Envelope Market Share, Size, Trends, Industry Analysis Report

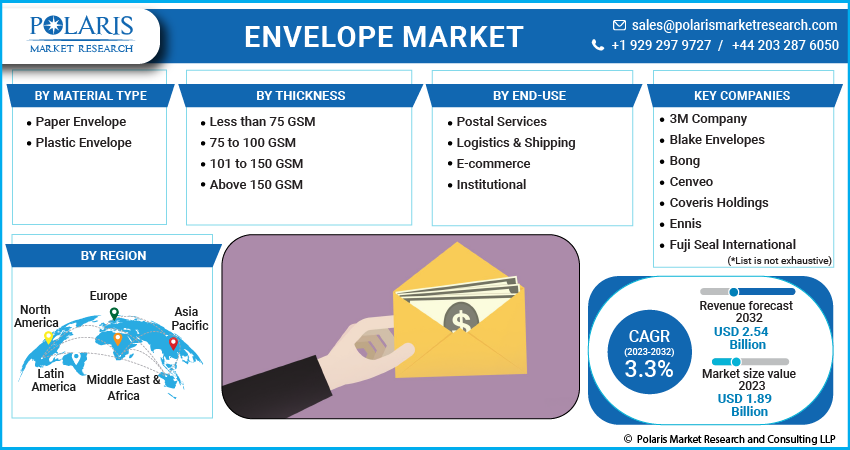

By Material Type (Paper Envelope, Plastic Envelope); By Thickness; By End-use (Postal Services, Logistics & Shipping, E-commerce, Institutional); By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 119

- Format: PDF

- Report ID: PM3677

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

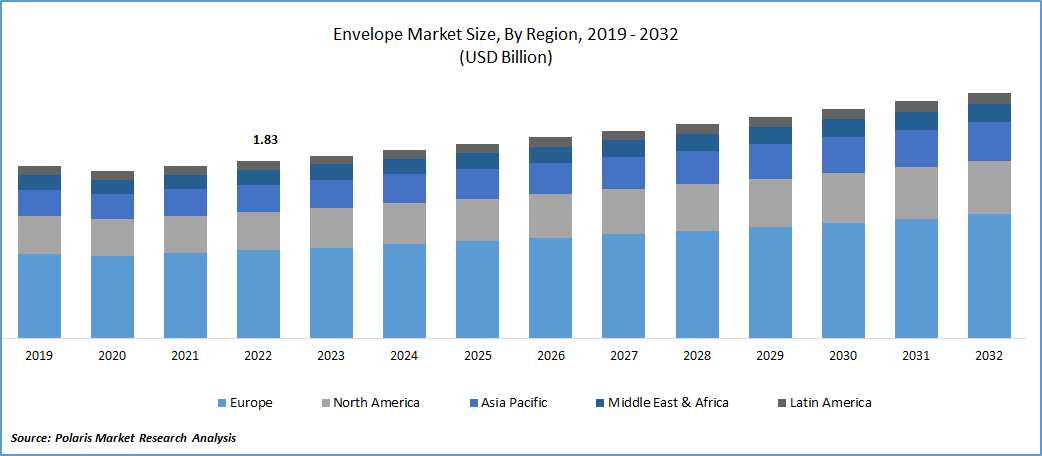

The global envelope market was valued at USD 1.83 billion in 2022 and is expected to grow at a CAGR of 3.3% during the forecast period.

The envelope market is experiencing growth driven by the increasing number of product launches by manufacturers.

- Mondi's introduction of 'Grow&Go' marks an expansion of its sustainable packaging portfolio, specifically targeting the farm-to-shelf segment and driving the growth of the global market. This suite of packaging products offers a wide range of sizes, including consumer-friendly trays, carry-packs, and bulk shipping boxes designed to optimize the delivery of fresh produce.

To Understand More About this Research: Request a Free Sample Report

By utilizing mono-material solutions made of easily recyclable paper, Grow&Go not only ensures the protection of fruits and vegetables from damage but also contributes to the circular economy. The adoption of such eco-friendly packaging solutions reduces food waste, while stackable and hygienic features further enhance the appeal of these products in the market. This continuous cycle of product launches by manufacturers contributes significantly to the growth of the envelope market.

Industry Dynamics

Growth Drivers

Increasing demand from shipping industry

Growth in parcel delivery services, which offer shipping of envelopes at no cost to customers, is driving the envelope market aspects during the forecast period. In recent times, advancement in technologies has brought about major changes and trends in the market. Availability of printing on envelopes has increased the demand for printed envelopes.

The widespread use of Manilla envelopes in offices and professional settings as a practical and functional means of transporting documents, letters, and objects through the post is driving the growth of the envelope market. Despite not being the most visually appealing envelopes, Manilla envelopes offer reliability and convenience, making them a preferred choice for many businesses. Their distinctive buff color and visible fibers, resulting from a less refined manufacturing process using semi-bleached wood fibers, contribute to their traditional and classic appearance. Additionally, the affordability of envelopes made from Manilla paper, along with their printing qualities and high recycled content, further supports their popularity and market growth.

For Specific Research Requirements, Speak With Research Analyst

Report Segmentation

The market is primarily segmented based on material type, thickness, end-use and region.

|

By Material Type |

By Thickness |

By End-use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Type Analysis

Paper Envelope segment is expected to witness fastest growth over the forecast period

Paper Envelope segment is expected to have faster growth for the market. They are widely recognized for their eco-friendly nature. As sustainability becomes a more significant concern for businesses and consumers alike, there is a growing preference for environmentally friendly packaging solutions. Paper envelopes, being recyclable and biodegradable, align with these sustainability goals and attract customers who prioritize eco-conscious choices. They also offer versatility and customization options. They can be easily printed on or decorated, allowing businesses to showcase their branding and personalize the envelopes according to their needs. This customization potential makes paper envelopes a popular choice for various industries, including marketing, advertising, and direct mail. Furthermore, paper envelopes are cost-effective compared to other packaging alternatives. They are often available at a lower price point, making them an economical choice for businesses, especially those that require large quantities of envelopes.

By Thickness Analysis

75 to 100 GSM segment accounted for the largest market share in 2022

75 to 100 GSM segment holds the largest market share for the market in the study period. Envelopes within the 75 to 150 GSM range offer a balance between durability and flexibility. They are suitable for a variety of uses, including business correspondence, direct mail marketing, catalogs, brochures, and invitations. This segment caters to both commercial and personal needs, making it a popular choice among businesses, organizations, and individuals. The envelopes within this thickness range provide adequate protection for the contents while still maintaining a manageable weight for efficient mailing.

They offer durability and resistance to tearing or damage during transit, ensuring that the enclosed documents or materials arrive in good condition. Furthermore, the 75 to 150 GSM segment offers a range of options in terms of paper quality, finishes, and colors. This allows for customization and branding opportunities, making envelopes within this range suitable for promotional and marketing purposes. Businesses can choose envelopes that align with their brand identity and create a professional and appealing presentation for their communications.

By End Use Analysis

E-commerce segment is expected to hold the larger revenue share

E-commerce segment is projected to witness a larger revenue share in the coming years. The rapid expansion of the e-commerce industry has significantly increased the demand for packaging materials, including envelopes. With the rise of online shopping, more products are being shipped to customers, requiring secure and efficient packaging solutions. Envelopes are commonly used for packaging various items, especially smaller and lightweight products. This segment places a high emphasis on cost-effective and efficient packaging solutions. Envelopes offer advantages such as lightweight construction, easy handling, and reduced material costs compared to larger packaging options. They are particularly suitable for shipping flat or low-profile items, such as clothing, accessories, books, and small electronics. This cost efficiency drives e-commerce companies to utilize envelopes extensively in their packaging operations.

Regional Insights

Asia Pacific registered with the highest growth rate in the study period

APAC is projected to witness a higher growth rate for the market. The surge in e-commerce activities in Asia Pacific has fueled the need for packaging and shipping solutions, including envelopes. The growth of online retail platforms and the increasing popularity of online shopping contribute to the rising demand for envelopes used in packaging and delivering goods. The significant surge in packaging consumption in the India, growing from 4.3 KGs/person/annum to 8.6 kg pppa in last decade, is driving the growth of the envelope market. This increase in packaging consumption reflects the growing demand for various packaging solutions, including envelopes, in India.

The adoption of smarter and sustainable packaging options, which has become a top concern, further fuels this growth. As India represents a significant portion of the region, the growth of the market in India has a ripple effect on the market. The need for effective packaging solutions, including envelopes, across industries such as e-commerce, retail, and logistics in India drives the overall growth of the region.

Europe garnered with the larger revenue share in the forecast time frame

Europe is expected to witness a larger revenue share for the market. It has a large population and a well-established postal system, which creates a significant demand for envelopes and postal services. Additionally, Europe has a strong business environment with numerous industries and organizations that rely on mailing and communication, further driving the demand for envelopes. The calculation by FEPE for 2022 of a total of 43 billion envelopes and pockets sold in Europe, despite a slight decrease of 6%, indicates a significant market size and demand for envelope products.

This data suggests that the envelope market is still robust and resilient, even in the face of challenges such as price increases. Additionally, the growth of the e-commerce business has contributed to increased industry sales, marking a positive trend for the envelope market. The combination of steady demand and the adaptation of envelopes to accommodate e-commerce needs has driven the growth of the envelope market, indicating its continued relevance and potential for further expansion.

Key Market Players & Competitive Insight

Major manufacturers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- 3M Company

- Blake Envelopes

- Bong

- Cenveo

- Coveris Holdings

- Ennis

- Fuji Seal International

- Glatfelter

- International Paper

- Macfarlane

- Mondi

- Neenah

- Novolex

- ProAmpac

- Sappi

- Sealed Air

- Smurfit Kappa

- Supremex

- UPM-Kymmene

- Wausau Paper

Recent Developments

- In February 2023, ProAmpac, a renowned player in the field of flexible packaging and material science, has introduced ProActive Recyclable Paper-1000 as part of its ProActive Recyclable product line. This latest offering represents a series of innovative paper-based packaging solutions that are designed for curbside recycling.

- In September 2022, Mondi collaborated with Heiber + Schroder to introduce the eComPack, a state-of-the-art high-performance machine designed for the automated packaging of Mondi's EnvelopeMailer tailored for the eCommerce industry.

Envelope Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1.89 billion |

|

Revenue forecast in 2032 |

USD 2.54 billion |

|

CAGR |

3.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Material Type, By Thickness, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global envelope market size is expected to reach USD 2.54 billion by 2032.

Key market players in the market 3M Company,Blake Envelopes,Bong, Cenveo, Coveris Holdings, Ennis, Fuji Seal International,Glatfelter.

Europe region contribute notably towards the global envelope market.

The global envelope market is expected to grow at a CAGR of 3.3% during the forecast period.

The envelope market report covering key segments are material type, thickness, end-use and region.