LiDAR Market Size, Share, Trends, Industry Analysis Report

By Type (Solid-State, Mechanical), By Component, By Range, By Installation, By Services, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 120

- Format: PDF

- Report ID: PM1421

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

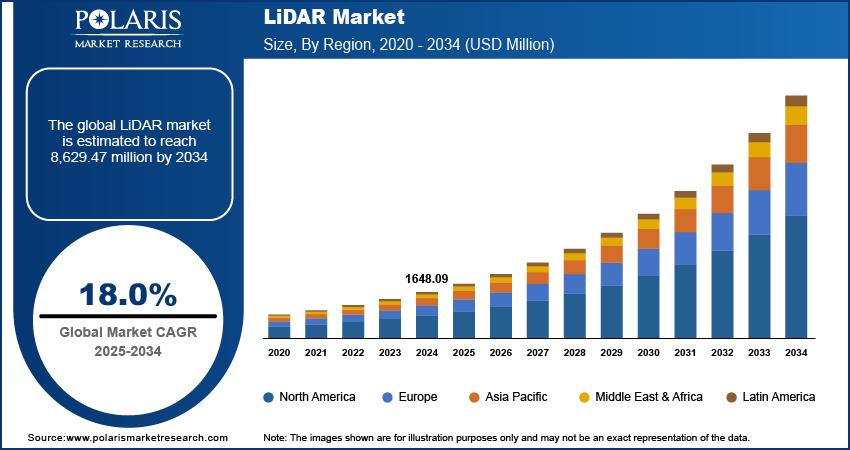

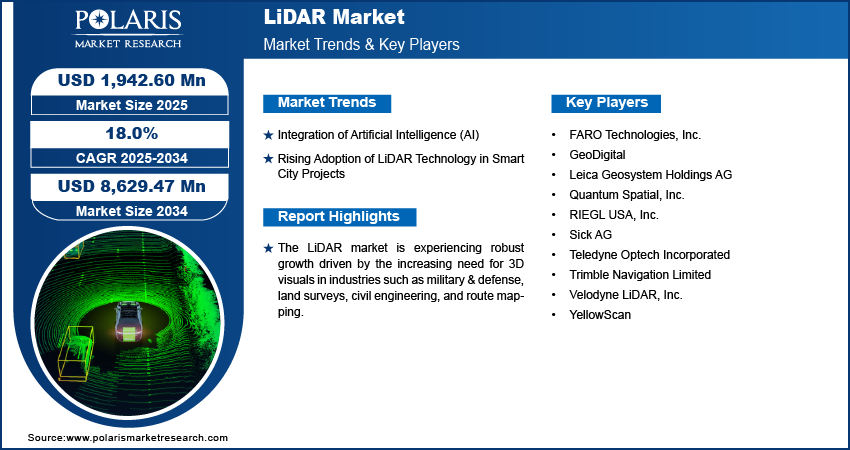

The light detection and ranging (LiDAR) market size was valued at USD 1,648.09 million in 2024 and is projected to register a CAGR of 18.0% from 2025 to 2034. The market is experiencing robust growth driven by the increasing need for 3D visuals in various industries, such as military & defense, land surveys, civil engineering, and route mapping. Moreover, LiDAR technology facilitates environmental monitoring in smart cities by supplying precise 3D data for mapping green areas, monitoring vegetation health, and evaluating air quality. This data facilitates sustainable urban development, thus boosting the adoption of LiDAR systems.

Key Insights

- In 2024, the short range (< 200m) segment dominated, due to its applications in manufacturing settings and industrial automation.

- The aerial surveying segment dominated in 2024. It is driven by its application in monitoring incidents in various areas such as roads, railways, highways, and bridges.

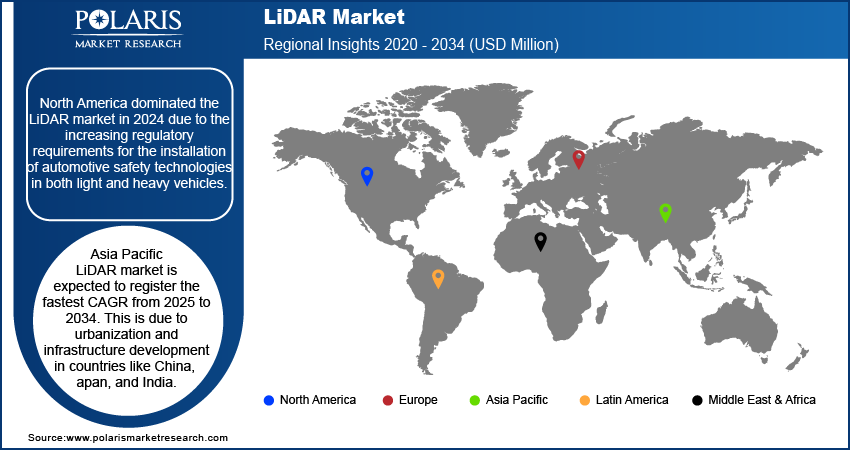

- North America held the largest share in 2024. The dominance is attributed to the increasing regulatory requirements for the installation of automotive safety technologies in light and heavy vehicles.

- The Asia Pacific LiDAR industry is expected to register the highest CAGR from 2025 to 2034. This is attributed to urbanization and infrastructure development in countries such as China, Japan, and India.

Industry Dynamics

- The rising integration of artificial intelligence (AI) into LiDAR technology is expected to boost the LiDAR industry growth.

- The market is witnessing substantial growth, fueled by the increasing implementation of smart city projects for urban planning, development, and management.

- High costs of LiDAR systems are restraining the growth of the market.

- Increasing investments and developments in advanced driver assistance systems (ADAS) systems are expected to offer opportunities in the coming years.

Market Statistics

2024 Market Size: USD 1,648.09 million

2034 Projected Market Size: USD 8,629.47 million

CAGR (2025–2034): 18.0%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

LiDAR (Light Detection and Ranging) is a remote sensing technology that measures distances by emitting laser pulses and analyzing their reflection from surfaces. It generates precise, three-dimensional information about the shape and surface characteristics of objects or landscapes. LiDAR has a variety of applications, including autonomous vehicles, environmental monitoring, and topographic surveying.

The laser scanners, crucial components of LiDAR, are another major contributor to the expansion of the LiDAR market size. They are capable of capturing intensity values to provide return signal strength, allowing for the differentiation of objects with different levels of reflectivity.

LiDAR laser scanners generate 2D point cloud data used in tasks such as localization, mapping, and environmental modeling. For instance, in December 2019, Pepperl+Fuchs launched the R2300 multi-layer scanner with four scan planes, enabling high measurement density in advanced LiDAR laser technology.

Market Trends and Drivers Analysis

Integration of Artificial Intelligence (AI)

The LiDAR market's CAGR is rising due to the incorporation of artificial intelligence into LiDAR technology. This integration is enhancing the capabilities and applications of LiDAR systems across various industries. AI-enabled LiDAR systems are being utilized to process large volumes of data more efficiently and accurately.

The use of AI algorithms has empowered LiDAR to better interpret and analyze 3D spatial data in real-time, leading to improved autonomous navigation for vehicles, drones, defense, and robots. For example, in July 2024, Zen Technologies, in collaboration with AI Turing Technologies, developed an AI-driven robotic quadruped that utilizes LiDAR to generate live 3D terrain maps. The quadruped enables enhanced mission planning, navigation, and threat evaluation for defense operations.

AI integration in LiDAR helps overcome limitations like data interpretation speed and complexity. This optimization enhances LiDAR systems by enabling predictive capabilities and adaptive responses as AI advances, thus driving market expansion.

Rising Adoption of LiDAR Technology in Smart City Projects

The LiDAR market is witnessing substantial growth, fueled by the increasing implementation of smart city projects for urban planning, development, and management. For example, according to the Indian Ministry of Housing and Urban Affairs, 90% of 100 smart city projects have been completed, with the remaining 10% currently in progress and receiving an allocation of Rs. 19,102 crores.

LiDAR technology is used in urban planning to create detailed 3D maps of city landscapes. This helps city planners visualize existing structures, design new projects, and improve land utilization, which drives the LiDAR market revenue.

For instance, in January 2022, Quanergy Systems, Inc. presented its 3D IoT LiDAR solutions and technologies for smart cities at CES 2022 in Las Vegas. These solutions included smart mobility, building occupancy management, perimeter intrusion detection, and retail flow management analytics.

Segment Analysis

Assessment by Range

The LiDAR market segmentation, based on range, includes short range (< 200m), medium range (200-500m) and long range (> 500m). In 2024, the short range (< 200m) segment dominated the market, mainly attributed to its applications in manufacturing settings and industrial automation. Short range LiDARs can sense object proximity and detect objects within the 0–200 m range to enhance operational safety and efficiency.

Short range LiDAR systems are integrated into robotics, drones, and autonomous vehicles for obstacle detection and avoidance in close proximity, contributing to system safety. The increasing use of short range LiDARs in various sectors, such as automotive, security, and industrial robotics, is driving the growth of the short range segment in the LiDAR market.

For instance, in January 2024, Innoviz Technologies collaborated with an OEM to develop an advanced short range LiDAR for L4 autonomous vehicles. This short range LiDAR, tailored for light commercial vehicles, shuttles, taxis, and trucks, aims to enhance the safety and performance of autonomous driving.

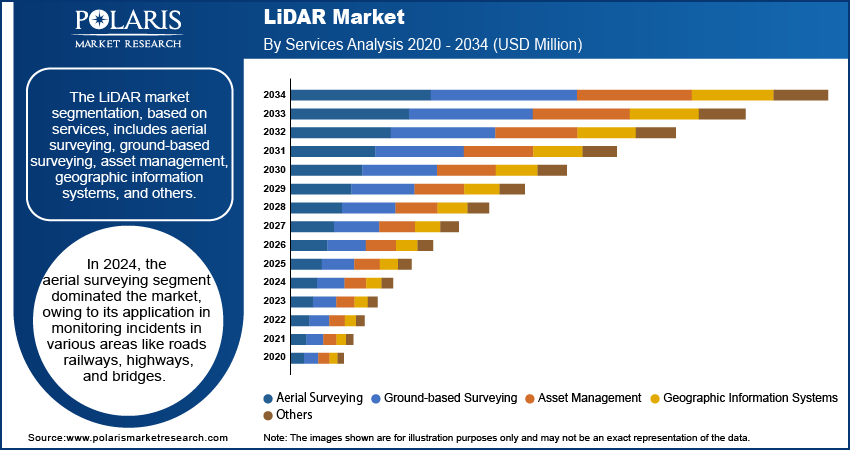

Evaluation by Services

The LiDAR market segmentation, based on services, includes aerial surveying, ground-based surveying, asset management, geographic information systems, and others. In 2024, the aerial surveying segment dominated the market, owing to its application in monitoring incidents in various areas like roads, railways, highways, and bridges.

Aerial surveying provides highly accurate 3D mapping of terrains and landscapes, offering precise results for site inspections. These surveys can be conducted using either manned or unmanned aerial systems, such as drones and aircraft. Typically, government agencies are responsible for carrying out these services.

For instance, in June 2024, Northeast Frontier Railway (NFR) performed an aerial LiDAR survey on the Lumding-Badarpur hill section to assess the soil strata, slope stability, water accumulation, and hill toe stability, with a focus on analyzing the impact of the monsoon season.

Breakdown by Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America dominated the LiDAR market in 2024 due to the increasing regulatory requirements for the installation of automotive safety technologies in both light and heavy vehicles. The implementation of regulatory requirements was done in response to the rising number of accidents. For example, the American Bar Association reported that in 2019, vehicle accidents caused 1.8 million injuries and 33,000 deaths in the United States. This trend led to the growing adoption of technologies like ADAS. By 2020, 92% of vehicles were equipped with at least one ADAS feature, such as automatic emergency braking (AEB) or forward collision warning (FCW).

Advancements in LiDAR systems have led to the development of LiDAR sensors, enabling market players to integrate these sensors into vehicles. This enhances safety and helps them comply with regulatory standards. For instance, in January 2024, Aeva launched the Atlas LiDAR sensor at CES 2024 in collaboration with Daimler Trucks North America. This LiDAR sensor has time-of-flight (ToF) and frequency-modulated continuous wave (FMCW) sensing capabilities.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Asia Pacific LiDAR market is expected to register the fastest CAGR from 2025 to 2034. This is due to urbanization and infrastructure development in countries like China, Japan, and India. Further, key market players in this region are expanding their presence in LiDAR technology for smart infrastructure, transportation networks, robotics, and environmental monitoring.

For instance, in August 2021, Kudan Inc. enhanced its presence in Japan and South Korea in collaboration with Ouster, Inc. across the automotive, industrial, smart infrastructure, and robotics sectors.

Advancements in manufacturing capabilities and a growing number of local LiDAR technology providers are driving market growth. These companies are increasingly innovating and producing LiDAR sensors and systems, thereby reducing costs and enhancing accessibility.

For instance, in September 2022, Luminar Technologies initiated the manufacturing of its advanced LiDAR sensors at a new facility in Asia, aiming to reduce the cost of each sensor to $100. These sensors were manufactured for a Chinese automaker SAIC Motor, enhancing safety features and enabling highway autonomous functionalities.

Key Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their product lines, which will help the LiDAR market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the LiDAR market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global market to benefit clients and increase the market sector. In recent years, the LiDAR market has offered some technological advancements. Major players in the LiDAR market include FARO Technologies, Inc.; GeoDigital; Leica Geosystem Holdings AG; Quantum Spatial, Inc.; RIEGL USA, Inc.; Sick AG; Teledyne Optech Incorporated; Trimble Navigation Limited; Velodyne LiDAR, Inc.; and YellowScan.

FARO Technologies, Inc. is a global technology company specializing in software-driven 3D measurement, imaging, and realization solutions. FARO’s product portfolio includes 3D scanners, laser projectors, and laser trackers. The company’s services encompass 3D measurement services, product training, and customer support, catering to industries such as manufacturing, architecture, engineering, construction, and public safety forensics. FARO has a significant presence in the Americas, Europe, Asia, and Australia. In October 2023, FARO introduced the Orbis Mobile Scanner, utilized for mobile and stationary data capturing in a single device. It provides options for local or cloud-based data processing and collaboration.

Teledyne Optech, a subsidiary of Teledyne Technologies, is a global provider of advanced lidar instruments and 3D imaging solutions. The company offers a wide range of products, including airborne laser, industrial & 3D imaging, airborne laser terrain mapping systems, and space lidar solutions. Teledyne Optech serves across industries such as energy, natural resources, infrastructure, and government. The company is headquartered in Canada and was founded in 1974. In April 2023, Teledyne Optech launched the CL-360 marine LiDAR sensor designed for marine use. This sensor is capable of being incorporated into high-resolution multibeam systems, enabling comprehensive image capture above and below the water.

List of Key Companies

- FARO Technologies, Inc.

- GeoDigital

- Leica Geosystem Holdings AG

- Quantum Spatial, Inc.

- RIEGL USA, Inc.

- Sick AG

- Teledyne Optech Incorporated

- Trimble Navigation Limited

- Velodyne LiDAR, Inc.

- YellowScan

LiDAR Industry Developments

April 2024: Luminar started the shipping of its LiDAR sensors to Volvo. The sensors are being integrated into the manufacturing of the Volvo EX90 electric vehicles to support safety and autonomous driving capabilities.

January 2024: Aeva launched Atlas, the initial 4D LiDAR sensor suitable for mass production automotive uses. It is designed to expedite the automotive sector towards more secure advanced driver assistance systems (ADAS) and autonomous driving.

December 2022: FARO Technologies, Inc. acquired SiteScape, a LiDAR 3D scanning software solution tailored for the O&M and AEC sectors. SiteScape empowers LiDAR-enabled mobile devices to efficiently digitize indoor environments, offering a convenient way to scan physical spaces for various applications.

Light Detection and Ranging Market Segmentation

By Type Outlook (Revenue – USD Million, 2020–2034)

- Solid-state

- Mechanical

By Component Outlook (Revenue – USD Million, 2020–2034)

- Navigation & Positioning Systems

- Laser Scanners

- Others

By Range Outlook (Revenue – USD Million, 2020–2034)

- Short Range (< 200m)

- Medium Range (200-500m)

- Long Range (> 500m)

By Installation Outlook (Revenue – USD Million, 2020–2034)

- Ground-Based

- Static

- Mobile

- Airborne

- Bathymetric

- Topographic

By Services Outlook (Revenue – USD Million, 2020–2034)

- Aerial Surveying

- Ground-based Surveying

- Asset Management

- Geographic Information Systems

- Others

By Application Outlook (Revenue – USD Million, 2020–2034)

- Urban Planning

- ADAS & Driverless Cars

- Corridor Mapping

- Environment

- Engineering

- Exploration

- Meteorology

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

LiDAR Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,648.09 million |

|

Market Size Value in 2025 |

USD 1,942.60 million |

|

Revenue Forecast in 2034 |

USD 8,629.47 million |

|

CAGR |

18.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The LiDAR market size was valued at USD 1,648.09 million in 2024 and is projected to be valued at USD 8,629.47 million in 2034.

The market is projected to grow at a CAGR of 18.0% from 2025 to 2034.

North America had the largest share of the market.

The key players in the market are FARO Technologies, Inc.; GeoDigital; Leica Geosystem Holdings AG; Quantum Spatial, Inc.; RIEGL USA, Inc.; Sick AG; Teledyne Optech Incorporated; Trimble Navigation Limited; Velodyne LiDAR, Inc.; and YellowScan.

The short range (< 200m) segment dominated the market in 2024.

The aerial surveying segment held the largest market share in 2024.