Endoscopy Visualization Systems Market Size, Share, Trends, & Industry Analysis Report

By Product, By Resolution Type (4K and FHD), By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM1968

- Base Year: 2024

- Historical Data: 2020-2023

What is the endoscopy visualization market size?

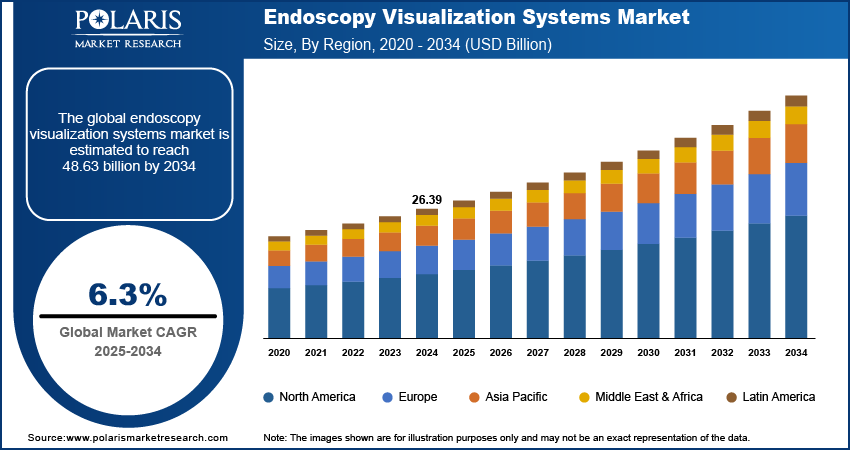

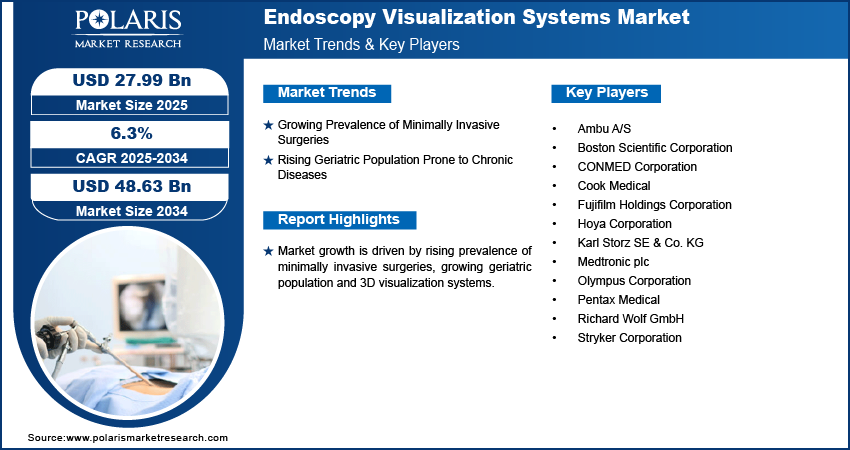

The global endoscopy visualization systems market size was valued at USD 26.39 billion in 2024, growing at a CAGR of 6.3% from 2025–2034. Rising gastrointestinal surgeries and rapidly growing aging population are boosting demand for endoscopy visualization systems.

Key Insights

- Endoscopy visualization systems dominated in 2024 due to widespread hospital adoption.

- Endoscopy visualization components expected to register highest CAGR with rising upgrades demand.

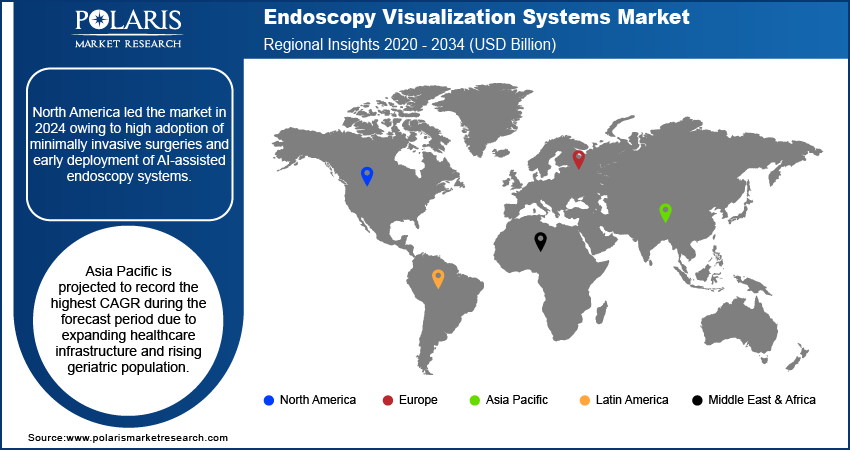

- North America led with advanced healthcare infrastructure and AI-assisted system adoption.

- The U.S. held largest share due to high minimally invasive surgery volumes.

- Asia Pacific fastest-growing with expanding healthcare infrastructure and aging population.

- China led APAC with hospital modernization and rising outpatient procedures.

Industry Dynamics

- Growing prevalence of minimally invasive surgeries is boosting demand for endoscopy systems.

- Rising geriatric population prone to chronic diseases is increasing procedure volumes.

- High device costs and lack of trained professionals are restraining adoption.

- Expansion of healthcare infrastructure and integration with telemedicine offer significant growth opportunities.

Market Statistics

- 2024 Market Size: USD 26.39 billion

- 2034 Projected Market Size: USD 48.63 billion

- CAGR (2025–2034): 6.3%

- North America: Largest Market Share

What is endoscopy visualization systems?

Endoscopy visualization systems offer high-definition imaging, 3D visualization, and AI-based diagnostic support for specialty clinics, ambulatory surgery centers, and hospitals. The solutions improve patient outcomes, enable early detection of disease, and increase procedural accuracy.

Increasing incidence of minimally invasive procedures and ageing populations are fueling system demand. Healthcare professionals are increasingly leveraging AI-facilitated, high-definition, and robotic-endoscopy devices to simplify procedures, minimize complications, and enhance operational efficiency.

Growing demand for high diagnostic accuracy, short procedure times, and patient safety is driving the market. Developed nations' hospitals and specialty facilities are increasingly adopting advanced visualization systems to assist complex procedures and streamline workflow. Top vendors are releasing miniaturized, cloud-connected, and AI-driven solutions to improve imaging quality, real-time monitoring, and procedural accuracy. For example, in September 2024, Olympus released its EVIS X1 endoscopy system in Brazil with advanced imaging technology and ergonomic gastro-intestinal endoscopes to promote detection and treatment of digestive diseases.

Drivers & Opportunities

Which are the factors driving the endoscopy visualization market growth?

Growing Prevalence of Minimally Invasive Surgeries: Growing demand for minimally invasive procedures is fueling demand for endoscopy visualization systems as such procedures demand accurate imaging and improved visualization to minimize complications, enhance patient recovery times, and maximize surgical results. Hospitals and surgery centers are placing greater emphasis on high-definition, 3D, and AI-based endoscopy equipment in order to satisfy the growing demand for safer and more effective procedures. In October 2025, Anatomage introduced its new endoscopy visualization system, providing ultra-realistic 3D cadaver perspectives and interactive simulations for advanced clinical training.

Rising Geriatric Population Prone to Chronic Diseases: The growing elderly population, usually suffering from age-related diseases and chronic gastrointestinal diseases, is driving endoscopy procedure demand. The World Health Organization (WHO) estimated that by 2030, one in every six individuals across the globe will be 60 years old and above, growing from 1 billion in 2020 to 1.4 billion, and 2.1 billion by 2050, with individuals over 80 years old tripling to 426 million. As elderly patients need repeated diagnostic and treatment procedures, medical care professionals are embracing high-end endoscopy visualization systems to improve procedure precision, minimize risks, and enhance patient care outcomes.

Segmental Insights

Product Analysis

In terms of product, segmentation includes endoscopy visualization systems and endoscopy visualization components. Endoscopy visualization systems held market share in 2024 owing to their wide usage in hospitals and surgical centers for minimally invasive surgeries. As an example, in September 2024, Stryker has introduced the 1788 Advanced Imaging Platform in India, which provides 4K resolution, improved fluorescence imaging, and expanded color gamut to enhance surgical visualization across specialties. Further, their compatibility with high-definition imaging and AI-based technologies is improving procedural accuracy and patient outcomes.

Endoscopy visualization parts are anticipated to experience the most rapid expansion due to growing demand for replacement and upgrade of installed equipment. Furthermore, advances in lenses, cameras, and illuminating modules are fueling adoption across new healthcare centers.

Resolution Type Analysis

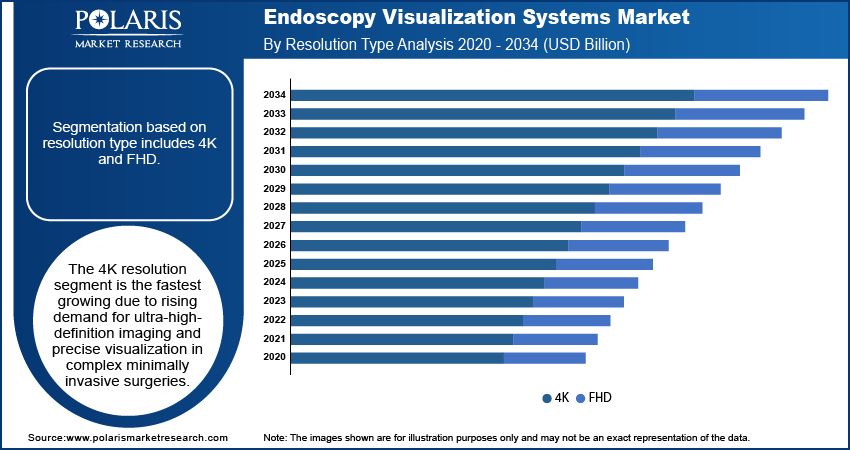

By resolution type, the market is divided into 4K and FHD. The FHD resolution type led the market in 2024 based on extensive adoption in hospitals and diagnostic centers for regular procedures. Additionally, its affordability and compatibility with the majority of endoscopy systems are facilitating gradual adoption across the world.

4K resolution is the most rapidly growing segment owing to increasing demand for ultra-high-definition imaging in high-complexity minimally invasive procedures. Apart from that, surgeons depend more on 4K systems for accurate visualization and enhanced diagnostic performance during procedures.

End User Analysis

Based on end user, the market is divided into hospitals, ambulatory surgical centers, specialty clinics, and diagnostic imaging centers. Hospitals held the maximum revenue share in 2024 due to high procedure volumes and established surgical infrastructure. Additionally, ongoing investments in upgraded endoscopy technologies for diagnostics and surgeries are maintaining their market supremacy.

Ambulatory surgical facilities are projected to expand most rapidly as these increasingly utilize minimally invasive surgical techniques. Furthermore, there is a growing need for smaller, less expensive, yet high-performance endoscopy systems in outpatient surgery.

Regional Analysis

North America dominated the endoscopy visualization systems market due to high adoption of minimally invasive surgeries and well-established healthcare infrastructure. Moreover, rising investments in AI-enabled and robotic-assisted endoscopy solutions are driving growth. Besides, rising demand in hospitals for advanced imaging is propelling market penetration.

The U.S. Endoscopy Visualization Systems Market Insight

The U.S. holds the largest market share owing to extensive use of high-definition and 3D endoscopy systems. Olympus introduced cutting-edge endoscopy systems VISERA S OTV-S500 platform and single-use devices for enhanced ENT imaging and procedures during October 2025. Additionally, supportive reimbursement policies favoring minimally invasive procedures are driving growth. Also, ongoing technological advancement in visualization systems is improving procedural efficiency and accuracy.

Europe Endoscopy Visualization Systems Market

Europe holds the significant market share with high procedural volumes and use of advanced endoscopy systems in hospitals. Further, strict regulation standards to ensure safe surgical procedures are driving growth. On top of this, rising use of minimally invasive procedures among the geriatric population is fueling market growth.

Asia Pacific Endoscopy Visualization Systems Market

Asia Pacific is the region with the highest growth due to growing healthcare infrastructure and increasing geriatric population. For example, Japan's geriatric population hit a record 36.25 million in September 2024, representing 29.3% of the population, according to Japanese Ministry of Internal Affairs and Communications. Additionally, mounting government efforts towards better early disease diagnosis are driving demand. Additionally, rising awareness about minimally invasive procedures is driving adoption in urban areas.

China Endoscopy Visualization Systems Market Overview

China is driving regional growth due to rapid hospital modernization and rising outpatient procedures. Moreover, increasing investments in AI-enabled and high-resolution endoscopy systems are supporting the market. In addition, expansion of specialty clinics is further strengthening system growth.

Key Players & Competitive Analysis Report

The endoscopy visualization systems market is relatively competitive, with companies advancing high-definition imaging, 3D visualization, and AI-based surgical instruments. Additionally, investments in robotic integration, cloud-based procedure management, and hospital and specialty clinic partnerships enhance system accuracy, scalability, and global reach.

Who are the major players in endoscopy visualization market?

Market major players are Olympus Corporation, Karl Storz SE & Co. KG, Stryker Corporation, Medtronic plc, Boston Scientific Corporation, Pentax Medical, Fujifilm Holdings Corporation, Richard Wolf GmbH, CONMED Corporation, Hoya Corporation, Cook Medical, and Ambu A/S.

Key Players

- Ambu A/S

- Boston Scientific Corporation

- CONMED Corporation

- Cook Medical

- Fujifilm Holdings Corporation

- Hoya Corporation

- Karl Storz SE & Co. KG

- Medtronic plc

- Olympus Corporation

- Pentax Medical

- Richard Wolf GmbH

- Stryker Corporation

Industry Developments

- July 2025: Fujifilm introduced the ELUXEO 8000 endoscopy system with 4K imaging and innovative features to improve visualization, accuracy, and workflow during gastrointestinal procedures.

- April 2025: Medtronic collaborated with Dragonfly to introduce an enhanced pancreaticobiliary endoscopy system with enhanced visualization and accuracy.

Endoscopy Visualization Systems Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Endoscopy Visualization Systems

- Standard Definition (SD)

- 2D systems

- 3D systems

- High Definition (HD)

- 2D systems

- 3D systems

- Standard Definition (SD)

- Endoscopy Visualization Components

- Camera Heads

- Insufflators

- Light Sources

- High-Definition Monitors

- Suction Pumps

- Video Processors

By Resolution Type Outlook (Revenue, USD Billion, 2020–2034)

- 4K

- UHD Resolution

- DCI Resolution

- FHD

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Diagnostic Imaging Centers

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Endoscopy Visualization Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 26.39 Billion |

|

Market Size in 2025 |

USD 27.99 Billion |

|

Revenue Forecast by 2034 |

USD 48.63 Billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 26.39 billion in 2024 and is projected to grow to USD 48.63 billion by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

North America led the market due to advanced healthcare infrastructure and early integration of AI-enabled and HD endoscopy visualization systems

A few of the key players in the market are Olympus Corporation, Karl Storz SE & Co. KG, Stryker Corporation, Medtronic plc, Boston Scientific Corporation, Pentax Medical, Fujifilm Holdings Corporation, Richard Wolf GmbH, CONMED Corporation, Hoya Corporation, Cook Medical, and Ambu A/S.

Endoscopy visualization systems dominated the market due to wide adoption in hospitals and high procedural volumes.

Ambulatory surgical centers are projected to grow at the highest rate due to increasing outpatient procedures and rising adoption of compact endoscopy solutions.