Drone Taxi Market Share, Size, Trends, Industry Analysis Report

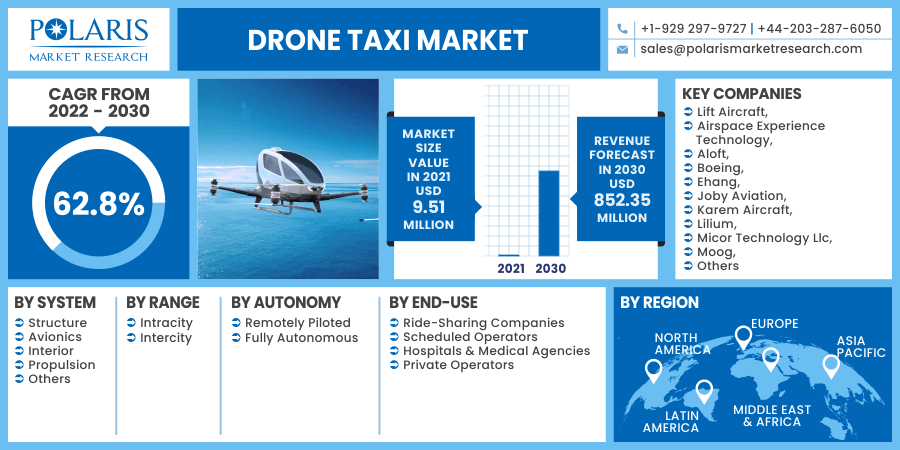

By System (Structure, Avionics, Interior, Propulsion and Others), By Range (Intracity and Intercity), By Autonomy (Remotely Piloted and Fully Autonomous), By End-Use, By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 110

- Format: PDF

- Report ID: PM2180

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

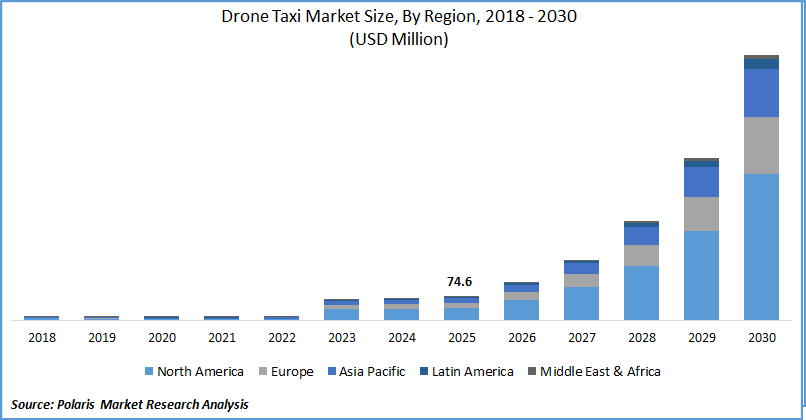

The global drone taxi market was valued at USD 9.51 million in 2021 and is expected to grow at a CAGR of 62.8% during the forecast period. On account of the rising number of vehicles running on the road along with the lucrative increase in traffic congestion in the urban areas, the demand for an efficient and better transportation system has soared, thus increasing the demand for drone taxi globally.

Know more about this report: request for sample pages

The progressive rise in the investments by the top player in the market, along with the growing number of government initiatives towards the environment and human health, is anticipated to fuel the growth of the market. Additionally, the growing number of smart city initiatives globally is expected to drive the growth of the drone taxi market. However, high fare along with stringent rules for drone taxi licenses is anticipated to hinder the growth of the market.

Before the Covid-19 outbreak, the drone taxi market was on a remarkable growth trajectory. In 2019, FAA (Federal Aviation Administration) in the US announced its engagement with more than 15 e-VTOL aircraft manufacturers, including EHang, Uber Air, Joby Aviation, Lilium, and others, with all these companies having the intent to launch commercial passenger travel in the coming years. However, since the outbreak, there have been various signs of slowing down. For instance, Uber Air revealed that remote working has negatively impacted the capability of its vehicle partners to conduct R&D activities. Moreover, EHangwas affected by the labor and supply chain disruptions during the outbreak. Voom, an app-based helicopter booking platform backed by Airbus, ceased its operations in 2020 due to the disruptions caused by the Covid-19 outbreak. Although, Airbus has asserted its commitment toward its drone taxi program.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The growing number of smart city initiatives globally is anticipated to drive the growth of the drone taxi market during the forecast period. Smart city models have encouraged various development opportunities for technology providers and associated service vendors. Along with rising government initiatives and a growing focus on the environment & human health, technology providers are aggressively developing innovative solutions for urban infrastructure design & development.

In May 2021, Osaka City undertook the development of infrastructure for drone services such as drone delivery and urban air mobility. For this project, Skyports, one of the leading vertiport companies in UK will assist in providing eVTOL technology. This project if further expected to enhance sustainability, tourism, and the economic performance of the city.

Report Segmentation

The market is primarily segmented on the basis of system, range, autonomy, end-use and region.

|

By System |

By Range |

By Autonomy |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Range

Intracity is the leading segment that accounted for the largest revenue share. This large market share can be attributed to the huge demand for air transportation in the core urban areas, around the city, and residential suburban areas around the city. Leading manufacturers, including Volocopter, Lift, Airbus, and Boeing, among others, are already heavily investing in the development of advanced and efficient intracity transportation services. For instance, Lilium is developing Lilium Jet, an e-VTOL jet with a cruising speed of over 300 km/hr. Along with a range of 300 km. The company is working to deploy this jet initially for intracity transportation and then for intercity transportation. Moreover, in December 2018, Lift Aircraft launched Hexa, a manned intracity e-VTOL with a market price of USD 49,500.

The intercity segment is likely to project a healthy growth rate in the forthcoming period. The growth of the segment can be attributed to the growing demand for alternative means of transportation in order to avoid traffic congestion. The rising focus towards environmental health is further estimated to drive the growth of the segment as the population is moving toward more energy-efficient and environment-friendly drone taxis.

Insight by System

The Propulsion segment is exhibited with the highest shares and leading the drone taxi market in 2021. This segment can be further segmented into fully electric, hybrid, and electric hydrogen. Among these, the fully electric segment is anticipated to hold the largest market size during the forecast period. This huge market share can be attributed to the rising demand for high performance, low emission, and fuel-efficient vehicles that have better endurance than other propulsion systems, enabling the drone taxis to fly for longer durations.

The segment of avionics is projected to show a significant growth rate in the approaching years. Avionics plays a prominent role in all aircraft, including drones. These are the electronic equipment and systems that are specifically designed for use in aviation. The growth of this segment can be attributed to the increasing demand for fuel efficiency and better safety and stability of the aircraft.

Geographic Overview

Geographically, Europe is leading the market with the largest revenue share, in 2021. In Europe, various urban communities have joined UAM (Urban Air Mobility) Initiative, which includes EIP-SCC (European Innovation Partnership on Smart Cities and Communities). This initiative is primarily focused on the generation of business opportunities for metropolitan air portability. At present, the guidelines for the Urban Air Mobility industry are being drafted. Further, as per EASA (European Union Aviation Safety Agency), air taxis & ambulances will be a part of European airspace by the coming years.

North America is anticipated to grow at the highest CAGR during the forecast period. This growth in the region can be attributed to funding by government authorities towards the use of drone taxis and strategic partnerships. For instance, in January 2020, Joby Aviation partnered with Uber and Toyota. The company is further planning to go in a reverse merger with Reinvent Technology Partners. On account of these factors, Air Taxis are expected to witness growth in demand for urban transportation in this region. Additionally, the presence of major e-VTOL aircraft manufacturers in the US is estimated to foster the adoption of drones for various commercial and civil applications.

Asia Pacific is projected to exhibit a lucrative CAGR in the approaching years. Furthermore, the rising traffic congestion, growing demand for faster modes of travel, and rising disposable income are anticipated to drive the growth of the market in the APAC region. Moreover, there is a growth in the number of developments of the drone taxi market in the region. For instance, the South Korean government outlines its plans to commercialize urban air travel by 2025 by demonstrating flight of drone taxis and further tests unmanned drone taxis in several areas of the region.

Competitive Insight

Some of the major players operating the global market include Lift Aircraft, Airspace Experience Technology, Aloft, Boeing, Ehang, Joby Aviation, Karem Aircraft, Lilium, Micor Technology Llc, Moog, Opener, Pipistrel, Scienex, Skydrive Inc, Tecnalia, Textron Inc, Volocopter, Xeriant, Zhejiang Geely.

Drone Taxi Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 9.51 million |

|

Revenue forecast in 2030 |

USD 852.35 million |

|

CAGR |

62.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By System, By Range, By Autonomy, By End-Use, By region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Lift Aircraft, Airspace Experience Technology, Aloft, Boeing, Ehang, Joby Aviation, Karem Aircraft, Lilium, Micor Technology Llc, Moog, Opener, Pipistrel, Scienex, Skydrive Inc, Tecnalia, Textron Inc, Volocopter, Xeriant, Zhejiang Geely. |