Downstream Processing Market Share, Size, Trends, Industry Analysis Report

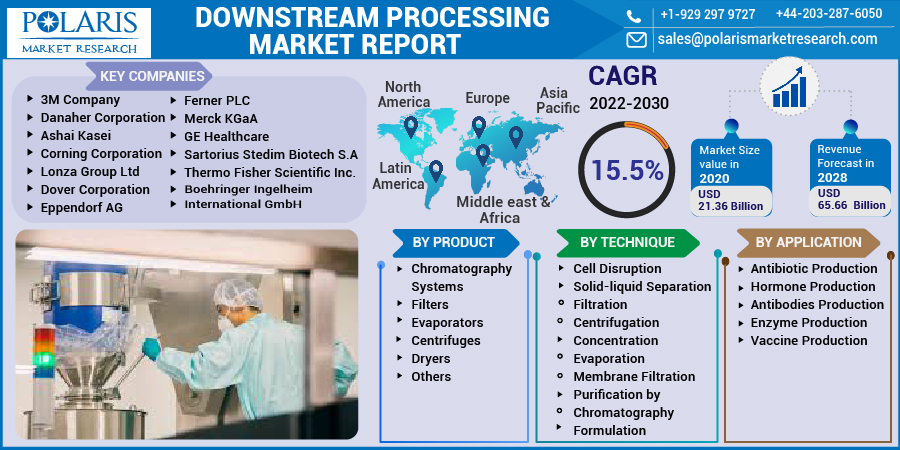

By Technique (Cell Disruption, Solid-liquid Separation, Concentration, Purification by Chromatography, Formulation); By Product; By Application; By Regions; Segment Forecast, 2021 - 2028

- Published Date:May-2021

- Pages: 128

- Format: PDF

- Report ID: PM1909

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

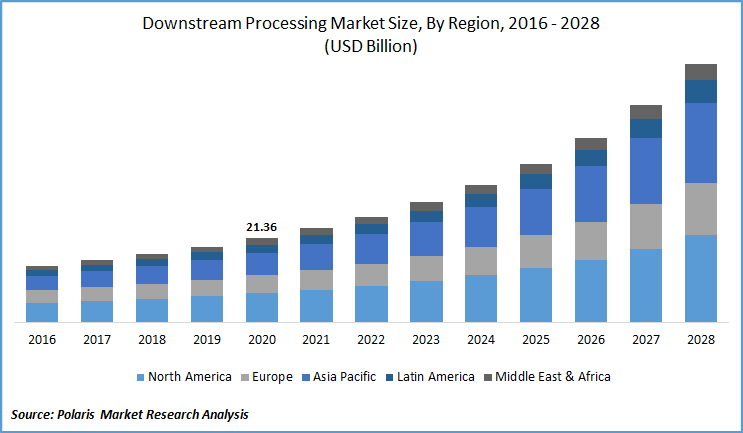

The global downstream processing market was valued at USD 21.36 billion in 2020 and is expected to grow at a CAGR of 15.5% during the forecast period. A significant factor driving market demand is the increased use of downstream processing techniques for the production of COVID-19 vaccines.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

For instance, in February 2021, Rentschler Biopharma will begin CureVac commercial production, formulation, and downstream processing of candidate vaccine. Bayer has also announced that 160 million doses of CVnCoV will be produced, in 2022.

Industry Dynamics

Growth Drivers

In January 2021, Thermo Fisher announced it will support 250 projects for COVID-19 treatment and vaccine progress in the coming years. These ventures make use of the company's CDMO proficiencies and its bioprocess consumable materials and equipment. It also formed alliances with Singapore and the U.S. government to increase vaccine and therapy production.

An increase in research and developmental activities regarding innovative bioprocess technologies has caused the implementation of constant downstream processing systems for high-resolution membrane systems, high-throughput process development, multicomponent separations, and perfusion chromatography systems.

The number of CMOs in the downstream manufacturing sector has grown as a result of outsourcing pharmaceutical manufacturers' high initial capital expenditure and process costs. In addition to mixing, disposable technologies, cell culture preparation, concentration, chromatography, and process control, CMOS assists pharma companies in enhancing downstream purification.

The research report offers a quantitative and qualitative analysis of the Downstream Processing Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Know more about this report: request for sample pages

Downstream Processing Market Report Scope

The market is primarily segmented based on product, technique, application, and region.

|

By Product |

By Technique |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

Chromatography systems accounted for the largest revenue share of the downstream processing market. Due to continuous R&D to improve the efficacy and pace of chromatography systems, the segment is expected to develop. Growth in the chromatography systems segment is also helped by an increase in deals and innovations.

For example, Sartorius Stedim Biotech announced in January 2021 that it would acquire Novasep's chromatography equipment company. Sartorius will be able to create new chromatography systems as a result of this, which will help the company solve reliability problems and bottlenecks in downstream processing.

Insight by Technique

Purification by chromatography accounted for the largest market share of the global downstream processing industry in 2020. Companies are following market expansion tactics such as a merger, acquisition, and agreement to extend their chromatography portfolio as filtration systems and single-use chromatography are well known recognized in downstream bioprocessing.

For instance, Repligen Corporation has entered into an acquisition agreement with ARTeSYN Biosolutions in, October 2020. ARTeSYN Biosolutions is a well-known manufacturer of single-use filtration and chromatography equipment. The company also offers a variety of single-use solutions for continuous production and media/buffer planning workflows.

Insight by Application

Due to the extensive use of antibiotics for the treatment of several diseases, antibiotic development dominated the downstream manufacturing sector, in 2020, with the largest revenue share. Antibiotic-resistant bacteria kill over 700,000 people per year. As a result, there is a strong market demand for the production of antibiotics, which propels the market growth for downstream processing.

Geographic Overview

Due to the rising government funding for promoting bioprocess technology, increasing medical spending, and developed healthcare infrastructure, North America dominated the downstream processing market with the largest revenue share, in 2020. Besides, the area has seen significant collaboration with healthcare behemoths that are heavily investing in biopharmaceutical and vaccine R&D.

Furthermore, major players in the downstream processing industry are expanding their presence in this area. For example, Thermo Fisher Scientific Inc. announced in December 2020 that it will expand its commercial manufacturing of drugs, vaccines, and therapies in Europe and North America.

The development incorporated 15 development and cGMP commercial manufacturing facilities, allowing the company to serve a wide variety of manufacturing capabilities while maintaining its high-quality standards.

Owing to the growing biotechnology investments by developers and customers, the market demand for downstream processing in the Asia Pacific is projected to expand at the fastest pace of 17.5%. The need for advanced medical facilities is being driven by the existence of a broad population base, and players are eager to introduce rapid analytical methods to help in-process design and bioprocessing.

Due to the rising biopharmaceutical industry and market demand for medicines and vaccines, China dominated the market share in the Asia Pacific downstream processing market. The biopharmaceutical industry is one of China's most active economic industries, with new biopharmaceutical equipment and processes constantly revolutionizing the industry.

Competitive Insight

Key players in the market for downstream processing are concentrating their energies on strategic acquisitions to boost their research and development capabilities, which will help them provide creative solutions to users and gain a competitive edge.

Market participants such as 3M Company, Danaher Corporation, Ashai Kasei, Corning Corporation, Lonza Group Ltd, Boehringer Ingelheim International GmbH, Dover Corporation, Eppendorf AG, Ferner PLC, Merck KGaA, GE Healthcare, Sartorius Stedim Biotech S.A, Thermo Fisher Scientific Inc., and Repligen are some of the companies operating in the market for downstream processing.

Gain profound insights into the 2024 Downstream Processing Market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.