Digestive Health Products Market Share, Size, Trends, Industry Analysis Report

By Ingredient (Food Enzymes, Probiotics, Prebiotics, Others); By Product; By Distribution Channel; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4624

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

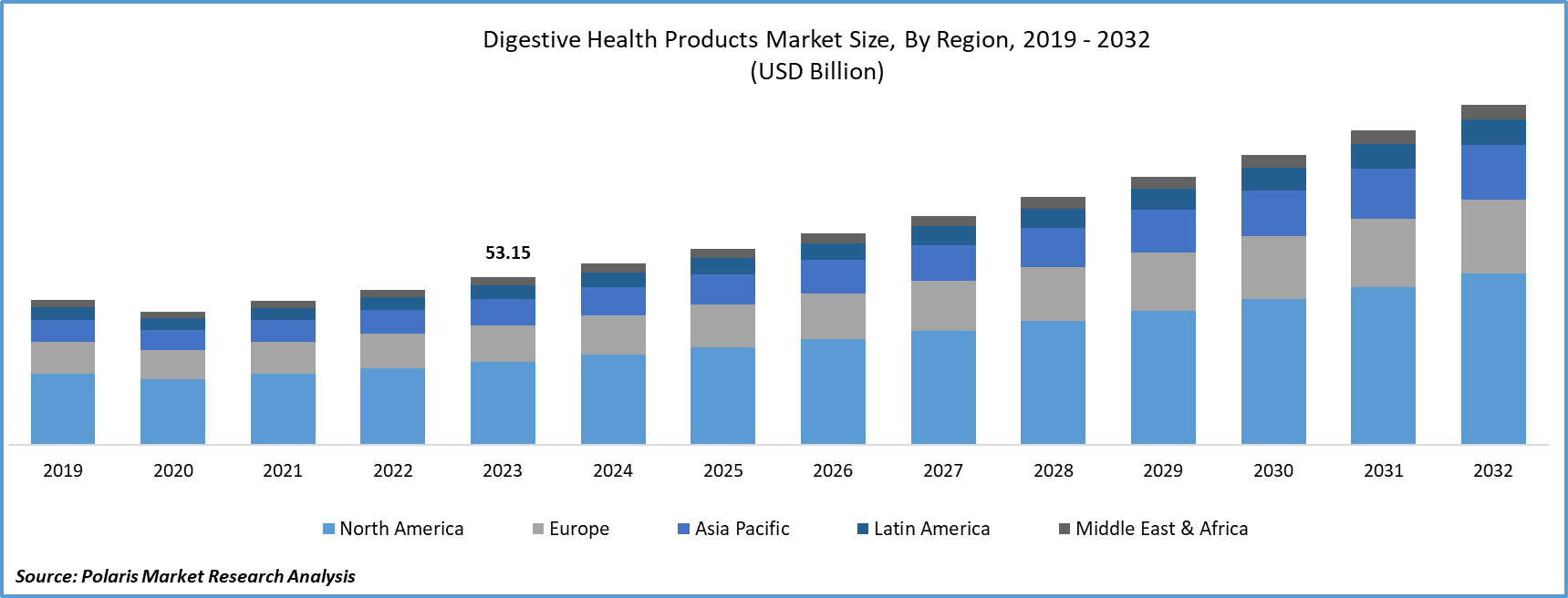

Digestive Health Products Market size was valued at USD 53.15 billion in 2023.

The market is anticipated to grow from USD 57.40 billion in 2024 to USD 107.68 billion by 2032, exhibiting the CAGR of 8.2% during the forecast period.

Market Introduction

The digestive health products market size is surging due to the escalating prevalence of digestive disorders globally. Conditions like irritable bowel syndrome and acid reflux have become more common, driven by sedentary lifestyles and heightened stress. This rise in digestive issues has prompted a surge in demand for solutions like probiotics, prebiotics, digestive enzymes, and dietary fibers known for their efficacy in managing and improving digestive well-being.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

For instance, in November 2023, Acutia introduced Acutia Gut Health, a new daily supplement that brings together the synergistic effects of a postbiotic, a prebiotic, and L-glutamine. This unique combination aims to rapidly alleviate digestive discomfort while fostering long-term improvements in gut health.

To Understand More About this Research: Request a Free Sample Report

The digestive health products market outlook is experiencing a robust surge driven by the escalating trend of incorporating probiotics and fermented foods into daily dietary regimens. Probiotics, known for their beneficial bacteria that promote gut health, are gaining immense popularity among health-conscious consumers. The market is witnessing a proliferation of products, including yogurts, kefir, kombucha, and sauerkraut, enriched with probiotics and fermented ingredients. Moreover, the growing preference for natural and functional foods has led to a surge in the consumption of fermented products. These foods not only contribute to gut health but also offer a spectrum of flavors and textures.

Industry Growth Drivers

Aging Population is Projected to Spur the Product Demand

The global digestive health products market analysis is witnessing substantial growth driven by the aging population. As individuals age, changes in digestive functions lead to increased demand for solutions to maintain optimal digestive health. Probiotics, prebiotics, fiber-rich supplements, and digestive enzymes are gaining popularity for their potential to address age-related digestive concerns. Manufacturers are innovating with formulations tailored to the specific needs of older consumers, emphasizing ingredients that support digestive functions and nutrient absorption. This proactive approach to preventive healthcare has resulted in a diverse range of products, including functional foods and dietary supplements, showcasing the market's commitment to addressing the unique digestive challenges faced by older people.

Growing Awareness of Digestive Health is Expected to Drive Gut Health Supplements Market Growth

The digestive health products market landscape is surging due to growing awareness regarding digestive well-being and overall health. Consumers are increasingly valuing products like probiotics, prebiotics, digestive enzymes, and dietary fibers for their positive impact on gut health. Probiotics, in particular, are popular for fostering beneficial bacteria growth, aiding digestion, and supporting the immune system. Lifestyle changes, stress, and dietary habits have heightened digestive concerns, prompting a proactive approach to gut health.

Industry Challenges

Regulatory Challenges is Likely to Impede the Probiotics for Gut Health Market Growth

Regulatory hurdles limit the digestive health products market's future scope. Stringent and varying regulations across regions create complexities for manufacturers introducing new products. Compliance with diverse frameworks becomes a costly challenge, stifling innovation. Rigorous requirements for scientific evidence supporting health claims slow down product introductions, hindering effective communication of benefits. Ambiguity in classifying ingredients adds further complications, discouraging investment in new digestive health products. Streamlining regulations, fostering international harmonization, and providing clearer health claim guidelines could unlock the market's potential, ensuring innovation and consumer safety and meeting the growing demand for digestive health solutions.

Report Segmentation

The digestive health products market analysis is primarily segmented based on ingredient, product, distribution channel, and region.

|

By Ingredient |

By Product |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Ingredient Analysis

Probiotics Segment Held Significant Market Revenue Share in 2023

The probiotics segment held a significant revenue share in 2023. Probiotics offer varied health benefits. They support digestion by maintaining a balanced gut microbiome, preventing issues like constipation and diarrhea. Probiotics boost the immune system, aiding in defense against infections. Their role in synthesizing essential nutrients contributes to overall nutrition. Emerging research suggests a link between probiotics, mental well-being, and mood regulation. They may assist in weight management by promoting healthy metabolism and help restore gut balance during antibiotic use. Probiotics have also shown positive effects on skin health, managing conditions like acne and eczema.

By Product Analysis

Dairy Products Segment Held Significant Market Revenue Share in 2023

The dairy products segment held a significant revenue share in 2023. Digestive health dairy products, like yogurt, kefir, buttermilk, and certain cheeses, are formulated to support a healthy digestive system. Enriched with live cultures, probiotics, and prebiotics, they contribute to a balanced gut microbiome, aiding in smoother digestion. Yogurt enhances gut health, while kefir offers a diverse range of beneficial bacteria. Buttermilk and certain cheeses also contain probiotics, promoting digestive well-being. Some dairy products are fortified with specific probiotic strains to enhance their digestive health benefits. These products aim to foster a harmonious gut environment and may alleviate common digestive issues.

By Distribution Channel Analysis

E-Commerce Segment is Expected to Experience Significant Growth During the Forecast Period

The e-commerce segment is expected to experience significant growth during the forecast period. E-commerce is driving significant growth in the sale of digestive health products, transforming consumer habits. Online platforms provide a convenient space for consumers to explore and purchase a diverse range of digestive health products, including probiotics and supplements. The accessibility and ease of online transactions have fueled the widespread adoption of e-commerce, reaching a global audience and accommodating diverse consumer preferences. As digital platforms evolve and consumer trust in online shopping deepens, the e-commerce-driven sale of digestive health products is set to experience significant growth, meeting the expanding demand for convenient and accessible wellness solutions.

Regional Insights

North America Region Accounted for a Significant Market Share in 2023

In 2023, the North American region accounted for a significant market share. The digestive health products market size in North America is experiencing substantial growth driven by heightened consumer awareness regarding digestive well-being. Probiotics, prebiotics, dietary supplements, and functional foods tailored for digestive health are gaining traction among health-conscious individuals. Factors such as a focus on preventive healthcare, an aging population, and increased recognition of the connection between digestive health and overall wellness are contributing to this market surge.

Asia-Pacific is expected to experience growth during the forecast period. Asia-Pacific's digestive health products industry is booming, driven by a health-conscious population embracing holistic well-being. Tailoring products to diverse tastes, market players are blending traditional remedies with modern supplements, incorporating locally sourced ingredients known for digestive benefits. E-commerce has played a pivotal role, providing convenient access to this range for consumers across diverse Asian countries.

Key Market Players & Competitive Insights

The digestive health products market player is characterized by a diverse array of participants, and the expected entry of new players is poised to intensify competitive dynamics. Leaders in the market consistently enhance their technologies, aiming to maintain a competitive advantage by emphasizing efficiency, reliability, and safety. These organizations prioritize strategic endeavors, including forming partnerships, improving product portfolios, and participating in collaborative ventures. Their primary goal is to outperform competitors within the industry, ultimately securing a significant digestive health products market share.

Some of the major players operating in the global digestive health products market include:

- Abbott Nutrition

- Bayer AG

- Cargill

- Chr. Hansen Holding A/S

- Danone

- DuPont Nutrition & Biosciences

- Herbalife Nutrition Ltd.

- International Flavors & Fragrances Inc.

- Johnson & Johnson

- Kerry Group

- Nestlé Health Science

- Pharmavite LLC (Nature Made)

- Procter & Gamble

- Reckitt Benckiser

- Yakult Honsha Co., Ltd.

Recent Developments

- In September 2022, MegaFood broadened its range of digestive wellness offerings by introducing the Digestive Health Water Enhancers. These water enhancers provide assistance to the gut, enriched with prebiotics and probiotics for digestive support.

- In April 2023, Gnosis unveiled an addition to its probiotic lineup, LifeinU L.Rhamnosus GG 350, an upgraded quality specification of the already-established reference probiotic strain, LifeinU L.Rhamnosus GG.

- In March 2023, Nutrazee revealed the introduction of its latest offering, Nutrazee Probiotic Gummies for Digestive & Immune Health. This recent inclusion in the company's product range is specially crafted to promote digestive and immune health, catering to both children and adults.

Report Coverage

The digestive health products market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, ingredients, products, distribution channels, and their futuristic growth opportunities.

Digestive Health Products Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 57.40 billion |

|

Revenue forecast in 2032 |

USD 107.68 billion |

|

CAGR |

8.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in Digestive Health Products Market are Abbott Nutrition, Bayer AG, Cargill, Danone, DuPont Nutrition & Biosciences, Johnson & Johnson

Digestive Health Products Market exhibiting the CAGR of 8.2% during the forecast period.

The Digestive Health Products Market report covering key segments are ingredient, product, distribution channel, and region.

key driving factors in Digestive Health Products Market are Growing awareness of digestive health

The global Digestive Health Products market size is expected to reach USD 107.68 billion by 2032