Disease Management Apps Market Size, Share, Trends, & Industry Analysis Report

By Platform (iOS, Android, Others), By Device, By Indication, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM5732

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

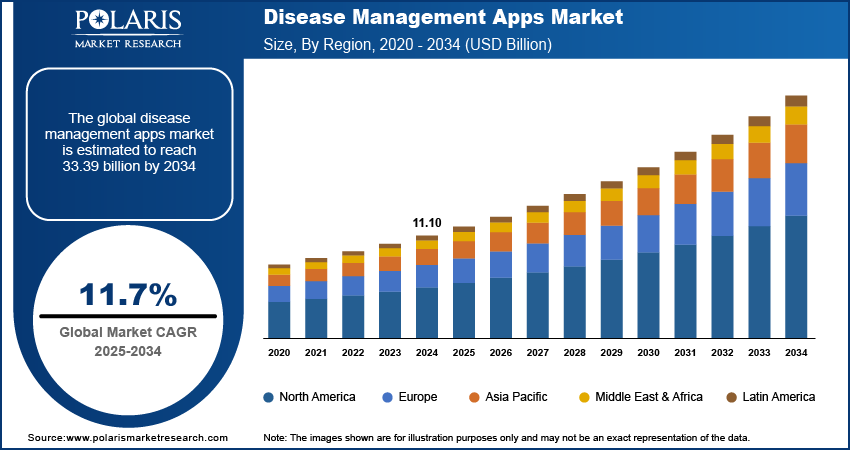

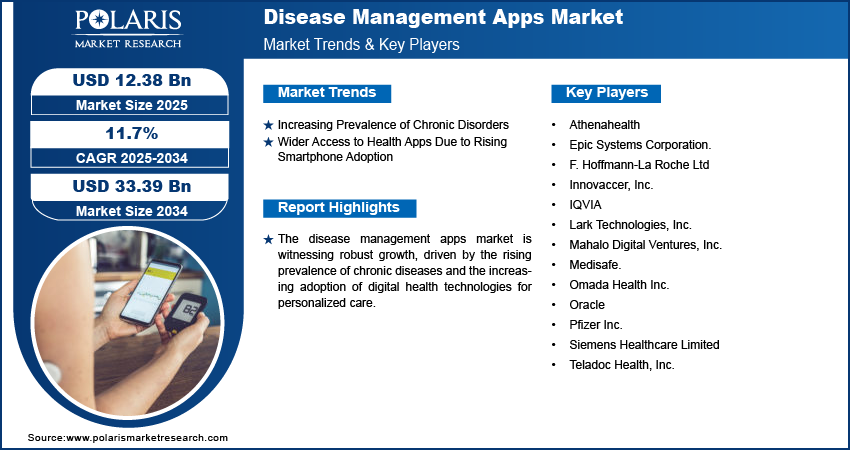

The global disease management apps market size was valued at USD 11.10 billion in 2024, registering a CAGR of 11.7% from 2025 to 2034. The growth is driven by rising consumer awareness about healthy lifestyles. Additionally, the increasing adoption of 5G networks and smartphones is expected to drive the growth of disease management apps, particularly in remote areas.

Key Insights

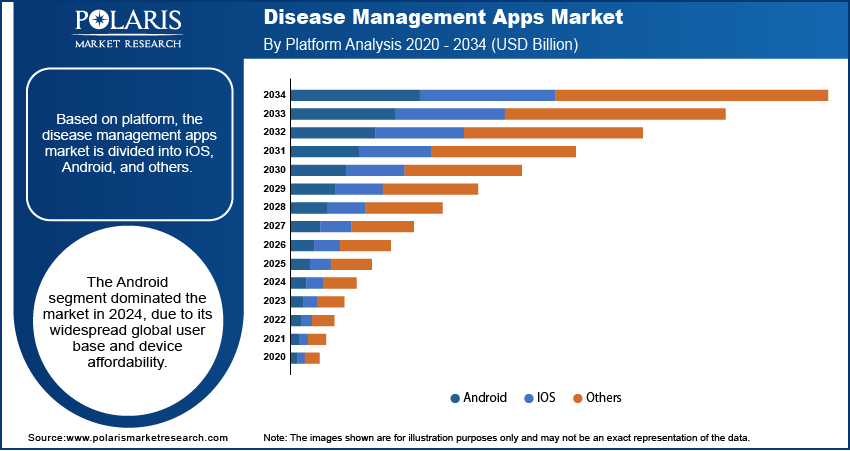

- The Android segment dominated the market in 2024. It is due to its widespread global user base and device affordability.

- The wearables segment is expected to witness the highest growth during the forecast period. The rising demand for real-time health monitoring and personalized data tracking boosts the segment growth.

- The obesity segment is expected to witness substantial growth during 2025–2034. This is owing to the increasing global prevalence of obesity and its strong association with chronic conditions, such as diabetes and hypertension.

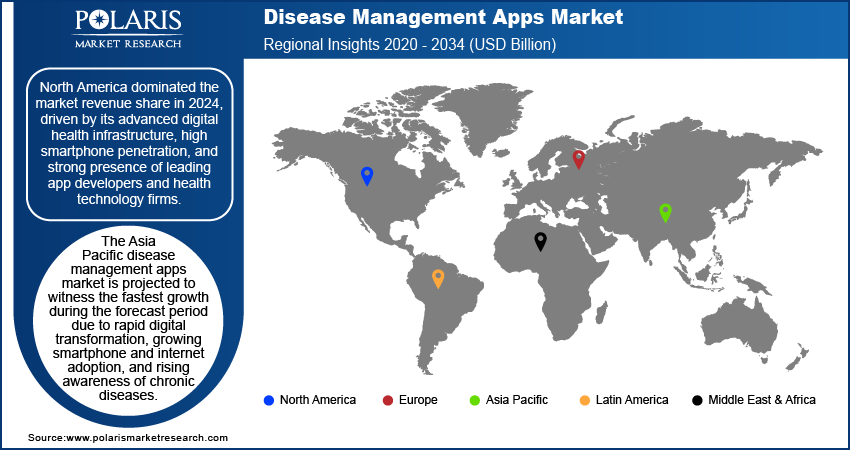

- North America dominated the global revenue share in 2024. The leading position is driven by its high smartphone penetration and strong presence of leading app developers and health technology firms.

- The Asia Pacific disease management apps industry is projected to witness the fastest growth during the forecast period. The growth is attributed to rapid digital transformation and rising awareness of chronic diseases.

Industry Dynamics

- The increasing prevalence of chronic diseases, including diabetes, cardiovascular diseases (CVD), and respiratory conditions, propels the market growth.

- Wider access to health apps, due to high smartphone adoption and 5G network implementation across rural areas, boosts the industry growth.

- Rising adoption of electronic health records (EHRs), cloud computing, and artificial intelligence in healthcare systems is expected to offer lucrative opportunities during the forecast period.

- High concerns regarding data privacy and security in health apps hinder the apps demand.

Market Statistics

2024 Market Size: USD 11.10 billion

2034 Projected Market Size: USD 33.39 billion

CAGR (2025–2034): 11.7%

North America: Largest market in 2024

AI Impact on Disease Management Apps Market

- Artificial intelligence (AI) systems analyze patient data, including symptoms, lifestyle, and medical history. The analysis is used to customize treatment recommendations. This approach boosts patient engagement and outcomes.

- Smartwatches, implants, and other devices track vitals continuously. AI tools process this data to detect anomalies and instantly alert users and providers.

- AI chatbots and virtual assistants assist users in managing symptoms, appointments, and medication schedules. NLP facilitates intuitive, conversational interfaces for better accessibility.

- Regulatory approvals for AI modules give market players a competitive advantage in clinical credibility.

- Collaborations with users and hospitals help players train AI models using diverse datasets. Such initiatives improve the accuracy and reach of these apps.

To Understand More About this Research: Request a Free Sample Report

Disease management apps are digital tools designed to help patients monitor, manage, and improve chronic or long-term health conditions through personalized care plans and real-time data tracking. The growing integration of healthcare with advanced information technology solutions boosts growth opportunities. According to a report by the ASTP, as of 2021, ∼78% of office-based physicians and 96% of non-federal acute care hospitals had implemented a certified electronic health record (EHR) system. This widespread adoption of EHRs has improved the functionality and reach. Disease management apps are evolving into more intelligent and interoperable platforms as healthcare systems increasingly adopt electronic health records (EHRs), cloud computing, and artificial intelligence. These apps offer automated alerts, teleconsultation features, and data analytics that support clinical decision-making, enabling healthcare providers to offer more accurate, timely, and proactive care. The seamless connection between patient data and digital health tools is creating a more efficient ecosystem for chronic disease management.

The strong promotion and support of digital health solutions by both government bodies and private stakeholders contribute to the expansion opportunities. Public health initiatives and funding programs are encouraging the adoption of digital tools to enhance care delivery, reduce healthcare costs, and improve outcomes for patients suffering from chronic illnesses. Simultaneously, innovation is accelerating app development and scaling, often through strategic partnerships with healthcare providers and insurers. In August 2023, WHO and G20 India launched the Global Initiative on Digital Health, a WHO-managed platform to advance digital health under the Global Strategy (2020–2025). It aligns investments, improves transparency, fosters collaboration, strengthens governance, and supports global strategy implementation. These collaborative efforts are enabling a supportive environment for the widespread adoption of disease management apps, particularly in underserved areas or populations with limited access to continuous care.

Industry Dynamics

Increasing Prevalence of Chronic Disorders

The increasing prevalence of chronic disorders such as diabetes, cardiovascular diseases, and respiratory conditions is driving the development of disease management apps. There is a growing need for continuous monitoring, personalized care, and patient engagement outside traditional clinical settings as the global burden of chronic illnesses continues to rise. According to a December 2024 WHO report, non-communicable diseases (NCDs) caused 43 million deaths in 2021, accounting for 75% of all non-pandemic-related fatalities worldwide. These apps offer tailored health tracking, medication reminders, symptom logging, and direct communication with healthcare providers, which are particularly beneficial for individuals managing long-term conditions. This shift toward proactive and self-managed care models is accelerating the demand for digital tools that can support patients in maintaining treatment adherence and improving health outcomes.

Wider Access to Health Apps Due to Rising Smartphone Adoption

The widespread adoption of smartphones has strengthened the growth potential of disease management apps by greatly broadening their accessibility. Health apps are becoming more readily available across different demographic and geographic segments, with a majority of the population now using smartphones. According to Apple's Annual Report, smartphone sales rose from USD 191,973 million in 2021 to USD 205,489 million in 2022, showcasing the growing demand for smartphones. This digital reach empowers individuals to monitor their health in real time, irrespective of their location or access to in-person healthcare. Additionally, modern smartphones offer features such as biometric sensors, app integrations, and internet connectivity, which improve the functionality and user experience of disease management applications. Therefore, as smartphone usage continues to grow, it lays a strong foundation for scaling digital health interventions globally.

Segmental Insights

By Platform Analysis

The segmentation, based on platform, includes iOS, Android, and others. The Android segment dominated the market in 2024, primarily due to its widespread global user base and device affordability. Android’s open-source platform has allowed greater flexibility for developers to create diverse health apps that are compatible with a wide range of devices. Its higher penetration in developing and emerging economies has also contributed to broader access to disease management tools, especially among populations with limited healthcare infrastructure. Additionally, the availability of numerous Android-based smartphones at various price points makes it more accessible to patients across different income levels, further fueling its dominance in the market.

By Device Analysis

The segmentation, based on device, includes smartphones, tablets, and wearables. The wearables segment is expected to witness the highest growth during the forecast period due to the rising demand for real-time health monitoring and personalized data tracking. Devices such as fitness bands, smartwatches, and wearable ECG monitors seamlessly sync with these apps to collect continuous health metrics such as heart rate, blood glucose levels, and physical activity. These integrated solutions allow patients and healthcare providers to make data-driven decisions and intervene early when health parameters fluctuate. They are expected to hold a critical role in managing chronic conditions and improving patient engagement as wearables become more advanced and user-friendly.

By Indication Analysis

The market segmentation, based on indication, includes obesity, cardiovascular issues, mental health, diabetes, and others. The obesity segment is expected to witness substantial growth during the forecast period, owing to the increasing global prevalence of obesity and its strong association with chronic conditions such as diabetes, hypertension, and cardiovascular diseases. Obesity management apps focus on lifestyle tracking, calorie monitoring, and behavioral coaching to support sustainable weight loss and health improvement. The rising awareness around the health risks of obesity, combined with the growing focus on preventive healthcare, is encouraging individuals to adopt mobile health tools for long-term weight and health management. This shift is driving the demand for digital interventions in obesity care.

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market revenue share in 2024, driven by its advanced digital health infrastructure, high smartphone penetration, and strong presence of leading app developers and health technology firms. The region’s early adoption of telehealth and connected health solutions has created a conducive environment for the growth of disease management applications. According to a July 2021 NIH report, 73% of 2,923 surveyed US hospitals offered some form of telehealth services, with over 50% specifically investing in telehealth consultation and stroke care capabilities. Additionally, supportive regulatory policies and insurance reimbursement for digital health services have further accelerated adoption across patient populations. Major contributing countries include the US, with its robust ecosystem of digital health innovators and high healthcare expenditure, and Canada, known for its integrated health IT systems and growing focus on chronic disease prevention.

The Asia Pacific disease management apps market is projected to witness the fastest growth during the forecast period due to rapid digital transformation, growing smartphone and internet adoption, and rising awareness of chronic diseases. According to the Department of Biotechnology 2025 data, non-communicable diseases (NCDs) contribute to 53% of total mortality and 44% of disability-adjusted life-years lost in India. Many countries in the region are investing heavily in healthcare modernization and digital infrastructure, which is expanding access to mobile health solutions. In addition, a large and aging population base is increasing the demand for effective chronic disease management tools. Countries such as India, China, and Indonesia are major contributors to this growth, supported by government-backed digital health initiatives and a surge in mobile health app usage across urban and semi-urban populations.

The Europe disease management apps market is projected to witness substantial growth during the forecast period, owing to its strong focus on preventive healthcare, rising chronic disease burden, and supportive regulatory frameworks for digital health integration. The region’s focus on interoperability and secure health data exchange is also boosting the adoption of mobile health technologies. Furthermore, public health agencies and healthcare providers are increasingly incorporating mobile tools to improve patient engagement and long-term care outcomes. Countries such as Germany, the UK, and France are playing a pivotal role, with ongoing digital health reforms, robust healthcare systems, and growing investments in patient-centric technologies.

Key Players & Competitive Analysis Report

The disease management apps sector is witnessing rapid evolution, driven by technological advancements, strategic investments, and emerging market segments. Major players such as Teladoc Health, Omada Health, and Epic Systems are leveraging competitive intelligence and strategy to improve user engagement and expand their regional footprint. Revenue growth is fueled by increasing demand for remote care, with sustainable value chains ensuring long-term scalability. Developed markets lead adoption, while emerging markets present untapped potential due to rising chronic diseases and digital health awareness. Disruptions and trends, such as AI-driven personalization and IoT integration, are reshaping the industry. Additionally, companies are prioritizing future development strategies, such as partnerships and expansion opportunities, to stay ahead. Expert insights highlight the importance of economic and geopolitical shifts in shaping market dynamics, with revenue opportunities tied to personalized care models. Thus, as competition intensifies, differentiation through product offerings and competitive positioning will be critical for sustained leadership. A few key players are Athenahealth; Epic Systems Corporation; F. Hoffmann-La Roche Ltd; Innovaccer, Inc.; IQVIA; Lark Technologies, Inc.; Mahalo Digital Ventures, Inc.; Medisafe; Omada Health Inc.; Oracle; Pfizer Inc.; Siemens Healthcare Limited; and Teladoc Health, Inc.

Key Players

- Athenahealth

- Epic Systems Corporation.

- F. Hoffmann-La Roche Ltd

- Innovaccer, Inc.

- IQVIA

- Lark Technologies, Inc.

- Mahalo Digital Ventures, Inc.

- Medisafe.

- Omada Health Inc.

- Oracle

- Pfizer Inc.

- Siemens Healthcare Limited

- Teladoc Health, Inc.

Industry Developments

October 2024: HealthSnap launched its Principal Care Management (PCM) program, expanding its virtual care platform. The PCM program, already live with Capital Cardiology Associates, offers disease-specific care plans and CMS-compliant support for patients having complex chronic conditions.

May 2024: JD Health launched AI-driven mental health services, such as the therapeutic chatbot "Small Universe for Chatting and Healing" and clinician tools. Powered by a healthcare-specific LLM, the chatbot offers empathetic, human-like interaction, marking China's first AI mental health platform.

February 2023: digital health firm Dawn Health partnered with Novartis to develop a platform for remote patient monitoring, aiming to advance hybrid chronic care models and improve outcomes for patients and providers.

Disease Management Apps Market Segmentation

By Platform Outlook (Revenue, USD Billion, 2020–2034)

- iOS

- Android

- Others

By Device Outlook (Revenue, USD Billion, 2020–2034)

- Smartphones

- Tablets

- Wearables

By Indication Outlook (Revenue, USD Billion, 2020–2034)

- Obesity

- Cardiovascular Issues

- Diabetes

- Mental Health

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Disease Management Apps Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.10 billion |

|

Market Size Value in 2025 |

USD 12.38 billion |

|

Revenue Forecast by 2034 |

USD 33.39 billion |

|

CAGR |

11.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 11.10 billion in 2024 and is projected to grow to USD 33.39 billion by 2034.

The global market is projected to register a CAGR of 11.7% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Athenahealth; Epic Systems Corporation; F. Hoffmann-La Roche Ltd; Innovaccer, Inc.; IQVIA; Lark Technologies, Inc.; Mahalo Digital Ventures, Inc.; Medisafe; Omada Health Inc.; Oracle; Pfizer Inc.; Siemens Healthcare Limited; and Teladoc Health, Inc.

The Android segment dominated the market in 2024.

The wearables segment is expected to witness the fastest growth during the forecast period.