Drone Communication Market Size, Share, & Industry Analysis Report

: By Communication, By Application, By End Use (Government & Defense Organizations, Commercial Enterprises, and Private Operators), and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5686

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

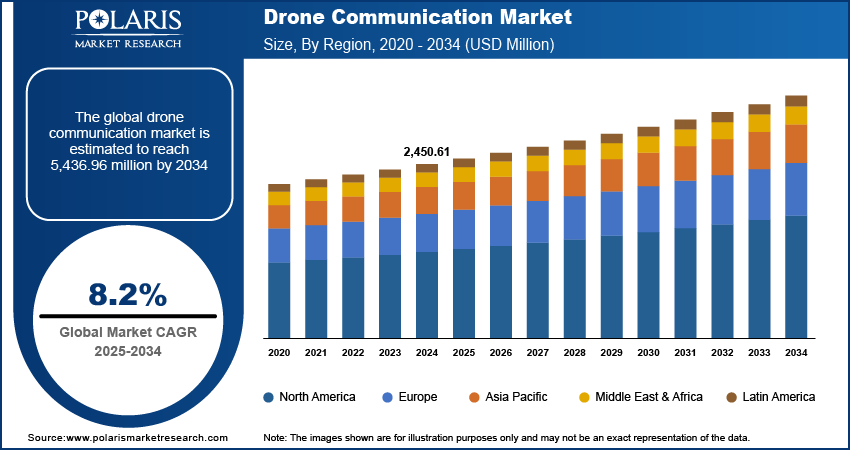

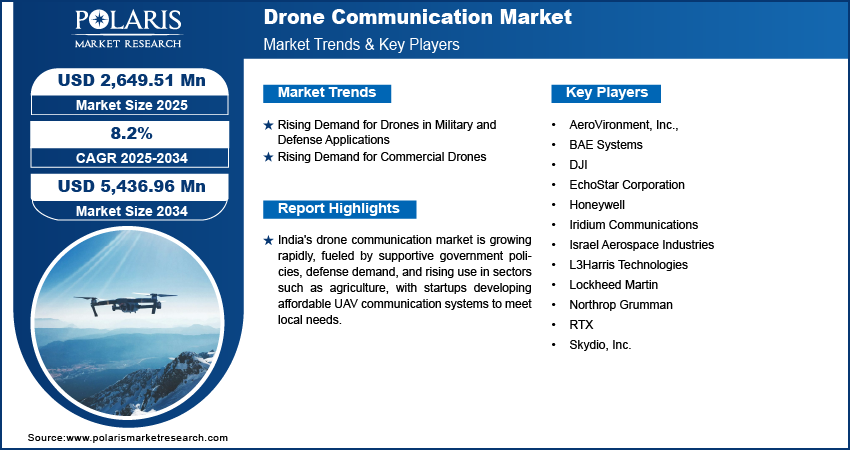

The global drone communication market size was valued at USD 2,450.61 million in 2024. It is projected to grow from USD 2,649.51 million in 2025 to USD 5,436.96 million by 2034, exhibiting a CAGR of 8.2% during 2025–2034.

Drone communication involves the transmission of control commands, telemetry data, and video feeds between the drone and its ground control station or other networked systems. It enables real-time navigation, monitoring, and coordination for various applications such as surveillance, delivery, and inspection.

Many industries are pushing for BVLOS operations to extend drone missions beyond the operator’s visual range. This requires dependable UAV communication systems to maintain, control, and monitor drones remotely. Whether it is inspecting power lines, surveying large agricultural fields, or making long-distance deliveries, secure drone communication links are vital for operational success and regulatory approval. Drone telemetry systems further play a major role in sending real-time updates about the drone’s position, speed, and system status. The need for robust communication technologies to support these operations safely is growing as the use of BVLOS grows, thereby driving the drone communication market demand.

To Understand More About this Research: Request a Free Sample Report

The combination of drones with AI and IoT is leading to the creation of smarter, more autonomous systems. Drones now make decisions using onboard AI and send critical information through real-time drone connectivity to cloud platforms or operators. Unmanned aerial vehicle networks work together, sharing data in real time to cover large areas efficiently. These smart drones rely on reliable drone data transmission to process information quickly and act accordingly. The integration of AI and IoT technology with drone control and navigation systems is driving demand for advanced communication infrastructure as more industries explore automation, thereby driving the growth of the drone communication market revenue.

Market Dynamics

Rising Demand for Drones in Military and Defense Applications

The military and defense sector heavily relies on drones for surveillance, reconnaissance, and combat missions. According to the Center for Air Power Studies, on August 14, 2023, the Indian Air Force (IAF) and Veda Aeronautical Pvt Ltd, a startup based in New Delhi, signed a historic agreement worth USD 35 million to produce 200 long-range swarm drones for the IAF. These operations demand secure drone communication links to transmit sensitive data in real time for tactical communication. UAV communication systems are essential for controlling drones over long distances, especially in hostile environments. Military drones often operate in BVLOS (Beyond Visual Line of Sight), which requires advanced communication networks to ensure safety and efficiency. The need for reliable, encrypted, and fast drone data transmission is rapidly increasing as defense forces continue to adopt unmanned systems, thereby driving the drone communication market development.

Rising Demand for Commercial Drones

Various industries such as agriculture, logistics, media, and infrastructure are rapidly integrating drones to improve efficiency. According to DHL, drones are used in major logistics operations such as last-mile delivery and short to medium distance transportation, inventory management and order picking, and surveillance and inspection. These drones need real-time drone connectivity to send data back to operators or cloud systems for processing. In agriculture, drones collect crop health data using cameras and drone sensors and send it through UAV communication systems. The growing number of commercial drone applications such as drone packaged delivery boosts the demand for high-performance communication solutions, thereby driving the adoption of drone communication systems.

Segment Analysis

Market Assessment by Communication

The drone communication market segmentation, based on communication, includes radio frequency (RF) communication, satellite communication (SATCOM), 5G and LTE-based communication, mesh networking, and optical and infrared communication. The radio frequency (RF) communication segment is expected to witness significant growth during the forecast period. RF communication is widely used in drones because it allows reliable, real-time data transfer between the drone and its controller. It supports functions such as navigation, video streaming, and telemetry over long distances, making it ideal for both commercial and military applications. The demand for stable and efficient RF-based UAV communication systems will rise as more industries use drones for delivery, surveillance, and inspection, thereby driving the segmental growth.

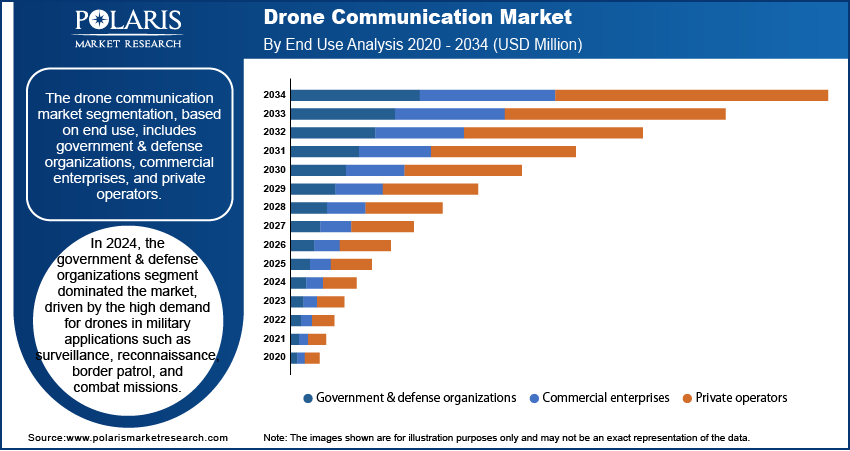

Market Evaluation by End Use

The segmentation, based on end use, includes government & defense organizations, commercial enterprises, and private operators. The government & defense organizations segment dominated the industry in 2024, driven by the high demand for drones in military applications such as surveillance, reconnaissance, border patrol, and combat missions. These operations require secure, long-range, and real-time communication systems, which significantly boost the need for advanced UAV communication systems. Defense organizations also have larger budgets and more frequent use of BVLOS operations, making them the primary adopters of advanced drone communication technologies, thereby driving the segmental growth.

Regional Overview

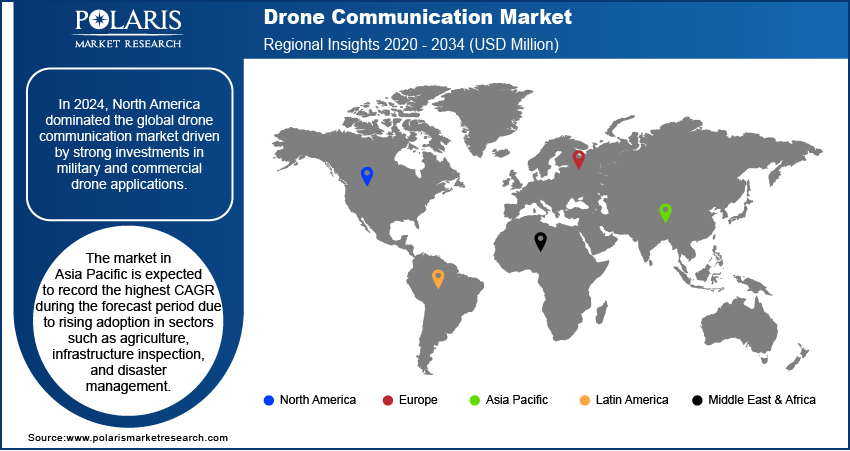

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the global market driven by strong investments in both military and commercial drone applications. The US Department of Defense uses drones for surveillance, reconnaissance, and security missions, which rely heavily on secure drone communication links. Additionally, industries such as agriculture, oil & gas, and logistics are adopting drones for daily operations. North America continues to drive innovation and demand in this sector with supportive government policies, advanced commercial UAV communication systems, and the rollout of 5G-enabled drone communication. The presence of key players such as Lockheed Martin and Northrop Grumman further fuel the market growth in North America.

The Asia Pacific drone communication market is expected to record the highest CAGR during the forecast period due to rising adoption in various sectors such as agriculture, infrastructure inspection, and disaster management. Countries such as China, Japan, and South Korea are investing in drone technology for both civilian and defense purposes. According to the Japan Ministry of Defense, in 2022, Japan installed disaster response drones of 15 sets worth USD 69,700 to collect information in the event of a large-scale disaster quickly. China, in particular, is a global hub for drone manufacturing, with companies such as DJI. The need for real-time drone connectivity and reliable drone telemetry systems is increasing as drone usage is expanding, thereby driving the growth of the Asia Pacific market.

The India drone communication market is experiencing substantial growth driven by government initiatives such as the Drone Shakti program and the liberalization of drone regulations. Drones are increasingly used in agriculture, mining, infrastructure mapping, and surveillance. The Indian defense sector is expanding its use of drones, creating a growing need for secure communication systems and drone control and navigation systems. Startups and tech firms are developing cost-effective UAV communication systems to meet local demand, thereby driving the demand for drone communication systems in India.

Key Players and Competitive Analysis

The industry opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the industry by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. This competitive trend is amplified by continuous progress in product offerings. A few major industry players are AeroVironment, Inc.; BAE Systems; DJI; EchoStar Corporation; Honeywell; Iridium Communications; Israel Aerospace Industries; L3Harris Technologies; Lockheed Martin; Northrop Grumman; RTX; and Skydio, Inc.

Israel Aerospace Industries (IAI) is a government-owned aerospace and defense company based in Lod, Israel, established in 1953. It operates primarily in the development and manufacturing of systems for military and commercial use. The company’s product range includes fighter aircraft, business jets, helicopters, unmanned aerial vehicles (UAVs), satellites, and space launchers. IAI also produces missile systems, precision-guided weapons, anti-ballistic defense systems, and naval weapons. In addition, it develops radar and electronic systems such as surveillance radars and command and control solutions. The company provides maintenance, repair, and overhaul (MRO) services for commercial aircraft, including passenger-to-cargo conversions. IAI also works on autonomous and robotic systems, as well as cyber and multi-domain defense solutions. Its organizational structure includes divisions such as the Bedek Aviation Group, Military Aircraft Group, and Systems, Missiles & Space Group. ELTA Systems, a subsidiary, focuses on electronic and radar technologies. Although headquartered in Israel, IAI serves customers worldwide, including in the US, India, Brazil, Germany, and South Korea. Its products and services are used by the Israel Defense Forces as well as foreign militaries and commercial clients. The company’s operations cover design, production, and support services across the aerospace and defense sectors. IAI’s activities span air, space, land, sea, and cyber domains, reflecting a broad scope of technological and operational capabilities. Its UAV Communication Suite includes software-defined radios, SATCOM, and line-of-sight systems, enabling voice, video, and data exchange across air, land, and sea domains for interoperable multi-domain operations

Northrop Grumman offers products to various industries, including aerospace and defense. Northrop Grumman is known for its innovative technologies and products that are designed to meet the needs of customers in the defense, intelligence, and space industries. One of the key areas of focus for Northrop Grumman is unmanned systems, including drones and autonomous vehicles. The company has developed a range of unmanned systems that are used for a variety of applications, from surveillance and reconnaissance to search and rescue operations. These systems are designed to be highly reliable and capable of operating in challenging environments. Another area of expertise for Northrop Grumman is space technology. The company has played a key role in NASA's space exploration programs, including the development of the James Webb Space Telescope, and also developed satellites and other space systems for a variety of customers, including the US military and commercial companies.

List of Key Companies in Drone Communication Market

- AeroVironment, Inc.,

- BAE Systems

- DJI

- EchoStar Corporation

- Honeywell

- Iridium Communications

- Israel Aerospace Industries

- L3Harris Technologies

- Lockheed Martin

- Northrop Grumman

- RTX

- Skydio, Inc.

Drone Communication Industry Developments

In February 2025, Vedanta Aluminium launched an AI-powered drone system at its Jamkhani coal mine in Odisha to enhance mine safety, monitoring through real-time alerts, remote surveillance and to enhance communication between officials.

In December 2024, Cucuyo and Cavok UAS announced a strategic partnership. Cucuyo’s P-100 laser communication terminal was successfully integrated and tested on Cavok’s professional drone platforms for resilient data transfer.

Drone Communication Market Segmentation

By Communication Outlook (Revenue USD Million, 2020–2034)

- Radio Frequency (RF) Communication

- Satellite Communication (SATCOM)

- 5G and LTE-Based Communication

- Mesh Networking

- Optical and Infrared Communication

By Application Outlook (Revenue USD Million, 2020–2034)

- Agriculture

- Construction & Mining

- Oil & Gas

- Military & Defense

- Commercial

- Emergency Services

- Others

By End Use Outlook (Revenue USD Million, 2020–2034)

- Government & Defense Organizations

- Commercial Enterprises

- Private Operators

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Drone Communication Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,450.61 million |

|

Market Size Value in 2025 |

USD 2,649.51 million |

|

Revenue Forecast in 2034 |

USD 5,436.96 million |

|

CAGR |

8.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The drone communication market size was valued at USD 2,450.61 million in 2024 and is projected to grow to USD 5,436.96 million by 2034.

The global market is projected to register a CAGR of 8.2% during the forecast period.

North America held the largest share in the global market in 2024.

A few key players in the market are AeroVironment, Inc.; BAE Systems; DJI; EchoStar Corporation; Honeywell; Iridium Communications; Israel Aerospace Industries; L3Harris Technologies; Lockheed Martin; Northrop Grumman; RTX; and Skydio, Inc.

The government & defense organizations segment dominated the market in 2024, driven by the high demand for drones in military applications such as surveillance, reconnaissance, border patrol, and combat missions.

The radio frequency (RF) communication segment is expected to witness significant growth during the forecast period. RF communication is widely used in drones as it allows reliable, real-time data transfer between the drone and its controller.