Digital Map Market Size, Share, Trends, Industry Analysis Report

: By Technology (LiDAR, InSAR, GIS, and Others), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 134

- Format: PDF

- Report ID: PM1076

- Base Year: 2024

- Historical Data: 2020-2023

Digital Map Market Overview

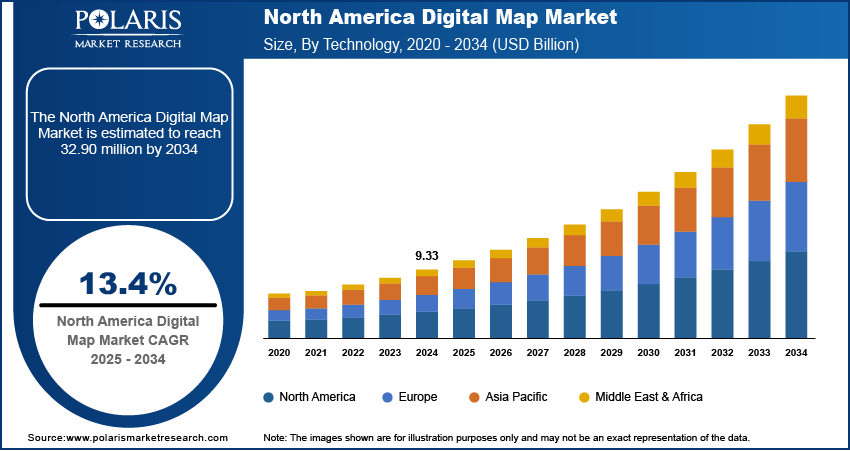

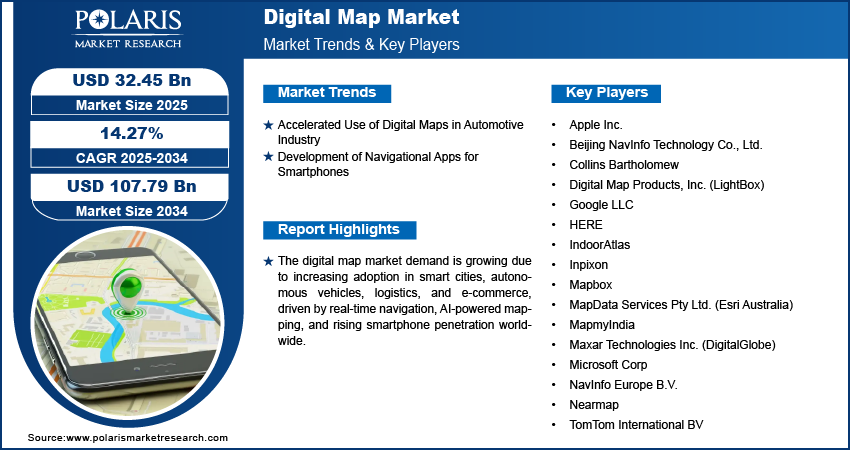

The global digital map market size was valued at USD 28.42 billion in 2024. The market is projected to grow from USD 32.45 billion in 2025 to USD 107.79 billion by 2034, exhibiting a CAGR of 14.27% from 2025 to 2034.

The digital map market demand is expanding rapidly, driven by advancements in technology and increasing reliance on location-based services. A digital map is a dynamic representation of geographical areas, integrating real-time data for navigation, urban planning, and commercial applications. Businesses, governments, and consumers use digital maps for route optimization, asset tracking, and geospatial analysis, propelling the market growth.

Growing smartphone adoption is expected to provide lucrative digital map market opportunities during the forecast period. According to the world economic forum, in 2022, global mobile subscriptions exceeded 8.58 billion, surpassing the world population of 7.95 billion, highlighting the widespread reach of mobile technology. Increased smartphone penetration enhances accessibility to GPS-based applications, ride-hailing services, and augmented reality navigation. Higher smartphone dependency in lower-income groups further strengthens the demand for digital maps as mobile internet becomes the primary mode of connectivity for many users.

To Understand More About this Research: Request a Free Sample Report

The rapid deployment of 5G technology is significantly driving the growth of the digital maps market by enhancing data transmission speeds and connectivity. This advancement enables more precise, real-time, and responsive mapping solutions critical for modern applications. The US Department of Defense’s Private 5G Deployment Strategy further highlights the strategic integration of high-speed networks to support improved communication and faster decision-making. Urban areas, with slightly higher smartphone dependence, are expected to benefit the most from 5G-enabled digital mapping, fueling demand across industries such as autonomous vehicles, smart cities, and logistics, where accurate and dynamic mapping is essential.

According to the digital map market outlook, businesses leveraging real-time mapping technology will gain competitive advantages, while governments can enhance infrastructure planning. The market growth trajectory is set to accelerate, driven by evolving consumer needs and technological advancements.

Digital Map Market Dynamics

Accelerated Use of Digital Maps in Automotive Industry

The growing integration of AI and real-time data analytics in digital maps is transforming the automotive industry. The demand for precise navigation, intelligent route planning, and safety-enhancing features continues to rise in the industry as vehicles become more connected. Automakers and tech companies are leveraging digital maps to support autonomous driving, electric vehicle infrastructure, and usage-based insurance models. For instance, in June 2024, Genesys International launched an AI-powered navigation map with AR navigation, AI-driven route planning, ADAS, ISA, and usage-based insurance, enhancing driving safety and convenience and supporting future autonomous and electric vehicle developments.

Advanced features such as Intelligent Speed Assistance (ISA) and real-time hazard detection are becoming essential for next-generation mobility solutions. The rapid adoption of these technologies is driving investments in high-precision mapping solutions. The accelerated use of digital maps is shaping the future of transportation by providing safer, more efficient, and highly personalized driving experiences. Hence, the accelerated use of digital maps in the automotive industry is propelling the digital map market demand globally.

Development of Navigational Apps for Smartphones

The integration of navigational apps in smartphones has revolutionized how users navigate as they offer turn-by-turn directions, real-time traffic updates, and points of interest information. Their convenience has made them essential for everyday travel and exploration, increasing the need for accurate and up-to-date mapping data.

Competition among app developers has led to continuous advancements in mapping technologies. Augmented reality features, voice-guided navigation, and crowd-sourced data integration enhance user experience and mapping accuracy. The widespread adoption of navigation apps has also created a growth opportunity for businesses, enabling targeted promotions and location-based marketing.

Growing smartphone usage and the increasing reliance on navigational apps push companies to innovate and invest in advanced mapping technologies, which is boosting the digital map market growth.

Digital Map Market Segment Analysis

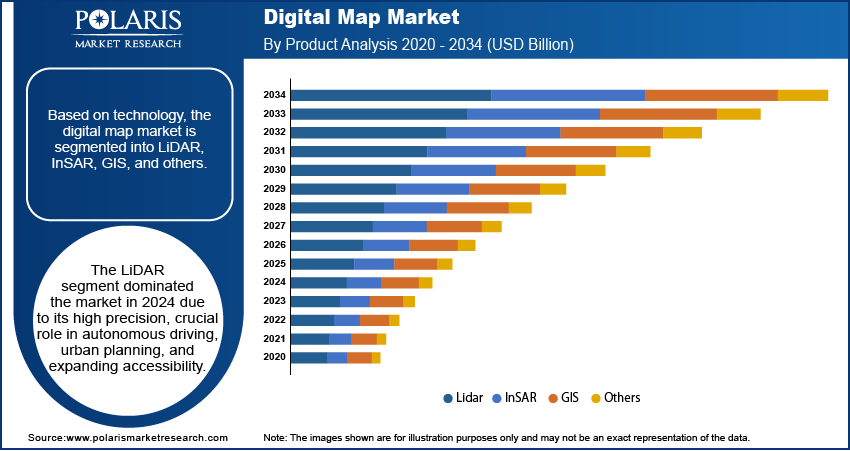

Digital Map Market Assessment by Technology Outlook

The global digital map market segmentation, based on technology, includes LiDAR, InSAR, GIS, and others. The LiDAR segment accounted for ~40% of the digital map market share in 2024 due to its unmatched precision in capturing high-resolution 3D data. The ability to create detailed maps of terrain, buildings, and vegetation has made it a crucial tool for industries relying on accurate spatial information. Its capability to detect changes in topography over time enhances applications such as urban planning, infrastructure development, and environmental monitoring.

The growing demand for autonomous driving solutions has contributed to the digital map market development. LiDAR's precise object recognition and elevation modeling are essential for self-driving vehicles to navigate safely. Greater affordability and accessibility of LiDAR technology have led to its wider adoption, accelerating innovation and expanding its role in digital mapping solutions.

Digital Map Market Evaluation by Application Outlook

The global digital map market segmentation, based on application, includes tracking and telematics, real-time location data management, risk assessment and disaster management, geocoding and geo-positioning, and route planning and optimization. The route planning and optimization segment is expected to register the highest CAGR of 17.5% during the forecast period, driven by the growing need for efficient transportation and logistics solutions. Advanced algorithms analyze traffic patterns, road conditions, and delivery constraints to generate optimized routes, helping businesses reduce costs, minimize delays, and improve operational efficiency. The ability to enhance fuel efficiency and resource utilization has made these applications essential across industries.

Real-time data integration allows dynamic route adjustments, increasing adaptability to changing conditions and unexpected disruptions. Sectors such as logistics, ride-hailing, and field service management depend on route planning solutions to streamline operations and enhance customer satisfaction. Increasing demand for automation and precision in transportation is fueling digital map market growth, pushing continuous innovation in route optimization technology.

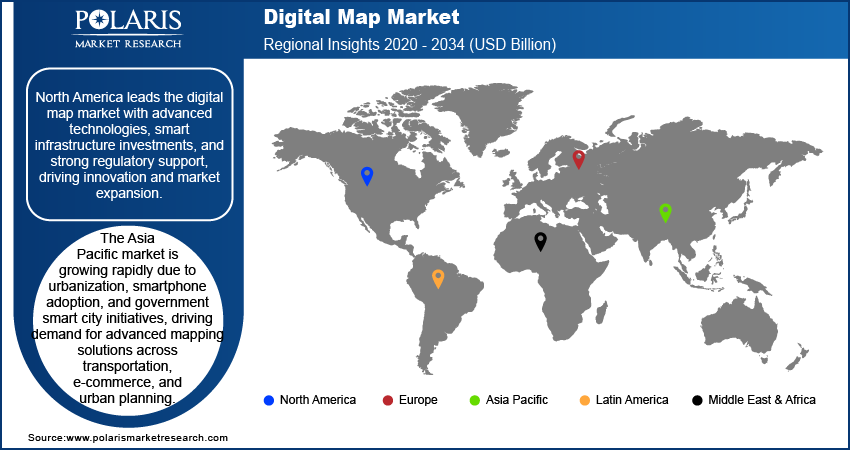

Digital Map Market Regional Analysis

By region, the study provides digital map market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market revenue share in 2024 due to the rapid adoption of location-based services and investments in smart infrastructure projects. The presence of advanced mapping technologies has accelerated market growth, enabling industries such as transportation, logistics, and retail to enhance operational efficiency. Leading technology companies are heavily investing in high-definition mapping data, augmented reality solutions, and 3D mapping technologies to meet evolving demands.

In North America, strong regulatory frameworks and government initiatives drive innovation, ensuring seamless integration of mapping solutions in smart cities and autonomous vehicles. The growing focus on precision agriculture and intelligent transportation systems strengthens digital map market expansion. North America remains a key hub for digital mapping advancements with a thriving ecosystem of tech giants and startups.

The Asia Pacific digital map market is experiencing substantial growth due to rapid urbanization and extensive infrastructure development. Cities are expanding, leading to increased demand for accurate and real-time digital mapping solutions to navigate complex urban environments.

Smartphone proliferation in countries such as China, India, and Japan has accelerated the digital map market growth. These devices rely heavily on GPS navigation systems and mapping technologies, driving adoption across various industries. Government initiatives focused on smart city development and enhanced digital connectivity also play a crucial role in boosting the market. These efforts promote the integration of advanced mapping technologies in urban planning, transportation, agriculture, and e-commerce, paving the way for future innovation and growth in the region.

Digital Map Market – Key Players and Competitive Analysis Report

The competitive landscape of the digital map market is shaped by global leaders and regional players focusing on innovation, strategic partnerships, and geographical expansion. Companies such as Apple Inc.; Mapbox; Maxar Technologies Inc. (DigitalGlobe); Digital Map Products, Inc. (LightBox); MapmyIndia; Microsoft Corp; Beijing NavInfo Technology Co., Ltd.; Nearmap; Inpixon; Google LLC; MapData Services Pty Ltd. (Esri Australia); HERE; Collins Bartholomew; TomTom International BV; IndoorAtlas; and NavInfo Europe B.V. leverage strong R&D capabilities and vast distribution networks to develop advanced mapping solutions.

Continuous product innovation enhances efficiency, accuracy, and scalability, meeting rising industry demands. Regional firms enter the market with cost-effective and specialized solutions tailored to local needs. Mergers and acquisitions, and collaborations with technology firms strengthen market positioning, fostering rapid advancements. The increasing adoption of digital maps in sectors such as transportation, e-commerce, and urban planning is intensifying competition, driving significant technological progress in the industry.

Apple Inc., headquartered in Cupertino, California., designs, manufactures, and markets smartphones, tablets, PCs, and wearables. It offers software, cloud, payment, and digital services globally, with a strong presence across multiple regions. In March 2024, Apple Maps introduced new features such as suggesting refuel stops for EVs and reading license plates to avoid restricted areas. Advanced navigation tools and upcoming announcements were witnessed at WWDC 2024 event.

Mapbox provides AI-powered location technology for businesses, enabling navigation for people, packages, and vehicles. It offers flexible, secure, and customizable mapping solutions. In January 2024, Mapbox introduced new AI-powered features in its latest Navigation SDK. It equips automakers to offer compelling alternatives to Apple CarPlay and Android Auto owing to AI-enabled navigation features, integration with in-vehicle systems, and interfaces to third-party services.

List of Key Companies in Digital Map Market

- Apple Inc.

- Beijing NavInfo Technology Co., Ltd.

- Collins Bartholomew

- Digital Map Products, Inc. (LightBox)

- Google LLC

- HERE

- IndoorAtlas

- Inpixon

- Mapbox

- MapData Services Pty Ltd. (Esri Australia)

- MapmyIndia

- Maxar Technologies Inc. (DigitalGlobe)

- Microsoft Corp

- NavInfo Europe B.V.

- Nearmap

- TomTom International BV

Digital Map Industry Development

In March 2024, Alphabet (GOOGLE) announced a feature on Google Maps that shows entrances for buildings to some select users, addressing the issue of navigating to specific building portions on the map.

In April 2023, Google rolled out a new indicator in its mapping platform, 'Google Maps.' The indicator will help users prevent losing their pin. With the new indicator, when the users manually put a pin in the map by tapping a location or when they find a place through Maps search, they can explore around without losing their pin.

In February 2023, Microsoft Maps selected Otonomo to improve its global mapping products and services. Streaming connected vehicle data provided by Otonomo will help Microsoft develop enhancements to its mapping services for Microsoft Maps users across Microsoft Azure, Windows, Microsoft 365, and Bing. This will include providing current traffic conditions, accident notification, and route optimization.

Digital Map Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- LiDAR

- InSAR

- GIS

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Tracking and Telematics

- Real-time Location Data Management

- Risk Assessment and Disaster Management

- Geocoding and Geo-Positioning

- Route Planning and Optimization

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Infrastructure and Energy

- Mobile Device

- Retail

- Military & Defense

- Government

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Map Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 28.42 billion |

|

Market Size Value in 2025 |

USD 32.45 billion |

|

Revenue Forecast by 2034 |

USD 107.79 billion |

|

CAGR |

14.27% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 28.42 billion in 2024 and is projected to grow to USD 107.79 billion by 2034.

The global market is projected to register a CAGR of 14.27% during the forecast period.

North America dominated the market in 2024.

A few key players in the market are Apple Inc.; Mapbox; Maxar Technologies Inc. (DigitalGlobe); Digital Map Products, Inc. (LightBox); MapmyIndia; Microsoft Corp; Beijing NavInfo Technology Co., Ltd.; Nearmap; Inpixon; Google LLC; MapData Services Pty Ltd. (Esri Australia); HERE; Collins Bartholomew; TomTom International BV; IndoorAtlas; and NavInfo Europe B.V.

The LiDAR segment led the market share in 2024.

The route planning and optimization segment is anticipated to register the highest growth rate during the forecast period.