Distributed Fiber Optic Sensor Market Size, Share, Industry Analysis Report

By Fiber Type (Single-Mode Fiber and Multimode Fiber), By Operating Principle, By Scattering Process, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6221

- Base Year: 2024

- Historical Data: 2020-2023

Overview

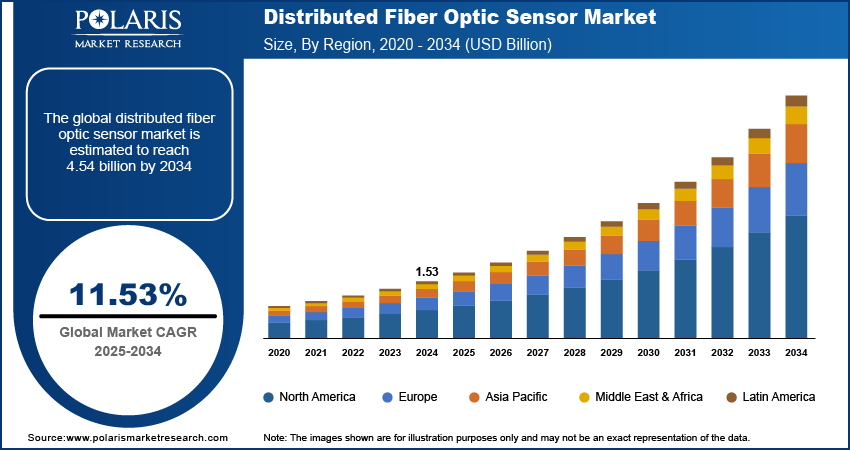

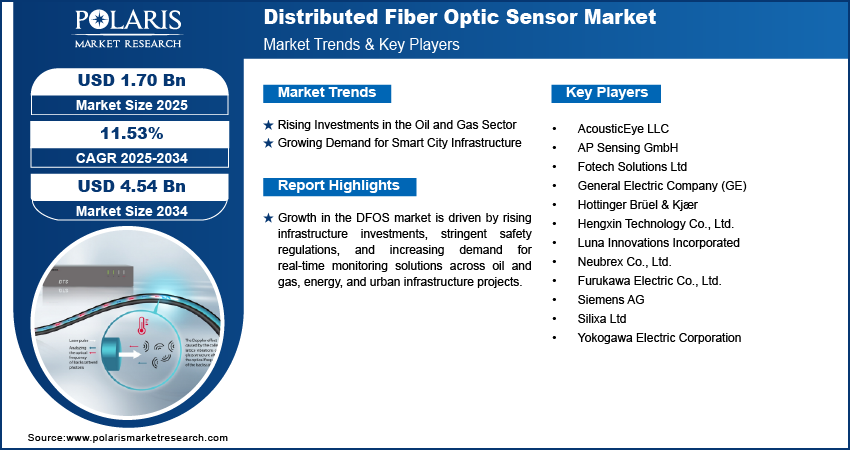

The global distributed fiber optic sensor market size was valued at USD 1.53 billion in 2024, growing at a CAGR of 11.53% from 2025–2034. Rising investments in the oil and gas sector coupled with growing demand for smart city infrastructure are driving the adoption of distributed fiber optic sensors for enhanced real-time monitoring and safety management across critical industrial and urban assets.

Key Insights

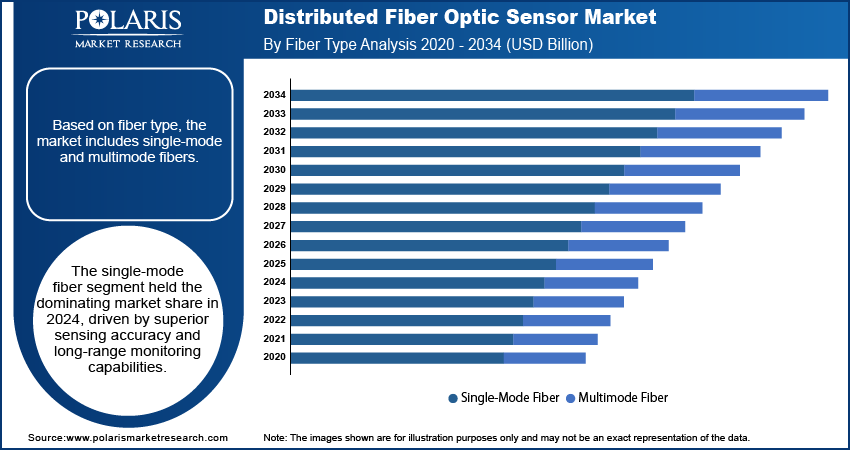

- The single-mode fiber segment dominated the distributed fiber optic sensing market share in 2024.

- The civil infrastructure and construction segment is set to grow fastest, driven by DFOS adoption for smart, sustainable, and cost-efficient asset monitoring.

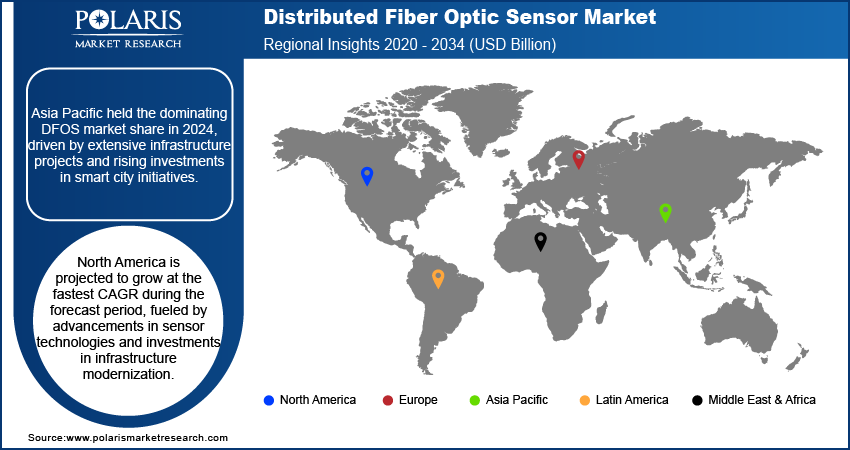

- The Asia Pacific distributed fiber optic sensing market dominated the global market share in 2024.

- The China distributed fiber optic sensing market held the largest regional share of the Asia Pacific market in 2024, driven by strong government support for pipeline safety, extensive high-speed rail network expansion.

- The market in North America is projected to grow at the fastest CAGR during the forecast period.

- The U.S. distributed fiber optic sensing market is expanding steadily, fueled by modernization of aging infrastructure, rising demand for perimeter security in defense and industrial facilities and regulatory focus on environmental compliance and asset integrity.

Industry Dynamics

- Growing focus on regulatory compliance and environmental safety is accelerating the adoption of DFOS in industries such as oil and gas, energy, and transportation.

- Expansion of smart city initiatives presents significant growth opportunities for DFOS providers to integrate sensing technology into urban infrastructure projects.

- Expansion in the renewable energy sector, such as wind and solar power projects requires reliable monitoring systems, presenting new growth avenues for the DFOS industry.

- High initial installation costs and the need for specialized technical expertise pose challenges to widespread adoption in emerging markets.

Market Statistics

- 2024 Market Size: USD 1.53 Billion

- 2034 Projected Market Size: USD 4.54 Billion

- CAGR (2025–2034): 11.53%

- Asia Pacific: Largest Market Share

AI Impact on Global Distributed Fiber Optic Sensor Market

- AI processes fiber optic data instantly to detect issues such as leaks or structural damage, improving response times for critical infrastructure.

- Machine learning identifies potential sensor failures before they occur, reducing downtime and maintenance costs across industries.

- AI distinguishes real threats from false alarms, improving perimeter and pipeline monitoring for safer operations.

- AI handles massive amounts of sensor data quickly, making large-scale monitoring systems more practical and cost-effective.

Distributed fiber optic sensors (DFOS) are advanced sensing systems that utilize fiber optic cables to detect physical parameters such as strain, temperature, and pressure over extended distances. These sensors provide continuous real-time monitoring with high accuracy and immunity to electromagnetic interference. DFOS technology is widely applied across infrastructure monitoring, oil and gas, energy, and transportation sectors due to its capability for long-range sensing and durability in harsh environments. The ability of DFOS to deliver distributed, continuous data along with its resistance to harsh environmental conditions makes it a preferred solution for critical asset management in industrial applications.

DFOS systems are primarily used for structural health monitoring of bridges, pipelines, tunnels and power grids to enhance safety and operational efficiency. In the oil and gas sector, they enable leak detection, pipeline integrity monitoring, and downhole temperature profiling. The energy sector leverages DFOS to monitor wind turbines and electrical cables to reduce maintenance costs and prevent failures.

The global distributed fiber optic sensor market is expanding due to increasing demand for advanced infrastructure monitoring and safety management. For instance, in January 2025, Baker Hughes launched SureCONNECT FE, a next-generation downhole fiber-optic wet-mate system for real-time reservoir monitoring in extreme conditions. The system reduces rig time, lowers maintenance costs, and improves operational safety. Rising investments in smart cities and critical infrastructure projects are driving the adoption of DFOS technology for real-time asset monitoring and predictive maintenance. Regulatory focus on safety compliance and environmental protection is accelerating the deployment of DFOS in sectors such as oil and gas, energy, and transportation. The growing need to reduce operational costs and prevent catastrophic failures is further driving market growth. Additionally, growing advancements in sensor accuracy and data analytics are enabling broader applications, driving DFOS as a key technology in modern infrastructure management.

Drivers & Opportunities

Rising Investments in Oil and Gas Sector: The oil and gas sector is rapidly investing in advanced monitoring technologies to enhance operational safety and efficiency. According to the U.S. Energy Information Administration, global liquid fuels production was 102.2 million barrels per day in 2023 and is expected to rise to 105.7 million barrels per day by 2026. Distributed fiber optic sensors provide continuous, real-time monitoring of pipelines, facilities, and downhole conditions, enabling early detection of leaks, corrosion, and structural faults. These capabilities reduce the risk of environmental hazards and costly downtime. Growing global energy demand and expansion of oil and gas infrastructure in regions such as the Middle East and North America are driving these investments. Regulatory pressure for improved safety and environmental compliance further incentivizes adoption of DFOS technology across upstream and midstream operations.

Growing Demand for Smart City Infrastructure: Smart city development relies heavily on integrating advanced sensor networks for efficient infrastructure management. India’s Union Budget 2024-25 allocated USD 19.67 billion to the Smart Cities Mission. As of March 2025, 7,502 projects, representing 93% of the total 8,062 been completed, while 560 projects, accounting for 7%, remained in progress. Distributed fiber optic sensors offer continuous monitoring of critical assets such as bridges, tunnels, and utility networks, supporting predictive maintenance and minimizing failures. Increasing urbanization and government initiatives for sustainable, resilient infrastructure drive demand for real-time data solutions. The ability of DFOS to withstand harsh urban environments and provide distributed sensing over long distances aligns with smart city objectives. Additionally, the need to improve public safety, optimize resource use, and reduce operational costs underpins the expanding adoption of DFOS in smart city projects globally.

Segmental Insights

Fiber Type Analysis

Based on fiber type, the segmentation includes single-mode fiber and multimode fiber. The single-mode fiber segment dominated the market in 2024, driven by its capability to transmit data over long distances with minimal signal loss. These fibers are preferred for applications in oil and gas, energy, and infrastructure monitoring due to their higher accuracy and ability to operate under harsh environmental conditions. Single-mode fibers also support advanced distributed sensing methods such as optical time domain reflectometry, enabling precise temperature and strain measurements. Growing adoption in large-scale infrastructure and cross-border pipeline monitoring projects further strengthens their position as the leading fiber type in the distributed fiber optic sensor market.

The multimode fiber segment is projected to grow at the fastest CAGR during the forecast period, due to rising adoption in short- to medium-range sensing applications. These fibers offer a cost-effective solution for monitoring within localized industrial environments such as manufacturing facilities, transport depots, and smaller civil infrastructure projects. Improvements in multimode fiber design have enhanced data transmission stability and reduced attenuation rates, increasing their suitability for distributed acoustic sensing. The growing demand for economical, easy-to-install sensing solutions in emerging markets is expected to further accelerate multimode fiber deployment in diverse industrial and infrastructure applications.

Operating Principle Analysis

By operating principle, the segment includes optical time domain reflectometry and optical frequency domain reflectometry. The optical time domain reflectometry segment dominated the market in 2024, driven by its ability to provide high-accuracy measurements over long distances. OTDR is widely used in oil and gas pipeline monitoring, power cable inspection, and structural health applications due to its proven reliability and ability to detect faults quickly. The technology’s compatibility with temperature and strain sensing applications further enhances its adoption across multiple industries. Increasing deployment in large-scale infrastructure projects, along with advancements in OTDR system resolution and signal processing, continues to maintain its dominance in the distributed fiber optic sensor market.

The optical frequency domain reflectometry segment is projected to grow at the fastest CAGR during the forecast period, due to its superior spatial resolution and high sensitivity in short-range applications. OFDR is used for precision monitoring in aerospace, advanced manufacturing, and civil engineering projects where localized fault detection is essential. Its capability to deliver dense data points enables accurate strain mapping, making it ideal for structural testing and research applications. Technological advancements that reduce system complexity and cost are expanding OFDR adoption in markets requiring compact, high-resolution sensing solutions for specialized environments.

Scattering Process Analysis

By scattering process, the segment includes rayleigh scattering effect, raman scattering effect, brillouin scattering effect, and fiber brag grating. The rayleigh scattering effect segment dominated the market in 2024, driven by its suitability for distributed acoustic sensing and structural monitoring. This method is widely implemented in oil and gas pipeline surveillance, perimeter security, and transportation infrastructure due to its ability to detect vibrations, strain, and other dynamic changes along the fiber. Rayleigh scattering provides high sensitivity over long distances, making it the preferred choice for large-scale monitoring projects. The increasing demand for real-time security and operational safety in energy and industrial sectors continues to strengthen its position in the distributed fiber optic sensor market.

The brillouin scattering effect segment is projected to grow at the fastest CAGR during the forecast period, due to its ability to measure temperature and strain over extended distances with high accuracy. This capability is valuable for monitoring high-voltage power cables, oil wells, and large infrastructure assets. Brillouin-based systems are growing popular in industries that require continuous, reliable measurements under fluctuating environmental conditions. Advances in sensing algorithms and hybrid system integration are enhancing performance, enabling the technology to capture market share from alternative methods in long-range structural health monitoring applications.

Application Analysis

Based on application, the segmentation includes temperature sensing, acoustic sensing, and other sensing applications. The temperature sensing segment dominated the market in 2024, driven by its critical role in oil and gas, power transmission, and industrial processing operations. Distributed fiber optic sensors provide accurate, continuous temperature profiles along the entire sensing length, enabling early detection of overheating, leaks, or process inefficiencies. These capabilities support preventive maintenance strategies and reduce the risk of catastrophic failures. Temperature sensing is also widely adopted in underground cable monitoring and geothermal energy projects. The increasing focus on safety, efficiency, and regulatory compliance across multiple sectors continues to maintain temperature sensing as the largest application area.

The acoustic sensing segment is projected to grow at the fastest CAGR during the forecast period, due to its ability to detect vibrations, movements, and disturbances in real time. Distributed acoustic sensing is rapidly deployed for perimeter security, intrusion detection, and railway track monitoring. In the oil and gas sector, it enables leak detection and operational surveillance without the need for additional sensing hardware. Advancements in data analytics and pattern recognition are enhancing detection accuracy, making acoustic sensing a preferred choice for applications requiring security and operational monitoring in diverse industrial environments.

End User Analysis

By end user, this segment includes oil & gas, energy & power, civil infrastructure & construction, transportation & railways, defense & security, environmental agencies, telecommunications, and aerospace & aviation. The oil and gas segment dominated the market in 2024, driven by the industry’s high demand for continuous asset monitoring and leak detection. Distributed fiber optic sensors are extensively deployed for pipeline integrity monitoring, downhole temperature profiling, and offshore platform surveillance. These systems help operators meet stringent environmental and safety regulations while reducing unplanned downtime. The sector’s reliance on large-scale, long-distance infrastructure makes DFOS an ideal solution for enhancing operational safety and efficiency. Ongoing investments in exploration, production, and transportation infrastructure continue to push oil and gas as the leading end-use industry for DFOS.

The civil infrastructure and construction segment is projected to grow at the fastest CAGR during the forecast period, due to increasing adoption of DFOS for structural health monitoring of bridges, tunnels, and high-rise buildings. According to Oxford Economics, the global construction market is projected to expand from USD 9.7 trillion in 2022 to USD 13.9 trillion by 2037, driven by urbanization and the adoption of green infrastructure, with China, the US, and India leading the growth. Governments and private developers are investing heavily in infrastructure modernization and smart city projects, which require real-time, continuous data to ensure asset safety and longevity. DFOS enables predictive maintenance and reduces inspection costs, making it an attractive solution for long-term asset management. The growing focus on sustainability and resilience in construction is further driving adoption in this segment.

Regional Analysis

Asia Pacific distributed fiber optic sensor market dominated the global market in 2024. This is due to rapid infrastructure expansion and large-scale industrial investments in countries such as China, India, and Japan. Regional driver for Asia-Pacific includes significant government funding in smart city projects and critical infrastructure monitoring initiatives, which increase the demand for advanced sensing technologies. Moreover, the presence of a growing oil and gas sector in the region fuels adoption of DFOS for pipeline integrity and safety monitoring. In addition, the rise in manufacturing and energy projects across Southeast Asia supports continued market growth in this region.

China Distributed Fiber Optic Sensor Market Insight

China held a dominating market share in the Asia Pacific distributed fiber optic sensor landscape in 2024, due to extensive infrastructure development and the government’s strong focus on smart city initiatives. Regional driver for China includes massive investments in expanding urban transportation networks and energy infrastructure, which require real-time structural health monitoring. Moreover, the country’s growing oil and gas sector increases demand for advanced sensing technologies to enhance safety and operational efficiency. According to China’s National Bureau of Statistics, industrial enterprises produced 17.65 million tons of crude oil in December, up 4.6% year on year, with daily output at 569,000 tons. Crude oil imports reached 48.36 million tons, increasing 0.6% year on year after a 9.1% drop in November. In addition, supportive policies promoting industrial digitization are pushing the adoption of distributed fiber optic sensors across multiple sectors.

Europe Distributed Fiber Optic Sensor Market

The distributed fiber optic sensor landscape in Europe is projected to hold a substantial share in 2034. This is due to stringent safety regulations and the focus on sustainable infrastructure development across key countries such as Germany, the UK, and France. For instance, in in July 2024, the European Commission announced USD 8.15 billion to 134 projects aimed at sustainable, safe, and smart transport infrastructure across Europe. About 83% of this funding supports climate-related initiatives, including major rail links, ports and intelligent transport systems. Regional driver for Europe includes increasing investments in renewable energy projects that require continuous asset monitoring to ensure operational efficiency. Moreover, the region’s focus on reducing environmental impact through smart infrastructure initiatives promotes adoption of distributed fiber optic sensors. In addition, public-private partnerships in infrastructure modernization projects further support DFOS market growth across European countries.

North America Distributed Fiber Optic Sensor Market

The market in North America is projected to grow at the fastest CAGR during the forecast period. This growth is primarily driven by technological advancements and increasing adoption across the oil and gas, energy and civil infrastructure sectors. Regional driver for North America includes strong regulatory frameworks focused on safety and environmental compliance, which push the integration of fiber optic sensing systems. Furthermore, substantial investments in upgrading aging infrastructure and smart grid deployments increase demand for real-time monitoring solutions. In addition, innovation hubs and established sensor manufacturers in the U.S. and Canada propel market expansion by offering sophisticated DFOS technologies.

The U.S. Distributed Fiber Optic Sensor Market Overview

The market in U.S. is expanding due to high technological capabilities and investments in infrastructure modernization. Regional driver for the U.S. includes stringent federal regulations on pipeline safety and environmental monitoring, which require advanced sensing technologies for compliance. Moreover, significant investments in smart grid and renewable energy projects are expanding the demand for distributed fiber optic sensors. According to the International Energy Agency (IEA), the Infrastructure Investment and Jobs Act allocated nearly USD 75 billion to clean energy initiatives by the end of 2023. This funding includes USD 21.3 billion for grid improvement and expansion, USD 21.5 billion for clean energy demonstration projects, USD 6.5 billion for energy efficiency programs and USD 8.6 billion for clean energy manufacturing and workforce development. In addition, the presence of leading sensor technology manufacturers accelerates innovation and market penetration across industrial and urban sectors.

Key Players & Competitive Analysis Report

The distributed fiber optic sensor market is moderately competitive, with leading players focusing on enhancing sensor accuracy, range, and integration capabilities. Key manufacturers are investing in developing application-specific solutions tailored for oil and gas, energy, and infrastructure sectors to meet stringent safety and environmental regulations. In addition, strategic collaborations between sensor providers, system integrators, and end users are driving customized solutions aligned with regional regulatory requirements and operational needs. These partnerships also facilitate innovation in data analytics and system interoperability, strengthening the market position of companies across critical infrastructure, transportation, and remote monitoring and control applications.

Major companies operating in the distributed fiber optic sensor industry include Luna Innovations Incorporated, Fotech Solutions Ltd, Hottinger Brüel & Kjær, AP Sensing GmbH, Yokogawa Electric Corporation, Silixa Ltd, Furukawa Electric Co., Ltd., General Electric Company (GE), Neubrex Co., Ltd., Siemens AG, AcousticEye LLC, and Hengxin Technology Co., Ltd.

Key Players

- AcousticEye LLC

- AP Sensing GmbH

- Fotech Solutions Ltd

- General Electric Company (GE)

- Hottinger Brüel & Kjær

- Hengxin Technology Co., Ltd.

- Luna Innovations Incorporated

- Neubrex Co., Ltd.

- Furukawa Electric Co., Ltd.

- Siemens AG

- Silixa Ltd

- Yokogawa Electric Corporation

Industry Developments

- November 2024: Sensonic opened a Fiber Sensing Innovation Farm in the UK to develop and test railway monitoring solutions using Distributed Acoustic Sensing. The facility features 12 km of buried optical fibers and AI-powered sensors for safe, efficient railway infrastructure monitoring.

- July 2024: VIAVI Solutions launched NITRO Fiber Sensing, a platform for real-time monitoring of critical infrastructure using advanced fiber optic sensing technologies. It helps detect threats and equipment issues early, reducing outages and costs.

Distributed Fiber Optic Sensor Market Segmentation

By Fiber Type Outlook (Revenue, USD Billion, 2020–2034)

- Single-Mode Fiber

- Multimode Fiber

By Operating Principle Outlook (Revenue, USD Billion, 2020–2034)

- Optical Time Domain Reflectometry

- Optical Frequency Domain Reflectometry

By Scattering Process Outlook (Revenue, USD Billion, 2020–2034)

- Rayleigh Scattering Effect

- Raman Scattering Effect

- Brillouin Scattering Effect

- Fiber Brag Grating

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Temperature Sensing

- Acoustic Sensing

- Other Sensing Applications

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Oil & Gas

- Energy & Power

- Civil Infrastructure & Construction

- Transportation & Railways

- Defense & Security

- Environmental Agencies

- Telecommunications

- Aerospace & Aviation

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Distributed Fiber Optic Sensor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.53 Billion |

|

Market Size in 2025 |

USD 1.70 Billion |

|

Revenue Forecast by 2034 |

USD 4.54 Billion |

|

CAGR |

11.53% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.53 billion in 2024 and is projected to grow to USD 4.54 billion by 2034.

The global market is projected to register a CAGR of 11.53% during the forecast period.

Asia Pacific dominated the market in 2024, driven by rapid infrastructure development and increasing adoption of energy-efficient monitoring solutions across urban centers.

A few of the key players in the market are Luna Innovations Incorporated, Fotech Solutions Ltd, Hottinger Brüel & Kjær, AP Sensing GmbH, Yokogawa Electric Corporation, Silixa Ltd, Furukawa Electric Co., Ltd., General Electric Company (GE), Neubrex Co., Ltd., Siemens AG, AcousticEye LLC, and Hengxin Technology Co., Ltd.

The single-mode fiber segment dominated the market in 2024, due to its high accuracy and long-distance sensing capabilities in critical infrastructure applications.

The acoustic sensing segment is projected to grow at the fastest CAGR, fueled by rising demand for real-time vibration and intrusion detection in the security and transportation sectors.