Drilling Polymers Market Share, Size, Trends, Industry Analysis Report

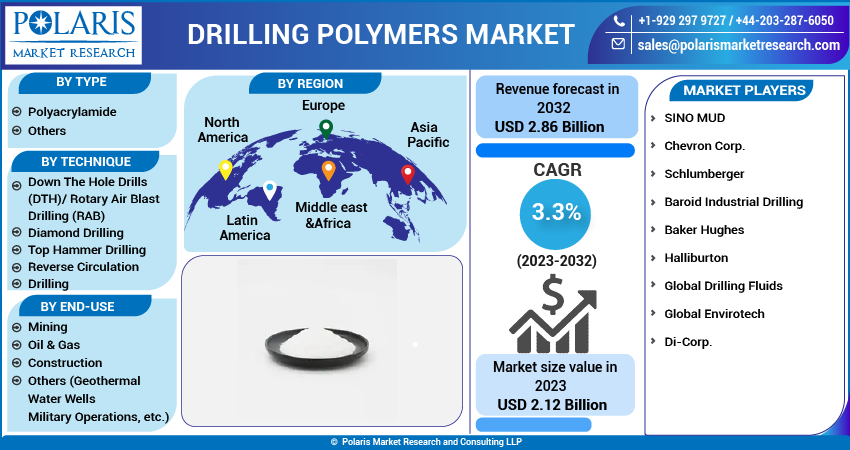

By Technique (DTH Drills, Diamond Drilling, Top Hammer Drilling, Reverse Circulation Drilling, Others); By End-Use (Oil & Gas, Mining, Construction, Others); By Type; By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Jul-2023

- Pages: 114

- Format: PDF

- Report ID: PM3566

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

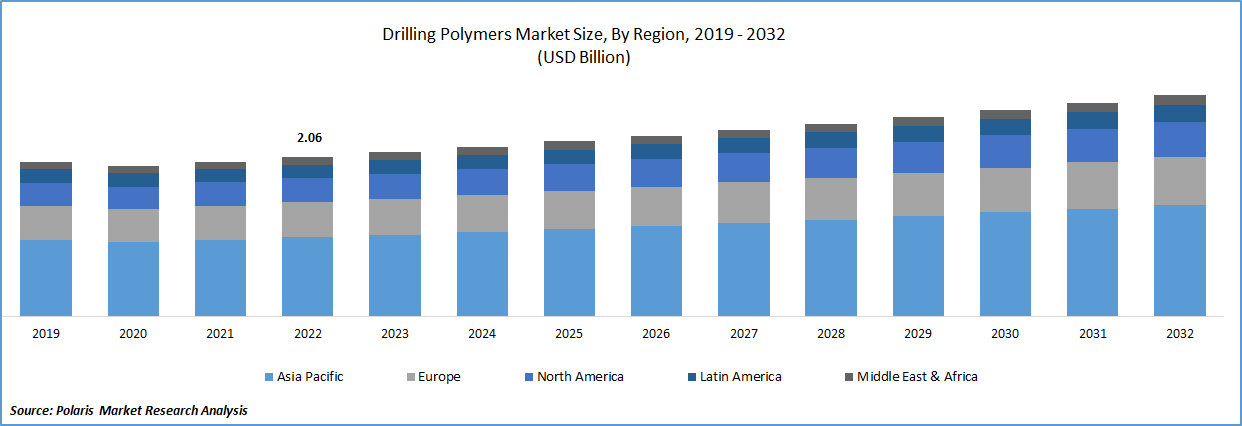

The global drilling polymers market was valued at USD 2.06 billion in 2022 and is expected to grow at a CAGR of 3.3% during the forecast period. Increasing demand for drilling polymers can be attributed to their beneficial properties that enhance drilling operations in various industries, including mining, construction, and oil & gas. These polymers are typically added to water-based drilling mud to improve its performance. One of the key advantages of drilling polymers is their ability to reduce the viscosity of the drilling mud. By lowering viscosity, the flow rate of the mud is improved, allowing for easier and more efficient drilling. This helps to reduce downtime during drilling operations and increases overall productivity.

To Understand More About this Research: Request a Free Sample Report

Drilling polymers also provide better lubrication to the drill bit, reducing friction and wear. This not only extends the lifespan of the drill bit but also improves drilling efficiency by enabling smoother and faster drilling processes. In the oil and gas industry, drilling polymers play a crucial role in borehole drilling. They help to stabilize the borehole, prevent the collapse of the wellbore walls, and enhance the overall drilling performance. By using drilling polymers, operators can optimize drilling operations, increase drilling speed, and improve wellbore integrity.

For Specific Research Requirements, Request for a customized Report

Industry Dynamics

Growth Drivers

Drilling polymers are specifically formulated to enhance the drilling process by reducing friction and offering superior lubrication to the drill bit. These properties play a vital role in improving drilling efficiency and overall operational performance. Reducing friction is crucial in drilling operations as it helps to minimize the resistance encountered by the drill bit during drilling. By reducing friction, drilling polymers enable smoother and faster drilling, which in turn leads to increased efficiency and productivity.

Additionally, the improved lubrication provided by drilling polymers helps to reduce heat generation and wear on the drill bit. This leads to longer tool life and decreased downtime for bit replacements, further enhancing the overall drilling process.

Increasing demand for drilling polymers can be attributed to the expanding oil & gas and mining sectors in the country. As per the Council on Foreign Relations, the United States meets approximately 90% of its natural gas requirement and 75% of its crude oil demand from domestic sources. This equates to a daily production of 11 million barrels of crude oil and 1 million cubic feet of natural gas in 2021. Consequently, the surge in onshore oil & gas exploration activities in the United States is expected to boost the demand for drilling polymers in the foreseeable future.

Report Segmentation

The market is primarily segmented based on type, technique, end use, and region.

|

By Type |

By Technique |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Polyacrylamide segment accounted for the largest market share in 2022

The dominance of polyacrylamide can be attributed to its water-soluble nature, which makes it highly effective as a viscosifier, & inhibitor. By encapsulating poly-acrylamide enhances the drilling process and contributes to improved efficiency & production rates. Its widespread use in the oil and gas industry further strengthens its position as a preferred polymer for optimizing drilling operations.

With the global increase in drilling activities, the demand for polyacrylamide and other polymers is expected to rise. Apart from polyacrylamide, other commonly used polymers in the industry include xanthan gum, & starch. These products possess distinct characteristics. Xanthan & guar gum, for instance, are natural & biodegradable. However, starch is a renewable & cost-effective source of polymer. The availability of different polymer options allows for flexibility in meeting specific drilling requirements and addressing environmental considerations.

Diamond Technique segment expected to hold significant market share

Diamond drilling segment is projected to hold significant market share in terms of revenue over the study period. These drill bits are equipped with diamond-impregnated tips that grind away the material as they rotate, enabling fast and efficient drilling. In diamond drilling, polymers play a crucial role in enhancing the efficiency and effectiveness of the drilling process. They serve as viscosifier, improving the viscosity of the drilling fluid, and help reduce friction between the drill bit and the rock surface. By reducing friction, the polymers facilitate smoother drilling and contribute to higher drilling speeds.

Reverse circulation recorded the highest growth rate. The incorporation of polymers into drilling fluids improves their ability to transport cuttings to the surface, which can be especially crucial in reverse circulation drilling, where large volumes of cuttings are generated. Additionally, the use of polymers can help reduce the likelihood of borehole collapse, ensuring that the drilling process is more efficient and effective.

Mining segment is expected to witness highest growth

As the demand for metals and mineral resources continues to rise, the mining sector is expected to expand accordingly. Furthermore, advancements in technologies and mining processes have made resource extraction more efficient and cost-effective, leading to improved productivity and profitability for mining operations. These factors contribute to the overall growth and expansion of the mining industry over the forecast period.

Oil & gas segment garnered the largest share. The increasing global demand for oil & gas has fueled a rise in drilling activities aimed at exploring and extracting these resources. Consequently, there has been a growing need for drilling polymers to support and optimize these drilling operations. According to the Organization of the Petroleum Exporting Countries (OPEC), there is a projected increase in oil demand of 17.6 million barrels per day between 2020 and 2045. This translates to a rise from 90.6 million barrels per day in 2020 to 108.2 million barrels per day in 2045. This anticipated growth in oil demand further strengthens the prospects for the drilling polymers market.

Asia Pacific region dominated the global market in 2022

Asia Pacific region dominated the global market with considerable market share in 2022. This growth can be attributed to the increasing mining and drilling activities across various countries in the region, including China, India, Japan, and South Korea. For instance, China, with over 1,500 major mining operations, holds a prominent position in the production of various minerals such as cement, coal, gold, aluminum, graphite, iron, steel, zinc, magnesium, and rare earth elements like antimony and tellurium. The country's substantial investments, spending approximately USD 200 billion annually on mine supply and services, coupled with its significant mineral production value of over USD 400 billion per year, contribute to the region's dominance in the industry.

North America region is anticipated to be the fastest growing region throughout the projected period. The oil and gas as well as mining activities in countries such as Canada, Mexico, and the United States are expected to drive the demand for drilling polymers in the market. For example, Canada ranks as the fourth-largest oil producer and sixth-largest natural gas producer globally, with Alberta being the leading province in oil and natural gas production.

Competitive Insight

Market is indeed highly competitive, featuring numerous manufacturers and suppliers, both large-scale and small-scale, operating in the industry. Key players in the market often prioritize innovation and product development to gain a competitive edge. They invest in research and development to introduce advanced drilling polymer solutions that meet the evolving needs of end-users. These players focus on enhancing the performance, efficiency, and environmental sustainability of their products to attract customers.

Smaller participants in the market may adopt pricing strategies as their primary competitive approach. They may offer more competitive prices to attract customers and gain market share. While pricing plays a role in the competition, it is essential to note that the market's emphasis on innovation and product development sets a benchmark for overall competition in the industry. Key players include SINO MUD, Chevron Corp., Schlumberger, Baroid Industrial Drilling, Baker Hughes, Halliburton, Global Drilling Fluids, Global Envirotech, and Di-Corp.

Recent Developments

- In March 2022, Baker Hughes completed the acquisition of the Altus Intervention. This move is expected to strengthen company’s existing portfolio in oil & gas management solutions.

Drilling Polymers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2.12 billion |

|

Revenue forecast in 2032 |

USD 2.86 billion |

|

CAGR |

3.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2021 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Technique, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

SINO MUD, Chevron Corp., Schlumberger, Baroid Industrial Drilling, Baker Hughes, Halliburton, Global Drilling Fluids, Global Envirotech, and Di-Corp. |

FAQ's

The global drilling polymers market size is expected to reach USD 2.86 billion by 2032.

Key players in the SINO MUD, Chevron Corp., Schlumberger, Baroid Industrial Drilling, Baker Hughes.

Asia Pacific contribute notably towards the global drilling polymers market.

The global drilling polymers market is expected to grow at a CAGR of 3.3% during the forecast period.

The drilling polymers market report covering key segments are type, technique, end use, and region.