Employee Benefit Broker Market Share, Size, Trends, Industry Analysis Report

By Benefit Type (Healthcare Insurance, Retirement Savings Plan, International Benefits, Others); By Application; By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4580

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

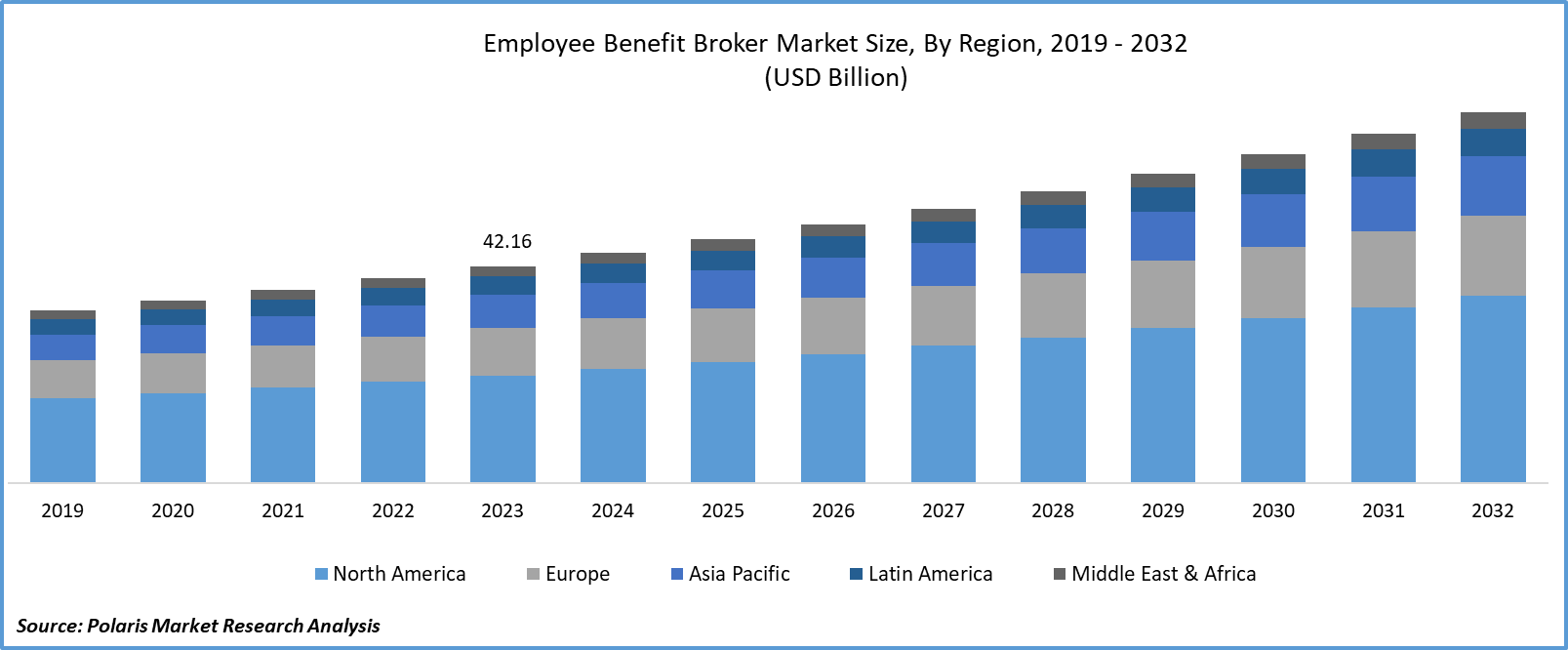

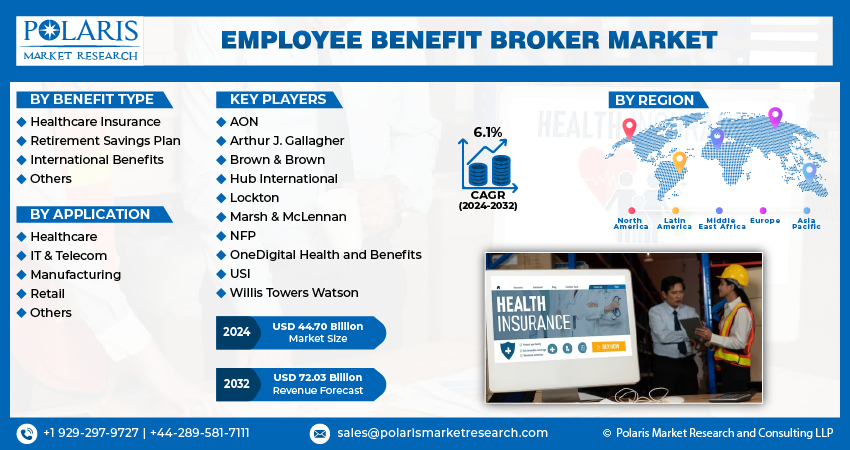

Global employee benefit broker market size was valued at USD 42.16 billion in 2023. The market is anticipated to grow from USD 44.70 billion in 2024 to USD 72.03 billion by 2032, exhibiting the CAGR of 6.1% during the forecast period.

Market Overview

The expansion of the market is driven by the fiercely competitive nature of the talent landscape. In a job market where the recruitment and retention of top-tier employees are crucial, companies are providing more attractive employee benefits to gain a competitive advantage and ensure the loyalty of talented professionals. Additionally, retirement benefit schemes like 401(k) plans or defined employee benefits plans have grown in importance as companies strive to attract and retain their workforce.

- As per the estimates of the U.S. Labor Organization, in 2023, in the private industry, among life benefits, 4 percent of the union workers had flexible working conditions, 1 percent had access to a flexible workplace, and 75 percent had access to employee assistance programs.

Annually, the renewal season imposes a significant strain on insurance entities throughout the value chain. This phase typically witnesses heightened overtime, slower processing times, and an elevated likelihood of employee burnout and administrative errors. Presently, with numerous agencies grappling with diminished staffing levels attributed to the Great Resignation and widespread retirements, this already demanding period has become even more arduous.

To Understand More About this Research: Request a Free Sample Report

Employers are encountering unparalleled complexity in managing their benefits programs, navigating through evolving regulatory mandates, and grappling with cost control challenges. Presently, brokers are tasked with delivering an elevated standard of service, which entails assisting employers in discovering innovative strategies to reduce healthcare expenses, educating them about alternative financing options, acting as extensions of their human resource departments, and overseeing or digitalizing benefits delivery and administration. This increased demand has placed additional strain on already burdened operations for many agencies.

Recruiting and retaining talent remains a formidable challenge for insurance organizations across the industry, impeding their ability to achieve profitable growth and provide satisfactory customer experiences. The departure of seasoned insurance professionals is depleting agencies of crucial knowledge and expertise needed to cater to employer needs adequately. A staggering 75% of independent agencies are actively seeking new talent. Despite this, 41% of agencies, as reported by the Big "I," are encountering difficulties in identifying and evaluating qualified candidates.

Contemporary employees are in search of comprehensive and flexible benefits packages that cover amenities like wellness initiatives, adaptable work schedules, and opportunities for career growth. This range of employee preferences requires a diverse strategy for benefits that can cater to a wide spectrum of demographics, spanning from millennials to baby boomers, thereby driving market expansion. Nevertheless, these benefits come at a cost to companies aiming to retain their workforce, considering the increasing challenge of employee retention within organizations. For example, based on a survey, 63.3% of companies acknowledge that retaining employees is more challenging than hiring new ones.

Growth Factors

Surge in adoption of digital benefit platforms

The market has witnessed significant growth due to technological progressions in high-speed internet and surge in adoption of digital benefit platforms. These advancements have empowered employers to optimize benefits management and provide accessible platforms through online portals and mobile apps. Additionally, businesses are embracing digital mediums to improve communication and bolster employer benefit assistance. As per a 2023 study conducted by Marsh McLennan, a insurance firm, 69% of HR professionals intend to boost investments in digital benefit platforms to enhance benefit administration and communication within the next one to three years.

Additionally, legal obligations play a crucial role in employee benefit broker market characteristics. In various jurisdictions, employers are legally mandated to offer certain benefits to their employees, such as health insurance or retirement savings plans. For example, in the United States, the Employee Benefits Security Administration of the U.S. Department of Labor oversees the implementation and enforcement of ERISA (Employee Retirement Income Security Act). Moreover, adherence to these regulations is necessary, thereby fostering employee benefit broker market growth.

Changing regulations and associated complexities pave need for brokers

The need for insurance organizations and employers to navigate the complexities of new and evolving regulations governing employee benefits drives the market. Regulations such as the Transparency in Coverage rule, Consolidated Appropriations Act, and the Department of Labor's cybersecurity guidance present ongoing challenges that demand vigilant attention from benefits brokers to ensure compliance.

These regulations mandate transparency, accountability, and security measures in employee benefit offerings. Benefits brokers play a crucial role in helping insurance organizations and employers understand and adhere to these regulations, ensuring that their benefits programs meet legal requirements and mitigate potential risks. As a result, insurance organizations and employers rely on benefits brokers to provide expertise, guidance, and support in navigating the complex regulatory landscape and safeguarding their interests.

Restraining Factors

Rising expenses

The challenge faced by employers in managing escalating expenses associated with health insurance, retirement plans, and other benefits. The increasing expenses of these benefits may exert significant pressure on employers' budgets, creating a financial constraint.

Employers are tasked with the delicate balance of controlling expenses while simultaneously endeavoring to offer competitive benefits to attract and retain top talent. This creates a complex dilemma for employers as they must navigate between cost containment measures and the desire to provide attractive benefits packages.

The need to strike this balance can restrain employers from fully investing in comprehensive employee benefit plans or from seeking out additional services from benefits brokers. As a result, employers may be cautious about engaging in new benefit offerings or expanding existing ones, which can limit the growth potential of the employee benefits broker market.

Report Segmentation

The market is primarily segmented based on benefit type, application, and region.

|

By Benefit Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Benefit Type Insights

Healthcare insurance segment accounted for the largest market share in 2023

In 2023, the healthcare insurance segment accounted for the largest market share due to increasing demand for healthcare insurance, which has become a foundational component of both employer and employee benefit packages. Moreover, the COVID-19 pandemic highlighted the essential need for healthcare access and coverage, intensifying the demand for employee health insurance broker benefits. Employees now place greater importance on health-related benefits, making comprehensive healthcare insurance an asset for attracting and retaining top talent.

The retirement savings plan segment will grow rapidly. As the workforce ages and individuals become more aware of the necessity for financial readiness in retirement, retirement savings have become a paramount concern for employees. Concurrently, employers acknowledge the significance of providing retirement savings options, like 401(k) plans or defined contribution plans, to attract and retain skilled professionals, foster employee loyalty, and promote comprehensive financial wellbeing.

By Application Insights

The retail segment is expected to witness the fastest CAGR during the forecast period.

The retail segment is expected to witness the fastest CAGR during the forecast period. Retail companies, characterized by diverse and frequently hourly workforces, are customizing their benefits to meet the distinct needs of their employees. These offerings encompass healthcare coverage, flexible scheduling alternatives, and educational assistance initiatives, all aimed at attracting and retaining talent.

IT & telecom, employee benefit broker market segment dominated the significant revenue share. This expansion is fueled by the increasing need for tech expertise, prompting companies to provide enticing benefits to retain and attract skilled professionals. These benefits range from conventional offerings like health insurance and retirement plans to more progressive perks such as flexible work arrangements tailored to the preferences of IT professionals. Additionally, the sector's tech-centric nature has led to the adoption of advanced benefits administration tools and digital platforms, elevating employee experience and involvement.

Regional Insights

North America region held the largest market share in 2023

In 2023, North America held the largest market share. In highly competitive labor markets, notably in sectors like technology and finance, companies vie for top talent through enticing benefit packages. This competitive landscape drives ongoing innovation and advancement in employee benefits offerings. North America benefits from well-established regulatory frameworks, such as the Affordable Care Act, which set standards for essential benefits, providing a solid foundation for expansion of employee benefit broker market scope.

Asia Pacific region is expected to grow at the fastest CAGR during the forecast period.

Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. Countries in the region are increasingly recognizing the importance of comprehensive benefits, encompassing health insurance, retirement plans, and work-life balance perks, driving up the demand for such offerings. Additionally, regulatory changes in the region are fostering the growth of employee benefits, with governments implementing reforms and incentives to encourage employers to offer more extensive benefits to their staff.

As per the report titled "Asia Pacific employee benefits market trends report, in 2022, published by Aon, approximately two-thirds of companies across various sectors report having a well-being strategy. This percentage is highest in the financial services and technology sectors, ranging between 70% and 80%.

Key Market Players & Competitive Insights

The Employee Benefit Broker Market is a dynamic sector within the broader insurance and employee benefits industry. Employee benefit brokers play a crucial role in facilitating the procurement and management of employee benefit packages for organizations of all market sizes. The Employee Benefit Broker Market insights are highly competitive, with key players competing on factors such as service offerings, industry expertise, technology solutions, and client relationships. To stay ahead in the market, leading brokers focus on innovation, personalized service delivery, and strategic partnerships.

Some of the major players operating in the global market include:

- AON

- Arthur J. Gallagher

- Brown & Brown

- Hub International

- Lockton

- Marsh & McLennan

- NFP

- OneDigital Health and Benefits

- USI

- Willis Towers Watson

Recent Developments in the Industry

- In October 2022, Standard Insurance collaborated with Alight within the Carrier Partner Program. This alliance enhanced the mutual client experience and streamlined benefits administration for employers and employees alike through the integration of Standard Insurance Company & Alight, Inc.

- In February 2023, WTW unveiled its latest offering, LifeSight PEP, a pooled employer plan (PEP) aimed at streamlining 401(k) plan support for employers and enhancing the outcomes of employees. The introduction of PEPs is geared towards achieving reduced plan costs and better employee outcomes, all while alleviating the operational burden and fiduciary responsibilities currently borne by employers. LifeSight PEP is designed to assist employers in navigating the growing complexities associated with sponsoring a defined contribution plan.

Report Coverage

The employee benefit broker market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, benefit type, application, and their futuristic growth opportunities.

Employee Benefit Broker Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 44.70 billion |

|

Revenue forecast in 2032 |

USD 72.03 billion |

|

CAGR |

6.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Employee Benefit Broker Market report covering key segments are benefit type, application, and region.

Employee Benefit Broker Market Size Worth $72.03 Billion By 2032

Employee benefit broker market exhibiting the CAGR of 6.1% during the forecast period.

North America is leading the global market

key driving factors in Employee Benefit Broker Market are Surge in adoption of digital benefit platforms