Distribution Automation Market Size, Share, Trends, & Industry Analysis Report

: By Type (Wired and Wireless), By Product, By Application, By Component, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5723

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

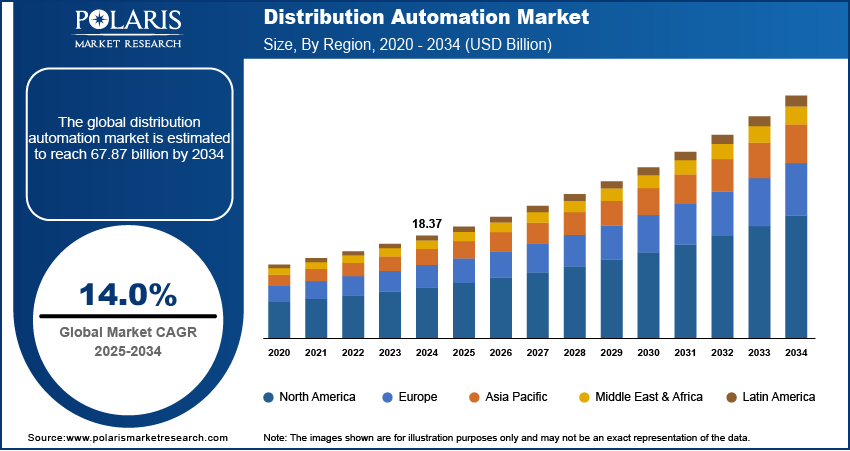

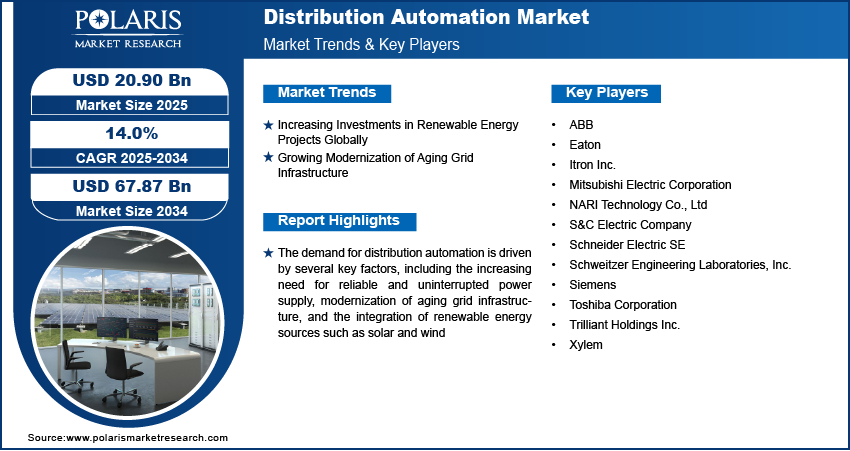

The global distribution automation market size was valued at USD 18.37 billion in 2024, growing at a CAGR of 14.0 % during 2025–2034. The demand for distribution automation is driven by the increasing need for a reliable and uninterrupted power supply, the modernization of aging grid infrastructure, and the integration of renewable energy sources such as solar and wind.

Distribution automation (DA) refers to the integration of advanced technologies such as sensors, processors, communication networks, and intelligent switches into electrical distribution systems to automate, monitor, and control the flow of electricity from substations to users. DA systems enable automatic fault detection and isolation, rapid feeder switching, and efficient outage management, which collectively reduce downtime and enhance service reliability for customers. Voltage monitoring and control, as well as reactive power management, are also streamlined, ensuring optimal power quality and minimizing energy losses. DA also supports seamless integration of distributed energy resources, such as solar and wind, into the grid, promoting renewable energy adoption and grid resilience. The implementation of DA brings significant operational and maintenance benefits, including reduced labor costs, improved fault diagnostics, and better system and asset utilization.

The growing urbanization globally is driving the distribution automation market growth. Urban areas require smarter systems to manage energy distribution, traffic flow, and waste management, which distribution automation systems offer by enabling localized control. Utility operators in urban centers are also adopting distribution automation solutions to reduce operational costs and improve service delivery in competitive environments. Moreover, expansion in urban areas is pushing industries and municipalities to deploy distributed automated solutions to maintain reliability and reduce electricity downtime. Therefore, the growing urbanization globally is propelling the demand for distributed automation.

To Understand More About this Research: Request a Free Sample Report

The distribution automation demand is driven by rising industrialization, particularly in emerging nations such as India, Brazil, and others. According to the Economic Survey 2023-24, Robust industrial growth of 9.5% was witnessed in India during the period. The expanding industrial sector requires flexible and scalable solutions to manage fluctuating energy needs, which traditional systems often fail to address efficiently. Distributed automation addresses these challenges by allowing factories to deploy modular & intelligent systems that optimize energy needs and adapt quickly to changing demands. Hence, the demand for distribution automation is rising with the growing industrialization, particularly in emerging nations.

Industry Dynamics

Increasing Investments in Renewable Energy Projects Globally

Renewable energy sources such as solar and wind are intermittent, geographically dispersed, and often integrated at the distribution level. This requires advanced distributed automation solutions to manage variable power flows, maintain voltage stability, and ensure real-time coordination between distributed energy resources (DERs) and the power grid. Utilities are also adopting decentralized automation solutions such as intelligent field devices, automated switches, and real-time monitoring software to respond quickly to fluctuations in renewable generation and load. The International Energy Agency, in its Renewables 2024 report, stated that the world is set to add more than 5,500 gigawatts (GW) of new renewable energy capacity between 2024 and 2030. As countries scale up their renewable capacity to meet climate goals and reduce carbon emissions, the need for a more responsive and resilient grid architecture intensifies, creating the demand for distributed automation solutions.

Growing Modernization of Aging Grid Infrastructure

Many existing power grids, particularly in developed regions, were built decades ago and lack the flexibility, resilience, and intelligence needed to meet rising energy demands. To address these challenges, utilities are investing in distributed automation solutions such as intelligent electronic devices (IEDs), remote terminal units (RTUs), and advanced distribution management systems (ADMS). These technologies enable real-time monitoring, remote control, predictive maintenance, and rapid fault isolation, which are essential for meeting rising energy demands by enhancing grid reliability and reducing operational costs. Upgrading aging networks with distributed automation extends the lifespan of infrastructure and supports the transition toward a more digital, resilient, and decentralized power system, thereby fueling the market.

Segmental Insights

By Type Analysis

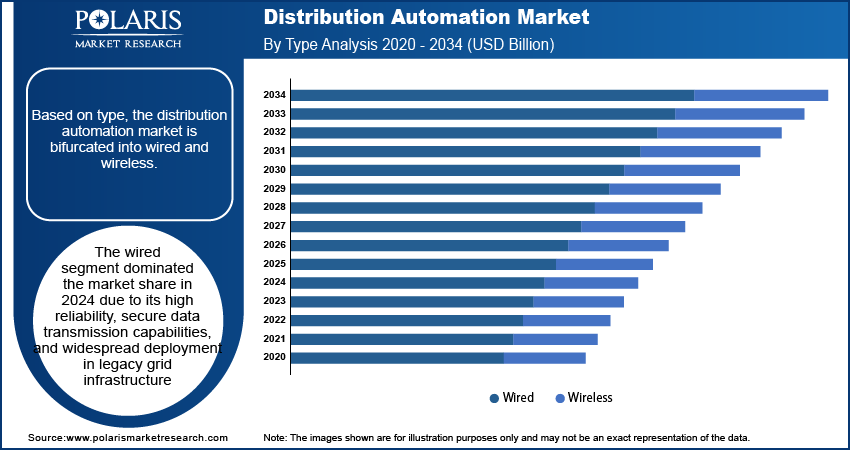

Based on type, the market is bifurcated into wired and wireless. The wired segment dominated the market share in 2024 due to its high reliability, secure data transmission capabilities, and widespread deployment in legacy grid infrastructure. Utilities favored wired communication systems such as power line communication (PLC) and fiber optics due to their resilience to external interferences and suitability for real-time control applications. Wired networks delivered low latency and consistent connectivity, which proved essential for critical applications such as fault detection, isolation, and service restoration (FDIR). Countries with mature grid systems, particularly in North America and Europe, continued to invest in upgrading existing infrastructure with wired communication frameworks to maintain operational stability and reduce outage durations.

By Product Analysis

Based on product, the market is divided into monitoring and control devices, power quality and efficiency devices, and switching and power reliability devices. The monitoring and control devices segment accounted for a major share in 2024 due to the widespread deployment of intelligent electronic devices (IEDs) and remote terminal units (RTUs) across power distribution networks. Utilities invested heavily in real-time grid monitoring solutions, including monitoring and control devices, to enhance operational visibility, reduce outage durations, and improve grid reliability. The growing need to automate fault detection, isolation, and service restoration further drove demand for monitoring and control devices. Additionally, the integration of distributed energy resources (DERs) and the increasing penetration of renewable energy sources necessitated the use of advanced monitoring devices capable of handling bidirectional power flows.

By Application Analysis

In terms of application, the distribution automation industry is divided into public and private. The private segment is expected to grow at a robust pace in the coming years, owing to the rapid industrialization, particularly in emerging economies such as India, China, and Brazil. Large commercial facilities, data centers, and industrial plants are increasingly deploying distribution automation solutions such as intelligent control and monitoring systems to ensure uninterrupted power supply and reduce operational costs. In addition, the growing presence of private renewable energy producers and microgrid operators is expanding the need for distributed automation solutions. The desire for energy independence, coupled with declining costs of automation technologies, is also encouraging private sector investment in smart energy infrastructure, including distribution automation.

By Component Analysis

Based on component, the market is segregated into software, field devices, and services. The field devices segment held the largest share in 2024 due to their critical role in enabling real-time monitoring, fault detection, and automated control across distribution networks. Utilities across developed and developing regions focused on upgrading legacy infrastructure by deploying field devices such as smart sensors, reclosers, voltage regulators, and automated switches to improve system reliability and reduce manual interventions. The increasing integration of renewable energy sources and the growing complexity of power distribution networks further fueled the demand for intelligent field equipment capable of managing two-way power flows and maintaining voltage stability. Additionally, rising investments in grid modernization initiatives and government mandates for energy efficiency supported large-scale deployments of field devices, contributing to the dominance of the segment.

Regional Analysis

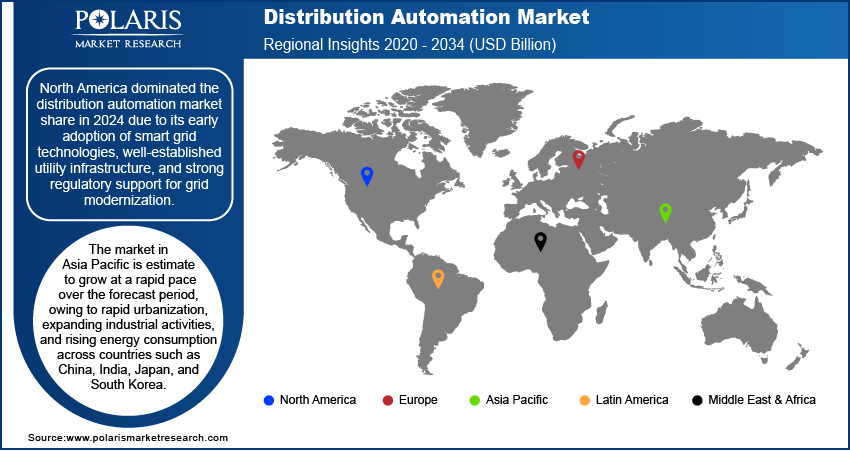

By region, the market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America distribution automation market dominated with the largest share in 2024 due to its early adoption of smart grid technologies, well-established utility infrastructure, and strong regulatory support for grid modernization. The US distribution automation market dominated in North America in 2024, driven by federal initiatives aimed at improving grid resilience, integrating renewable energy, and reducing outage durations. Utilities across the country invested heavily in advanced monitoring, control, and switching technologies to enhance operational efficiency and manage increasing electricity demand from data centers and distributed energy resources. The presence of major players and a mature ecosystem for research and development further supported widespread deployment of distributed automation systems in the region.

The Asia Pacific distribution automation market is estimated to grow at a rapid pace over the forecast period, owing to rapid urbanization, expanding industrial activities, and rising energy consumption across countries such as China, India, Japan, and South Korea. The China distribution automation market is expected to lead the regional growth, backed by strong government mandates, massive investments in grid infrastructure, and the rollout of nationwide smart grid programs. India is also emerging as a high-potential region, supported by its ambitious electrification goals and increasing private sector participation. The growing deployment of renewable energy and the need to improve grid reliability in rural areas are prompting greater adoption of automation technologies in the region.

The Europe distributed automation market is projected to hold a substantial market share during the forecast period, owing to a strong commitment to sustainability, energy efficiency, and grid reliability. Countries such as Germany, the UK, and France are adopting intelligent grid solutions as part of broader climate and energy transition strategies. The European Union’s stringent regulatory framework, including the Clean Energy Package and various national-level decarbonization targets, is compelling utilities to modernize their grid infrastructure and integrate distribution automation technologies. The widespread deployment of renewable energy sources across the region is also necessitating the use of advanced monitoring, control, and switching systems to manage grid stability and variability in power supply.

Key Players and Competitive Analysis

The distribution automation market is highly competitive, with key players leveraging product portfolio expansion, strategic partnerships, and mergers & acquisitions (M&A), to strengthen their market positions. Major companies are continuously innovating by introducing advanced smart grid solutions, including fault detection, isolation, and restoration (FDIR) systems, smart sensors, and AI-driven grid management platforms. These product expansions allow companies to cater to diverse utility needs, from real-time monitoring to predictive maintenance, enhancing their competitive edge. Strategic partnerships play a crucial role in accelerating innovation and market penetration. Collaborations between automation providers and utility companies enable real-world testing and customization of solutions.

ABB; Eaton; Itron Inc.; Mitsubishi Electric Corporation; NARI Technology Co., Ltd; S&C Electric Company; Schneider Electric SE; Schweitzer Engineering Laboratories, Inc.; Siemens; Toshiba Corporation; Trilliant Holdings Inc.; and Xylem are among the prominent companies in the distribution automation market.

Schneider Electric SE is a French multinational corporation recognized globally for its expertise in energy management and digital automation. Headquartered in Rueil-Malmaison, France, the company operates in over 100 countries. Schneider Electric’s core mission is to empower customers by making the most of their energy and resources, bridging progress and sustainability through innovative solutions. A significant focus for Schneider Electric is power distribution, where it has been a leader for more than 50 years. The company’s portfolio spans low and medium-voltage electrical distribution, grid automation, and critical power solutions. Its flagship platform, EcoStruxure Power, exemplifies Schneider’s commitment to digital transformation in power distribution. Schneider Electric’s solutions are designed to address the evolving demands of a decentralized, decarbonized, and digitized energy landscape.

ABB is a global technology company in electrification and automation, with a history spanning over 140 years and a presence in more than 100 countries. Headquartered in Zurich, Switzerland, ABB employs around 110,000 people worldwide and is listed on the SIX Swiss Exchange and Nasdaq Stockholm. The company’s purpose is to enable a more sustainable and resource-efficient future by leveraging its expertise in engineering, digitalization, and technological innovation. ABB invests approximately 4–5% of its annual revenues in research and development, driving continuous advancements in its core areas. Power distribution has been a traditional core activity for ABB, alongside power generation, transmission, industrial automation, and robotics. The company provides a comprehensive portfolio of products and solutions for electrical distribution, including switchgear, circuit breakers, distribution automation, and digital monitoring systems. ABB’s offerings are designed to support the integration of renewable energy, enhance grid reliability, and enable smarter, more efficient power networks. Its technologies help utilities, industries, and infrastructure operators optimize energy flows, reduce losses, and ensure the safe and reliable delivery of electricity.

Key Players

- ABB

- Eaton

- Itron Inc.

- Mitsubishi Electric Corporation

- NARI Technology Co., Ltd

- S&C Electric Company

- Schneider Electric SE

- Schweitzer Engineering Laboratories, Inc.

- Siemens

- Toshiba Corporation

- Trilliant Holdings Inc.

- Xylem

Industry Developments

May 2025: Toshiba International Corporation (TIC) announced the launch of the Toshiba 3000 SP series uninterruptible power system (UPS). The 3000 SP Series UPS offers unparalleled reliability and efficiency, making it ideal for enterprise IT systems and edge data centers.

February 2025: Schneider Electric, a major company in the digital transformation of energy management and NextGen automation, showcased a comprehensive range of electrical and automation products and solutions in India to accelerate the country’s energy transition and empower customers across industries, infrastructure, data centers, buildings, and homes.

December 2024: ABB Electrification opened a new Smart Buildings & Smart Power Technology Hub to showcase power distribution and building automation solutions for data centers and both commercial and residential buildings.

Distribution Automation Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Wired

- Wireless

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Monitoring and Control Devices

- Power Quality and Efficiency Devices

- Switching and Power Reliability Devices

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Private

- Public

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Software

- Field Devices

- Services

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Industrial

- Commercial

- Residential

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Distribution Automation Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.37 billion |

|

Market Size Value in 2025 |

USD 20.90 billion |

|

Revenue Forecast by 2034 |

USD 67.87 billion |

|

CAGR |

14.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 18.37 billion in 2024 and is projected to grow to USD 67.87 billion by 2034.

The global market is projected to register a CAGR of 14.0% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are ABB; Eaton; Itron Inc.; Mitsubishi Electric Corporation; NARI Technology Co., Ltd; S&C Electric Company; Schneider Electric SE; Schweitzer Engineering Laboratories, Inc.; Siemens; Toshiba Corporation; Trilliant Holdings Inc.; and Xylem

The wired segment dominated the market share in 2024.

The private segment is expected to witness the fastest growth during the forecast period.