DNA Diagnostics Market Size, Share, Trends, Industry Analysis Report

: By Offering (Instruments, Reagents & Kits, and Services & Software), Technology, Specimen, Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 - 2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5229

- Base Year: 2024

- Historical Data: 2020-2023

DNA Diagnostics Market Overview

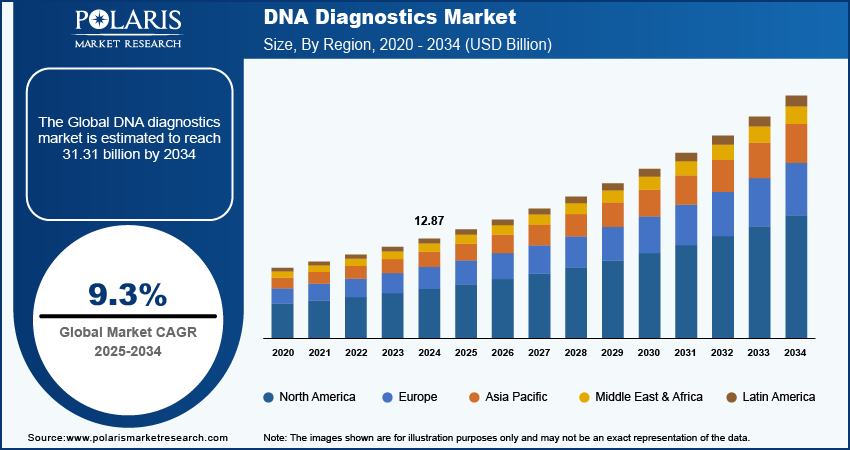

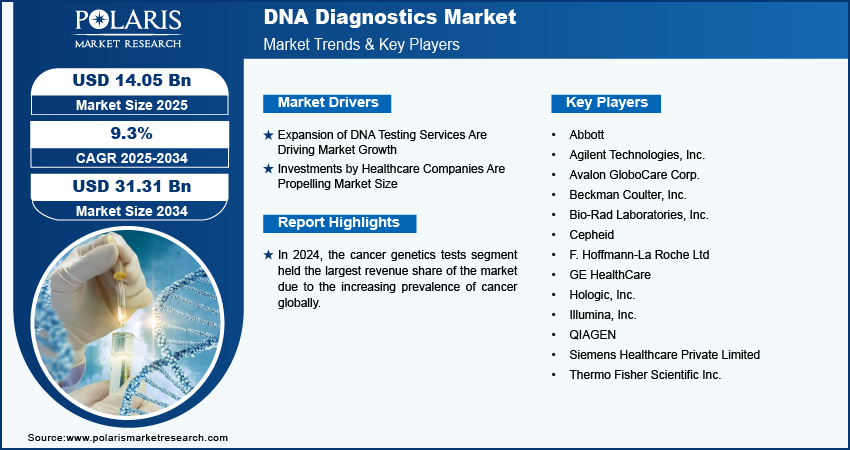

Global DNA diagnostics market size was valued at USD 12.87 billion in 2024. The market is projected to grow from USD 14.05 billion in 2025 to USD 31.31 billion by 2034, exhibiting a CAGR of 9.3% during the forecast period.

DNA diagnostics refers to the use of genetic testing to identify and analyze changes in DNA sequences that are linked to diseases, genetic disorders, or other health conditions. The growth of the DNA diagnostics market is fueled by the increasing prevalence of genetic disorders across the globe. For instance, according to WHO, there are approximately 10,000 distinct types of monogenic diseases caused due to mutations in a single gene. Globally, the prevalence stands at 10 per 1000 individuals, indicating that between 70 million and 80 million people live with one of the genetic disorder conditions. This growth in genetic conditions has resulted in a heightened need for effective tools to identify and assess genetic disorders. Thus, the growing incidence of conditions such as rare genetic diseases, hereditary cancers, and inherited metabolic disorders are bolstering the development of advanced diagnostic technologies, thereby driving the DNA diagnostics market.

To Understand More About this Research: Request a Free Sample Report

Advancements in genomic technology are significantly propelling the DNA diagnostics market by enhancing the precision, speed, and affordability of genetic testing. Innovations such as next-generation sequencing (NGS), advanced bioinformatics, and high-throughput data analysis have revolutionized the ability to identify genetic variants and mutations with greater accuracy. For instance, in May 2024, BioAro, a genomic research and technology company, introduced PanOmiQ, a software that offers real-time insights into the complexities of the human genome. Such technological improvements enable comprehensive genome analysis, allowing for more detailed and reliable diagnostic results. Consequently, the continual evolution of genomic technologies is supporting the development of new diagnostic tools and methods, which fuels the DNA diagnostics market growth.

DNA Diagnostics Market Drivers and Trends

Expansion of DNA Testing Services

The expansion of DNA testing services broadens access to genetic testing and increases its adoption among diverse populations. The proliferation of testing services ranging from clinical diagnostics for disease identification to direct-to-consumer genetic tests for ancestry and health insights has made genetic information more accessible. Several companies are introducing at-home DNA testing services due to the increasing availability of testing options and the integration of these services into routine healthcare practices. For instance, in May 2024, iMeUsWe expanded DNA testing services in collaboration with MapMyGenome. The DNA testing service has been developed to offer in-depth insights into crucial aspects of wellness, health, and ancestry. Such expansion of testing services is promoting innovation and competition in the market, further contributing to the growth of the DNA diagnostics market.

Investments by Healthcare Companies

Healthcare companies are increasing investments to fuel innovation, research, and the development of new diagnostic technologies. The investments enable companies to advance genomic research, improve testing methodologies, and enhance the accuracy and reliability of DNA diagnostics. For instance, in May 2024, Karius, a developer of infectious disease diagnostics, raised USD 100 million in funding for the expansion of its microbial DNA test, which is capable of detecting over 1,000 pathogens from a single blood sample. These types of funding are supporting the development of next-generation sequencing platforms, high-throughput data analysis systems, and advanced bioinformatics solutions. Therefore, the investments made by the companies are facilitating partnerships with research institutions and the integration of genetic testing into healthcare practices, which propels the growth of the DNA diagnostics market.

DNA Diagnostics Market Segment Insights

DNA Diagnostics Market Breakdown by Offering Insights

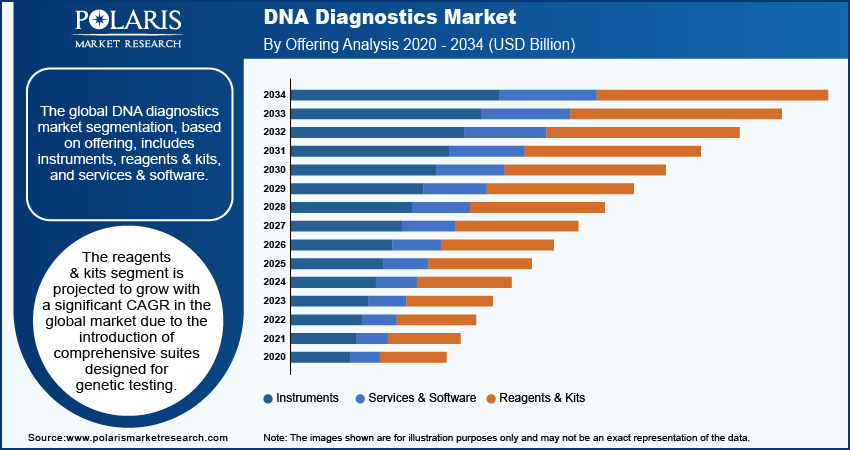

The DNA diagnostics market segmentation, based on offering, includes instruments, reagents & kits, and services & software. The reagents & kits segment is projected to register a significant CAGR in the global market due to the introduction of comprehensive suites designed for genetic testing. Several diagnostic companies are launching advanced reagents and kits to facilitate various aspects of DNA analysis, including sample preparation, amplification, and detection, that enhance the efficiency and accuracy of genetic testing.

For instance, in July 2024, Creative Diagnostics introduced an extensive range of Host Cell DNA Assay Kits designed for the detection and quantification of residual host cell DNA impurities in biological products. Such developments of solutions streamline the testing process and improve reliability. Thus, the increasing innovations and availability of kits to address a wide range of genetic testing is expected to drive the significant growth of the reagents & kits segment over the forecast period.

DNA Diagnostics Application Insights

The DNA diagnostics market segmentation, based on application, includes cancer genetics tests, infectious diseases DNA testing, newborn genetic screening, preimplantation & reproductive diagnosis, non-infectious diseases DNA testing, hematology & immunology/identity diagnostics & forensics, pharmacogenomics/drug metabolism, prenatal DNA carrier screening, and others. In 2023, the cancer genetics tests segment held the largest revenue share of the market due to the increasing prevalence of cancer globally. For instance, according to the National Cancer Institute, in 2022, the global incidence of new cancer cases reached nearly 20 million, with 9.7 million cancer-related deaths reported. This rising incidence of cancer has significantly heightened the demand for genetic tests that identify mutations and biomarkers associated with various cancers. Therefore, the increasing demand has driven a substantial revenue share of the cancer genetics tests segment in the global DNA diagnostics market.

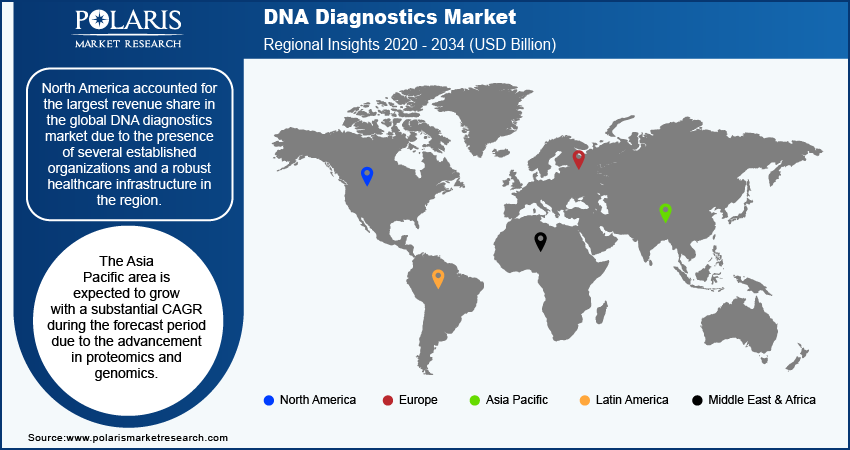

DNA Diagnostics Regional Insights

By region, the study provides the DNA diagnostics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest revenue share in the global DNA diagnostics market due to the presence of several established organizations and a robust healthcare infrastructure in the region. North American market possesses several biotechnology firms and diagnostic companies, such as Abbott; GE HealthCare; Beckman Coulter, Inc.; Bio-Rad Laboratories, Inc.; and Thermo Fisher Scientific, Inc., that drive innovation and advancements in DNA diagnostics. These organizations contribute to the development of technologies, including advanced sequencing platforms and comprehensive genetic testing solutions. Also, North America’s well-established healthcare system supports the widespread adoption of DNA diagnostics through extensive clinical networks, facilitating broad access to genetic testing services. Thus, the combination of a robust industry presence and significant research and development activities in North America has resulted in the dominance of the region in the global DNA diagnostics market.

Asia Pacific is expected to grow with a substantial CAGR during the forecast period due to the advancement in proteomics and genomics. For instance, in May 2024, SOPHiA GENETICS, a cloud-based healthcare technology firm, collaborated with Microsoft and NVIDIA to leverage their expertise in technology and genomics. This partnership was aimed to introduce an efficient and scalable solution for whole genome sequencing (WGS) analysis in healthcare facilities. Such advancements are resulting in a rising demand for advanced testing services to aid in research, drug development, and personalized medicine.

China DNA diagnostics market is expected to grow significantly due to the country's increasing investment in healthcare infrastructure and biotechnology. The country’s government has prioritized advancements in healthcare as part of its broader responsibility to improve public health and medical services. This focus includes substantial funding for research and development in genetic technologies, as well as initiatives to enhance the availability and quality of diagnostic services. Thus, the development and adoption of advanced DNA diagnostic tools and technologies are accelerating, thereby driving market growth in the country.

DNA Diagnostics Key Market Players & Competitive Insights

The global DNA diagnostics market is dynamic, with several key players driving innovation and growth. Major biotechnology and pharmaceutical companies dominate the market through their extensive portfolios of advanced genetic testing technologies and solutions. These companies invest heavily in research and development to enhance their product offerings and maintain competitive advantages.

The market features a range of specialized firms and startups focused on areas such as personalized medicine, cancer diagnostics, and genetic disease testing. Competition is further intensified by ongoing advancements in genomic technology, decreasing costs of sequencing, and the emergence of new players in both developed and emerging markets. Major players in the DNA diagnostics market include Abbott; Agilent Technologies, Inc.; Avalon GloboCare Corp.; Beckman Coulter, Inc.; Bio-Rad Laboratories, Inc., Cepheid, F. Hoffmann-La Roche Ltd, GE HealthCare, Hologic, Inc., Illumina, Inc., QIAGEN, Siemens Healthcare Private Limited, and Thermo Fisher Scientific Inc.

Thermo Fisher Scientific Inc. offers a wide range of specialty diagnostics, life sciences solutions, laboratory products, analytical instruments, and biopharma services to customers worldwide. The life sciences solutions division offers a comprehensive range of instruments, reagents, and consumables for medical and biological research, disease diagnosis, and drug and vaccine discovery and production. The analytical instruments division provides a broad portfolio of consumables, instruments, software, and services for use in biotechnology, pharmaceutical, academic, environmental, government, and other research and industrial markets, as well as clinical laboratories. In February 2023, Thermo Fisher Scientific announced that its Applied Biosystems TaqPath PCR kits for infectious diseases such as M. tuberculosis complex (MTB), multi-drug-resistant tuberculosis (MTB MDR), hepatitis B virus (HBV), human immunodeficiency virus (HIV), hepatitis C virus (HCV), and for genetic analysis (HLA B27) had been granted licensing rights by the Central Drugs Standard Control Organisation (CDSCO).

Bio-Rad Laboratories, Inc. is a manufacturer and developer of a wide range of products associated with life science and clinical diagnostics. The company is headquartered in Hercules, California, and has a global presence spanning North America, Europe, the Middle East and Africa, Latin America, and Asia Pacific regions. It specializes in life science research, digital biology, and clinical diagnostics. The core offerings of Bio-Rad Laboratories, Inc. include varied products and diagnostic tests such as diabetes testing, infectious disease testing, autoimmune testing, chromatography, and cell isolation & analysis, among others. In addition, the Bio-Rad Laboratories, Inc. platform serves as a combination of varied services, including food and beverage testing, classroom education, molecular testing, and others. In April 2024, Bio-Rad Laboratories, Inc. introduced the ddPLEX ESR1 Mutation Detection Kit and ultrasensitive multiplexed digital PCR assay. This new assay adds to the company's range of ddPCR offerings for the oncology sector, offering multiplexed and sensitive mutation detection assays that play a crucial role in translational research, therapy selection, and disease monitoring.

List of Key Companies in DNA Diagnostics Market

- Abbott

- Agilent Technologies, Inc.

- Avalon GloboCare Corp.

- Beckman Coulter, Inc.

- Bio-Rad Laboratories, Inc.

- Cepheid

- F. Hoffmann-La Roche Ltd

- GE HealthCare

- Hologic, Inc.

- Illumina, Inc.

- QIAGEN

- Siemens Healthcare Private Limited

- Thermo Fisher Scientific Inc.

DNA Diagnostics Industry Developments

July 2024: Avalon GloboCare Corp announced that Laboratory Services MSO, LLC introduced a direct-to-consumer, non-invasive DNA test in the US The test is designed to assess potential genetic predisposition to opioid dependence.

September 2023: Yourgene Health, an international molecular diagnostics group, introduced the Yourgene MagBench Automated DNA Extraction Instrument and Kit. The MagBench system provides a streamlined, rapid, and cost-effective robotic cell-free DNA (cfDNA) extraction workstation that is specifically tailored for Yourgene’s Sage 32 NIPT Workflow.

July 2023: Quest Diagnostics introduced a consumer-initiated genetic test, the Genetic Insights test. This test utilizes a saliva sample to examine 36 genes, providing insights into an individual's susceptibility to nearly twenty inheritable conditions.

DNA Diagnostics Market Segmentation

By Offering Outlook

- Instruments

- Reagents & Kits

- Services & Software

By Technology Outlook

- In Situ Hybridization

- Mass Spectroscopy

- Microarrays

- Polymerase Chain Reaction (PCR)

- Sequencing

- Others

By Specimen Outlook

- Blood, Serum, and Plasma

- Urine

- Others

By Application Outlook

- Cancer Genetics Tests

- Infectious Diseases DNA Testing

- CT/NG Diagnostic

- HBV Diagnostic

- HCV Diagnostic

- HIV Diagnostic

- HPV Diagnostic

- MRSA Diagnostic

- TB Diagnostic

- Others

- Newborn Genetic Screening

- Preimplantation & Reproductive Diagnosis

- Non-Infectious Diseases DNA Testing

- Cardiovascular Diseases

- CNS & PNS Related

- Lung, Kidney, Liver & GT Related

- Sensory Diseases

- Skeletal, Connective, Ectodermal & Dermal DNA Testing

- Hematology & Immunology/Identity Diagnostics & Forensics

- Pharmacogenomics/Drug Metabolism

- Prenatal DNA Carrier Screening

- Others

By End User Outlook

- Diagnostic laboratories

- Hospitals & clinics

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

DNA Diagnostics Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 12.87 billion |

|

Market size value in 2025 |

USD 14.05 billion |

|

Revenue Forecast in 2034 |

USD 31.31 billion |

|

CAGR |

9.3% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global DNA diagnostics market size was valued at USD 12.87 billion in 2024 and is projected to grow to USD 31.31 billion by 2034.

The global market is projected to grow at a CAGR of 9.3% during the forecast period, 2025-2034.

North America had the largest share in the global market

The key players in the market are Abbott, Agilent Technologies, Inc., Avalon GloboCare Corp., Beckman Coulter, Inc., Bio-Rad Laboratories, Inc., Cepheid, F. Hoffmann-La Roche Ltd, GE HealthCare, Hologic, Inc., Illumina, Inc., QIAGEN, Siemens Healthcare Private Limited, and Thermo Fisher Scientific Inc.

The reagents and kits segment is expected to grow with a substantial CAGR in the global market, driven by the development of comprehensive suites tailored for genetic testing.

In 2024, the cancer genetics tests segment accounted for the largest market share because of the increasing prevalence of cancer globally.