Dimethyl Ether Market Share, Size, Trends, Industry Analysis Report

By Raw Material (Fossil Fuel Based, Bio-based); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 118

- Format: PDF

- Report ID: PM2486

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

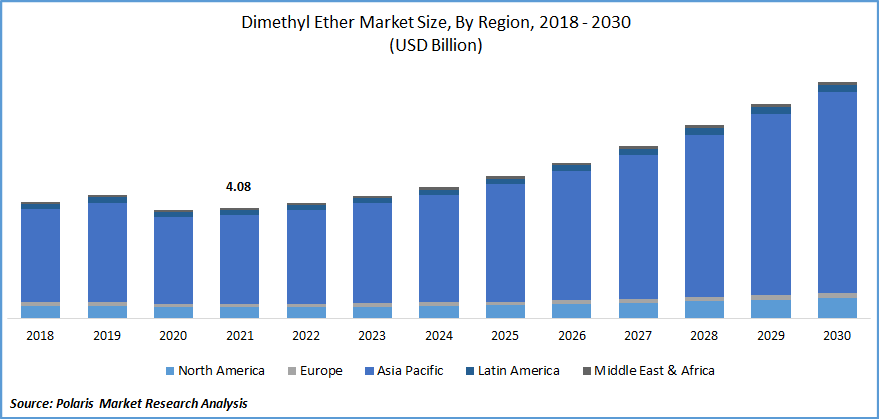

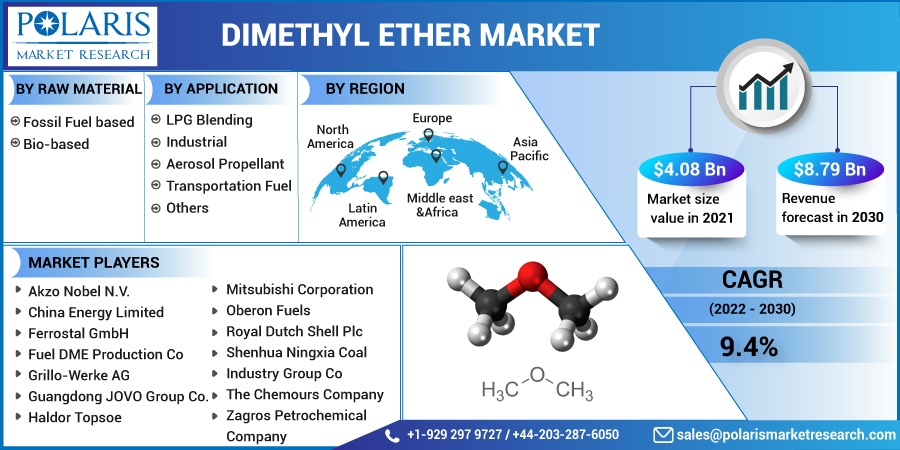

The global Dimethyl Ether (DME) market was valued at USD 4.08 billion in 2021 and is expected to grow at a CAGR of 9.4% during the forecast period. Dimethyl ether is one of the cleanest energy sources manufactured from fossil fuels such as coal petroleum residue, natural gas, and coal. Dimethyl ether is also known as methoxy methane, which is an odorless and colorless gas.

Know more about this report: Request for sample pages

Dimethyl ether has a low boiling point and is generated from various raw materials such as methanol, coal, natural gas, and biomass. Dimethyl ether is also a substitute for energy fuels as it has zero sulfur content. Dimethyl ether has a variety of applications in numerous segments, such as it is used in the petrochemical and chemical industries as a solvent.

The energy and oil industry is one of the most critical facets of the global economy, and the coronavirus occurrence in China in December 2019 & the gradual expansion of the disease dramatically decreased crude oil price & demand. Due to the dramatic increase in COVID cases, people are advised to "sit at home" and refrain from traveling. Corona restricts all forms of transportation; hence less oil will likely be used in transportation. Furthermore, restrictions on economic operations and manufacturing have drastically resulted in lower fuel usage, significantly impacting the dimethyl ether market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Dimethyl ether has various uses, including transportation gasoline, propellant, chemical feedstock, aerosol, and refrigerant. The blending of LPG has become a significant application in recent years. It is also a suitable substitute for LPG because of its high cetane number, low toxicity, and good flammability. DME can also be made from diverse raw materials, including wood, methanol, and syngas, allowing for increased demand and production.

The massive increase in demand from the automotive market and strict regulations against high emission fuels in the automotive sector are contributing to increased demand. It has a higher cetane number which provides a better ignition value to reduce environmental pollutants. The constantly growing automobile market in most developing economies is expected to drive the dimethyl ether market during the forecast period.

Report Segmentation

The market is primarily segmented based on raw material, application, and region.

|

By Raw Material |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Fossil Fuel segment accounted for a significant share

The fossil fuel-based segment held a significant share of the dimethyl ether market in 2021. The fossil fuel segment includes dimethyl ether production using natural coal and gas. In addition, the abundant availability of natural gas recoverable reserves also boosts market growth.

Natural gas reserves can be utilized to produce DME for its widespread applications in aerosol propellants, transportation fuel, LPG blending, and other industrial applications such as blowing agents for refrigerants, solvent extracting agents, insulation panels, and fuel for welding & cutting.

There is increased demand for ultra-low-carbon or carbon-negative fuels that are cost-effective, realistic, and long-term substitutes for today's fossil fuels. The easy availability of natural gas, owing to technological advancements, which is attributed to high research and development investment in the gas and oil market, will further help in attaining promising gains in the fossil fuel-based market during the forecast period.

LPG blending accounted for a major share in 2021

The LPG blending segment had the largest market share of the dimethyl ether market and is expected to grow during the forecast period further. The increasing demand for dimethyl ether for LPG blending has increased in order to reduce harmful emissions. In addition, the huge demand has also occurred due to the growing & rising population, primarily in the Asia Pacific region. As per the World Energy Council, total recoverable coal reserves in China, which is the biggest reservoir of coal, will be 80.2 thousand MTOE (Million Tons of Oil Equivalent) in 2020, which will help reduce imports and meet the rising DME demand in the region at cost-effective prices.

It is possible to add value-adding advantages to LPG usage across household uses. LPG use for heating and cooking for domestic reasons has been a significant factor in the increase of dangerous pollutants in the environment.

Moreover, several manufacturers are investing in the research and development to utilize dimethyl ether as an alternative fuel to LPG, which is highly expensive. The continuous investment in technological advancements and R&D is expected to boost the market further.

Growing demand from the automotive industry

Most developed and developing economies across the globe have introduced strict regulations against high-emission fuels in the automotive sector. The constant growing concern regarding the environment leads to the development of alternatives to traditional fuels. The automotive market is expected to increase the demand for dimethyl ether as it is potentially utilized as a replacement for propane in Liquid Petroleum Gas (LPG), which is used as a fuel in the automotive market as well as households. The usage of dimethyl ether will also increase in gas turbines and as a fuel in diesel engines during the forecast period.

The growing demand for automobiles from growing economies is another significant driving factor. Also, using dimethyl ether in households will encourage market players to introduce new products, which will further drive the market's growth during the forecast period.

Asia Pacific dominated the global market in 2021

Asia-Pacific dominated the dimethyl ether market in 2021. The high product demand in Asia Pacific is attributed to its widespread applications in LPG blending, gradually gaining momentum to attain environmental sustainability. In addition, an improved regulatory framework in favor of the environment in the region has increased its application in LPG blending to reduce soot, particulate matter, and other pollutants to improve the overall air quality in the coming years.

China's constantly growing automobile market is also expected to increase the dimethyl ether demand over the forecast period. Furthermore, the easy availability of coal reserves in China will benefit the Asia Pacific regional dimethyl ether market. Moreover, specific environmental regulations set by most governments across the region will positively impact dimethyl ether development.

Competitive Insight

Some of the major players operating in the global dimethyl ether market include Akzo Nobel N.V., China Energy Limited, Ferrostal GmbH, Fuel DME Production Co, Grillo-Werke AG, Guangdong JOVO Group Co., Haldor Topsoe, Jiutai Energy Group, Korea Gas Corporation, Mitsubishi Corporation, Oberon Fuels, Royal Dutch Shell Plc, Shenhua Ningxia Coal Industry Group Co, The Chemours Company, and Zagros Petrochemical Company. These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products to cater to the growing consumer demands.

Recent Developments

In March 2021, SHV Energy and KEW Technology entered a joint venture known as Circular Fuels Ltd. This venture intended to develop renewable dimethyl ether (rDME) production plants and convert renewable and recycled carbon feedstock into renewable liquid gas.

In August 2020, The Oberon Fuels, producer of the renewable dimethyl ether transportation fuel, extended its team to construct the first renewable Dimethyl Ether across the globe.

Dimethyl Ether Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 4.08 billion |

|

Revenue forecast in 2030 |

USD 8.79 billion |

|

CAGR |

9.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Raw Material, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Akzo Nobel N.V., China Energy Limited, Ferrostal GmbH, Fuel DME Production Co, Grillo-Werke AG, Guangdong JOVO Group Co., Haldor Topsoe, Jiutai Energy Group, Korea Gas Corporation, Mitsubishi Corporation, Oberon Fuels, Royal Dutch Shell Plc, Shenhua Ningxia Coal Industry Group Co, The Chemours Company, and Zagros Petrochemical Company |