Edible Offal Market Share, Size, Trends, Industry Analysis Report

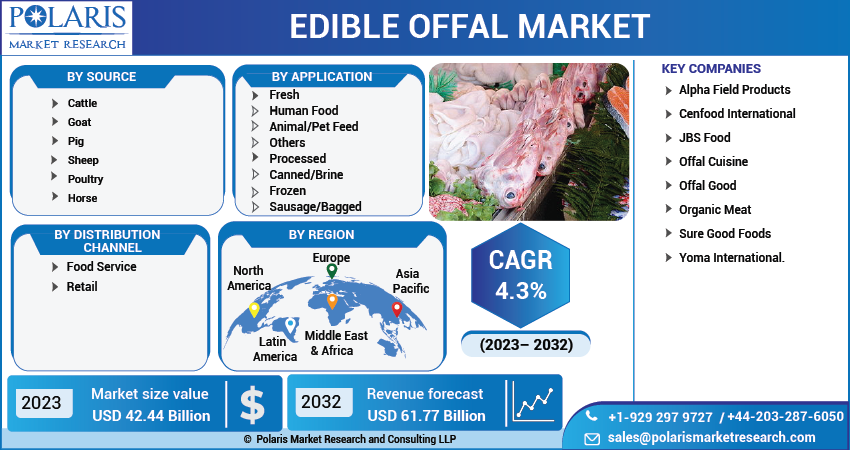

By Source (Cattle, Goat, Pig, Sheep, Poultry, Horse, Others), By Application (Processed, Fresh), By Distribution Channel (Food Service, Retail), By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Sep-2023

- Pages: 114

- Format: PDF

- Report ID: PM3734

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

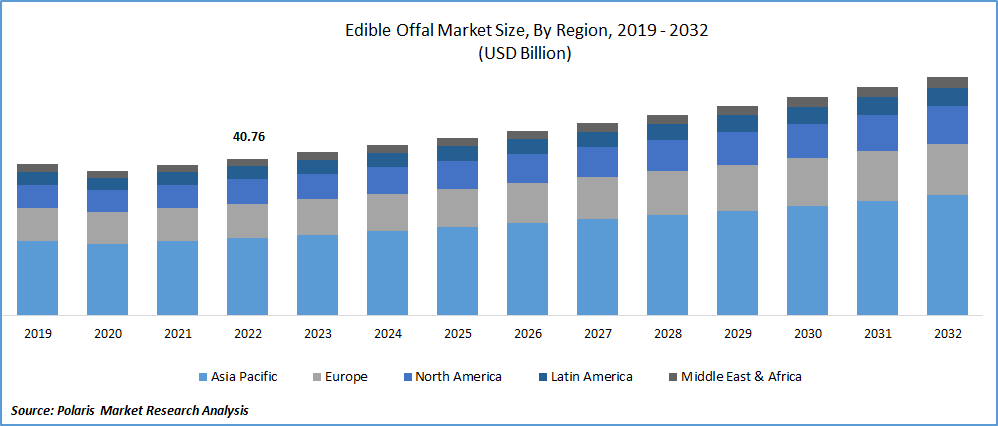

The global edible offal market was valued at USD 40.76 billion in 2022 and is expected to grow at a CAGR of 4.3% during the forecast period.

Market growth is primarily due to its nutritional value and the cost-effectiveness it presents compared to other cuts of meat. Edible offal is economically priced in comparison to premium meat cuts, rendering it an appealing choice for consumers aiming to procure protein sources without straining their budget. As the cost of meat experiences fluctuations and economic circumstances evolve, edible offal emerges as a financially viable alternative that does not compromise on nutritional benefits.

To Understand More About this Research: Request a Free Sample Report

Edible offal boasts an elevated nutrient density, packing a greater concentration of essential nutrients per serving compared to alternative forms of lean muscle meat. They are rich sources of vital nutrients like vitamin B12 and iron. This nutritional advantage adds to their appeal, as these nutrients are crucial for maintaining overall health and well-being. Consequently, the consumption of edible offal provides an avenue for obtaining substantial nutritional benefits while being mindful of economic considerations.

Governments around the world are actively advocating for the utilization of offals to address both food waste reduction and enhanced nutritional intake in comparison to conventional meat. This is driven by the fact that offals possess higher nutritional value when compared to more traditional cuts of meat. Additionally, the escalating concern surrounding greenhouse gas emissions is playing a role in driving the demand for animal by-products, as their utilization can contribute to mitigating these emissions. This is achieved by reducing the necessity for additional livestock production, which is a notable source of greenhouse gas emissions.

Edible offal represents a valuable resource due to its rich protein content and nutrient composition. By encouraging the consumption of animal by-products, the industry can meet the increasing demand for high-quality protein while simultaneously optimizing resource utilization. This is particularly significant in the context of the environmental impact associated with extensive meat production. By substituting some meat consumption with nutrient-dense offals, the industry can play a role in fulfilling nutritional requirements while also mitigating the environmental burden linked with heightened meat production and its associated greenhouse gas emissions.

For Specific Research Requirements, Request for a Customized Research Report

Industry Dynamics

Growth Drivers

Offal integration meets consumer demand for convenient food solutions.

Food industry is consistently exploring innovative avenues to integrate edible offal into processed food items. Offal is finding its way into various processed meat products like sausages, pâtés, and meatballs. This diversification allows offal to be introduced in more accessible and user-friendly formats, addressing consumers' preferences for ready-to-eat or simple-to-cook choices. This strategic approach acknowledges the contemporary lifestyle patterns of consumers, particularly their inclination towards convenient and swift meal solutions. With busy schedules becoming the norm, modern consumers are seeking hassle-free dining options.

By incorporating offal into these processed products, the food industry effectively caters to this demand for convenience. Simultaneously, these offal-based processed offerings break down potential barriers to offal consumption. Such barriers might include the perceived complexity of preparation or cultural associations with lower social status. By transforming offal into appealing, easy-to-consume products, the food industry is creating an opportunity for wider acceptance and utilization of this nutrient-rich resource.

Report Segmentation

The market is primarily segmented based on source, application, distribution channel, and region.

|

By Source |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source

Pig offal segment accounted for the largest share

Pig offal segment held the largest share. The adoption of pig offal serves a dual purpose: it aids in the reduction of food waste and maximizes the utilization of the complete pig carcass. This strategic approach resonates with the heightened consumer consciousness surrounding food waste and the concerted effort to curtail environmental impact. As a result, the demand for pig offal has experienced growth. It is evident in the UK, where offal shipments recorded a 3% increase to reach 35,300 tonnes. This upsurge in demand for offal is primarily attributed to its role in enhancing the value proposition of the pig carcass while concurrently addressing waste reduction concerns. This aligns well with the ongoing endeavor to optimize resource utilization, align with eco-friendly practices, and contribute to a more sustainable food ecosystem.

Horse offal segment will grow at rapid pace. Horse offal stands out due to its remarkable nutrient density, offering essential vitamins, minerals, and proteins. For instance, horse liver, renowned for its elevated iron content, rendering it a valuable source of nutritional benefits. Individuals who prioritize nutrient-rich dietary choices and seek diversity in their eating habits might be inclined towards horse offal due to its robust nutritional composition.

By Application

Processed segment accounted for the largest share

Processed segment held the largest share. The transformation of offal into varied forms through processing, and its subsequent integration into processed meat products, has the potential to elevate its flavor profile. This integration introduces a distinctive taste and a heightened richness to the products, rendering them more enticing to consumers seeking novel and delectable flavors.

Fresh offal segment will grow at rapid pace. This growth can be attributed to the ascending culinary trends that center on the exploration of distinct and less familiar ingredients. Fresh offal, renowned for its unique flavors and textures, captivates individuals who possess a penchant for culinary adventure.

By Distribution Channel

Food service segment accounted for the largest share

Food service segment held the largest share. The escalating popularity of fine dining restaurants, coupled with an increased appetite for organ meats, is set to propel the demand for offal within the food service sector. Many restaurants are strategically adopting a practice of utilizing entire animal carcasses, which includes offal, to maximize flavor profiles and curtail wastage. Furthermore, the ascending trend of nose-to-tail dining observed in various Western nations is generating a heightened demand for offal within the food service sector.

Retail segment will grow at rapid pace. This expansion is underpinned by a discernible shift in consumer behavior towards heightened awareness of sustainability and ethical considerations when making food selections. This growing consciousness has fueled a rising inclination among consumers to embrace a holistic approach to utilizing animals for consumption, thereby reducing food waste. In response, various retailers are capitalizing on this trend by presenting offal as a sustainable and environmentally-friendly choice.

Regional Insights

Asia Pacific region dominated the global market

Asia Pacific held the largest share. The region's dynamic landscape is characterized by a burgeoning population, accompanied by escalating income levels and rapid urbanization. This collective shift has given rise to heightened consumer demand for a wide variety of food items, which includes offal. This evolving market scenario is opening avenues for both retailers and suppliers to tap into the growing demand for offal within the region. As consumers seek diverse and evolving food preferences, there exists a promising opportunity for industry participants to align their offerings with this demand for offal.

Europe will grow at rapid pace The region's escalating appetite for edible offal is propelled by multiple factors, prominently including the growing consumer preference for meat derived from sustainable sources. Additionally, the upward trajectory of the organuary movement in the region is contributing to this demand surge.

In line with this, Association of Meat Suppliers (AIMS) in the UK, which is actively advocating for the consumption of organ meats like kidneys, liver, & offal. This push aligns with both personal health benefits and environmental considerations. The momentum of such movements is amplifying the appeal of edible offal in Europe, as consumers increasingly recognize its positive impact on both individual well-being and the broader ecosystem.

Key Market Players & Competitive Insights

The Edible Offal market is marked by intense competition, with key players continuously driving innovation and diversification. These industry leaders capitalize on the growing trend of integrating offal into processed meat products like sausages, pâtés, and meatballs, aligning with modern consumers' preference for convenient and ready-to-eat options amidst their busy lifestyles. Cenfood International and Organic Meat also play significant roles, leveraging their expertise to meet evolving consumer demands. This dynamic competitive landscape underscores the industry's commitment to meeting consumer preferences while fostering culinary innovation in offal-based food products.

Some of the major players operating in the global market include:

- Alpha Field Products

- Cenfood International

- JBS Food

- Offal Cuisine

- Offal Good

- Organic Meat

- Sure Good Foods

- Yoma International.

Edible Offal Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 42.44 billion |

|

Revenue forecast in 2032 |

USD 61.77 billion |

|

CAGR |

4.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Source, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global edible offal market size is expected to reach USD 61.77 billion by 2032.

Key players in the edible offal market are Alpha Field Products, Cenfood International, JBS Food, Offal Cuisine.

Asia Pacific contribute notably towards the global edible offal market.

The global edible offal market is expected to grow at a CAGR of 4.3% during the forecast period.

The edible offal market report covering key segments are source, application, distribution channel, and region.