Electronic Grade Nitric Acid Market Size, Share, & Industry Analysis Report

: By Type (EL Grade, VL Grade, UL Grade, and SL Grade), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5702

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

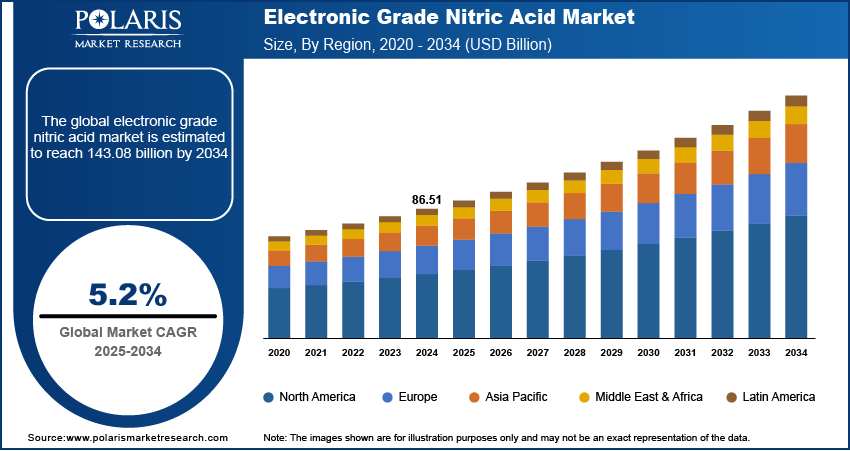

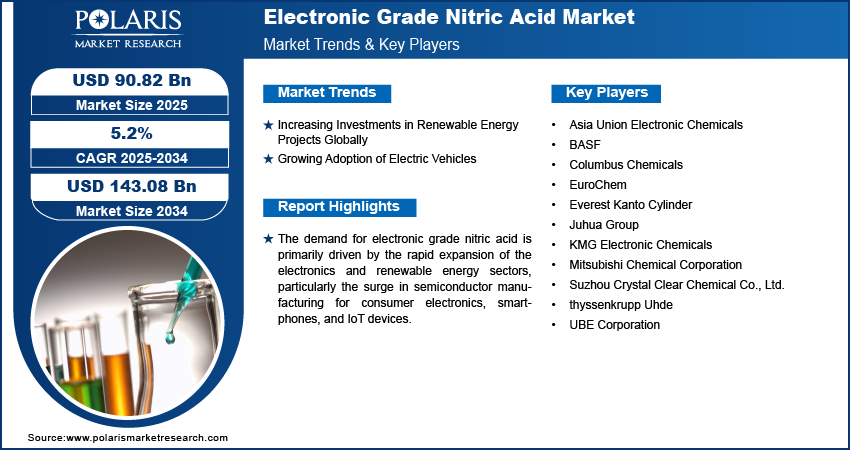

The global electronic grade nitric acid market size was valued at USD 86.51 billion in 2024, growing at a CAGR of 5.2% during 2025–2034. The demand for electronic-grade nitric acid is primarily driven by the rapid expansion of the electronics and renewable energy sectors, particularly the surge in semiconductor manufacturing for consumer electronics, smartphones, and IoT devices.

Electronic-grade nitric acid (EGNA) is a highly purified form of nitric acid (HNO₃), distinguished by its extremely low levels of metallic and organic contaminants, making it suitable for use in the sensitive manufacturing environments of the electronics industry. The acid undergoes additional purification processes to meet stringent quality standards required for advanced technologies. This ultra-high purity acid is critical in the fabrication of semiconductors, integrated circuits, flat panel displays, and photovoltaic cells, where even trace impurities can result in defects or reduced performance of electronic components. In semiconductor manufacturing, electronic grade nitric acid is primarily used for cleaning and etching silicon wafers and removing organic and inorganic residues. Additionally, it is employed in the production of LCD panels and solar cells, where it helps in surface preparation and cleaning, contributing to the efficiency and longevity of these devices.

The growing production of automobiles is driving the electronic grade nitric acid market growth. Automobiles are equipped with infotainment systems, navigation systems, and advanced driver-assistance systems (ADAS). Electronic grade nitric acid serves as a crucial cleaning agent in the production of printed circuit boards (PCBs) and semiconductor devices, which form the backbone of these electronic systems present in automobiles. Automotive manufacturers are also forming partnerships with semiconductor companies to secure a stable chip supply to meet the growing production demand, prompting new fabrication facilities and capacity expansions. These developments are increasing the consumption of electronic-grade nitric acid used in photolithography, etching, and wafer cleaning. According to the Society of Indian Automobile Manufacturers, the automotive industry in India produced a total of 28.4 million vehicles, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles, in FY 2023-24, as against 25.9 million vehicles in FY 2022-23. Therefore, the demand for acid is increasing with the growing production of automobiles globally.

To Understand More About this Research: Request a Free Sample Report

The rising demand for electronic-grade nitric acid is driven by the growing adoption of smartphones. Smartphones are complex devices packed with advanced technology that require numerous intricate parts, such as printed circuit boards (PCBs), semiconductors, and various microelectronic components. Electronic grade nitric acid (EGNA) serves as a cleaning agent in the manufacturing process of these components, ensuring the high level of precision and purity necessary for optimal performance. Furthermore, the releases of new models and updates are creating a sustained demand for miniaturized and advanced electronic parts. This ongoing cycle of innovation, production, and adoption of smartphones is necessitating the use of EGNA to maintain the high standards of manufacturing. According to the Groupe Speciale Mobile (GSMA’s) annual State of Mobile Internet Connectivity Report 2023, over half (54%) of the global population owns a smartphone. Hence, as smartphone adoption increases globally, the demand for electronic grade nitric acid rises.

Market Dynamics

Increasing Investments in Renewable Energy Projects Globally

Increasing investments in renewable energy projects globally are expanding the manufacturing of high-efficiency solar panels. Governments across regions, especially in Asia Pacific, Europe, and North America, are offering financial incentives, subsidies, and policy frameworks to encourage the deployment of large-scale solar power projects. For instance, the government of India plans to invest US$ 107.89 billion (Rs. 9,12,000 crore) in power transmission infrastructure by 2032 to boost capacity and support growing electricity demand. Producers of these solar cells rely on electronic grade nitric acid for critical processes such as wafer texturing, doping, and surface cleaning. Therefore, as renewable energy investment continues to rise in response to climate goals and rising energy demand, the need for the acid in PV manufacturing is estimated to expand in the coming years.

Growing Adoption of Electric Vehicles

Electric vehicles (EVs) rely on a wide range of microchips to operate battery management systems, power inverters, onboard chargers, thermal controls, and infotainment systems. These chips must meet strict performance and reliability standards, especially in high voltage and thermal conditions typical in electric drivetrains. This adoption of microchips in EVs is driving demand for electronic-grade nitric acid to ensure defect-free fabrication processes. Major automakers are further expanding electric vehicles production capacity to meet global climate targets and respond to consumer demand for cleaner mobility. For instance, according to data from the Ministry of Road Transport and Highways (MoRTH) in 2024, India's electric vehicle (EV) market experienced significant growth, with sales reaching approximately 1.95 million units—an over 27% increase compared to 2023. This surge elevated EVs to account for 3.6% of total automobile sales. The expansion was supported by government initiatives like the PM E-DRIVE scheme, which provided demand incentives and bolstered charging infrastructure development. This expansion is increasing the need for automotive-grade semiconductors, which is driving the use of electronic-grade nitric acid in chip etching, cleaning, and surface preparation.

Segmental Insights

By Type Analysis

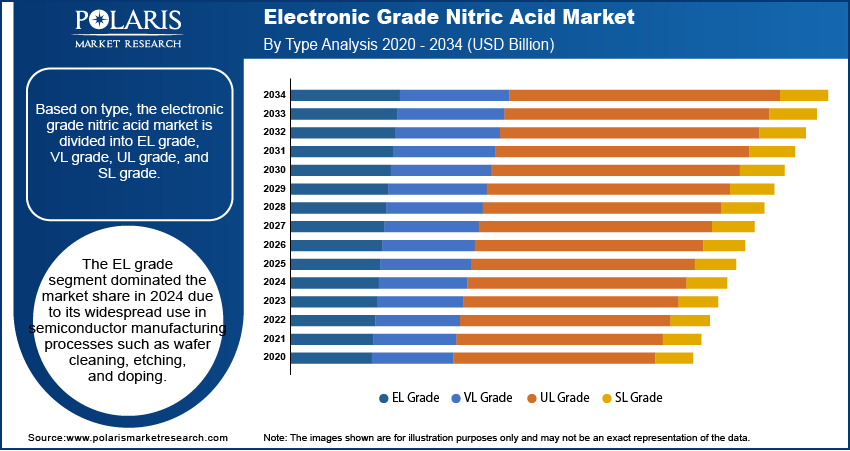

Based on type, the market is divided into EL grade, VL grade, UL grade, and SL grade. The EL grade segment dominated the electronic grade nitric acid market share in 2024 due to its widespread use in semiconductor manufacturing processes such as wafer cleaning, etching, and doping. Major foundries and integrated device manufacturers preferred EL grade due to its high purity levels, which are essential for reducing contamination risks in the production of microelectronic components. The consistent rise in global semiconductor sales, fueled by growing demand for advanced consumer electronics, 5G infrastructure, and automotive electronics, further boosted the demand for this grade. Additionally, countries in Asia Pacific, particularly South Korea, Taiwan, and China, expanded their semiconductor fabrication capacities, which significantly increased the consumption of EL grade nitric acid.

By Application Analysis

In terms of application, the electronic-grade nitric acid market is divided into semiconductor, solar energy, LCD panel, and others. The semiconductor segment accounted for a major market share in 2024 due to the critical role high-purity nitric acid plays in integrated circuit manufacturing. The rapid expansion of global semiconductor production, driven by rising demand for smartphones, electric vehicles, and advanced computing devices significantly increased the consumption of nitric acid for semiconductor applications. Moreover, large-scale investments in chip fabrication facilities contributed to the segmental growth.

The solar energy segment is expected to grow at a robust pace in the coming years, owing to the growing shift toward renewable energy sources, where high-purity nitric acid is essential for producing high-efficiency solar cells. Manufacturers are using EGNA for surface texturing and doping processes in silicon wafer-based solar panels. Additionally, the growing implementation of stricter climate policies and incentives for clean energy projects is positioning the solar energy segment for strong and sustained market dominance in the coming years.

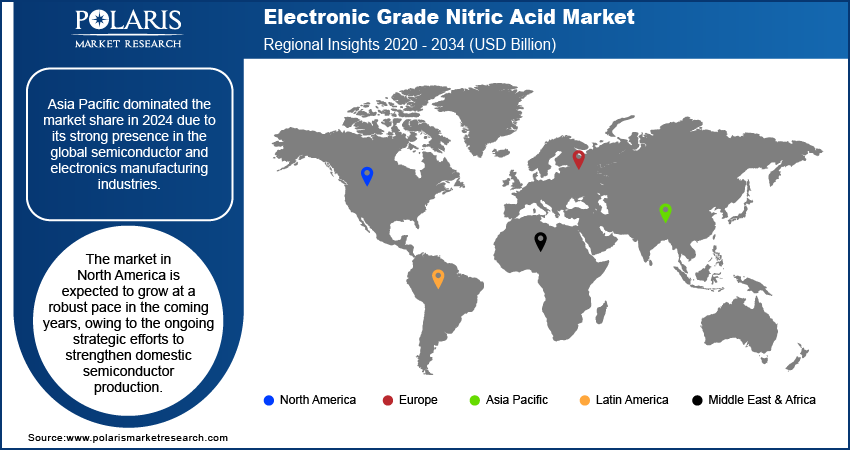

Regional Analysis

By region, the industry report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market share in 2024 due to its strong presence in the global semiconductor and electronics manufacturing industries. Countries such as China, Taiwan, South Korea, and Japan drove demand for EGNA through extensive investments in chip fabrication facilities and consumer electronics production. China emerged as the leading country in the region, supported by government initiatives such as “Made in China 2025,” which prioritized domestic semiconductor self-sufficiency. Major foundries and contract manufacturers in the region expanded operations across the region, increasing the consumption of the acid. Additionally, the rising adoption of electric vehicles and smart technologies in Asia accelerated the need for high-performance electronic components, further boosting electronic grade nitric acid demand.

The North America electronic grade nitric acid market is expected to grow at a robust pace in the coming years, owing to the ongoing strategic efforts to strengthen domestic semiconductor production. The US is estimated to drive the regional growth during the forecast, propelled by substantial federal funding and incentives under the CHIPS and Science Act. Major chipmakers in the region, including Intel, TSMC, and Samsung, are building or expanding fabrication facilities across states such as Arizona, Texas, and Ohio, contributing to high demand for electronic grade nitric acid.

The Europe electronic grade nitric acid market is expected to hold a substantial share in the coming years, owing to the established base of specialty chemical manufacturers and growing investments in semiconductor and electronics production. Countries such as Germany, France, and the Netherlands are contributing significantly to the industry growth, leveraging their advanced R&D infrastructure and strategic initiatives to boost domestic microelectronics capabilities. Germany is projected to lead the region, backed by a strong automotive sector transitioning toward electric mobility and digitalization, which is increasing demand for semiconductor components and electronic grade nitric acid.

Key Players and Competitive Analysis

The electronic grade nitric acid industry is characterized by the presence of several global and regional players, each focusing on strengthening their market position through strategic initiatives such as product portfolio expansion, capacity enhancements, partnerships, and mergers and acquisitions (M&A). Product portfolio diversification remains a critical competitive strategy in the market. Major companies are focusing on offering high-purity nitric acid with ultra-low metal content to meet the stringent requirements of semiconductor manufacturing and advanced electronics applications. Partnerships and collaborations with semiconductor manufacturers and specialty chemical firms are enhancing R&D capabilities and supporting innovation in nitric acid formulations.

Asia Union Electronic Chemicals; BASF; Columbus Chemicals; EuroChem; Everest Kanto Cylinder; Juhua Group; KMG Electronic Chemicals; Mitsubishi Chemical Corporation; Suzhou Crystal Clear Chemical Co., Ltd.; thyssenkrupp Uhde; and UBE Corporation are a few prominent companies in the electronic grade nitric acid market.

UBE Corporation is a prominent Japanese chemical company with a history spanning over 120 years, originally established in 1897 by Sukesaku Watanabe in the city of Ube, Japan. Initially founded as Okinoyama Coal Mine, the company evolved into Ube Industries, Ltd., and later became UBE Corporation, reflecting its diversification and growth beyond its mining origins. UBE Corporation is publicly traded on the Tokyo and Fukuoka Stock Exchanges and is a constituent of the Nikkei 225 stock index. The company’s global headquarters are located in Tokyo, with a major operational base in Ube, Yamaguchi, and it serves customers worldwide, maintaining a consolidated workforce of nearly 8,000 employees as of 2023. UBE Corporation operates through six core business units: chemicals and plastics, specialty chemicals and products, cement, pharmaceuticals, machinery and metal products, and energy and environment. The chemicals segment is the foundation of UBE’s business, supplying a wide array of products ranging from basic chemicals to high-functionality materials for advanced industries. UBE’s product portfolio includes polyimides, separation membranes, ceramics, nylon polymers, caprolactam, ammonium sulfate, industrial chemicals, fine chemicals, high-performance coatings, and synthetic rubber, serving sectors such as automotive, electronics, construction, and agriculture.

EuroChem is a global company in the production of fertilizers and industrial chemicals, headquartered in Zug, Switzerland. Established as one of the world’s top five producers of nitrogen, phosphate, potash, and complex fertilizers, EuroChem operates with a vertically integrated business model that encompasses mining, manufacturing, logistics, and distribution. This structure enables the company to maintain cost leadership and stringent quality control across its vast portfolio, serving customers in more than 100 countries and employing approximately 27,000 people. EuroChem’s operations span the globe, with key manufacturing and distribution facilities located in Russia, Belgium, Lithuania, Brazil, China, Kazakhstan, Estonia, Germany, and the US. In the context of electronic grade nitric acid, EuroChem leverages its advanced production technologies and rigorous quality assurance protocols to meet the ultra-high purity standards demanded by the semiconductor, photovoltaic, and electronics industries.

Key Players

- Asia Union Electronic Chemicals

- BASF

- Columbus Chemicals

- EuroChem

- Everest Kanto Cylinder

- Juhua Group

- KMG Electronic Chemicals

- Mitsubishi Chemical Corporation

- Suzhou Crystal Clear Chemical Co., Ltd.

- thyssenkrupp Uhde

- UBE Corporation

Electronic Grade Nitric Acid Industry Developments

March 2025: thyssenkrupp Uhde, a major chemical technology solution provider, was awarded a contract by Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC) for the construction of a Weak Nitric Acid (WNA-III) Plant in Bharuch, Gujarat, India.

November 2024: UBE Corporation, a prominent Japanese chemical company, announced that it has decided to increase the production capacity of high-purity nitric acid at the Ube Chemical Factory in order to meet a further increase in demand.

Electronic Grade Nitric Acid Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- EL Grade

- VL Grade

- UL Grade

- SL Grade

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Semiconductor

- Solar Energy

- LCD Panel

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electronic Grade Nitric Acid Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 86.51 billion |

|

Market Size Value in 2025 |

USD 90.82 billion |

|

Revenue Forecast by 2034 |

USD 143.08 billion |

|

CAGR |

5.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 86.51 billion in 2024 and is projected to grow to USD 143.08 billion by 2034.

The global market is projected to register a CAGR of 5.2% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Asia Union Electronic Chemicals; BASF; Columbus Chemicals; EuroChem; Everest Kanto Cylinder; Juhua Group; KMG Electronic Chemicals; Mitsubishi Chemical Corporation; Suzhou Crystal Clear Chemical Co., Ltd.; thyssenkrupp Uhde; and UBE Corporation.

The EL grade segment dominated the market share in 2024.

The solar energy segment is expected to witness the fastest growth during the forecast period.