Electrophysiology Devices Market Size, Share, Trends, Industry Analysis Report

: By Indication [Atrial Fibrillation (AF), Supraventricular Tachycardia, Atrioventricular Nodal Re-entry Tachycardia (AVNRT), Wolff-Parkinson-White Syndrome (WPW), Bradycardi, Other], By Application, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM2598

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

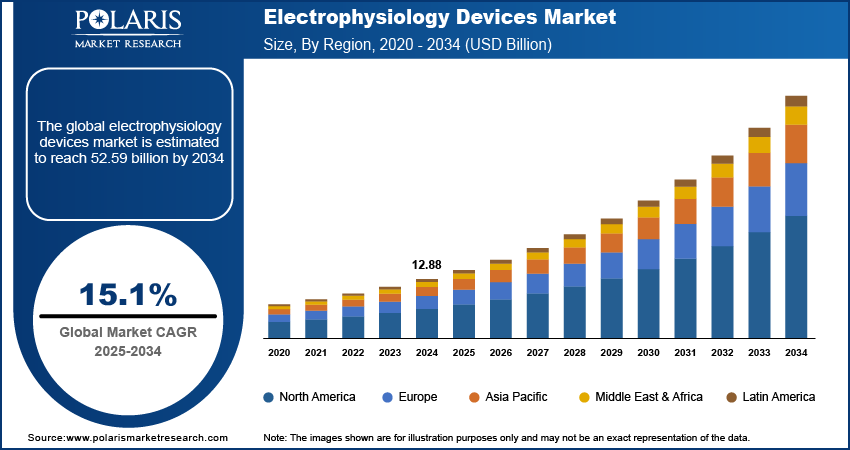

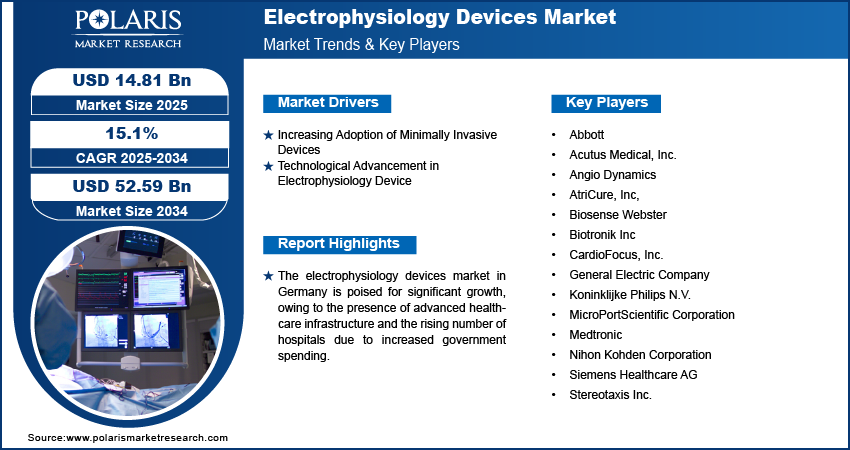

The electrophysiology devices market size was valued at USD 12.88 billion in 2024, exhibiting a CAGR of 15.1% from 2025 to 2034. The market is driven by the increasing prevalence of cardiovascular diseases, aging populations, the growing adoption of minimally invasive procedures, and continuous technological advancements.

Key Insights

- The atrial fibrillation segment grew significantly in 2024 because of an increase in AF prevalence among people aged 45 years and older.

- The hospital segment dominated the market in 2024, fueled by increased admissions and prolonged stays to treat chronic diseases.

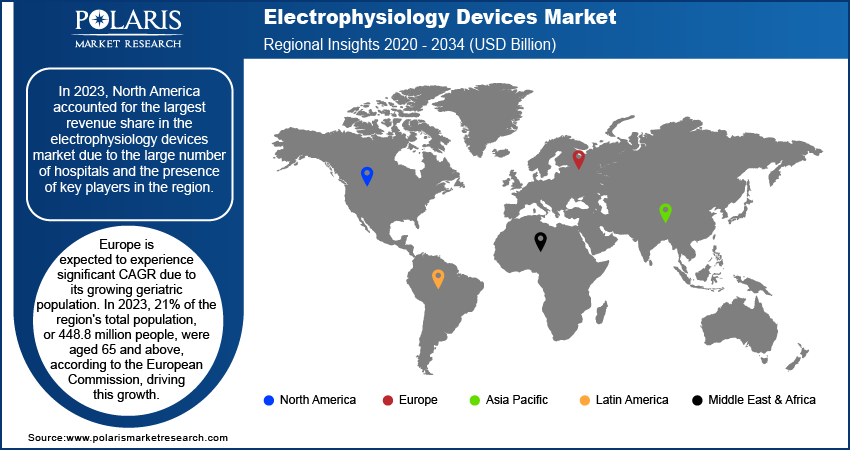

- In 2024, the North American region held the largest share of the revenue in the electrophysiology devices market, primarily due to the high number of hospitals and major industry players in the region.

- Europe is expected to experience robust CAGR growth over the forecast period, driven by its increasing geriatric population.

Industry Dynamics

- The increasing incidence of cardiovascular diseases is expected to drive demand for electrophysiology devices and propel market growth throughout the forecast period.

- The increasing adoption of minimally invasive procedures among healthcare practitioners is anticipated to drive demand for electrophysiology devices.

- Progress in imaging technologies is enhancing treatment outcomes and effectiveness, stimulating demand for electrophysiology devices, and driving market growth.

- High electrophysiology devices and procedure costs, as well as limited availability in low-income economies, can hamper market growth.

Market Statistics

2024 Market Size: USD 12.88 billion

2034 Projected Market Size: USD 52.59 billion

CAGR (2025-2034): 15.1%

North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Electrophysiological devices are medical instruments used to measure the electrical activity in cells or tissues. These devices detect changes in cell membrane potential and measure the electric currents passing through ion channels. The market for electrophysiology devices is primarily driven by the increasing prevalence of cardiovascular diseases worldwide. For instance, according to the World Heart Federation, the reported deaths due to cardiovascular disease have significantly increased to 20.5 million people in 2021, reflecting a 2% from 1990, when the reported deaths were recorded at 12.5 million. Globally, cardiovascular-related deaths are responsible for 1/3rd of total deaths and are expected to increase in the coming years, thereby fueling the market expansion. Changing lifestyle habits, obesity, and other factors are the major causes of increasing incidents of cardiovascular disease. Electrophysiological devices are used to monitor abnormal heart rhythms in cardiovascular diseases. According to the World Heart Federation, cardiovascular disease is the leading cause of premature death for men in 146 countries and for women in 98 countries. Thus, the increasing prevalence of cardiovascular disease is expected to increase demand for electrophysiology devices and simultaneously contribute to the electrophysiology device market growth in study years.

The electrophysiology devices market is expected to grow due to the growing aging population in major countries globally. The increasing geriatric populations with chronic conditions in major countries have led to a higher number of hospital admissions, extended hospital stays, and more complex surgeries. For instance, according to the Public Health Department of the United Kingdom reports about 0.8 million annual hospital admissions for individuals aged 75 and older, with an average of 0.3 million repeat admissions per patient. This age group’s readmission rate is nearly double that of younger patients, including those under 50 and those aged 50-75. Therefore, the growing aging population with chronic diseases and increasing hospital admissions of the geriatric population are expected to drive the electrophysiology device market during the forecast period.

Market Drivers

Increasing Adoption of Minimally Invasive Devices

Increasing adoption of minimally invasive devices and procedures by healthcare professionals is anticipated to fuel the demand for electrophysiology devices. According to John Hopkins University, the probability of getting surgery site infection after using an invasive procedure or surgery is 1-3%. Additionally, according to the Centers for Disease Control and Prevention, surgical site infection due to invasive procedures and surgeries rate has increased by 4% in 2024 in the United States, rising from 110,800 cases found in 2015. From 2015 to 2024, the number of infection cases has increased by 2-3% annually. The increase in complications and infections from invasive procedures has led a major portion of healthcare professionals and the general population to adopt non-invasive or minimally invasive procedures, positively impacting market growth.

Technological Advancement in Electrophysiology Devices

The electrophysiology devices market is anticipated to grow due to advancements in technology. Innovations such as advanced designs, sophisticated mapping systems, and high-resolution imaging techniques have greatly improved the accuracy and efficiency of electrophysiology procedures. For example, advancements in high-density mapping technology enable better pinpointing of arrhythmogenic regions in the heart, resulting in improved outcomes for ablation procedures. Similarly, innovations in catheter technology, like the development of flexible and more responsive catheters, have made procedures more efficient and reduced patient discomfort. Additionally, progress in imaging technologies such as 3D imaging and real-time visualization have given clinicians enhanced insights into intricate procedures, enabling more efficient treatment strategies. Overall, these technological advancements help enhance patient results, reduce complications, and increase efficiency during procedures. This is expected to increase the demand for electrophysiology devices for various disease treatments and diagnostics, ultimately propelling the electrophysiology device market growth during the forecast period.

Segment Insights

Market Assessment by Indication Outlook

The electrophysiology devices market segmentation, based on indication, includes atrial fibrillation (AF), supraventricular tachycardia, atrioventricular nodal re-entry tachycardia (AVNRT), Wolff-Parkinson-white syndrome (WPW), bradycardia and others. The atrial fibrillation segment held the significant market growth in 2024. This is due to the increase in the prevalence of AF worldwide in the 45+ age group. For instance, according to American Heart Association, the United States records 3-6 million cases of AF annually, and is expected to increase to 6 to 16 million by 2050. Similarly, the European region records 4.5 million cases of AF annually, almost 2% of the total population size, which is expected to increase and reach 14 million cases by 2060. The growing prevalence of the disease has raised awareness among healthcare practitioners and resulted in an increase in demand for electrophysiology devices.

Market Evaluation by End User Outlook

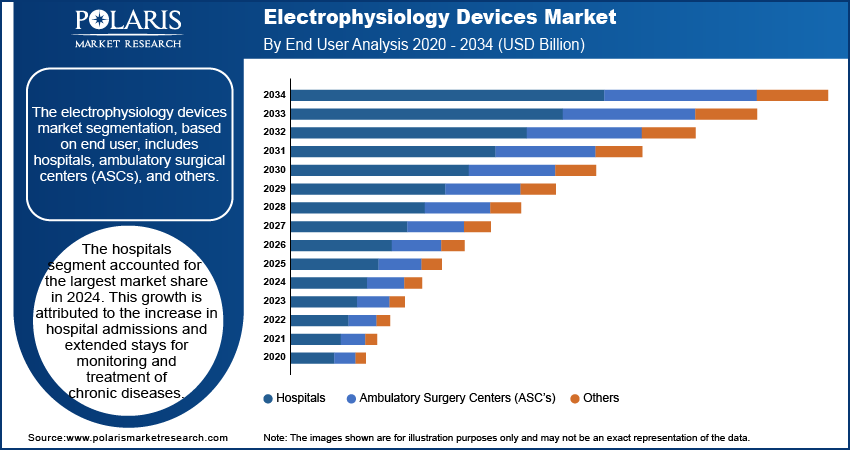

The electrophysiology devices market segmentation, based on end user, includes hospitals, ambulatory surgical centers (ASCs), and others. hospitals segment accounted for the largest market share in 2024. This growth is attributed to the increase in hospital admissions and extended stays for monitoring and treatment of chronic diseases. Hospitals are generally in high demand due to the availability of resources and skilled professionals. Also, they are backed by large investments for the procurement of expensive machines and have a skilled workforce to handle advanced machinery. Therefore, hospitals are considered to be the largest consumer of electrophysiology devices.

Market Share by Region

By region, the study provides the electrophysiology devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest revenue share in the electrophysiology devices market due to the large number of hospitals and the presence of key players in the region. For instance, according to the American Hospital Association and the Government of Canada, as of 2024, there were 7,066 hospitals in North America. Of these, 946 were in Canada, and 6,120 were in the United States. Among Canada's 946 hospitals, there were 230 small hospitals with an average of 30–40 beds, 71 micro hospitals with an average of 15 beds, and 317 major hospitals with an average of 939 beds. Additionally, there were 328 medium-sized hospitals. In the United States, there were 916,752 beds as of 2024. Furthermore, it is projected that significant companies engaged in mergers and acquisitions, as well as growing their product offerings with advanced technology, will drive the North American electrophysiology devices market.

Europe is projected to register a substantial CAGR during the forecast period due to the rising geriatric population in the region. For instance, according to the European Commission, in 2023, the geriatric population in the region accounted for 21% of the total population size, which is 448.8 million people above 65 years. The median age of European citizens has crossed 44 years as of January 2023. Moldova, a European country, had the largest share of the population above 65 in 2023, which has increased by 6.2% from 2013. It was followed by Poland, which has seen a 5.5% increase in the total population share of the older population age group since 2013. Luxembourg had the lowest population share of above 65 years and the lowest percentage increased since 2013 compared to other European countries. This growing population share of the geriatric population has led to increased hospital admissions and readmissions in the region, which is expected to boost the electrophysiology market further.

For instance, according to the Germany Federal Statistical Office, as of 2023, Germany had 1,893 hospitals with 16.8 million yearly active patients. Additionally, the government spent 498 billion euros on the healthcare sector and 6,000 euros per person in the year 2023, which was 12% of the country’s GDP. Healthcare spending in 2023 has significantly increased since 2009, which was recorded at 281.6 billion euros, almost double as compared to 2009. Moreover, increasing hospital admissions in the country are expected to fuel the electrophysiology market in the forecast years. For instance, in 2022, the country recorded 480,000 patients. Out of these, 26,000 required intensive care with an average stay period of 7.2 days, accounting for 69% of the country’s total bed occupancy.

Key Market Players & Competitive Insights

The electrophysiology devices market is always evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development capabilities, advanced manufacturing technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative medical devices and meeting the needs of specific market sectors. This competitive environment is amplified by continuous progress in product offerings and new applications, greater emphasis on sustainability, and the rising requirement for tailor-made, single-use products in diverse industries. Major players in the electrophysiology devices market include Abbott; Acutus Medical, Inc.; Angio Dynamics; AtriCure, Inc.; Biosense Webster (Johnson & Johnson Services, Inc.); Biotronik Inc; CardioFocus, Inc; General Electric Company; Koninklijke Philips N.V.; MicroPortScientific Corporation; Medtronic; Nihon Kohden Corporation; Siemens Healthcare AG; and Stereotaxis Inc.

Medtronic, based in Dublin, Ireland, is a global medical technology company dedicated to improving patient outcomes across various therapeutic fields. Founded in 1949, the company is known for developing and manufacturing a wide range of advanced medical devices, including pacemakers, insulin pumps, spinal implants, robotic surgical systems, and deep brain stimulation systems. Medtronic’s innovations are crucial for managing cardiovascular conditions, diabetes, neurological disorders, and spinal issues. Operating in over 150 countries, the company combines its extensive expertise with advanced research to tackle major healthcare challenges. In December 2023, the company announced that the United States Food and Drug Administration (FDA) had approved the PulseSelect Pulsed Field Ablation (PFA) System for the treatment of both paroxysmal and persistent atrial fibrillation (AF). This was the first PFA technology to receive FDA approval and followed the European CE (Conformité Européenne) Mark of the PulseSelect PFA system in November 2023.

Siemens Healthcare, a division of Siemens AG, is a well-known global leader in medical technology and healthcare solutions. Headquartered in Erlangen, Germany, Siemens Healthcare specializes in a broad range of advanced diagnostic and therapeutic technologies. The company is known for its innovations in imaging systems, including MRI, CT, and ultrasound, as well as its contributions to laboratory diagnostics and healthcare IT solutions. Siemens Healthcare is dedicated to improving patient care and outcomes through advanced technologies that enhance diagnostic accuracy, streamline workflows, and support personalized medicine. By investing heavily in research and development, Siemens Healthcare continually pushes the boundaries of medical technology, offering solutions that address complex healthcare challenges. The company operates globally, serving healthcare providers with advanced tools and solutions designed to optimize clinical performance and patient management. In August 2023, at the annual meeting of the European Society of Cardiology (ESC), the company unveiled the Acuson Origin, a groundbreaking cardiovascular ultrasound system. The new system features advanced artificial intelligence (AI) capabilities that enable it to identify the anatomy being imaged and anticipate the next steps necessary for enhancing patient care. Equipped with AI algorithms, the Acuson Origin automates approximately 500 different measurements, marking a significant advancement in cardiovascular imaging technology.

List of Key Companies

- Abbott

- Acutus Medical, Inc.

- Angio Dynamics

- AtriCure, Inc,

- Biosense Webster (Johnson & Johnson Services, Inc.)

- Biotronik Inc

- CardioFocus, Inc.

- General Electric Company

- Koninklijke Philips N.V.

- MicroPortScientific Corporation

- Medtronic

- Nihon Kohden Corporation

- Siemens Healthcare AG

- Stereotaxis Inc.

Electrophysiology Devices Industry Developments

January 2024: GE HealthCare launched the Prucka 3 with CardioLab EP Recording system to advance electrophysiology diagnostics. This new system enhances signal clarity with advanced filtering and noise reduction, which is vital for accurate arrhythmia diagnosis and treatment. The Prucka 3 introduces features such as dual real-time displays, cycle length labeling, and multiple review windows, improving EP lab efficiency. The system is designed to support emerging electrophysiology technologies. It is part of GE HealthCare’s broader cardiology care portfolio, including recent innovations like Allia IGS Pulse and CardioVisio for Atrial Fibrillation.

February 2023: Abbott announced that two of its electrophysiology products have gained regulatory approval. The TactiFlex Ablation Catheter, Sensor Enabled, received CE mark in Europe for treating abnormal heart rhythms like atrial fibrillation (AFib). This catheter, known for its flexible tip and contact force sensing, reduces procedure time and radiation exposure compared to standard methods. When used with Abbott's Ensite X EP System, it enhances high-power ablation treatment, marking the latest advancement in Abbott's arrhythmia solutions.

June 2022: Acutus Medical, Inc. announced the commercial launch of its expanded suite of left-heart access products, including the AcQCross Qx system, compatible with the TruSeal and FX delivery systems for the Watchman LAAC Device. The AcQCross system, which integrates a needle and dilator to simplify the transseptal access process, aims to enhance the safety and efficiency of left-heart procedures. The system is now available in the US, offering broad compatibility with leading sheaths and improving procedural versatility.

Electrophysiology Devices Market Segmentation

By Indication Outlook

- Atrial Fibrillation (AF)

- Supraventricular Tachycardia

- Atrioventricular Nodal Re-entry Tachycardia (AVNRT)

- Wolff-Parkinson-White Syndrome (WPW)

- Bradycardia

- Other

By Application Outlook

- Treatment Device

- Implantable Cardioverter Defibrillators (ICDs)

- Automated External defibrillators (AEDs)

- Pacemakers CRT-P

- CRT-D

- Catheters

- Others

- Diagnostics Device

- Holter Monitoring Devices

- Diagnostic Electrophysiology Catheters

- Electrocardiograph (ECG)

- EP Mapping & Imaging Systems

- Insertable Cardiac Monitors (ICM)

By End User Outlook

- Hospitals

- Ambulatory Surgery Centers (ASC’s)

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electrophysiology Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.88 billion |

|

Market Size Value in 2025 |

USD 14.81 billion |

|

Revenue Forecast in 2034 |

USD 52.59 billion |

|

CAGR |

15.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End-User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The electrophysiology devices market size was valued at USD 12.88 billion in 2024 and is projected to grow to USD 52.59 billion by 2034.

The market is projected to register a CAGR of 15.1% from 2024 to 2032.

In 2024, North America had the largest share of the market due to the large number of hospitals and the presence of key players in the region

The key players in the market are Abbott; Acutus Medical, Inc.; Angio Dynamics; AtriCure, Inc.; Biosense Webster (Johnson & Johnson Services, Inc.); Biotronik Inc; CardioFocus, Inc; General Electric Company; Koninklijke Philips N.V.; MicroPortScientific Corporation; Medtronic; Nihon Kohden Corporation; Siemens Healthcare AG; and Stereotaxis Inc.

The hospitals segment accounted for the largest market share in 2024. This growth is attributed to the increase in hospital admissions and extended stays for monitoring and treatment of chronic diseases.

The atrial fibrillation segment held the significant market growth in 2024, due to the increase in the prevalence of AF worldwide in the 45+ age group.