies segment holds the largest market share due to their role in providing specialized treatments for complex and severe dermatological conditions. Hospitals often manage patients suffering from chronic skin diseases requiring more advanced therapies, such as biologics and prescription medications that may not be readily available in retail outlets. Additionally, the increasing number of hospital-based dermatology departments and the growing demand for specialized care in treating conditions such as psoriasis, eczema, and skin cancer contribute to the dominance of this segment.

The retail pharmacies segment is registering the highest growth, driven by the increasing demand for over-the-counter (OTC) dermatology products. Consumers are increasingly opting for retail pharmacies due to the accessibility and convenience of purchasing non-prescription products such as acne treatments, moisturizers, and topical medications. The rise in consumer awareness of skin health and the growing trend toward self-medication have accelerated this segment's expansion. Moreover, the growing presence of retail pharmacy chains and online platforms is fueling the growth of this distribution channel, making dermatological products more widely available to the general public.

Dermatology Drugs Market Regional Analysis

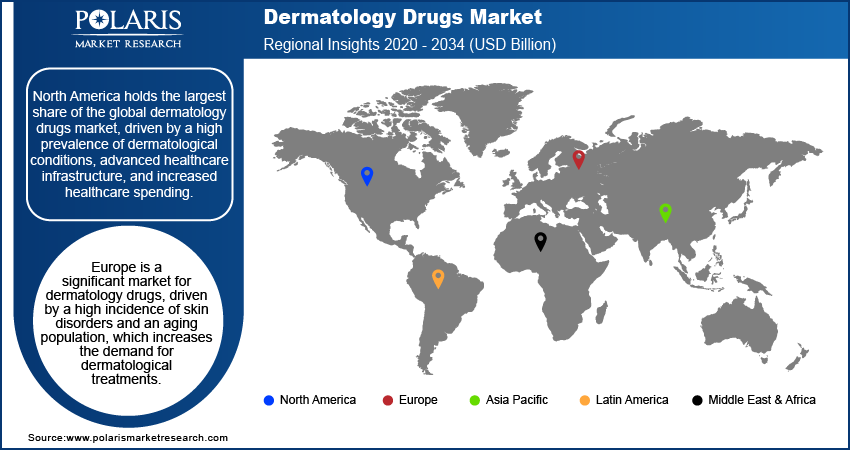

By region, the study provides dermatology drugs market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global dermatology drugs market, driven by a high prevalence of dermatological conditions, advanced healthcare infrastructure, and increased healthcare spending. The region’s dominance is further supported by the presence of major pharmaceutical companies and a well-established distribution network for both prescription and over-the-counter products. Additionally, the rising demand for innovative treatments, such as biologics and targeted therapies, along with strong awareness about skin health, contributes to North America's leading position. The growing adoption of digital health technologies and telemedicine for dermatological care also plays a role in expanding the market. While Europe and Asia Pacific are also witnessing significant growth, North America remains the market leader due to these factors.

Europe is a significant market for dermatology drugs, driven by a high incidence of skin disorders and an aging population, which increases the demand for dermatological treatments. The region benefits from advanced healthcare systems and a strong focus on research and development, which fosters innovation in dermatology therapies. The growing prevalence of chronic skin conditions such as psoriasis and eczema, coupled with the demand for both prescription and over-the-counter products, further supports market growth. The increasing adoption of biologics and personalized treatments, along with supportive regulatory frameworks for dermatological and drug device combination product approvals, are also contributing to the Europe dermatology drugs market expansion.

The Asia Pacific dermatology drugs market is witnessing rapid growth, fueled by the increasing prevalence of skin diseases, a rising middle-class population, and expanding healthcare access. Countries such as China, India, and Japan are seeing a surge in demand for both dermatological treatments and skincare products, driven by factors such as urbanization, changing lifestyles, and greater awareness of skin health. The market in this region is also influenced by the growing adoption of advanced dermatology treatments, including biologics, as well as the increasing availability of OTC products in retail pharmacies. However, disparities in healthcare access between urban and rural areas remain a challenge for market penetration in some countries.

Dermatology Drugs Market – Key Players and Competitive Insights

A few key players in the dermatology drugs market are AbbVie, Eli Lilly and Company, Johnson & Johnson, Novartis, GlaxoSmithKline, Amgen, Pfizer, Sanofi, Bayer, Merck & Co., UCB, Bristol-Myers Squibb, L'Oréal, Galderma, and Meda Pharmaceuticals. These companies are actively involved in developing, manufacturing, and distributing a wide range of dermatological treatments targeting conditions such as acne, psoriasis, eczema, alopecia, and rosacea. Some of these players also focus on biologics and advanced therapies that offer more targeted approaches to skin diseases. Galderma, for example, is known for its broad portfolio of prescription and over-the-counter products, while L'Oréal leads in the skincare segment with a strong emphasis on dermatological cosmetics.

Competitive dynamics in the dermatology drugs market are shaped by factors such as product innovation, regulatory approvals, and strategic collaborations. Companies such as AbbVie and Eli Lilly are investing heavily in biologics and novel drug formulations to address more severe dermatological conditions. Their focus on targeted therapies and biologic drugs is expanding their market share in high-demand segments such as psoriasis and atopic dermatitis. Additionally, companies are focusing on expanding their presence in emerging markets, where increased access to healthcare and growing awareness about skin conditions are driving demand. The shift toward personalized dermatology treatments is also influencing competition, with more companies investing in personalized medicine to cater to individual patient needs.

In terms of market strategy, many players are focusing on expanding their product portfolios and enhancing patient outcomes through innovative delivery mechanisms. For instance, some companies are developing topical treatments with better absorption properties and longer-lasting effects, while others are incorporating telemedicine or digital health platforms to improve patient access to dermatology care. The rise of e-commerce platforms has also impacted the distribution strategy, as companies increasingly use online channels to reach broader consumer bases. Moreover, collaborations between pharmaceutical companies and research organizations are helping to accelerate the development of new drugs, particularly in biologics and targeted therapies, positioning them for sustained growth in the market.

AbbVie is a global biopharmaceutical company known for its dermatology treatments, particularly in the area of immunology and inflammation. The company’s dermatology portfolio includes drugs for conditions such as psoriasis, atopic dermatitis, and acne. AbbVie’s most notable product in dermatology is Rinvoq (upadacitinib), a medication for moderate-to-severe atopic dermatitis. The company is focused on expanding its dermatology offerings, and in recent years, it has made efforts to strengthen its pipeline through acquisitions and partnerships.

Johnson & Johnson is another major player in the dermatology drugs market, with a broad range of products aimed at treating both common and complex skin conditions. The company’s dermatology portfolio includes products for acne, eczema, and psoriasis, as well as over-the-counter skincare items. J&J is particularly recognized for its work in dermatology through its Janssen Pharmaceuticals division.

List of Key Companies in Dermatology Drugs Market

- AbbVie

- Amgen

- Bayer

- Bristol-Myers Squibb

- Eli Lilly and Company

- Galderma

- GlaxoSmithKline

- Johnson & Johnson

- L'Oréal

- Meda Pharmaceuticals

- Merck & Co.

- Novartis

- Pfizer

- Sanofi

- UCB

Dermatology Drugs Industry Developments

- In May 2023, AbbVie received approval from the European Medicines Agency for Rinvoq to treat moderate-to-severe atopic dermatitis in adults.

- In April 2023, Johnson & Johnson announced the launch of Tremfya (guselkumab) for the treatment of moderate-to-severe psoriasis in pediatric patients aged 6 years and older, expanding the drug's indications and reaching a new patient demographic.

Dermatology Drugs Market Segmentation

By Therapy Outlook

- Acne

- Psoriasis

- Rosacea

- Alopecia

- Others

By Type Outlook

- Prescription

- Over-the-Counter (OTC)

By Route of Administration Outlook

- Topical

- Oral

- Parenteral

By Distribution Channel Outlook

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Drug Class Outlook

- Anti-Infectives

- Corticosteroids

- Anti-Acne

- Calcineurin Inhibitors

- Retinoids

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Dermatology Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 25.56 billion |

|

Market Size Value in 2025 |

USD 28.06 billion |

|

Revenue Forecast by 2034 |

USD 66.15 billion |

|

CAGR |

10.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The dermatology drugs market has been segmented on the basis of therapy, type, route of administration, distribution channel, and drug class. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy

The dermatology drugs market growth and marketing strategies are focused on product innovation, expanding patient access, and strengthening brand presence. Companies are increasingly investing in research and development to introduce novel treatments, particularly biologics and personalized therapies, which cater to specific skin conditions. Strategic partnerships and collaborations with healthcare providers and research institutions are also common to accelerate the development of new therapies. Additionally, digital health platforms and e-commerce are being leveraged to enhance patient engagement and improve product accessibility. Companies are also focusing on expanding their market presence in emerging regions, where rising healthcare awareness is driving demand.

FAQ's

? The dermatology drugs market size was valued at USD 25.56 billion in 2024 and is projected to grow to USD 66.15 billion by 2034.

? The market is projected to register a CAGR of 10.0% during the forecast period.

? North America had the largest share of the market in 2024.

? A few key players in the dermatology drugs market include AbbVie, Eli Lilly and Company, Johnson & Johnson, Novartis, GlaxoSmithKline, Amgen, Pfizer, Sanofi, Bayer, Merck & Co., UCB, Bristol-Myers Squibb, L'Oréal, Galderma, and Meda Pharmaceuticals.

? The acne therapy segment accounted for the largest market share in 2024.

? The prescription drugs segment accounted for a larger share of the market in 2024.

? Dermatology drugs refer to medications used to treat various skin conditions and disorders. These conditions can range from common issues such as acne, eczema, and psoriasis to more complex conditions such as skin cancer and alopecia. Dermatology drugs can be delivered in several forms, including topical treatments (creams, gels, and ointments), oral medications (pills and tablets), and parenteral treatments (injections or infusions). These drugs help manage symptoms, reduce inflammation, and, in some cases, cure or control skin diseases. They are prescribed by dermatologists or available over-the-counter, depending on the severity and type of skin condition being treated.

? A few key trends in the market are described below: Increasing Demand for Biologics: Biologic drugs are gaining popularity due to their targeted action and effectiveness for various conditions such as psoriasis and eczema. Rising Personalized Dermatology Treatments: Advancements in genetic research and diagnostics are fueling the demand for personalized therapies tailored to individual patient profiles. Growth of Over-the-Counter (OTC) Products: There is an increasing preference for accessible, self-administered treatments, driving the growth of OTC dermatology products. Advancements in Topical Drug Formulations: Innovations in drug delivery systems, such as enhanced absorption and longer-lasting effects, are improving the effectiveness of topical treatments.

? A new company entering the dermatology drugs market could focus on developing innovative treatments for emerging or underserved conditions, such as rare skin diseases or advanced biologic therapies for chronic conditions such as psoriasis and atopic dermatitis. Investing in personalized medicines using genetic testing to tailor treatments to individual patients could also provide a competitive edge. Additionally, capitalizing on the growing demand for OTC products and expanding into emerging markets with rising healthcare access could offer significant opportunities. Embracing digital health technologies and integrating telemedicine solutions to enhance patient engagement and treatment monitoring would also help differentiate the company in a competitive market.

? Companies manufacturing, distributing, or purchasing dermatology drugs and related products, and other consulting firms must buy the report.