Emollients In Personal Care Market Size, Share, Trends, Industry Analysis Report

By Product (Green, Silicone Fluids, Mineral Oils, & Others), and By Region – Market Forecast, 2025–2034Emollients In Personal Care Market Size, Share, Trends, Industry Analysis Report By Product (Green, Silicone Fluids, Mineral Oils, & Others), and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6070

- Base Year: 2024

- Historical Data: 2020-2023

Overview

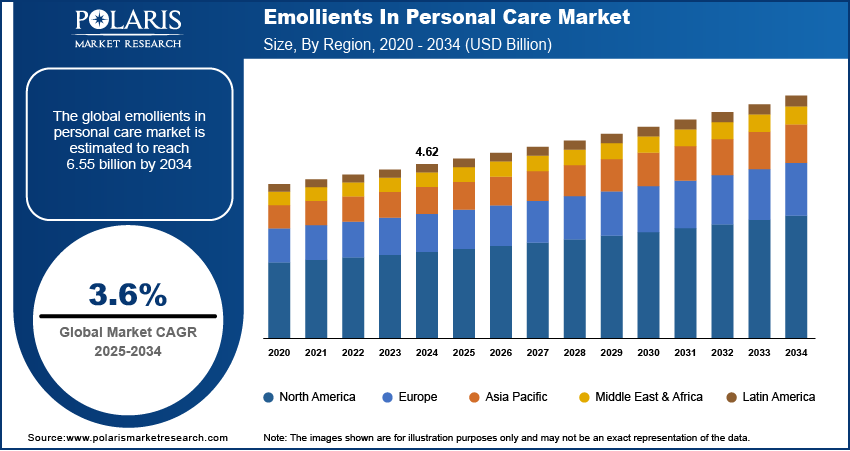

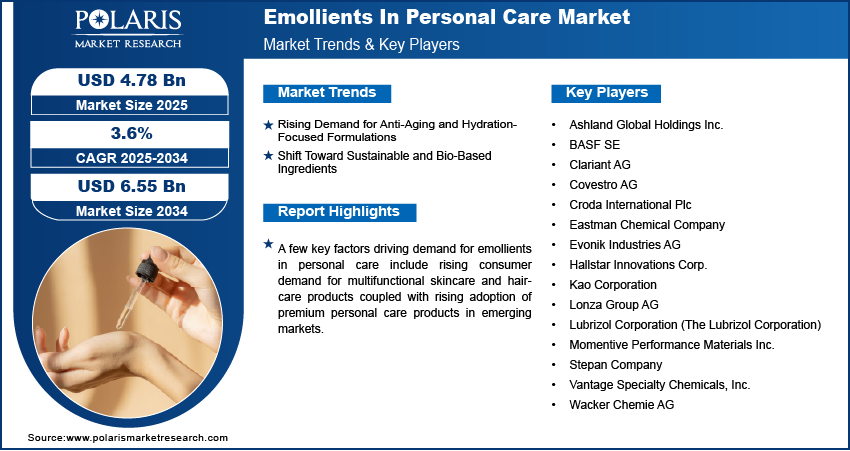

The global emollients in personal care market size was valued at USD 4.62 billion in 2024, growing at a CAGR of 3.6% from 2025 to 2034. Key factors driving demand for emollients in personal care include rising demand for anti-aging and hydration-focused formulations coupled with shift toward sustainable and bio-based ingredients.

Key Insights

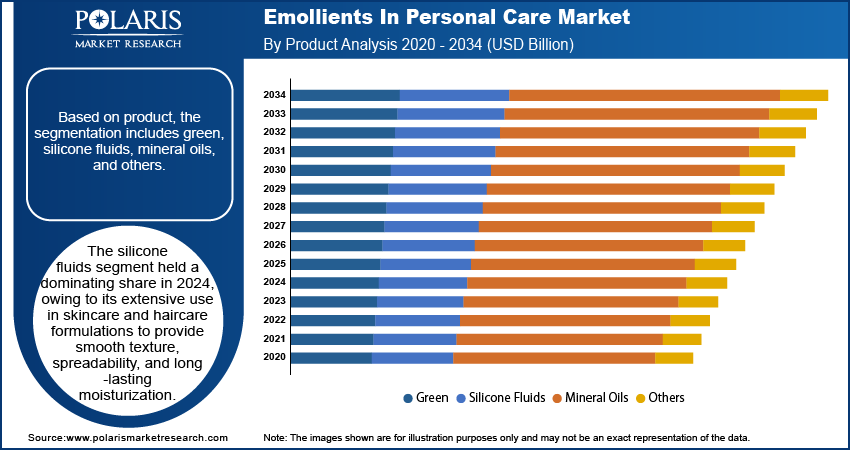

- The silicone fluids segment dominated the market share in 2024.

- The green emollients segment is projected to grow at a rapid pace in the coming years, driven by rising demand for sustainable and bio-based alternatives to petrochemical-derived ingredients.

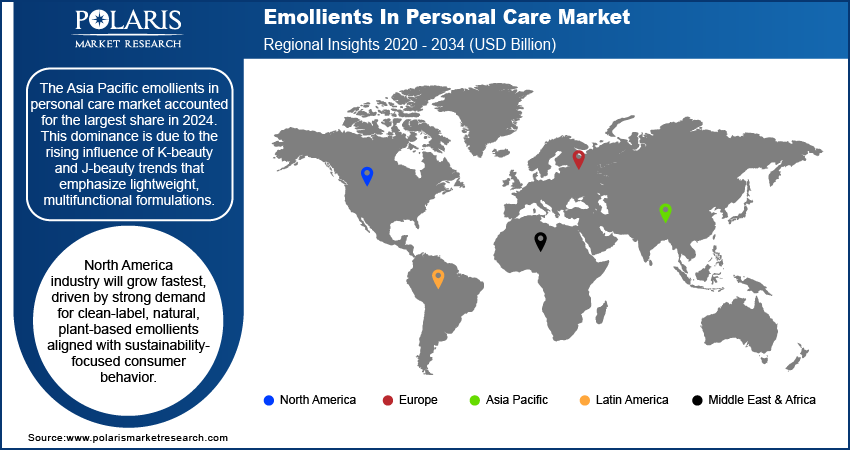

- The Asia Pacific emollients in personal care market dominated the global market share in 2024.

- India emollients in personal care market is driven by rapidly expanding middle-class population with rising disposable incomes that are fueling demand for skincare and cosmetic products.

- The market in North America is projected to grow at a fast pace from 2025-2034, attributed to the strong consumer demand for clean-label, natural, and plant-derived emollients in line with sustainability-focused purchasing behavior.

- The market in the U.S. is growing rapidly, due to the presence of leading cosmetic manufacturers and advanced R&D facilities.

Industry Dynamics

- Growing demand for anti-aging and hydration-focused products is boosting the use of advanced emollients. Brands are developing newer products to enhance skin barrier protection, elasticity, and moisture.

- Increasing preference for natural and bio-based ingredients is propelling adoption of plant-based and green emollients. This is consistent with clean beauty and consumer demands for natural cosmetics.

- Nanoemulsion and microencapsulation advancements are creating new market opportunities. These technologies enhance delivery, stability, and absorption of emollients in personal care items.

- The premium price of natural and specialty emollients poses a significant constraint. It restricts adoption in mass-market items and presents affordability issues for price-conscious consumers.

Market Statistics

- 2024 Market Size: USD 4.62 Billion

- 2034 Projected Market Size: USD 6.55 Billion

- CAGR (2025–2034): 3.6%

- Asia Pacific: Largest Market Share

The emollients in personal care market includes specialty ingredients designed to impart moisture, softness, and smoothness to the skin and hair with high efficacy and safety levels. Commonly used in skincare, haircare, cosmetics, sun care, and baby care, these ingredients improve skin moisturizing, enhance texture, and provide long-lasting comfort for various consumer demands. Developments in bio-based emollients, multi-benefit formulations, and natural oil blends are improving product performance, sustainability, and compatibility with sensitive skin, which are allowing more effective, sustainable, and responsive personal care solutions.

Increasing consumer demand for hair and skincare products that are multifunctional is driving the emollients in personal care market. Brands highlight hydration, barrier function, and better sensorial experience for product formulation. The changing consumer trend and stringent environmental regulations are driving the use of natural, bio-based, and sustainable emollients.

The increasing demand for premium personal care products within emerging economies, coupled with growing concern for dermatologically safe, natural, and sustainable formulations, is driving the market. Industry players are focusing more on creating eco-certified and multi-functional emollients with enhanced moisturizing retention to ensure skin compatibility for sensitive skin, addressing various consumer requirements. These developments are rendering emollients more sustainable, efficient, and adaptable, thus widening its use in the areas of skincare, haircare, sun protection, and cosmetic products.

Drivers & Opportunities

Rising Demand for Anti-Aging and Hydration-Focused Formulations: Increasing consumer interest in skin care, hydration, and anti-aging is fueling demand for next-generation emollients in personal care. Skincare that is enriched with emollients boosts moisture levels, provides better texture, and creates silkier sensory feel. In 2023, the European cosmetics market was estimated to be worth approximately USD 104.6 billion (RSP), placing Europe and the U.S. among the world's largest markets. This expansion is building robust opportunities for new emollient applications in moisturizers, serums, and sun care.

Shift Toward Sustainable and Bio-Based Ingredients: Rising regulatory pressure coupled with environmentally aware consumers are driving the transition towards natural, bio-based, and biodegradable emollients. Leading brands are reformulating to substitute petrochemical-based actives with renewable options. The 2024 Voice of the Consumer Sustainability Survey discovered that 45% of consumers worldwide aim to drive positive environmental change through everyday choices. This change is compelling manufacturers to provide high-performance, eco-certified emollients to fuel clean beauty with efficacy in skin and hair care.

Segmental Insights

By Product

Based on product, the emollients in personal care market are segmented into green, silicone fluids, mineral oils, and others. Silicone fluids were the largest in 2024 due to its widespread application in skincare and haircare products for imparting smooth texture, spreadability, and long-term moisturization. Its stability, non-greasy feel, and capacity for boosting product sensory attractiveness are driving its growth in premium cosmetics, sunscreens, and leave-on products.

Green emollients are expected to register the fastest growth over the forecast period, fueled by increasing demand for eco-friendly and bio-based alternatives to petrochemical-derived ingredients. Plant-based oils, esters, and butters are emerging fast among consumers and clean beauty brands alike, as well as brands aligned with eco-certification and natural product formulations. The segment is also fueled by mounting regulatory pressure for green safety of ingredients and enhanced consumer demand for transparent and ethical supply of products.

Regional Analysis

The Asia Pacific emollients in personal care market held the largest share in 2024. This is driven by the K-beauty and J-beauty trends that promote lightweight, multi-tasking products adoption. Increasing urban pollution and climate-related skin problems are driving demand for shielded skincare with innovative emollients. Rising demand for premium cosmetic usage and increased product offerings by regional and international companies are driving the growth further.

India Emollients in Personal Care Market Overview

India is emerging as a key growth hub in the Asia Pacific market, due to growing middle class with greater disposable incomes is driving demand for cosmetics and skincare. The India Brand Equity Foundation estimates the middle class to grow from 432 million during 2020–21 to 715 million during 2030–31, and 1.02 billion during 2047. This population transformation is driving premium personal care expenditure, driving demand for high-quality emollients.

North America Emollients in Personal Care Market Assessment

North America is projected to grow at a fast pace from 2025-2034. This is due to the growing demand for clean-label, natural, and plant-based emollients that complement sustainability-driven solutions. Rising demand for advanced skincare product by premium skincare brands, dermatologist-recommended products, and high-performance products are driving growth across personal care applications.

U.S. Emollients in Personal Care Market Overview

The U.S. dominated the North America emollients in personal care market. The growth is driven by top cosmetic companies and sophisticated R&D centers fueling product development. Rising demand for premium, multi-benefit, and dermatologist-endorsed skincare is driving the use of natural and synthetic emollients in moisturizing, antiaging, and sun protection. According to the American Academy of Dermatology, one out of four Americans struggle with skin conditions every year, driving demand for clinically proven, skin-like products. Strong investment in clean-label and bio-based formulations, in addition to strong retail and e-commerce channels, is further propelling market growth.

Europe Emollients in Personal Care Market Outlook

Europe held a significant share of the global market in 2024. Regulations such as Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) and EU Cosmetics Regulation support the use of safe, sustainable ingredients. Increasing demand for organic, vegan, and environmentally certified cosmetics by consumers is pushing the demand of natural emollient in skin care, hair care, and hygiene. Emerging regional markets like the UK, Germany, and France are investing strongly in sustainable cosmetic innovation driving regional demand.

Key Players & Competitive Analysis

The global personal care emollients market is competitive. Companies such as Ashland Global Holdings Inc., BASF SE, and Clariant AG are driving portfolios and providing high-performing solutions for skincare, haircare, and cosmetics. Ashland Global Holdings Inc. is concentrating on bio-based and multifunctional emollients to address increasing demand for sustainable and clean-label offerings. BASF SE is investing in new ingredients that promise to improve hydration, texture, and sensory attractiveness in personal care products. Clariant AG is building its market position using sustainable and natural emollients for high-end beauty and wellness brands.

The market is experiencing high demand for premium emollients with consumers preferring ever more dermatologically safe, eco-friendly, and multifunctional products that deliver hydration, anti-aging, and UV protection in one. Vendors are investing in R&D to develop silicone alternatives, plant-derived emollients, and hybrid formulations that meet with the shift toward sustainability and regulatory compliance. Strategic partnerships with cosmetic companies, ingredient providers, and research centers are increasing further innovation pipelines, while increasing digital interaction and e-commerce-led distribution are boosting brand visibility.

Prominent players in the emollients in personal care industry are Ashland Global Holdings Inc., BASF SE, Clariant AG, Covestro AG, Croda International Plc, Eastman Chemical Company, Evonik Industries AG, Hallstar Innovations Corp., Kao Corporation, Lonza Group AG, Lubrizol Corporation, Momentive Performance Materials Inc., Stepan Company, Vantage Specialty Chemicals, Inc., and Wacker Chemie AG.

Key Players

- Ashland Global Holdings Inc.

- BASF SE

- Clariant AG

- Covestro AG

- Croda International Plc

- Eastman Chemical Company

- Evonik Industries AG

- Hallstar Innovations Corp.

- Kao Corporation

- Lonza Group AG

- Lubrizol Corporation (The Lubrizol Corporation)

- Momentive Performance Materials Inc.

- Stepan Company

- Vantage Specialty Chemicals, Inc.

- Wacker Chemie AG

Emollients In Personal Care Industry Developments

In March 2025, BASF SE introduced a next-generation renewable lipid-based functional emollient designed to improve sustainability and provide better sensory benefits in personal care applications. This innovation reinforces BASF's vision for sustainable ingredient innovation and meets the increased interest in high-performance, bio-based cosmetics.

Emollients In Personal Care Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Green

- Biobased Esters

- Biobased Alkanes

- Vegetable Oils

- Others

- Silicone Fluids

- Cyclomethicones

- Dimethicones

- Others

- Mineral Oils

- Petrolatum

- Paraffinum Liquid (Mineral Oil)

- Synthetic Hydrocarbons (Isododecane and Isohexadecane)

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Emollients In Personal Care Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.62 Billion |

|

Market Size in 2025 |

USD 4.78 Billion |

|

Revenue Forecast by 2034 |

USD 6.55 Billion |

|

CAGR |

3.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.62 billion in 2024 and is projected to grow to USD 6.55 billion by 2034.

The global market is projected to register a CAGR of 3.6% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Ashland Global Holdings Inc., BASF SE, Clariant AG, Covestro AG, Croda International Plc, Eastman Chemical Company, Evonik Industries AG, Hallstar Innovations Corp., Kao Corporation, Lonza Group AG, Lubrizol Corporation, Momentive Performance Materials Inc., Stepan Company, Vantage Specialty Chemicals, Inc., and Wacker Chemie AG

The silicone fluids segment dominated the market revenue share in 2024, owing to its extensive use in skincare and haircare formulations to provide smooth texture, spreadability, and long-lasting moisturization.

The green emollients segment is projected to witness the fastest growth during the forecast period, driven by rising demand for sustainable and bio-based alternatives to petrochemical-derived ingredients.