Elevators & Escalators Market Size, Share, Trends, & Industry Analysis Report

By Type (Elevators, Escalators), By Service, By Elevator Technology, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 112

- Format: PDF

- Report ID: PM2423

- Base Year: 2024

- Historical Data: 2020 - 2023

What is Elevators & Escalators Market Size?

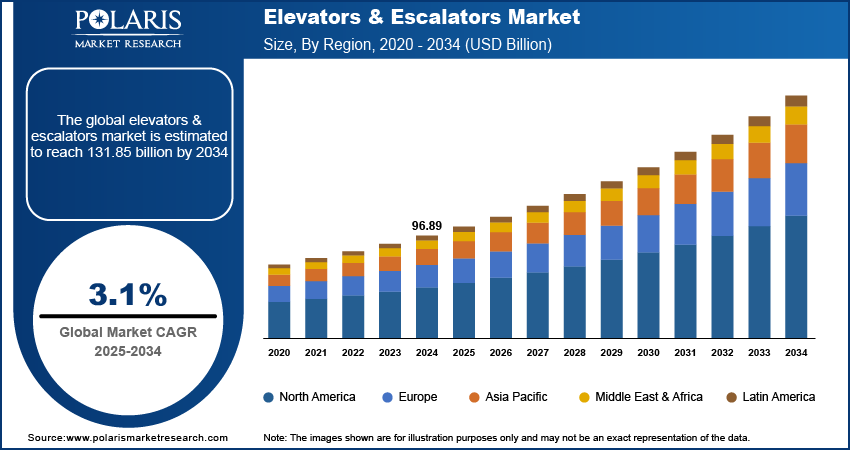

The global elevators & escalators market was valued at USD 96.89 billion in 2024 and is expected to grow at a CAGR of 3.1% during the forecast period. The key factors such as the rising adoption of modern safety features in escalators, technological advancements, and the rising construction sectors are driving the industry growth during the forecast period.

Key Insights

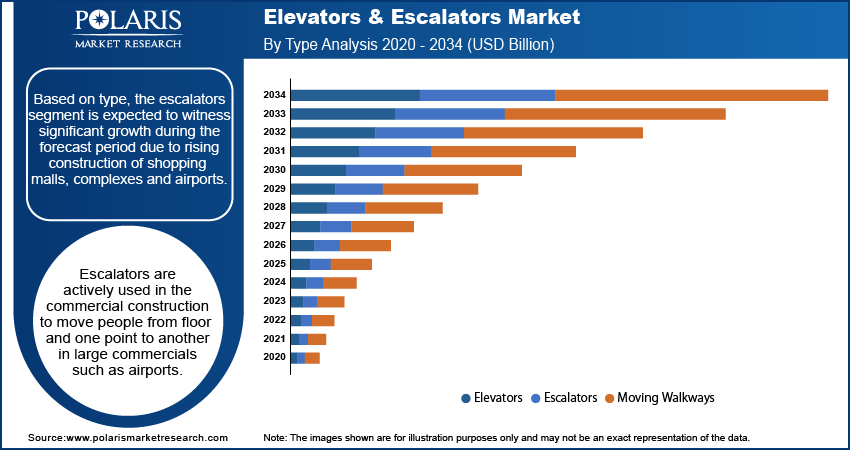

- The escalators are expected to witness significant growth during the forecast period due to rising construction of commercial complexes.

- The residential segment accounted for the largest share in 2024 driven by growth in construction of high-rise buildings.

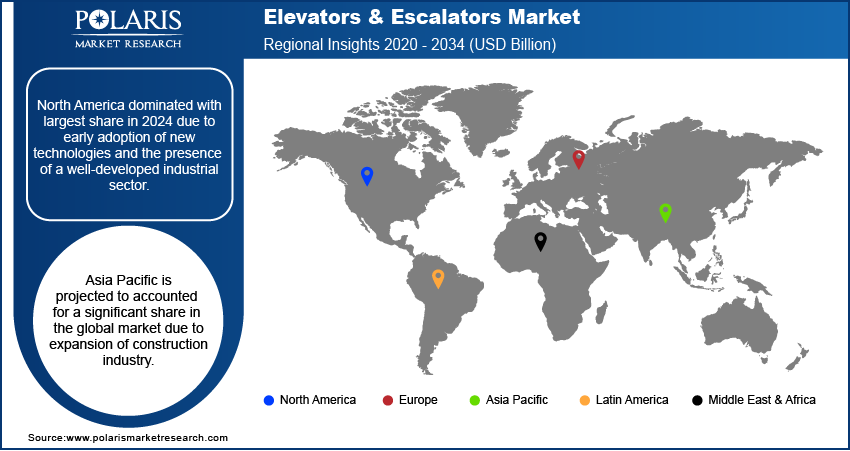

- North America dominated with largest share in 2024 due to early adoption of new technologies and the presence of a well-developed industrial sector.

- Asia Pacific is projected to accounted for a significant share in the global market due to expansion of construction industry.

Industry Dynamics

- The rising construction activities is fueling the industry growth.

- The rising adoption of modern safety features in escalators is expanding the industry.

- The technological advancement is driving the growth.

- Limited infrastructure capacity and high installation costs limits the growth.

Market Statistics

- 2024 Market Size: USD 96.89 Billion

- 2034 Projected Market Size: USD 131.85 Billion

- CAGR (2025-2034): 3.1%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Technological advancement is making elevators and escalators more safe and accurate which is fueling the adoption. Various safety mechanisms, such as emergency escape features, safety brakes, door shuttering devices, door detectors, pit queues, and others, have resulted in more advanced escalator services. The industrial and commercial sectors incorporate modern safety features in escalators such as skirt brushes to prevent objects from becoming entangled in escalators, step level monitors, lack step sensors, handrail alarm systems, and sensors to trigger an automatic stoppage in the case of emergency, and others. Thus, the technologically advanced safety solutions make escalators accurate and effective in handling emergencies. Furthermore, major industry players are expanding their footprint by improving their escalator production and operating capacity, which is further driving the growth of the industry.

Industry Dynamics

Which Factor is Driving Elevators & Escalators Market Growth?

Construction activities are rising worldwide. This growth is driven by higher investment in infrastructure and increased spending on building projects. There has also been a higher demand for homes owing to people having more disposable income. As a result, the demand for elevators and escalators is also increasing, particularly in residential buildings and commercial complexes. According to the U.S. Census Bureau, in July 2025, the construction spending in U.S. alone was USD 2,140.5 billion. Moreover, growing urbanization in developing regions such as India, Vietnam, and Brazil is further driving the demand for the residential, and commercial buildings. According to the World Bank Group, as of 2024, 88% of the Brazil’s population lives in urban areas, thereby fueling the growth of the industry.

Report Segmentation

The market is primarily segmented based on type, service, elevator technology, end-use, and region.

|

By Type |

By Service |

By Elevator Technology |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by End-Use

Which Segment By End Use Dominated the Industry in 2024?

Based on the end-use industry segment, the residential segment dominated with largest share in 2024. The rising complexity of living standards in emerging economies drives the global residential market. Emerging economies such as India, China, and Southeast Africa are experiencing unprecedented growth in urbanization as their populations migrate to cities in search of work. As a result, high-rise buildings almost always equipped with smart escalators are becoming increasingly necessary to accommodate a sizable population in cities. Further, based on elevator technology, traction holds the highest share in the market. Traction lifts are more efficient than hydraulic lifts that can be used in all high-rise and mid-rise building structures.

Insight by Type

Why Escalator Segment is Expected to Witness Significant Growth During the Forecast Period?

Based on type, the escalators segment is expected to witness significant growth during the forecast period due to rising construction of shopping malls, complexes and airports. Escalators are actively used in the commercial construction to move people from floor and one point to another in large commercials such as airports. The rising government investment in these facilities is driving the demand for the escalators. Moreover, urbanization worldwide is rising, due to which the demand for the commercial buildings, shopping malls is rising. According to the World Bank Group, as of 2024, 58% of the world’s population lives in urban areas. This rise in the urbanization and commercial spaces demand is fueling the need for the escalators, thereby driving the segment growth.

Geographic Overview

Which Region Dominated with Largest Share in 2024?

The North America dominated with largest share in 2024 driven by its well-established urban infrastructure. The region has one of the most modern urban infrastructures worldwide which fuels the number of the high-rise buildings. According to the Council on Tall Buildings and Urban Habitat, the U.S. consist of 253 buildings with height more than 200 meters. This higher number is fueling the demand for the elevators in the region. Moreover, the spending on the commercial construction such as shopping malls, complexes and airports is increasing in the region. According to the U.S. Census Bureau, in July 2025, the spending on commercial construction was USD 736.7 billion. This higher spending on the commercial spending is fueling the demand for the escalators, thereby driving the growth.

What is the reason for Asia Pacific's Significant Growth During the Forecast Period?

Asia Pacific is expected to witness a high CAGR in the global market during the forecast period. Factors such as easy availability of raw materials, low labor costs, and a relatively tight regulatory environment drive the market. The construction industry is expanding due to rising spending and government initiatives. Rising urbanization and smart city development in major countries such as India, China and Vietnam drive the demand for the industry. Companies are diversifying their revenue streams with the help of passenger boarding bridges and automated gate systems, thereby driving the growth in the region.

Who are the Major Players in the Industry?

Some of the major players operating in the global market include Otis Elevator, Electra Elevators, Escon Elevators, Fujitec Co., Ltd., Hitachi Ltd., Eita Elevator, Kleemann, Kone Corporation, Mitsubishi Electric Corporation, Orona, Hyundai Elevator, Schindler Group, Sigma Elevator Company, Thyssenkrupp AG, and Toshiba Elevators And Building Systems Corporation.

Industry Development

September 2025, Otis launched flexible phased elevator modernization packages Arise MOD Prime and MOD Plus in Europe, enabling customers to upgrade aging elevators in phases. These solutions improved safety, efficiency, and energy savings while offering customizable options for residential and commercial buildings.

Elevators & Escalators Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 96.89 Billion |

| Market size value in 2025 | USD 99.85 Billion |

|

Revenue forecast in 2034 |

USD 131.85 Billion |

|

CAGR |

3.1% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By Service, By Elevator Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Eita Elevator, Electra Elevators, Escon Elevators, Fujitec Co., Ltd., Hitachi Ltd., Hyundai Elevator, Kleemann, Kone Corporation, Mitsubishi Electric Corporation, Orona, Otis Elevator, Schindler Group, Sigma Elevator Company, Thyssenkrupp AG, and Toshiba Elevators And Building Systems Corporation |

FAQ's

• The market size was valued at USD 96.89 Billion in 2024 and is projected to grow to USD 131.85 Billion by 2034.

• The market is projected to register a CAGR of 3.1% during the forecast period.

• A few of the key players in the market are Eita Elevator, Electra Elevators, Escon Elevators, Fujitec Co., Ltd., Hitachi Ltd., Hyundai Elevator, Kleemann, Kone Corporation, Mitsubishi Electric Corporation, Orona, Otis Elevator, Schindler Group, Sigma Elevator Company, Thyssenkrupp AG, and Toshiba Elevators and Building Systems Corporation.

• The residential segment accounted for the largest market share in 2024.

• The escalators segment is expected to record significant growth.