Electric Kick Scooters Market Share, Size, Trends, Industry Analysis Report

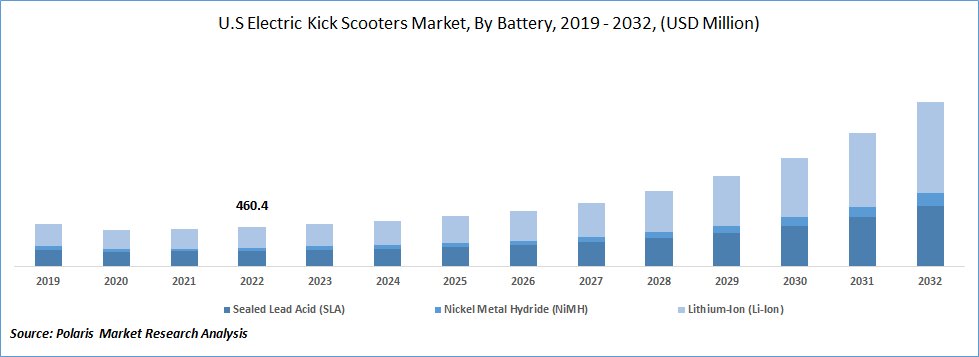

By Battery (Sealed Lead Acid (SLA), Nickel Metal Hydride (NiMH), Lithium-Ion (Li-Ion)); By Distance Range; By Application; By Voltage; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 112

- Format: PDF

- Report ID: PM2063

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

The global electric kick scooters market was valued at USD 2,814.32 million in 2022 and is expected to grow at a CAGR of 13.5% during the forecast period.ith growing concerns about air pollution and traffic congestion and the increasing need for efficient and sustainable transportation options, people are seeking alternatives to traditional modes of transportation. Electric kick scooters provide a solution by offering a clean and efficient way to travel short distances. They are particularly popular among commuters who must navigate crowded city streets and reach their destinations quickly.

To Understand More About this Research: Request a Free Sample Report

Electric kick scooters, or e-scooters, are lightweight and portable personal transportation devices powered by an electric motor. An electric kick scooter is compact and significantly helps in reducing traffic congestion. It is environment friendly, portable, and efficiently achieves higher speed with less effort. Also, electric kick scooters are cost-friendly. They have zero maintenance cost. Due to such inherent properties, market electric kick scooters are expected to have a potential growth opportunity in developed and developing economies for the electric kick scooters market.

Advancements in battery technology and electric motor efficiency have significantly contributed to the market growth. Modern e-scooters have high-capacity lithium-ion batteries that provide longer range and faster charging times. These improvements have enhanced electric kick scooters' overall performance and reliability, making them a viable mode of transportation for many users.

Furthermore, the rise of ride-sharing and rental services has propelled the electric kick-scooter market. Companies like Bird and Lime have introduced dockless electric scooter-sharing programs in many cities worldwide. These services allow users to rent an e-scooter temporarily, providing convenience and flexibility. The availability of shared electric kick scooters has made them easily accessible to a larger audience, further fueling the market growth.

The COVID-19 pandemic initially caused a decline in the electric kick scooter market as lockdowns and travel restrictions reduced the demand for shared mobility services. However, as conditions eased, e-scooters became a preferred choice for personal transportation due to their ability to facilitate social distancing. Governments also promoted micro-mobility solutions, including e-scooters, to encourage sustainable and socially distanced travel. The demand for personal electric kick scooters increased as individuals sought alternatives for outdoor activities while adhering to safety guidelines. Though the pandemic disrupted supply chains, the production and availability of e-scooters eventually recovered.

Industry Dynamics

Growth Drivers

The electric kick scooter market has experienced significant growth and popularity driven by the increasing demand for sustainable transportation has boosted the adoption of electric kick scooters. As concerns about air pollution and environmental impact grow, these scooters offer a cleaner alternative, producing zero emissions and reducing carbon footprints.

The rise of urbanization and traffic congestion has fueled the demand for electric kick scooters. In crowded cities, these scooters provide a convenient solution for navigating through congested streets, offering a compact and maneuverable mode of transport for short-distance travel.

Technological advancements have also played a crucial role in the market's growth. Improved battery technology, electric motors, and scooter design have enhanced performance and reliability. Lithium-ion batteries extend the scooters' range with higher energy densities, while more efficient engines provide better acceleration and speed, making electric kick scooters more appealing and accessible.

Additionally, the emergence of ride-sharing and rental services, supported by governments, has expanded the market. Companies like Lime and Bird have introduced electric kick-scooter sharing programs, making them easily accessible and affordable to a wider audience. Government initiatives, including creating dedicated lanes and incentives, further encourage the adoption and use of electric kick scooters.

Report Segmentation

The market is primarily segmented based on battery, distance range, application, voltage, and region.

|

By Battery |

By Distance Range |

By Application |

By Voltage |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Lithium-Ion (Li-Ion) segment accounted for the largest market share in 2022

Lithium-ion (Li-Ion) batteries segment dominated the market holding the largest market share. The prices of Li-Ion batteries have been decreasing, and manufacturers are actively investing in research and development projects to enhance the technology further.

Li-Ion batteries are rechargeable batteries widely used in portable electronics. Their high energy density has made them increasingly popular in electric vehicles. Moreover, they have a reduced environmental impact and lower maintenance costs, making them a favorable choice for integration into electric kick scooters. These inherent advantages of Li-Ion batteries compared to alternative battery options are driving the growth of the electric kick scooter market in the coming years.

48V segment expected to grow at highest CAGR rate during forecast period

The 48V segment is anticipated to experience the highest CAGR rate in the market. This is primarily attributed to the popularity of electronic kick scooters with voltages exceeding 48V, as they offer an extended range. Furthermore, these kick scooters emit carbon dioxide at a reasonable cost, aligning with the growing emphasis on reducing carbon footprints.

Moreover, 48V scooters provide additional amenities such as air conditioning compressors and turbochargers, which are challenging to incorporate into scooters with lower voltages like 12V or 24V. The availability of these features enhances the appeal and functionality of 48V electric kick scooters.

Asia Pacific dominated the global market in 2022

Asia Pacific region dominated the global market. Countries such as China, India, and other South Asian nations have implemented robust legislation to support the development of vehicle charging infrastructure, which is expected to drive regional growth. For example, India has put legislation in place to address the limited availability of charging sites for electric vehicles (EVs). According to the National Research Development Corporation (NRDC), India currently has less than 0.1 percent of the world's one million public charging sites, equivalent to approximately 700.

India recognizes the need for a significant acceleration in charging infrastructure. However, securing adequate funding is crucial to achieving the necessary scale. In response to this concern, the Indian government has taken initial steps, including establishing a national EV program called the FAME II scheme. This program includes subsidies to set up 2,636 charging stations for electric vehicles nationwide.

By focusing on improving charging infrastructure, particularly through initiatives like the FAME II scheme, the Asia Pacific region, and specifically countries like China and India, are expected to experience substantial growth in the kick bike market. Developing a robust charging network is vital to support the increasing adoption of electric vehicles and promote sustainable transportation in these markets.

Competitive Insight

Some of the major players operating in the global market include Gogoro Inc., Ninebot, Fuzion Scooters, Swagtron India, Niu International, Globber, Terra Motors India, Yamaha Motor Co., Ltd., Golabs Inc., Razor USA LLC, KTM Sportmotorcycle GmbH, Vmoto Limited, Xiaomi, YADEA Technology Group Co., Ltd., Jiangsu Xinri E-Vehicle Co., Ltd., GOVECS AG, Mahindra & Mahindra Ltd., Okai, Ningbo MYWAY Intelligent Technology Co., Ltd., IconBIT, and Xootr LLC.

Recent Developments

- In October 2022, NIU International recently introduced the KQi3 Max, an electric scooter with a top speed of 20 MPH and a range of 40.4 miles. This model is designed to provide consumers with optimal comfort and stability during their rides.

- In November 2022, Segway Ninebot has launched its latest electric scooter, the UIFI, in the Chinese market.

Electric Kick Scooters Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3,007.95 million |

|

Revenue forecast in 2032 |

USD 11,790.20 million |

|

CAGR |

13.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Battery, By Distance Range, By Application, By Voltage, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Gogoro Inc., Ninebot, Fuzion Scooters, Swagtron India, Niu International, Globber, Terra Motors India, Yamaha Motor Co., Ltd., Golabs Inc., Razor USA LLC, KTM Sportmotorcycle GmbH, Vmoto Limited, Xiaomi, YADEA Technology Group Co., Ltd., Jiangsu Xinri E-Vehicle Co., Ltd., GOVECS AG, Mahindra & Mahindra Ltd., Okai, Ningbo MYWAY Intelligent Technology Co., Ltd., IconBIT, and Xootr LLC. |

FAQ's

The Electric Kick Scooters Market report covering key are battery, distance range, application, voltage, and region.

Electric Kick Scooters Market Size Worth $ 11,790.20 Million By 2032.

The global electric kick scooters market expected to grow at a CAGR of 13.5% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in Electric Kick Scooters Market are Growing demand for electric kick scooters for shared mobility services.